Connecticut Letter to Other Entities Notifying Them of Identity Theft of Minor

Description

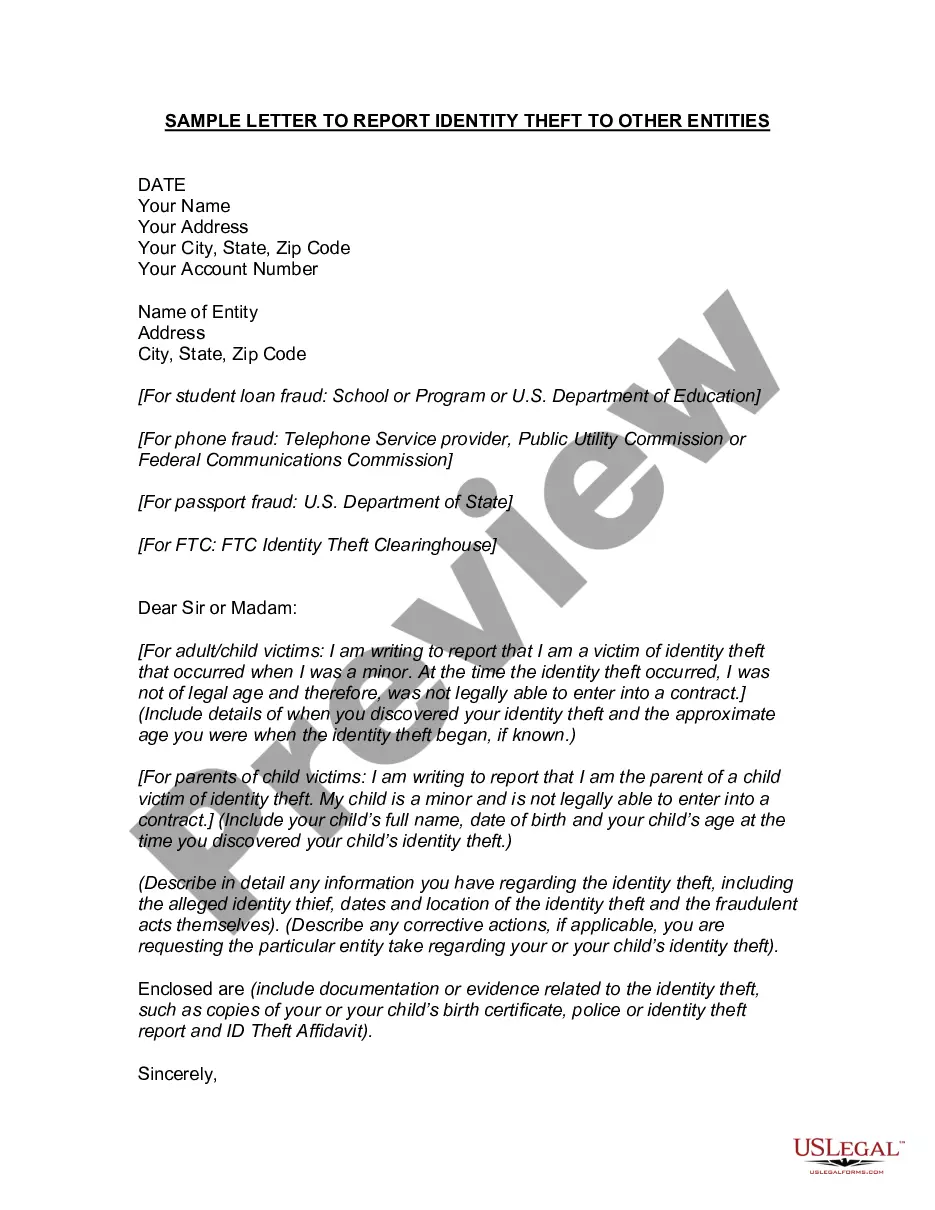

How to fill out Letter To Other Entities Notifying Them Of Identity Theft Of Minor?

Are you currently in a placement that you require files for sometimes business or individual reasons virtually every time? There are a variety of authorized file layouts available on the Internet, but finding versions you can rely isn`t simple. US Legal Forms provides 1000s of type layouts, much like the Connecticut Letter to Other Entities Notifying Them of Identity Theft of Minor, which are published to fulfill federal and state specifications.

Should you be previously familiar with US Legal Forms web site and also have your account, simply log in. Afterward, you may down load the Connecticut Letter to Other Entities Notifying Them of Identity Theft of Minor web template.

Should you not come with an profile and need to begin to use US Legal Forms, follow these steps:

- Find the type you will need and ensure it is for your appropriate city/area.

- Use the Review option to check the form.

- Browse the explanation to ensure that you have selected the appropriate type.

- If the type isn`t what you`re looking for, make use of the Look for field to get the type that suits you and specifications.

- Whenever you get the appropriate type, simply click Purchase now.

- Pick the rates prepare you need, fill in the required information to produce your account, and pay for the transaction making use of your PayPal or bank card.

- Select a handy file structure and down load your copy.

Locate every one of the file layouts you have bought in the My Forms food list. You can get a extra copy of Connecticut Letter to Other Entities Notifying Them of Identity Theft of Minor anytime, if required. Just select the essential type to down load or produce the file web template.

