Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

US Legal Forms - one of the most prominent collections of legal templates in the United States - provides a selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, jurisdictions, or keywords.

You can obtain the newest versions of documents like the Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner by Retiring Partner within minutes.

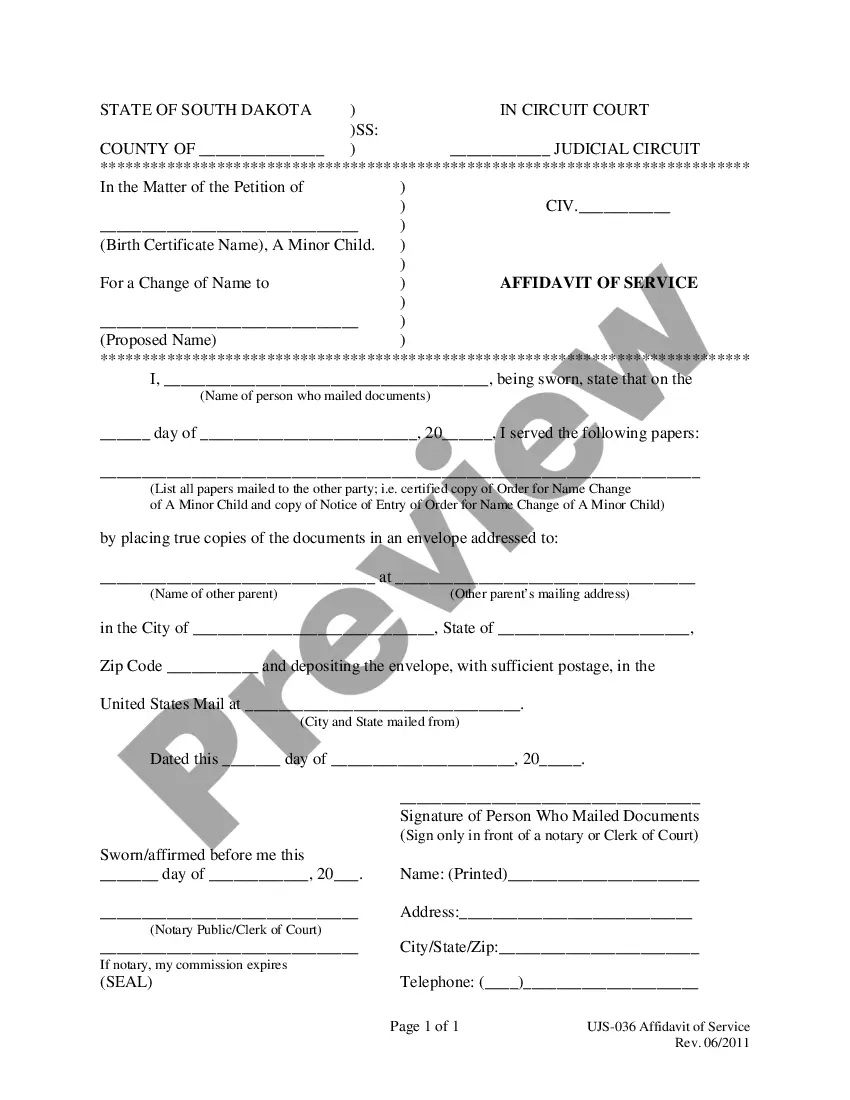

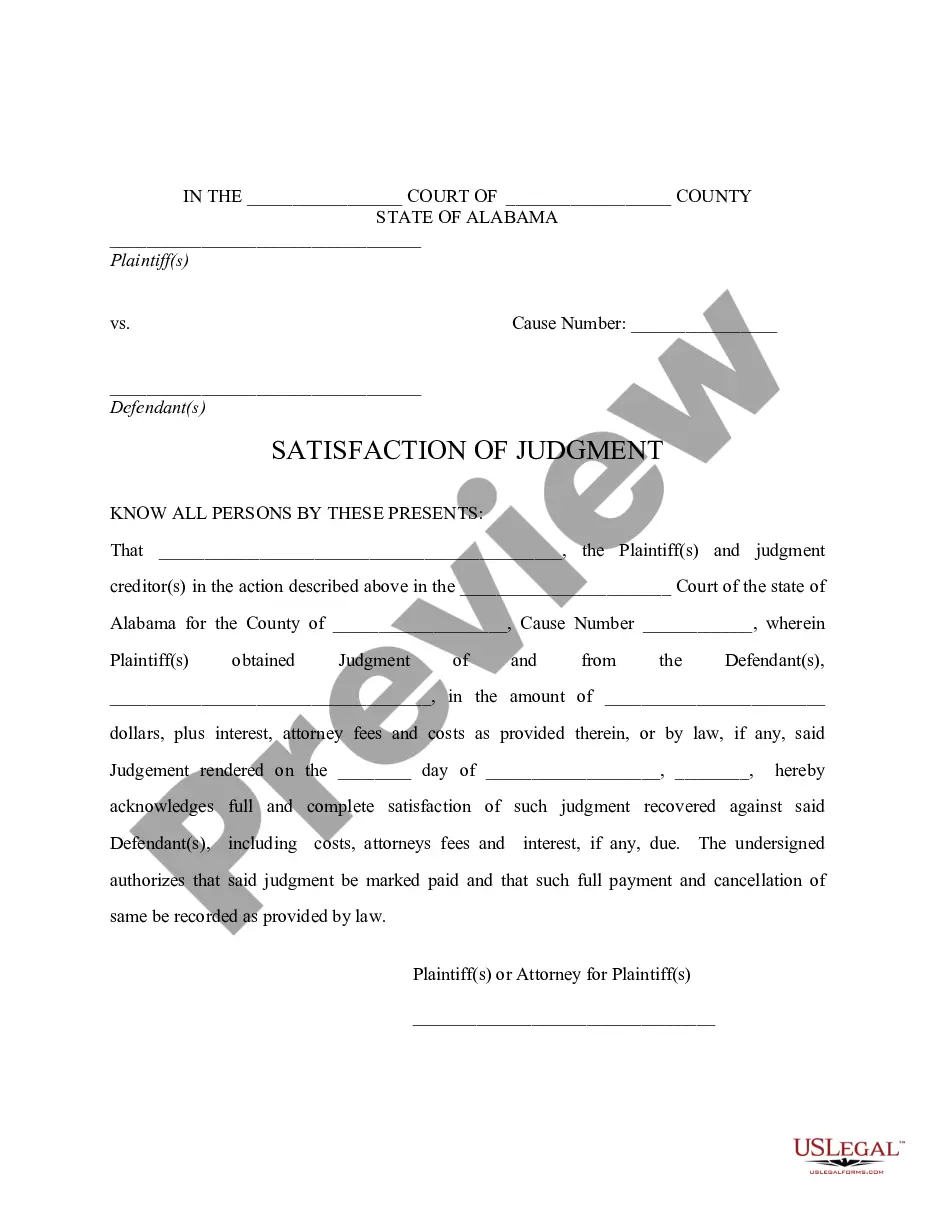

Select the Preview option to review the contents of the form. Check the form's summary to confirm that you have selected the right document.

If the form does not fulfill your requirements, use the Search bar at the top of the screen to find one that does.

- If you already possess an account, Log In and download the Connecticut Agreement to Dissolve and Wind Up Partnership with Sale to Partner by Retiring Partner from the US Legal Forms catalog.

- The Download option will appear on every form you view.

- You can access all previously acquired forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have chosen the correct form for your city/state.

Form popularity

FAQ

To shut down a business in Connecticut, you must formally dissolve your business entity with the state. This typically involves filing dissolution paperwork and resolving any outstanding tax obligations. If you are part of a partnership, consider a Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner for an organized exit. This agreement can ensure that all partners are on the same page and that legal matters are handled correctly.

Removing yourself from a business partnership involves discussions with your partners and reviewing the partnership agreement. It's crucial to address how your departure will affect the business and how your share will be bought or sold. A Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can simplify this process. This formal document provides guidelines that protect both you and your partners during this transition.

To dissolve a partnership, partners should follow the terms outlined in their partnership agreement. This often includes notifying all partners, settling outstanding debts, and distributing remaining assets. Utilizing a Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can streamline this process. This agreement serves to clarify the steps and maintain legal compliance during dissolution.

