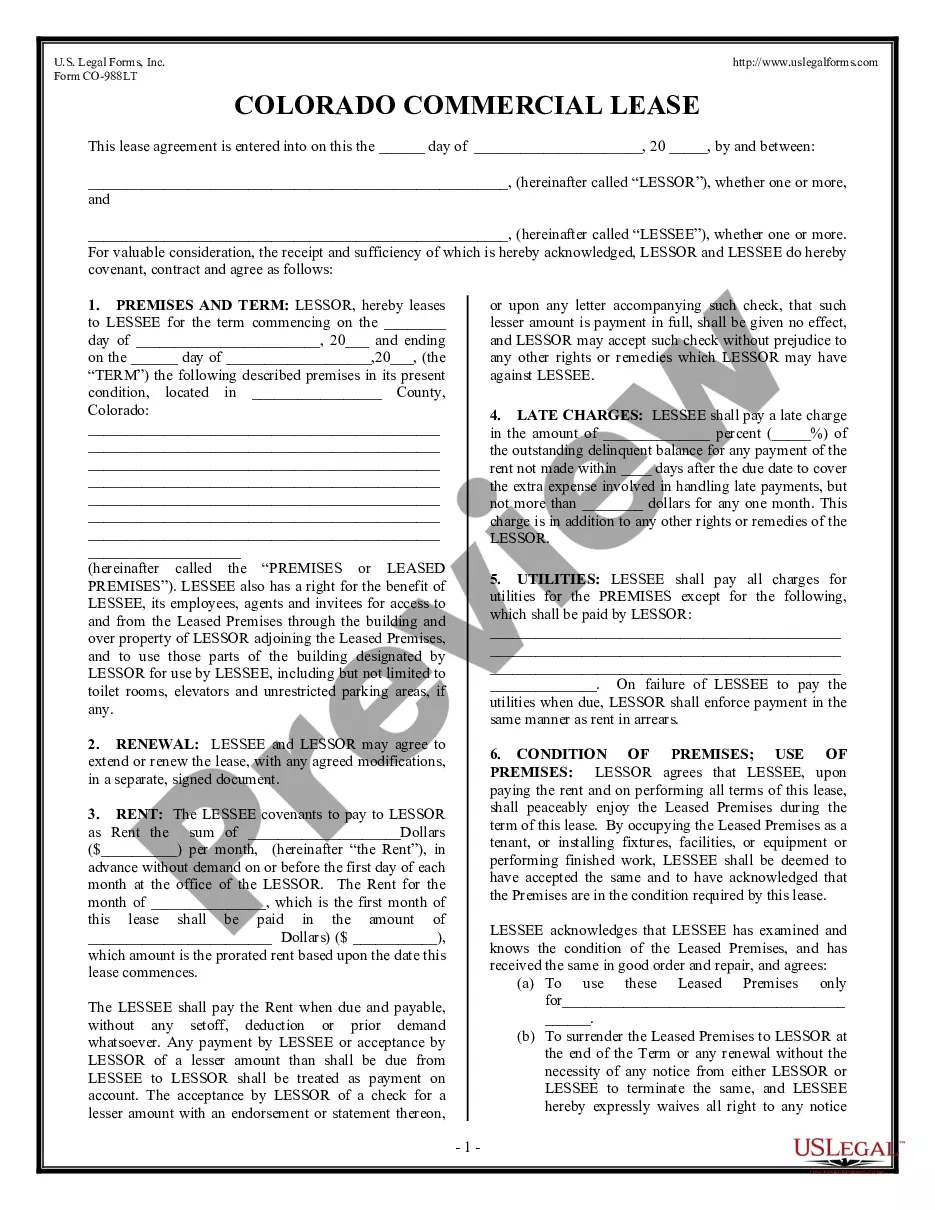

Connecticut Lease of Business Premises — Real Estate Rental is a legal agreement between a landlord and a tenant that outlines the terms and conditions for leasing a business space in Connecticut. This comprehensive document ensures that both parties understand their rights and responsibilities. The lease typically includes important details such as the duration of the lease, rental rates, payment terms, maintenance and repair obligations, property use restrictions, and the rights to renew or terminate the lease among others. It serves as a vital framework for the smooth functioning of a business and provides protection to both the landlord and tenant. There are different types of Connecticut Lease of Business Premises — Real Estate Rentals that cater to various business needs and preferences: 1. Gross Lease: In this type of lease, the tenant pays a fixed rental amount, and the landlord is responsible for covering all operating expenses, including utilities, maintenance, and taxes. This lease offers simplicity and predictability for tenants, as they have a clear understanding of their financial obligations. 2. Net Lease: This lease requires the tenant to pay a base rent along with additional operating expenses such as taxes, insurance, and maintenance. Net leases can be further categorized into three subtypes: a. Single Net Lease (N Lease): The tenant pays a base rent, real estate taxes, and the landlord handles other operating expenses. b. Double Net Lease (IN Lease): The tenant pays a base rent, real estate taxes, insurance premiums, and the landlord handles maintenance costs. c. Triple Net Lease (NNN Lease): The tenant pays a base rent, real estate taxes, insurance premiums, and maintenance costs. A triple net lease places the highest financial burden on the tenant as they are responsible for almost all expenses, making it more common in commercial real estate. 3. Percentage Lease: This type of lease is commonly used for retail businesses where the tenant pays a base rent plus a percentage of their sales revenue. Percentage leases allow landlords to share in the tenant's success while also providing a consistent income stream. 4. Modified Gross Lease: This lease is a combination of gross and net leases, where the tenant and landlord share expenses such as utilities, insurance, and maintenance. The specifics of cost sharing are negotiated between both parties and outlined in the lease. Connecticut Lease of Business Premises — Real Estate Rental contracts are crucial for establishing a stable rental relationship between landlords and tenants. They help protect the rights and interests of both parties while ensuring a smooth and mutually beneficial business operation.

