Connecticut Contract with Employee to Work in a Foreign Country: A Comprehensive Guide Introduction: A Connecticut Contract with Employee to Work in a Foreign Country is a legally binding agreement between an employer based in Connecticut and an employee, outlining the terms and conditions under which the employee will work in a foreign country. This contract ensures clarity, protection, and mutual understanding between the two parties involved. In this detailed description, we will explore the various aspects of a Connecticut Contract with Employee to Work in a Foreign Country, including its purpose, key components, and different types. Purpose: The primary purpose of a Connecticut Contract with Employee to Work in a Foreign Country is to establish a clear understanding between the employer and the employee regarding the rights, obligations, and expectations throughout the employment period in a foreign country. This contract aims to ensure compliance with relevant laws and regulations, outline compensation and benefits, specify job responsibilities, and define the terms of employment termination or renewal. Key Components: 1. Parties Involved: The contract should clearly identify the employer based in Connecticut and the employee who will be working in a foreign country. 2. Job Description and Responsibilities: A comprehensive job description, along with a clear outline of the employee's responsibilities and reporting structure, should be included. This helps in setting clear expectations regarding the nature of work and performance standards. 3. Duration and Location: The contract should specify the start date and the length of the employment period abroad. Additionally, the specific foreign country or countries where the employee will be working should be stated. 4. Compensation and Benefits: The contract should outline the employee's salary, payment frequency, and any additional benefits such as housing, transportation, healthcare, and vacation allowances. It should also address currency exchange rates and any potential adjustments due to living and working in a foreign country. 5. Legal Requirements and Compliance: The contract should explicitly state that the employee and employer will comply with all applicable laws and regulations in both Connecticut and the foreign country. It should also mention any necessary permits, visas, or work authorizations required for the employee to work legally in the foreign country. 6. Termination and Renewal: The contract should clearly define the conditions and procedures for the termination or renewal of the employment agreement. This includes outlining the notice period required for termination, conditions for termination with cause or without cause, and any severance or repatriation obligations. Different Types of Connecticut Contracts with Employee to Work in a Foreign Country: 1. Fixed-Term Contract: This type of contract defines a specific period of employment abroad, typically for a year or more, with a predetermined end date. It provides certainty to both parties regarding the duration of employment. 2. Indefinite Contract: In contrast to a fixed-term contract, an indefinite contract does not specify an end date. Instead, it continues until either party decides to terminate the agreement based on the agreed-upon conditions outlined in the contract. 3. Secondment Agreement: A secondment agreement is a type of contract where an employee is temporarily assigned to work in a foreign country while remaining an employee of their original Connecticut-based organization. This arrangement often involves the continuation of the employee's existing terms and conditions, including benefits and salary. Conclusion: A Connecticut Contract with Employee to Work in a Foreign Country is a vital legal instrument that facilitates employment abroad while safeguarding the rights, responsibilities, and expectations of both the employee and employer. By addressing important aspects such as job description, compensation, compliance, and termination, this contract ensures a transparent and mutually beneficial relationship. Employees and employers should seek legal advice to draft and review these contracts, ensuring compliance with both Connecticut and international laws.

Connecticut Contract with Employee to Work in a Foreign Country

Description

How to fill out Connecticut Contract With Employee To Work In A Foreign Country?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

