Connecticut Revocable Trust Agreement Granteror as Beneficiary is a legal document that outlines the terms and conditions under which a trust is established in Connecticut, with the granter designated as the beneficiary. This type of trust allows individuals (granters) to retain control over their assets while also planning for the distribution of their estate upon their death. The trust agreement serves as a comprehensive roadmap, detailing the rights, responsibilities, and obligations of the granter and the trustee. It includes provisions for the management, investment, and distribution of trust assets during the granter's lifetime and after their passing. One type of Connecticut Revocable Trust Agreement is the "Revocable Living Trust." This type of trust is created by individuals during their lifetime and can be changed or revoked at any time. It enables the granter to maintain full control over their assets while they are alive, providing flexibility and control over the trust's terms. Another type of Connecticut Revocable Trust Agreement is the "Credit Shelter Trust" or "Bypass Trust." This trust is commonly used for estate planning purposes to maximize the use of federal and state estate tax exemptions. Upon the granter's death, a portion of their assets will be placed in this trust, effectively bypassing estate taxes that would have been due if the assets were left directly to the beneficiaries. A "Qualified Personnel Residence Trust" (PRT) is yet another type of Connecticut Revocable Trust Agreement. This trust allows the granter to transfer their primary residence or vacation home to the trust while still residing in it for a fixed term. This strategy provides potential estate tax savings while allowing the granter to continue using and living in the property during the designated term. Creating a Connecticut Revocable Trust Agreement Granteror as Beneficiary has several advantages. It enables privacy in the distribution of assets, avoids probate, and allows for the efficient management of assets during the granter's lifetime and after death. Additionally, it provides protection from potential challenges to the estate, offers potential tax benefits, and ensures the granter's wishes are upheld. In conclusion, a Connecticut Revocable Trust Agreement Granteror as Beneficiary is a legal tool that allows individuals to maintain control of their assets while planning for the distribution of their estate. Different types of revocable trusts, such as Revocable Living Trusts, Credit Shelter Trusts, and Qualified Personnel Residence Trusts, offer various estate planning benefits and allow individuals to tailor their trust to their specific needs. Consulting with a qualified attorney is recommended to ensure compliance with Connecticut laws and to create an effective and personalized trust agreement.

Connecticut Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Connecticut Revocable Trust Agreement - Grantor As Beneficiary?

Have you been in a position in which you will need paperwork for possibly enterprise or person functions almost every working day? There are plenty of legal papers layouts available on the net, but finding versions you can trust isn`t simple. US Legal Forms delivers a huge number of form layouts, much like the Connecticut Revocable Trust Agreement - Grantor as Beneficiary, which can be published to meet federal and state requirements.

Should you be presently familiar with US Legal Forms website and get a free account, simply log in. Next, you may acquire the Connecticut Revocable Trust Agreement - Grantor as Beneficiary template.

Should you not offer an profile and want to begin to use US Legal Forms, adopt these measures:

- Get the form you will need and make sure it is for that proper town/area.

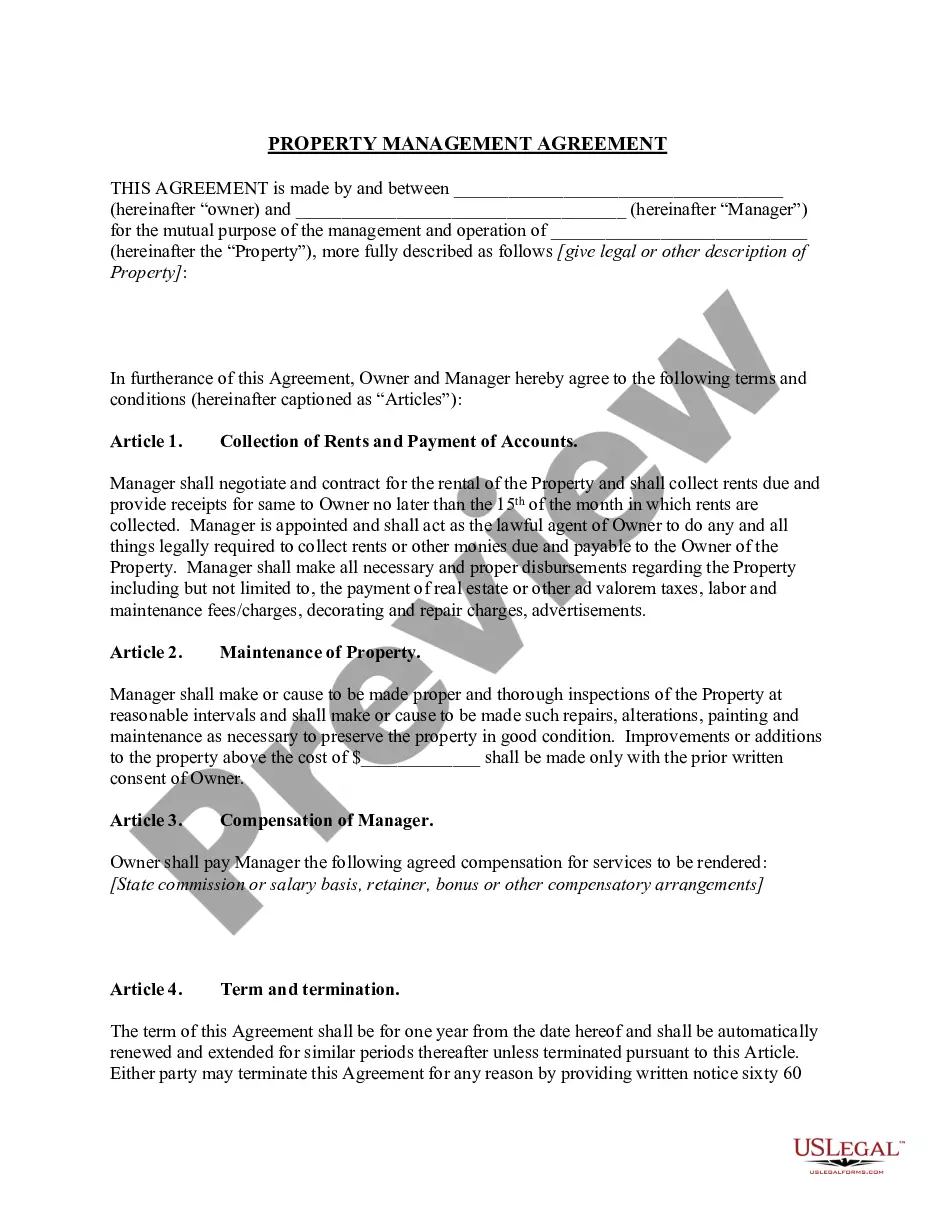

- Utilize the Review button to check the form.

- Look at the information to ensure that you have chosen the proper form.

- When the form isn`t what you`re searching for, utilize the Look for field to discover the form that suits you and requirements.

- Whenever you discover the proper form, click Get now.

- Opt for the costs prepare you need, fill out the desired information to create your money, and pay money for the order with your PayPal or bank card.

- Select a handy data file format and acquire your copy.

Find all the papers layouts you may have purchased in the My Forms food selection. You can aquire a further copy of Connecticut Revocable Trust Agreement - Grantor as Beneficiary anytime, if possible. Just click the required form to acquire or print the papers template.

Use US Legal Forms, the most considerable assortment of legal types, to conserve efforts and avoid errors. The service delivers appropriately created legal papers layouts which can be used for a range of functions. Generate a free account on US Legal Forms and begin creating your lifestyle easier.