Connecticut's Agreement for Sale of Goods, Equipment, and Related Software is a legal document that outlines the terms and conditions for the sale of specific goods, equipment, or related software between parties involved in a transaction within the state of Connecticut. The agreement is typically used when selling various types of goods, equipment, or software products, ensuring that both the buyer and the seller are in agreement and legally protected throughout the transaction. It serves as a binding contract that outlines the rights, obligations, and responsibilities of each party involved, aiming to minimize disputes and provide a clear understanding of the sale. This agreement is applicable to a wide range of products, including but not limited to: 1. Goods: Connecticut Agreement for Sale of Goods involves the sale of physical products, such as electronics, furniture, vehicles, machinery, appliances, and other tangible items. 2. Equipment: It encompasses the sale of specialized tools, machinery, apparatus, or devices used in various industries, such as medical equipment, construction machinery, manufacturing tools, laboratory instruments, and more. 3. Software: This agreement also covers the sale of computer software, including applications, programs, and digital products used on computers, smartphones, or other electronic devices. The Connecticut Agreement for Sale of Goods, Equipment, and Related Software includes vital elements to protect the interests of both parties involved. It typically covers details such as: 1. Identification of Parties: The agreement clearly identifies the buyer and the seller, including their legal names, addresses, and contact information. 2. Description of Goods, Equipment, or Software: It provides a detailed description of the items being sold, including specifications, quantities, quality standards, model numbers, and any relevant identifying details. 3. Purchase Price: The agreed-upon price for the goods, equipment, or software is clearly stated, including any applicable taxes, shipping or handling costs, and payment terms. 4. Delivery and Acceptance: This section outlines the terms for delivery, including the delivery date, shipping methods, and responsibilities of each party. It also specifies the acceptance criteria for the products upon delivery. 5. Title and Risk of Loss: The agreement defines when the title of goods, equipment, or software transfers from the seller to the buyer, along with the risk of loss during transit or storage. 6. Warranties and Disclaimers: It details any warranties provided by the seller, including the duration, coverage, and limitations. Additionally, it may include disclaimers limiting the seller's liability. 7. Terms of Payment: This section outlines the agreed-upon payment terms, including due date, method of payment, late payment penalties, and any other payment-related provisions. 8. Intellectual Property Rights: If the agreement involves software or any intellectual property, it addresses ownership, licensing, restrictions, usage rights, and any other related provisions. 9. Governing Law and Dispute Resolution: The agreement specifies Connecticut law as the governing law for any disputes and outlines a mechanism for dispute resolution, such as arbitration or mediation. It is essential to consult a legal professional to ensure the Agreement for Sale of Goods, Equipment, and Related Software complies with Connecticut laws and fully protects the parties involved in the transaction.

Connecticut Agreement for Sale of Goods, Equipment and Related Software

Description

How to fill out Connecticut Agreement For Sale Of Goods, Equipment And Related Software?

It is feasible to invest time on the Internet looking for the legal document template that meets the federal and state requirements you have.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can easily obtain or print the Connecticut Agreement for Sale of Goods, Equipment and Associated Software from my service.

