A Connecticut Buy Sell Agreement Between Co-Owners of Real Property is a legally binding agreement that outlines the terms and conditions for the buying and selling of real property between co-owners. This agreement is particularly beneficial when multiple individuals own and share ownership of a property, such as joint tenants or tenants in common. It helps protect the co-owners' interests and provides a clear roadmap for the potential sale or transfer of their shares in the property. The main purpose of a Buy Sell Agreement is to establish a framework for situations that may lead to the sale or transfer of the property. This includes scenarios like co-owners wanting to sell their share, disagreements among co-owners, disability, death, or retirement of a co-owner. By having a well-drafted agreement in place, potential issues can be addressed ahead of time, ensuring a smooth transition or resolution. A Connecticut Buy Sell Agreement should contain several key components to effectively address the various aspects of the co-ownership. These may include: 1. Identification of Parties: Clearly mention the names, addresses, and ownership percentages of all co-owners involved in the agreement. If there are more than two co-owners, their respective roles and responsibilities should also be defined. 2. Property Description: Provide a detailed description of the property being co-owned, including its physical address, boundaries, and any relevant legal identifiers (such as parcel numbers or deeds). 3. Purchase and Sale Terms: Specify the conditions under which a co-owner can sell their share, such as offering it first to the other co-owners before considering external buyers. The agreement should outline the process for determining the fair market value of the property and how the purchase price will be calculated. 4. Triggering Events: Identify the events that may trigger the need to sell a co-owner's share, such as death, disability, divorce, bankruptcy, or retirement. Clearly define the procedures to be followed in such circumstances. 5. Right of First Refusal: Determine whether the other co-owners have the right to match or exceed any offer made by an external buyer. This provision helps maintain the cohesion of the co-ownership group and prevents unwanted third-party involvement. 6. Financing and Payment Terms: Specify how the purchase will be financed, outlining the acceptable forms of payment and any potential installment or financing arrangements. 7. Dispute Resolution: Include a dispute resolution clause to address conflicts that might arise between co-owners. This may involve mediation or arbitration, allowing for a peaceful and efficient resolution process. In Connecticut, there are different types of Buy Sell Agreements, including: 1. Cross-Purchase Agreement: This is when co-owners agree to purchase each other's shares directly. In case of a triggering event, the remaining co-owners can buy the departing co-owner's share in proportion to their ownership percentages. 2. Stock Redemption Agreement: This type of agreement is commonly used for properties held by a corporation or limited liability company (LLC). In the event of a trigger event, the entity itself buys back the shares of the departing co-owner. 3. Wait-and-See Agreement: With this agreement, the co-owners wait until a triggering event occurs to decide whether they want to buy or sell their shares. The agreement lays out the terms and conditions for each scenario. In conclusion, a Connecticut Buy Sell Agreement Between Co-Owners of Real Property is crucial for ensuring a clear, fair, and efficient process when selling or transferring shares in a co-owned property. It helps minimize potential conflicts and provides a solid foundation for addressing various triggering events. By understanding the different types of agreements available, co-owners can choose the one that best suits their needs and circumstances.