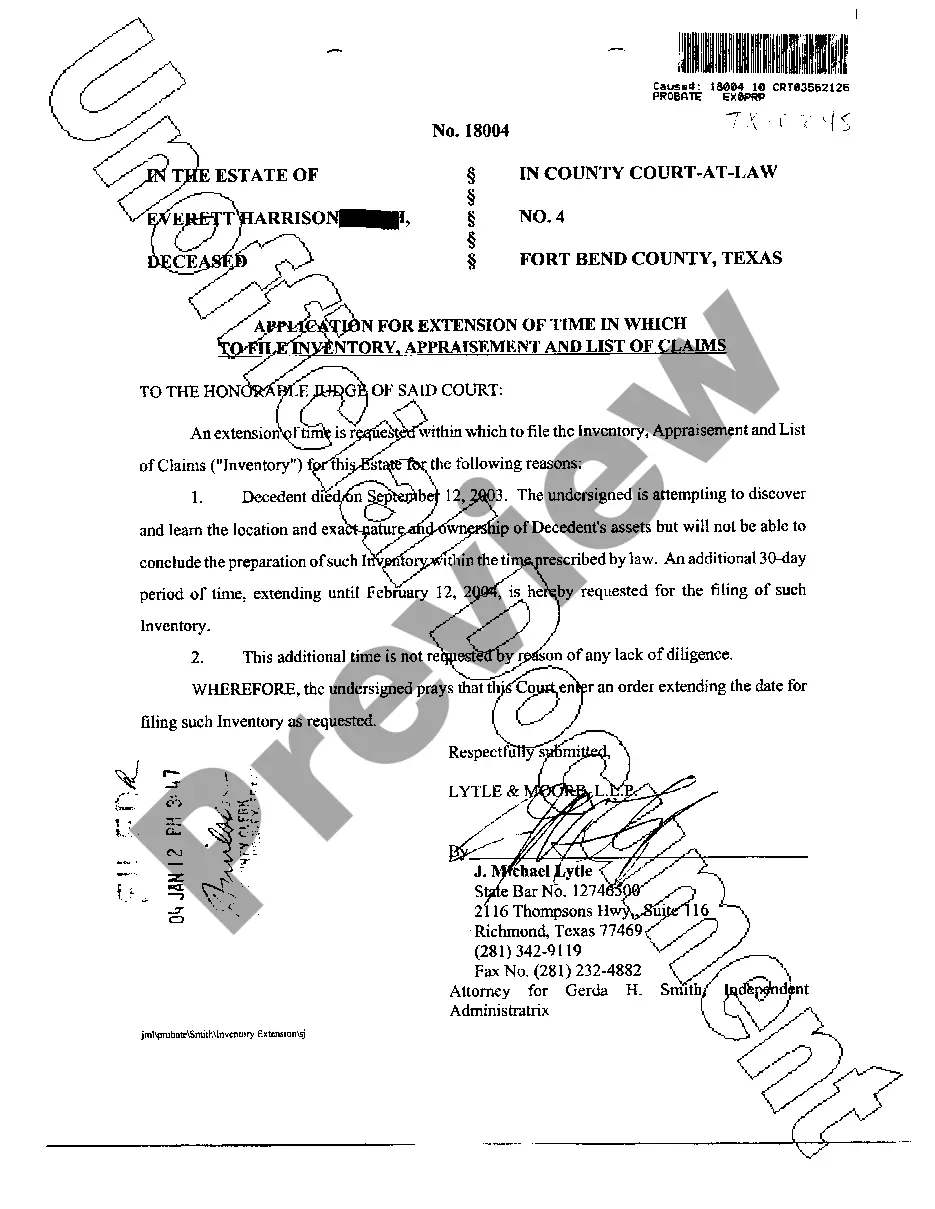

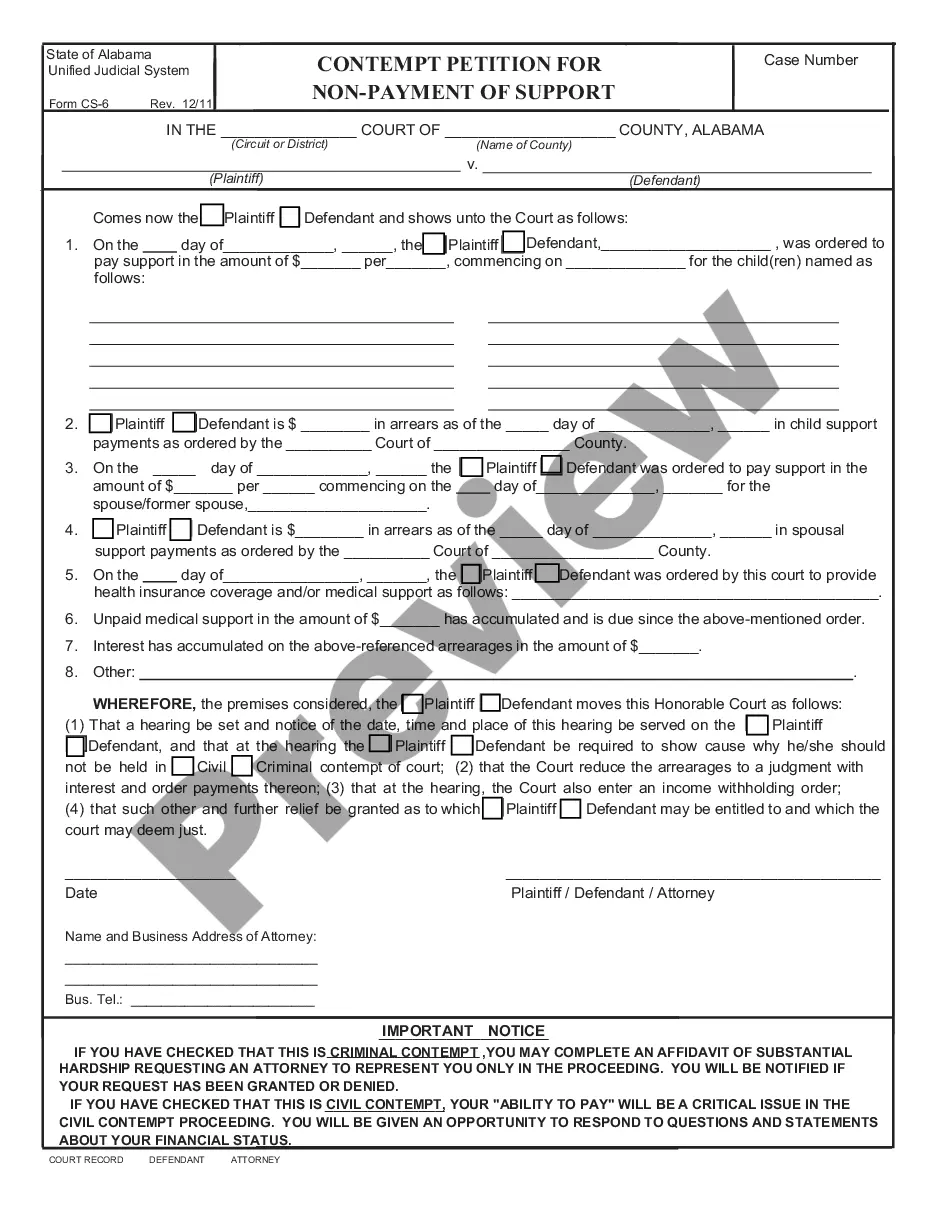