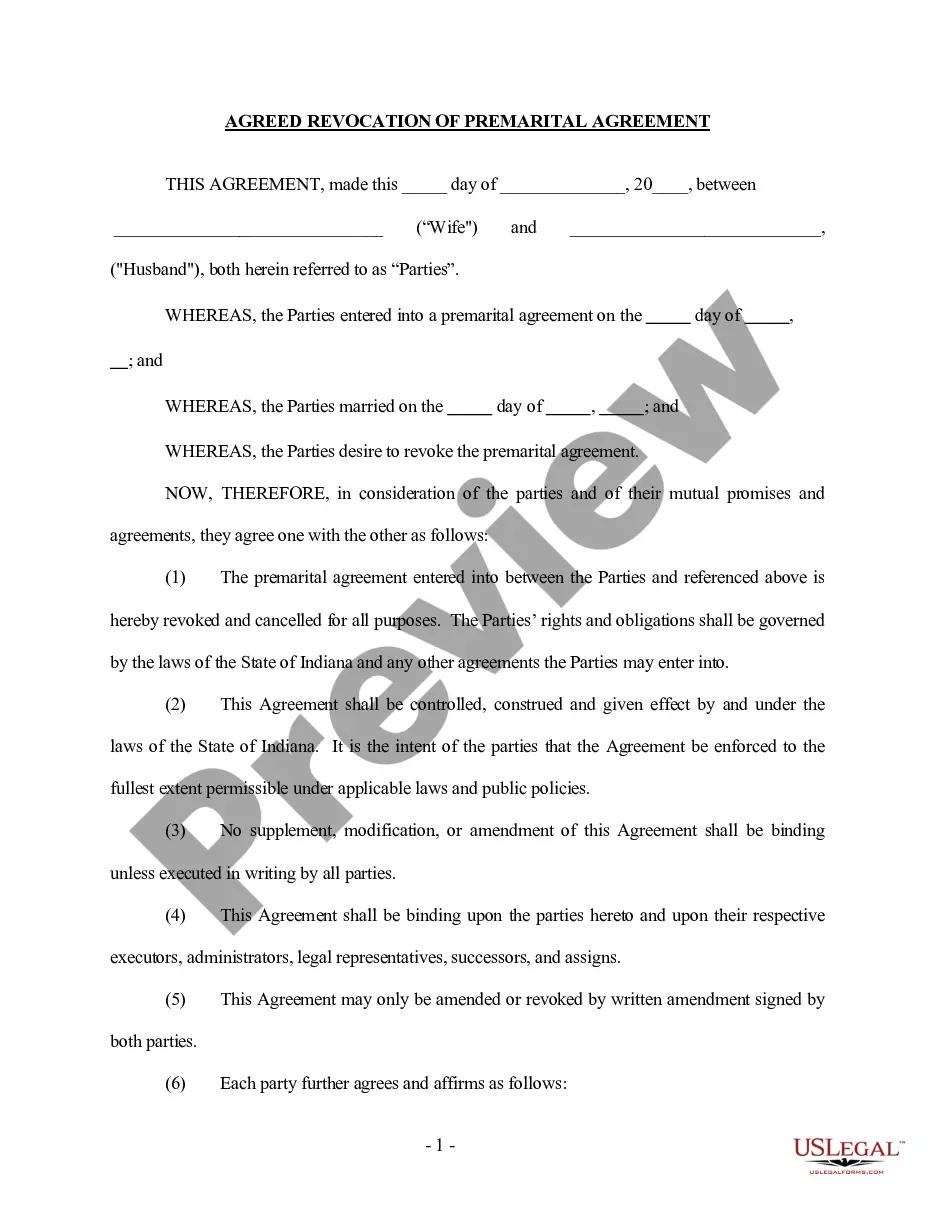

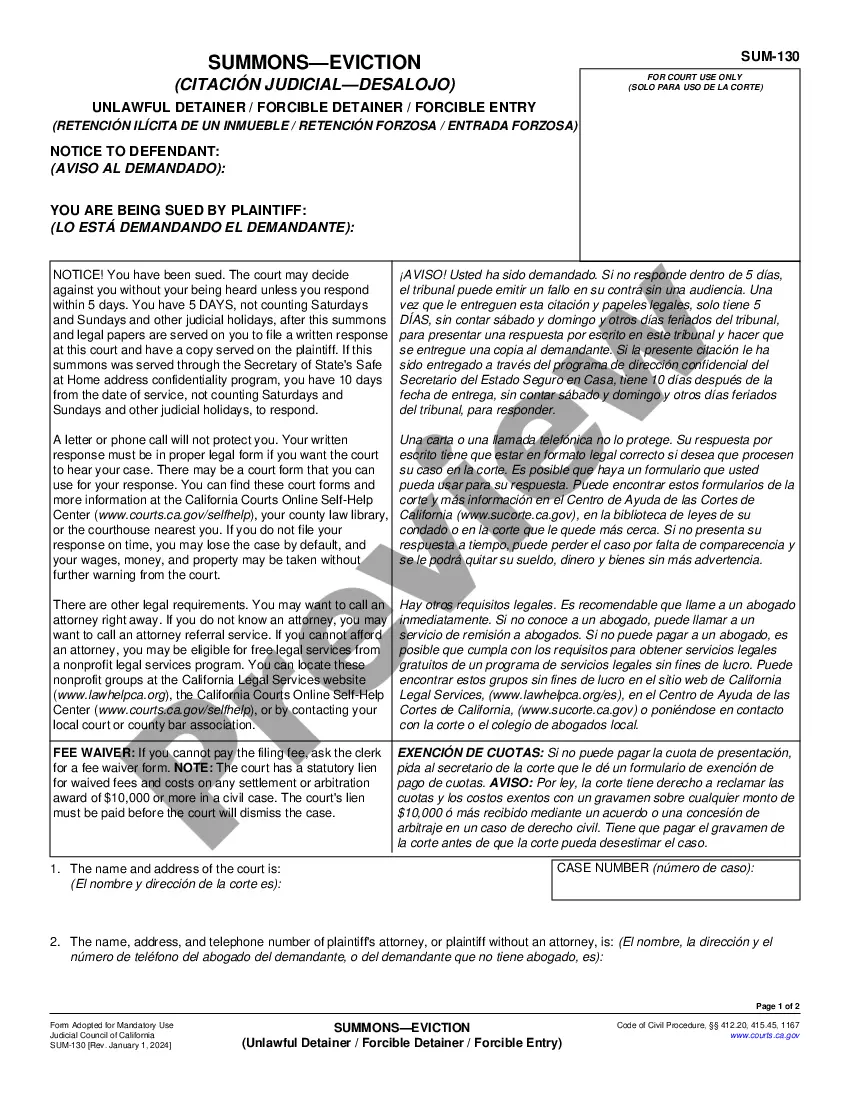

Review the document outline to confirm you have selected the appropriate template. If available, utilize the Preview option to examine the document format as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Connecticut Agreement for Sale of Goods, Equipment and Associated Software.

- Every legal document template you acquire is yours indefinitely.

- To request another copy for any purchased document, navigate to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, adhere to the simple instructions below.

- First, ensure that you have chosen the correct document template for your selected county/town.

Form popularity

FAQ

You can obtain a seller's permit in Connecticut by filling out the appropriate application on the Connecticut Department of Revenue Services website. This is particularly important for those working with the Connecticut Agreement for Sale of Goods, Equipment and Related Software. Completing this step enables you to collect and remit sales tax on your sales.

To obtain a vendor's license in Connecticut, you need to apply at your local city or town hall. This license is important for those engaged in the Connecticut Agreement for Sale of Goods, Equipment and Related Software. By securing a vendor's license, you enhance your business’s legitimacy and compliance with local laws.

To get a seller's permit in Connecticut, you can apply through the Connecticut Department of Revenue Services. This process is essential for those engaged in the Connecticut Agreement for Sale of Goods, Equipment and Related Software. Completing the application correctly can help you avoid any penalties and ensure a smooth sales operation.

Yes, you generally need a business license to operate online in Connecticut. This is crucial whether you are dealing with the Connecticut Agreement for Sale of Goods, Equipment and Related Software or any other type of sales. Obtaining the necessary licenses ensures your business complies with state regulations, enhancing your credibility with customers.