When a partner retires from a partnership, the business must address their share and contributions. Typically, the partnership's agreement outlines the terms for buyouts and settlements. A Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner may be necessary to ensure a smooth transition and proper distribution of assets. This process can help prevent disputes and clarify each partner's responsibilities.

Yes, you can wind up a partnership by following a defined process established in the partnership agreement or state law. Typically, this includes drafting a Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. It's essential to ensure all financial matters are resolved and that the interests of all partners are addressed during the winding-up period.

Winding up a partnership involves settling accounts, paying off debts, and distributing remaining assets among partners. The process typically begins after a Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is enacted. This agreement serves as a guideline to ensure an orderly dissolution while addressing any outstanding obligations.

Ending a partnership gracefully requires clear communication and mutual respect among partners. Drafting a Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can facilitate this process. It helps define the terms and conditions for winding up, ensuring all parties understand their rights and responsibilities while preserving relationships.

Partnerships may be dissolved under various circumstances, including mutual agreement among partners, expiration of a certain term, or achievement of a specific project. A retiring partner's decision to exit can also lead to a Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. Additionally, if a partner becomes incapacitated or engages in misconduct, dissolution may become necessary.

Yes, you can dissolve a partnership, but it is important to follow the correct legal procedures. Review your partnership agreement for termination clauses, and notify all partners of your intention. Engaging with the Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner ensures that you adhere to all necessary steps for a successful dissolution.

When one partner wishes to leave the partnership, it can trigger a dissolution process, depending on the partnership agreement's terms. Partners should communicate openly about the departure and begin settling any financial obligations. The Connecticut Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner provides a framework to manage this situation amicably.