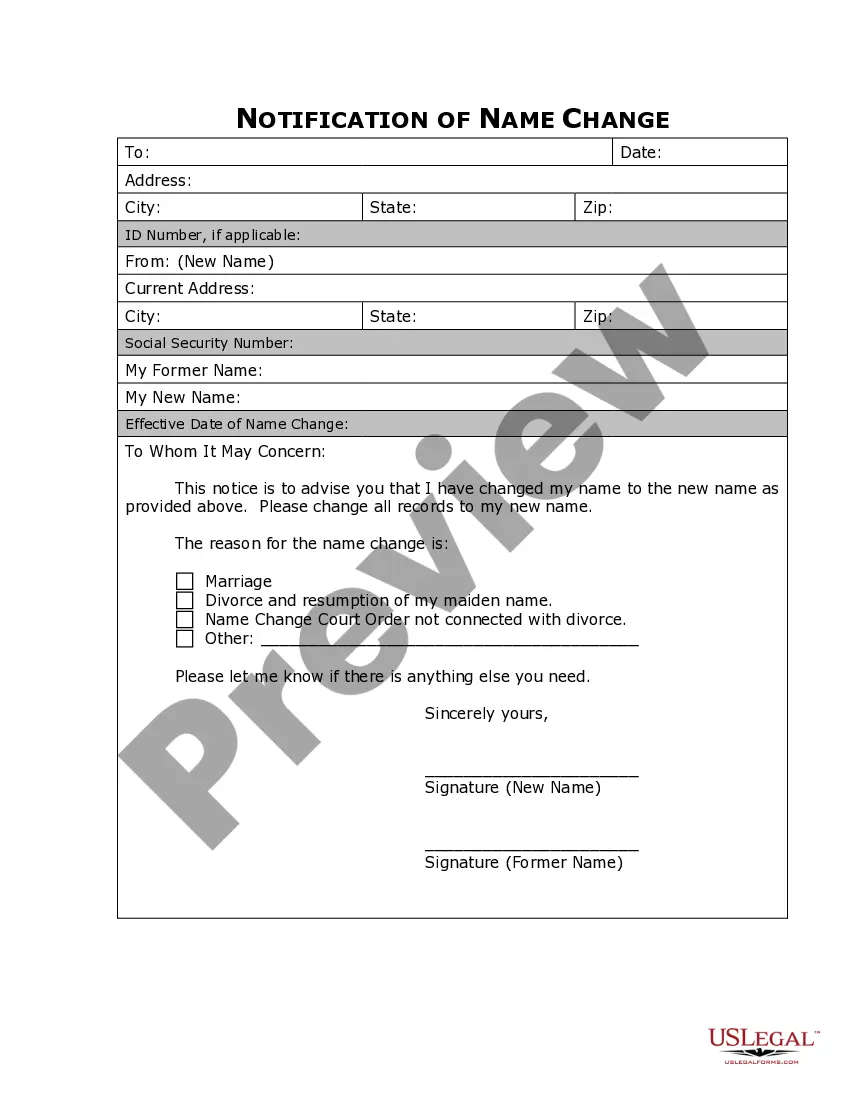

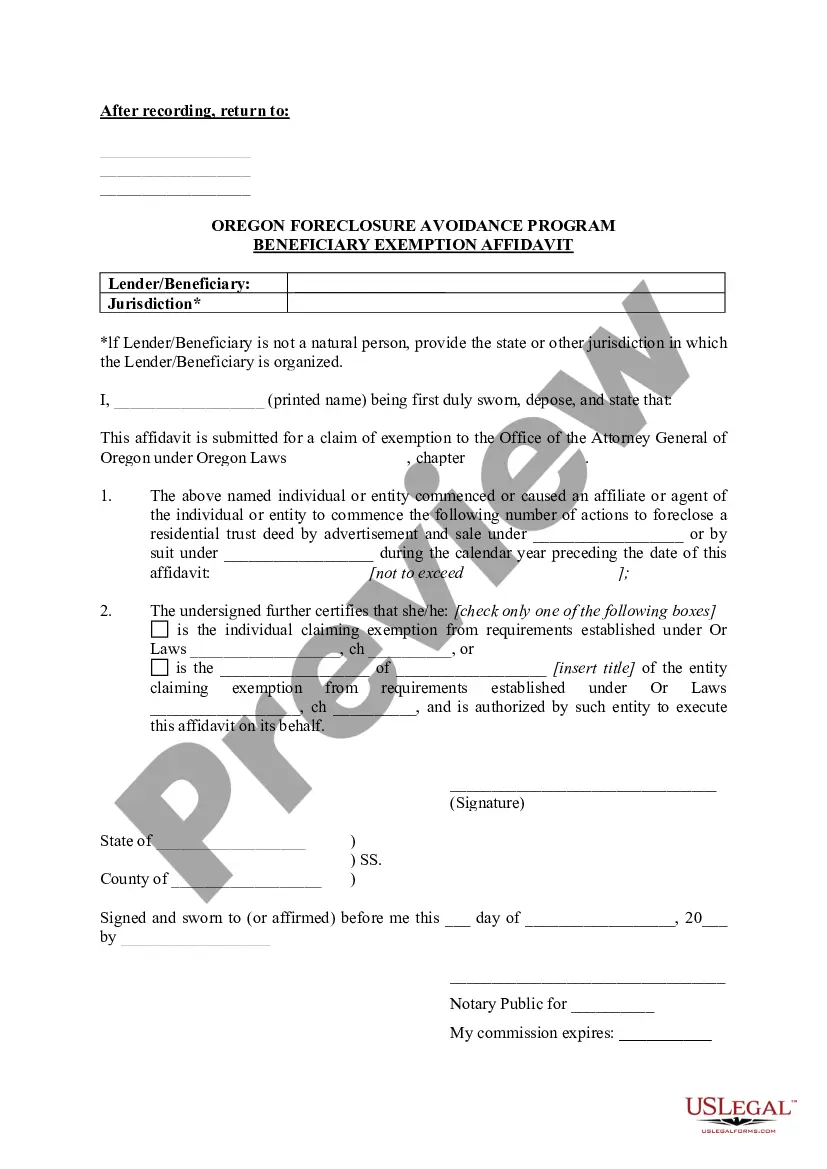

You can quickly obtain the latest versions of forms such as the Connecticut Contract with Employee to Work in a Foreign Country.