In Connecticut, a CT source refers to the origin of goods or services used for tax purposes. When dealing with the Connecticut Agreement for Sale of Goods, Equipment and Related Software, understanding your CT source helps determine applicable taxation and compliance issues. Proper identification of your source can streamline your sales process.

Some items are exempt from sales tax in Connecticut, including food products, certain medical supplies, and goods purchased for resale. Understanding these exemptions can significantly benefit your business operations if you deal in related items under the Connecticut Agreement for Sale of Goods, Equipment and Related Software. Always confirm with current state regulations to leverage available exemptions.

In Connecticut, maintenance services may be subject to sales tax, especially if they involve tangible personal property. When you provide maintenance in conjunction with equipment or software as defined in the Connecticut Agreement for Sale of Goods, Equipment and Related Software, it’s vital to determine if tax applies. Clarity on your service offerings can prevent compliance issues.

The Nexus threshold in Connecticut refers to the level of connection a business must have to the state before it is required to collect sales tax. Typically, if a business has a physical presence, such as an office or employees in Connecticut, they must comply with sales tax laws. Consider how the Connecticut Agreement for Sale of Goods, Equipment and Related Software might impact your Nexus status for sales tax obligations.

Yes, software as a service (SaaS) is generally taxable in Connecticut, depending on how it is presented to the consumer. When SaaS is combined with hardware or provided under the Connecticut Agreement for Sale of Goods, Equipment and Related Software, tax implications might vary. To stay compliant, review your specific offerings and seek guidance as needed.

Connecticut does not tax several services, including those related to personal care, education, and certain types of consulting. However, it is crucial to assess each service according to the Connecticut Agreement for Sale of Goods, Equipment and Related Software to determine its tax status. Always consult with a tax professional to ensure you accurately classify your services to avoid unexpected tax liabilities.

More info

IPS.