Connecticut Lease of Business Premises - Real Estate Rental

Description

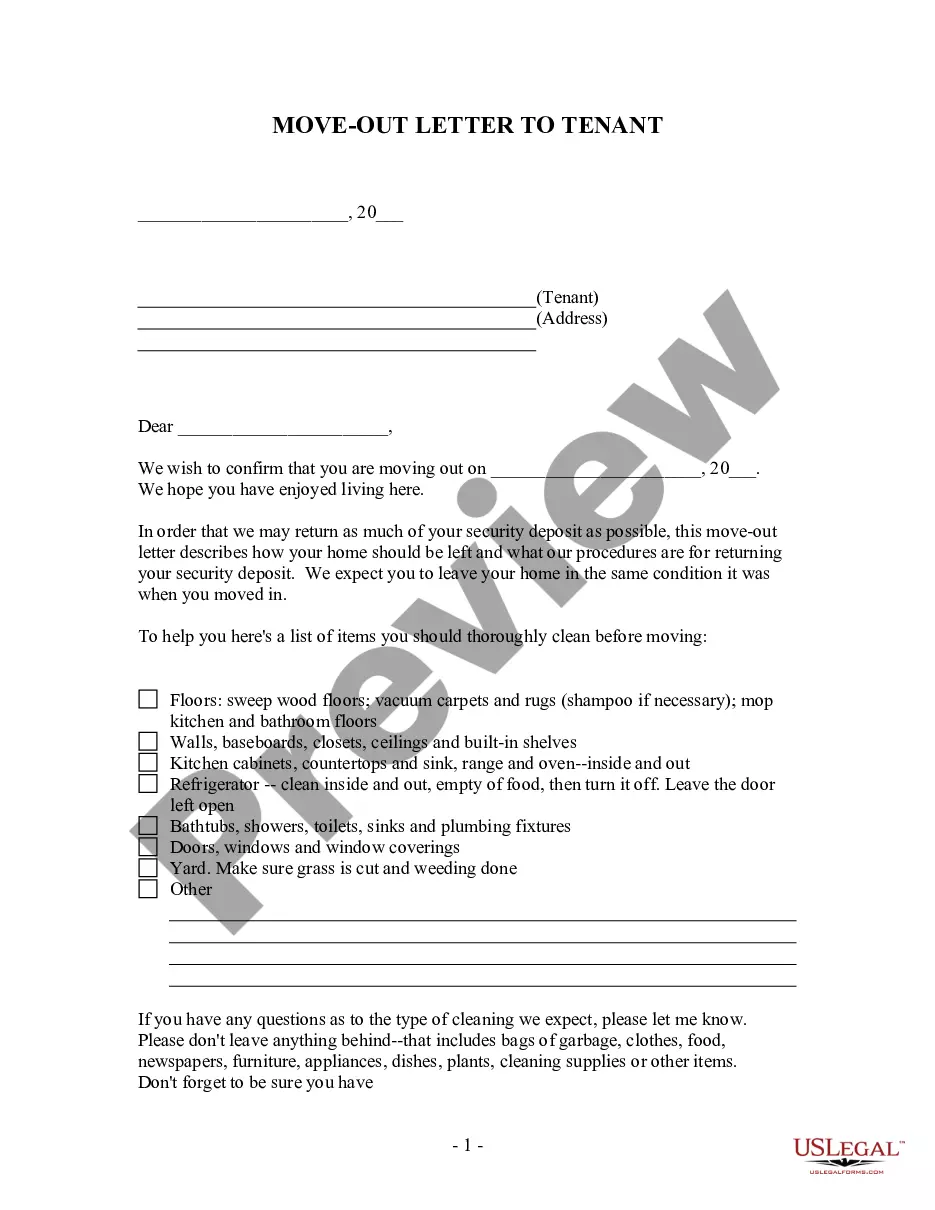

How to fill out Connecticut Lease Of Business Premises - Real Estate Rental?