Read the form description to ensure you've selected the right form.

If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you have a subscription, Log In and download the Connecticut Contract with Employee to Work in a Foreign Country from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can find all previously downloaded forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are some simple instructions to help you get started.

- Make sure you have selected the correct form for your city/state.

- Click the Preview option to review the contents of the form.

Form popularity

FAQ

Working in the US while living in another country is not inherently illegal, but it does involve specific legal considerations. It is essential to comply with both US tax laws and any relevant laws in the country where you reside. If you have a Connecticut contract with an employee to work in a foreign country, understanding these laws can help you avoid complications. Consulting with legal experts or using platforms like US Legal Forms can assist in navigating these issues effectively.

Section 31-53 of the Connecticut General Statutes governs the employment contracts for individuals who work in foreign countries. This section outlines the legal requirements and protections for employees working under a Connecticut contract with an employer to work in a foreign location. It ensures that both employers and employees understand their rights and responsibilities, which can help prevent misunderstandings in international work situations.

Yes, you can work remotely for a U.S. company while living in another country, provided that all legal and taxation aspects are addressed. A Connecticut Contract with Employee to Work in a Foreign Country can clarify the terms of your remote employment, including salary, hours, and responsibilities. This contract serves to protect both you and the employer by laying out clear expectations and ensuring compliance with local and international laws.

To hire a foreigner, a U.S. company should first understand the legal requirements in the employee's country. Developing a Connecticut Contract with Employee to Work in a Foreign Country is crucial for outlining the job details and legal expectations. Utilizing platforms like uslegalforms can simplify this process by providing templates and guidance, ensuring that all necessary information is correctly documented and compliant with applicable laws.

Yes, a U.S. company can hire a foreign employee in another country, given they comply with that country's labor laws. This often involves the creation of a Connecticut Contract with Employee to Work in a Foreign Country, which specifies the terms of employment under the relevant legal framework. This process helps ensure that both the company and the employee meet all local regulations while aligning with U.S. standards of employment.

A foreign contract employee is an individual who works for a U.S. company but is employed under a contract that recognizes their status in a different country. This arrangement typically requires a Connecticut Contract with Employee to Work in a Foreign Country to outline the terms of employment, including responsibilities, duration, and compensation. Such contracts help both employers and employees understand their rights and obligations across borders, ensuring compliance with local laws.

In 2024, you can begin filing Connecticut state taxes as soon as the tax season opens, typically in late January. If you are working under a Connecticut Contract with Employee to Work in a Foreign Country, be mindful of the key deadlines to avoid late fees. Staying informed about the state's tax calendar ensures that you meet all necessary filing requirements in a timely manner.

You must file a nonresident tax return in Connecticut if you have earned income sourced from the state that meets the filing thresholds. For individuals operating under a Connecticut Contract with Employee to Work in a Foreign Country, your income’s source is crucial in determining your filing requirement. Keeping careful records of your Connecticut-sourced income will help you assess your obligations.

Yes, Connecticut follows a 183-day rule, which states that an individual may be considered a resident for tax purposes if they are present in the state for at least 183 days during the tax year. If you are working under a Connecticut Contract with Employee to Work in a Foreign Country, your presence in the state can affect your tax residency status. Understanding this rule helps you determine your tax obligations accurately.

The filing threshold for Connecticut varies based on your filing status and whether you are a resident or nonresident. Generally, if your income meets the minimum filing amount detailed in state guidelines, you need to file a return. For individuals working under a Connecticut Contract with Employee to Work in a Foreign Country, tracking this threshold is important to ensure you stay compliant with state tax laws.