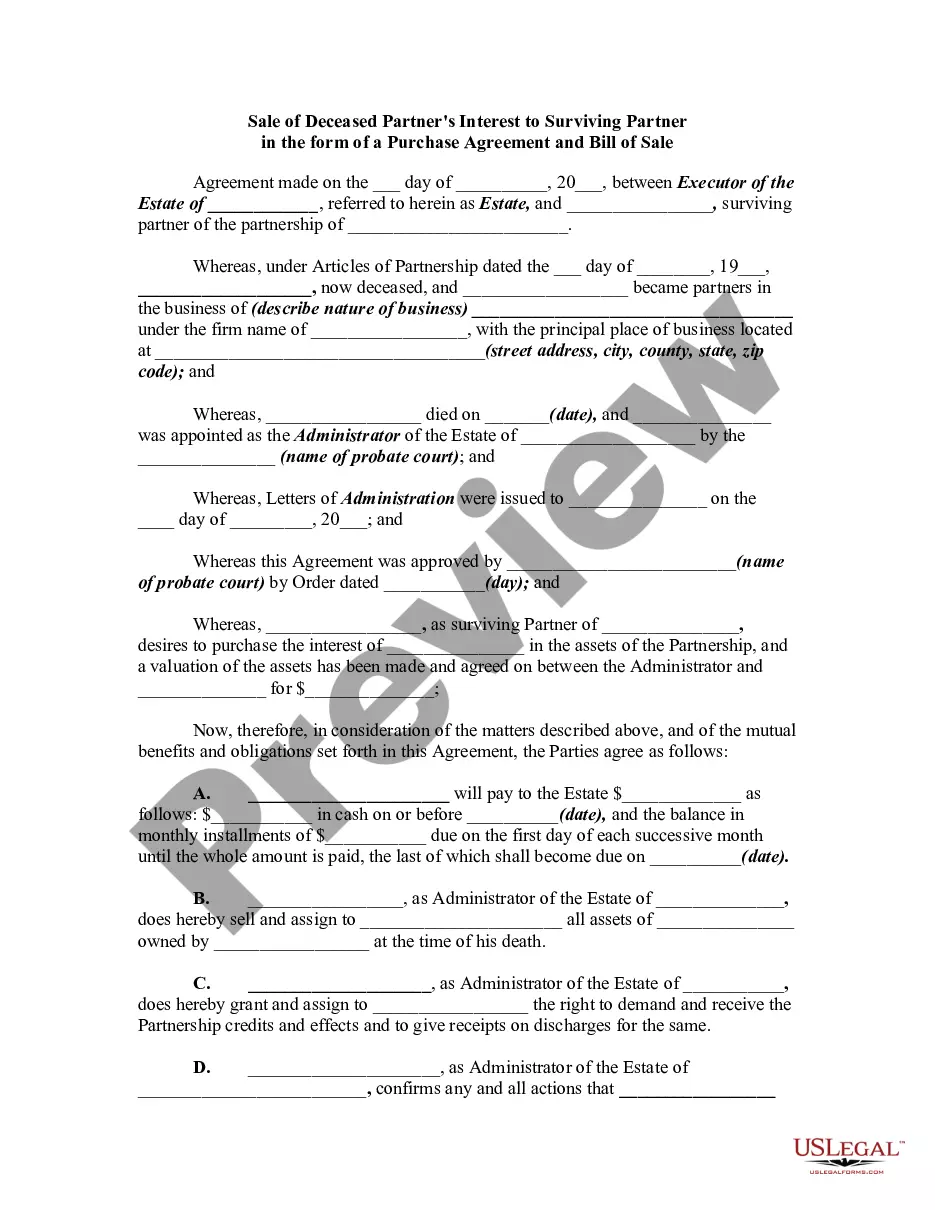

Connecticut Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale Keywords: Connecticut, sale of deceased partner's interest, surviving partner, purchase agreement, bill of sale. Introduction: When a partner in a business located in Connecticut passes away, it is necessary to address the disposition of their interest in the partnership. In such cases, the surviving partner may desire to purchase the deceased partner's interest to maintain sole ownership and control of the business. This transaction is typically executed through a Purchase Agreement and Bill of Sale. There are several types of Connecticut Sale of Deceased Partner's Interest to Surviving Partner, including: 1. Voluntary Sale: In this type of sale, the surviving partner and the estate of the deceased partner mutually agree on the terms and conditions of the sale. The Purchase Agreement outlines the terms of the transaction, such as the purchase price, payment terms, and any warranties or representations. The Bill of Sale is executed following the agreement, transferring the deceased partner's interest to the surviving partner. 2. Forced Sale by Court Order: If there is no agreement between the surviving partner and the deceased partner's estate, either party may petition the court to order a forced sale. The court will assess the circumstances and determine a fair value for the deceased partner's interest. Once the court determines the purchase price, a Purchase Agreement is executed, accompanied by a Bill of Sale to transfer the interest. 3. Sale through Partnership Agreement: In situations where the partnership agreement explicitly stipulates the procedure for the sale of a deceased partner's interest, the surviving partner must adhere to these provisions. The terms of the sale, including the purchase price and payment terms, will be outlined in the partnership agreement. A Purchase Agreement and Bill of Sale are executed according to the guidelines defined within the partnership agreement. Key Elements of a Connecticut Sale of Deceased Partner's Interest to Surviving Partner: 1. Identification of Parties: The Purchase Agreement and Bill of Sale must clearly identify the surviving partner and the deceased partner's estate or legal representatives. 2. Purchase Price and Payment Terms: The agreement should state the purchase price for the deceased partner's interest, whether it is a fixed amount or determined by appraisal. Payment terms, including any installments or lump sum payments, should also be specified. 3. Transfer of Interest: The Bill of Sale should contain a clear and comprehensive description of the interest being transferred. It should be signed by the appropriate representatives to ensure a legal transfer. 4. Warranties and Representations: Both parties may include warranties and representations in the Purchase Agreement to protect their interests and clarify any obligations or liabilities associated with the sale. 5. Governing Law: The agreement should specify that Connecticut law governs the interpretation and enforcement of the Purchase Agreement and Bill of Sale. Conclusion: When a partner in a Connecticut business passes away, the surviving partner may choose to purchase the deceased partner's interest to maintain control and ownership. Different types of sales, including voluntary sales, forced sales by court order, and sales executed according to the partnership agreement, may occur. The Purchase Agreement and Bill of Sale play crucial roles in effectuating a smooth transfer of the deceased partner's interest to the surviving partner.

Connecticut Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out Connecticut Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