If you need to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's convenient and user-friendly search feature to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or search terms.

Use US Legal Forms to locate the Connecticut Lease of Business Premises - Real Estate Rental in just a few clicks.

Every legal document template you acquire belongs to you permanently. You can access every form you downloaded in your account. Click the My documents section and choose a form to print or download again.

Stay competitive and download and print the Connecticut Lease of Business Premises - Real Estate Rental with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download button to access the Connecticut Lease of Business Premises - Real Estate Rental.

- You can also view forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the appropriate form for the correct city/state.

- Step 2. Use the Preview option to review the form`s contents. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your pricing plan and enter your information to register for the account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Connecticut Lease of Business Premises - Real Estate Rental.

Form popularity

FAQ

tomonth lease agreement in Connecticut allows tenants to rent a property with flexibility, usually renewing automatically each month. This type of agreement gives both parties the option to terminate the lease with proper notice, typically 30 days. When drafting a Connecticut Lease of Business Premises Real Estate Rental, it's important to include clear terms regarding notice periods and rental increases. For tailored lease agreements that meet your specific needs, consider using uslegalforms as a trusted resource.

Connecticut has laws that provide protections for both landlords and tenants, but it often leans in favor of tenant rights. Despite this, landlords can still maintain their interests effectively. Understanding the Connecticut Lease of Business Premises - Real Estate Rental allows landlords to navigate these laws efficiently. You can utilize resources from uslegalforms to create compliant lease agreements that safeguard your interests and ensure a positive rental experience.

The most common residential lease in Connecticut is the standard one-year lease. This lease typically includes specific terms regarding rent, security deposits, and maintenance responsibilities. The Connecticut Lease of Business Premises - Real Estate Rental gives property owners and tenants a clear understanding of their rights and obligations. By using a well-crafted lease agreement, you can avoid disputes and ensure a smooth rental experience.

Yes, you can assign a commercial lease, but it typically requires the landlord's consent. The lease agreement will outline specific processes and any conditions that must be met for assignment. Utilizing a trusted platform like uslegalforms can help you navigate the requirements associated with a Connecticut Lease of Business Premises - Real Estate Rental, ensuring that all legalities are appropriately handled.

The best lease type for commercial property depends on your specific business needs. Common options include gross leases, net leases, and modified gross leases, each offering different levels of expense responsibility. When seeking a Connecticut Lease of Business Premises - Real Estate Rental, it's essential to consider factors such as financial predictability and control over expenses to determine which lease structure aligns with your business goals.

The assignment and assumption of a commercial lease is a legal process whereby the original tenant assigns their lease to a new tenant, and that new tenant assumes all responsibilities outlined in the lease. This agreement transfers rights, such as the occupancy and obligations, ensuring the landlord is informed and consents to the transfer. Understanding this process is vital in the context of a Connecticut Lease of Business Premises - Real Estate Rental.

To assign a commercial lease, the original tenant must review the lease agreement for clauses regarding assignment. After confirming that assignment is permissible, the tenant will need to draft an assignment agreement, often requiring landlord approval. This process is crucial in a Connecticut Lease of Business Premises - Real Estate Rental setting to ensure all parties are aware of their rights and obligations.

In Connecticut, most residential leases do not require notarization, while commercial leases are typically not mandated to be notarized either. However, having a lease agreement notarized can provide an additional layer of protection for both parties involved. When engaging in a Connecticut Lease of Business Premises - Real Estate Rental, it is advisable to consult an attorney to ensure all legal requirements are met.

The recent renters' law in Connecticut includes several protections aimed at ensuring fair treatment of tenants. Key provisions prohibit unjust evictions, mandate proper notice for lease terminations, and enhance security deposit regulations. These changes significantly influence the landscape of real estate rentals in Connecticut, making it essential for business owners to stay informed regarding their lease agreements.

A lease is a contract between a landlord and a tenant that outlines the terms of renting a property. An assignment, in contrast, is when the tenant transfers their rights and responsibilities under that lease to another party. Understanding the distinctions is important when navigating the intricacies of a Connecticut Lease of Business Premises - Real Estate Rental, as it affects liability and tenant rights.

Interesting Questions

More info

The border is one of the primary reasons that Chicago is called the City of Bridges. It also happens to be among the top three largest cities in the United States, after New York City, Los Angeles, and Houston. With a population of more than 2.5 million (2010) Chicago land is the most populous of the major U.S. cities. Over 1 million Chicagolandites are on the move each day, traveling east to west or north to south. The area surrounding or containing Chicago's metropolitan border has more than 4.5 million residents, making it the third largest metropolitan area in the country, after Seattle, Washington, and Chicago. Chicago land has over 30,000 miles of borders, with a lot of them being physical.