Use US Legal Forms, probably the most substantial assortment of authorized forms, to conserve time and avoid blunders. The support provides skillfully made authorized file layouts that you can use for an array of reasons. Generate your account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

In synthetic identity theft, criminals will create identities and attach a child's actual Social Security number to the profile. This allows them to obtain loans, file a false tax return, or apply for government benefits using the child's Social Security number.

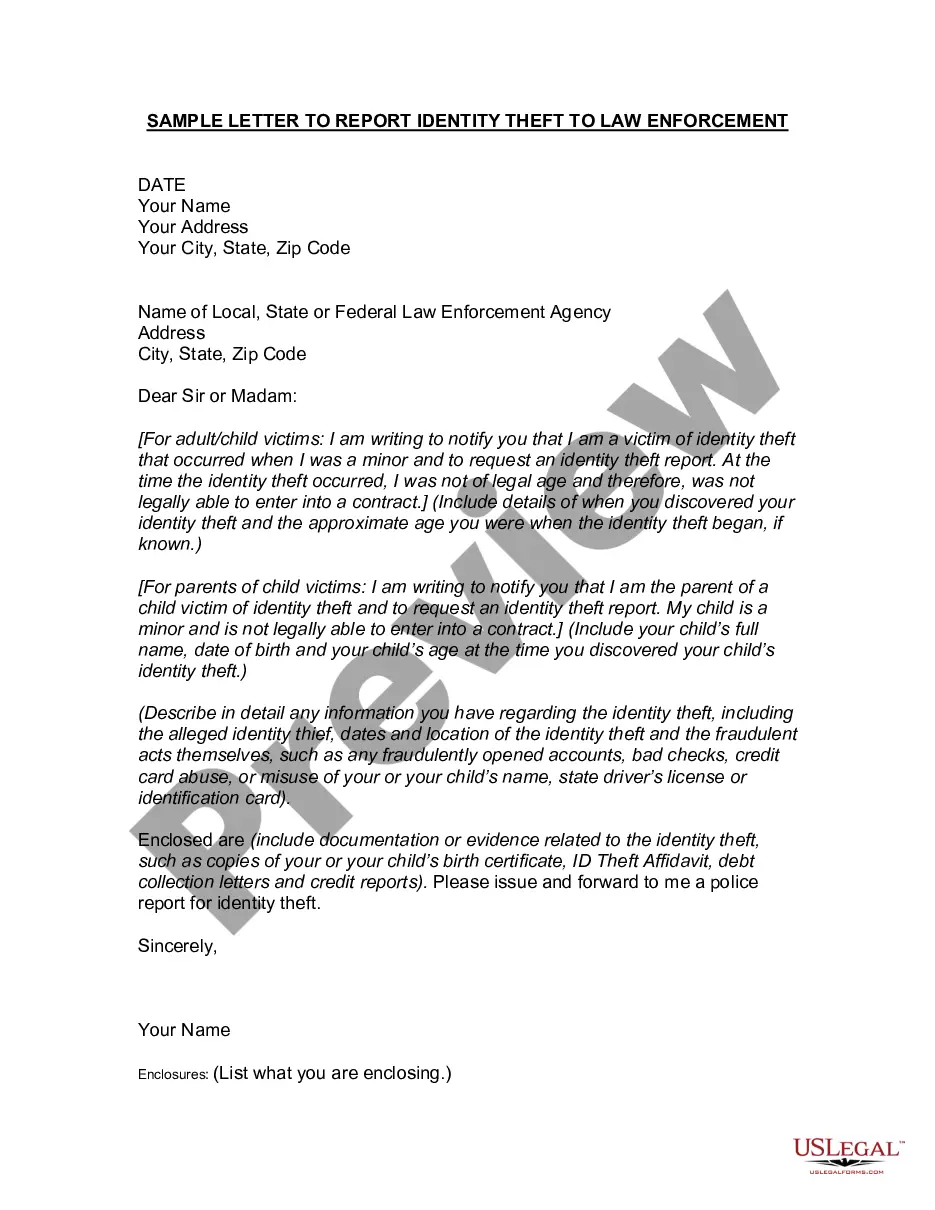

Connecticut law allows victims of identity theft to report identity theft to the law enforcement agency where they reside, and to obtain a copy of the report. If your personal information was compromised online, contact the Internet Crime Complaint Center to file a com- plaint at: .ic3.gov.

Contact the three credit bureaus. You can find out if your child may be a victim of identity theft by contacting the three major credit bureaus.

Tools/Resources for Victims Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Identity theft is a felony-level offense in Connecticut, and the degree and punishment vary depending on the age of the victim and the value of goods or services obtained. In today's technological age, more and more personal identifying information is being stolen by identity theft rings.

Contact the Federal Trade Commission (FTC) to report the ID theft and get a recovery plan. Contact your local law enforcement and get a police report. Contact the fraud departments of companies where accounts were opened in your child's name.

They may think it's okay to use their child's identity temporarily. But if you don't pay it back, you will damage your child's credit score and set them up for financial hardship when they reach adulthood. The law remains the same, regardless of the circumstances.

Warning Signs of Child Identity Theft Unexpected bills addressed to your child. Collection notices that arrive by mail or phone, targeting your child. Denial of government benefits for your child on the basis that they've already been paid to someone using your child's Social Security number.