If you wish to comprehensive, download, or print legal papers web templates, use US Legal Forms, the largest assortment of legal kinds, which can be found on the web. Use the site`s simple and easy practical research to get the paperwork you require. Various web templates for enterprise and person functions are sorted by categories and states, or search phrases. Use US Legal Forms to get the Connecticut Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale with a few mouse clicks.

In case you are previously a US Legal Forms customer, log in for your account and click the Obtain option to obtain the Connecticut Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale. Also you can accessibility kinds you previously downloaded within the My Forms tab of your respective account.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that appropriate town/land.

- Step 2. Use the Preview method to look over the form`s articles. Don`t forget about to read the description.

- Step 3. In case you are not happy with the develop, make use of the Lookup industry towards the top of the display screen to find other variations from the legal develop web template.

- Step 4. When you have identified the form you require, click on the Get now option. Choose the pricing strategy you choose and put your qualifications to register on an account.

- Step 5. Approach the purchase. You should use your charge card or PayPal account to accomplish the purchase.

- Step 6. Select the formatting from the legal develop and download it on your device.

- Step 7. Total, modify and print or signal the Connecticut Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale.

Each legal papers web template you buy is your own property forever. You have acces to each and every develop you downloaded within your acccount. Select the My Forms area and pick a develop to print or download once more.

Be competitive and download, and print the Connecticut Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale with US Legal Forms. There are thousands of professional and status-particular kinds you can utilize for the enterprise or person requirements.

Form popularity

FAQ

§ 45a-436(a) (2021). Statutory share: ??means a life estate of one-third in value of all the property passing under the will, real and personal, legally or equitably owned by the deceased spouse at the time of his or her death, after the payment of all debts and charges against the estate.

1 General principles. When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death? of any partner.

If your name is not on the deed of your home, you do not have a legal right to the property. However, this does not mean that all is lost. In many cases, equity is still split between both parties, even if your name is not on the deed.

Connecticut lets you register stocks and bonds in transfer-on-death (TOD) form. People commonly hold brokerage accounts this way. If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at your death.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

(a)(1) Any person eighteen years of age or older, and of sound mind, may execute in advance of such person's death a written document, subscribed by such person and attested by two witnesses, either: (A) Directing the disposition of such person's body upon the death of such person, which document may also designate an ...

Spouse and children -- spouse takes 1/2 the estate. If the children are also the spouse's, the spouse also takes $100,000. If they are not, spouse only takes 1/2. Whatever remains is divided equally among the children in the same generation.

A Guide to Connecticut Inheritance Laws Intestate Succession: Spouses and Children? Spouse and parents? Spouse inherits the first $100,000 of property, and three-quarters of the remaining balance ? Parents inherit the rest5 more rows ?