Connecticut Buy Sell Agreement Between Co-Owners of Real Property

Description

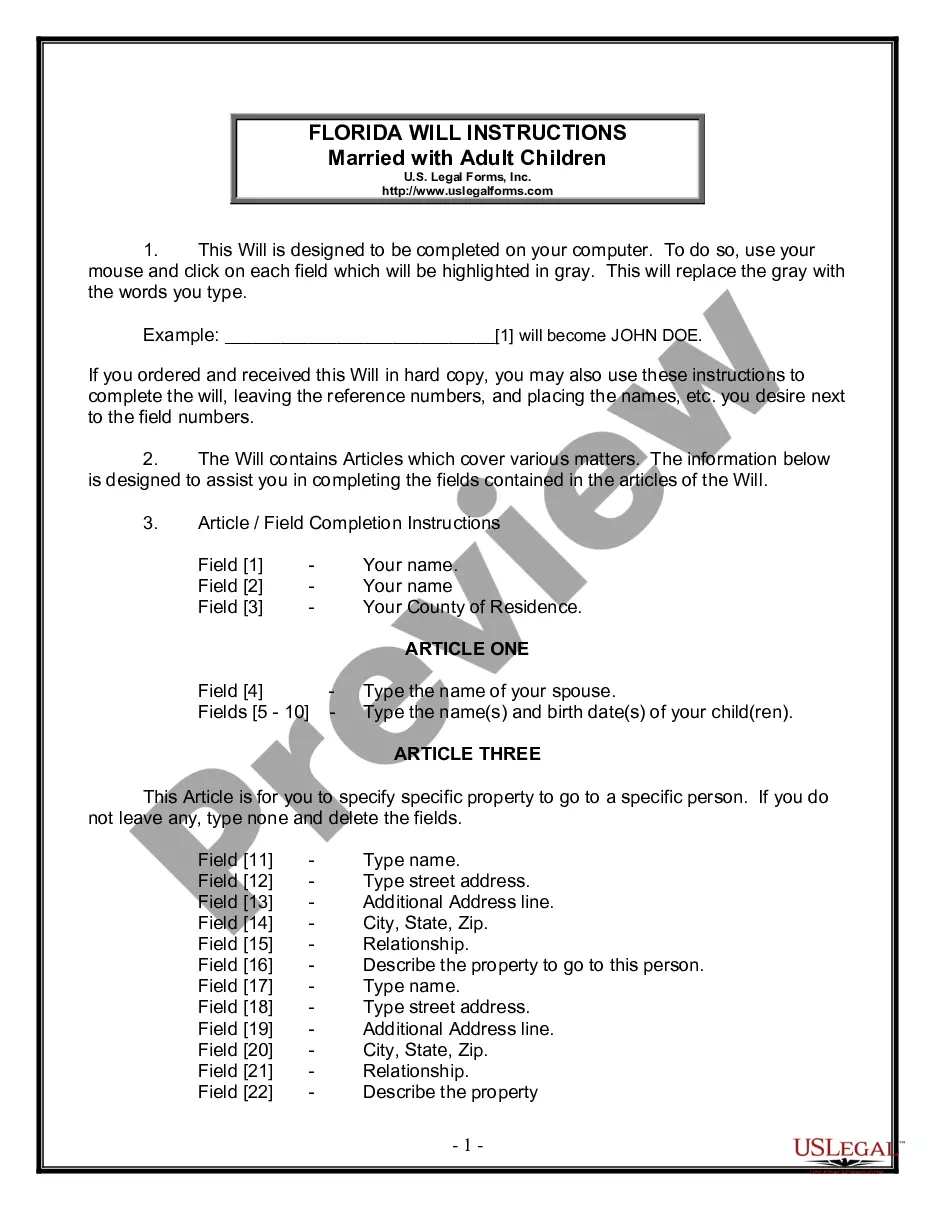

How to fill out Connecticut Buy Sell Agreement Between Co-Owners Of Real Property?

Are you in a situation where you need to have files for both enterprise or specific purposes nearly every working day? There are tons of legal record templates available on the Internet, but getting ones you can rely on isn`t simple. US Legal Forms gives thousands of kind templates, just like the Connecticut Buy Sell Agreement Between Co-Owners of Real Property, that happen to be created to satisfy federal and state demands.

When you are presently acquainted with US Legal Forms site and possess a free account, basically log in. Following that, you can download the Connecticut Buy Sell Agreement Between Co-Owners of Real Property template.

If you do not come with an profile and wish to begin using US Legal Forms, adopt these measures:

- Get the kind you want and make sure it is for that proper area/state.

- Use the Review button to analyze the form.

- Look at the outline to ensure that you have selected the correct kind.

- In the event the kind isn`t what you are seeking, make use of the Look for field to find the kind that meets your needs and demands.

- Whenever you discover the proper kind, click Get now.

- Select the rates strategy you want, fill out the desired info to produce your bank account, and pay for the order making use of your PayPal or credit card.

- Select a hassle-free document format and download your copy.

Find every one of the record templates you have bought in the My Forms menus. You may get a further copy of Connecticut Buy Sell Agreement Between Co-Owners of Real Property anytime, if required. Just click on the essential kind to download or printing the record template.

Use US Legal Forms, probably the most substantial assortment of legal forms, to save efforts and steer clear of mistakes. The services gives professionally manufactured legal record templates which can be used for a range of purposes. Make a free account on US Legal Forms and initiate creating your daily life a little easier.