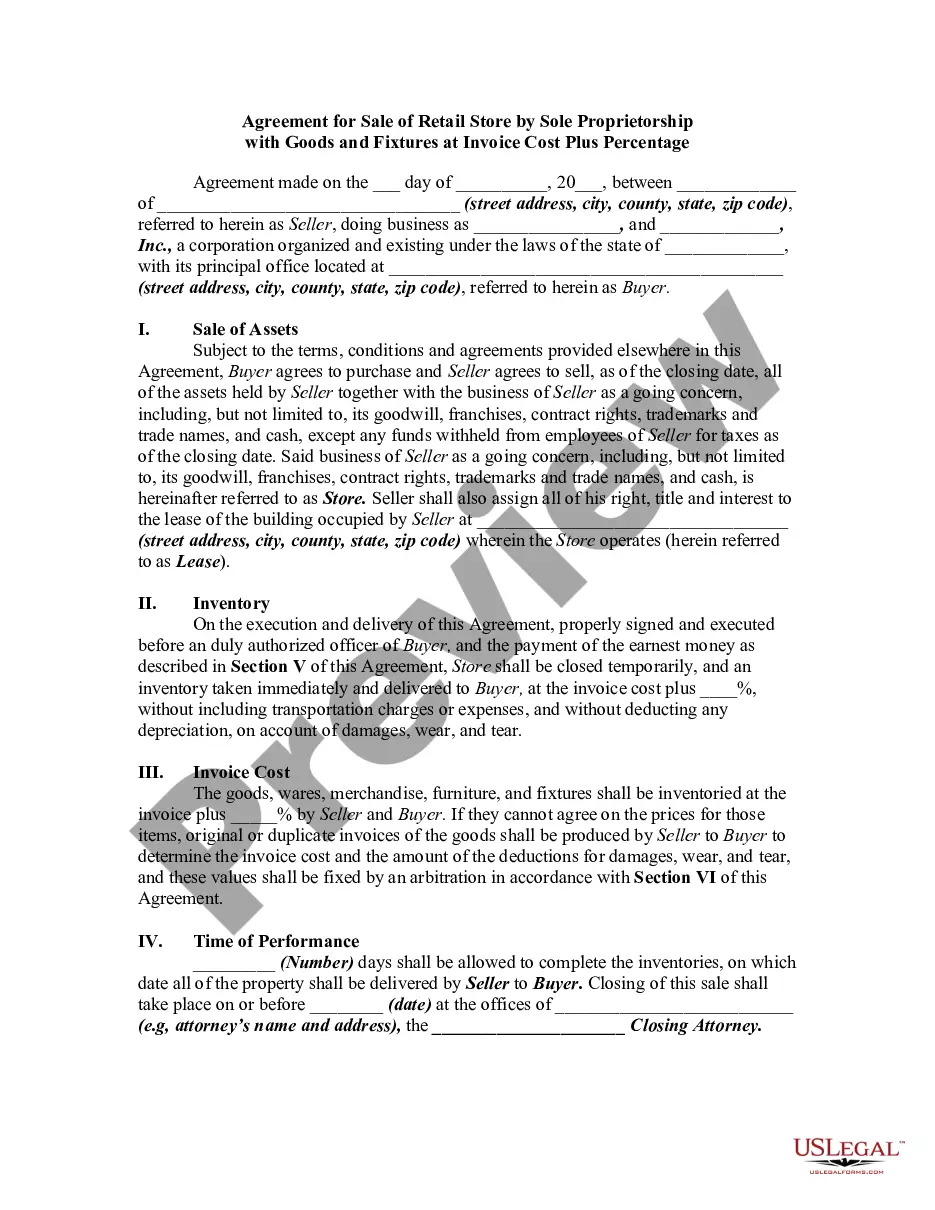

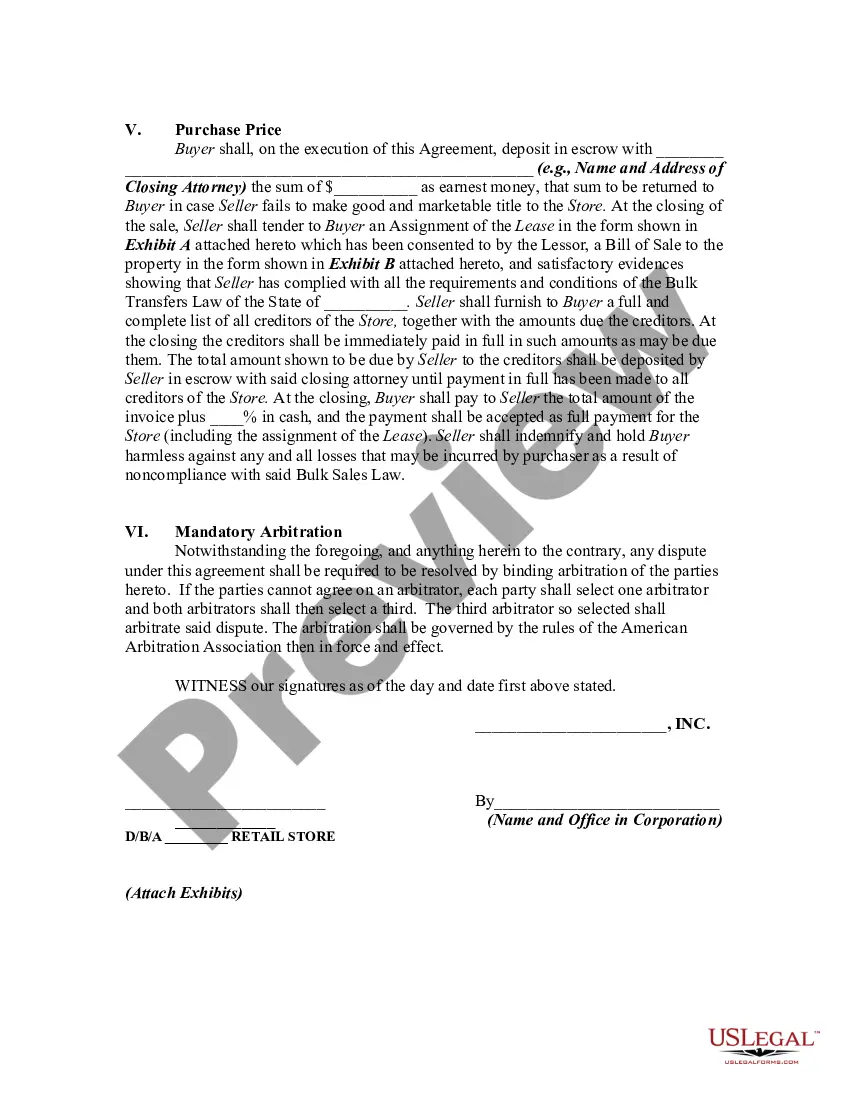

Connecticut Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding contract between a sole proprietor who operates a retail store and a buyer who wishes to purchase the business. This agreement outlines the terms and conditions under which the sale will take place, including the price, payment terms, and other relevant details. In Connecticut, there are no specific variations of the Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. However, it is essential to include all necessary information in the contract to protect both parties' interests and ensure a smooth transaction. Key Elements of a Connecticut Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage: 1. Parties involved: Clearly state the names and addresses of both the seller (sole proprietor) and the buyer, along with their respective legal representatives, if any. 2. Sale terms: Specify the date of the agreement, the effective date of the sale, and any contingencies or conditions that need to be fulfilled before the sale can be finalized. 3. Description of the retail store: Provide detailed information about the retail store being sold, including its name, address, business type, and any relevant permits or licenses associated with it. 4. Goods and fixtures: List and describe all the goods, inventory, and fixtures included in the sale, including their quantities, estimated values, and conditions at the time of the sale. 5. Purchase price: Clearly state the purchase price of the retail store, which will be calculated as the invoice cost (cost price) of the goods and fixtures, plus a specified percentage amount or markup. This percentage is typically agreed upon between the seller and the buyer. 6. Payment terms: Outline the payment details, including the initial deposit amount, if applicable, the balance amount, and any installment payments or financing arrangements agreed upon. Include the due dates and method of payment. 7. Representations and warranties: Include any representations and warranties made by the seller regarding the retail store, its condition, financial performance, and legal compliance. Similarly, state any representations and warranties made by the buyer regarding their ability and intention to complete the purchase. 8. Non-compete clause: If the seller will be restricted from engaging in a similar business within a specified geographic area and timeframe after the sale, include a non-compete clause to protect the buyer's interests. 9. Further assurances: Clearly state that both parties will cooperate and provide any additional documents, information, or actions required to complete the sale and transfer ownership of the retail store. 10. Governing law and jurisdiction: Specify that the agreement will be governed by Connecticut laws and any disputes will be resolved through arbitration or litigation in Connecticut courts. It is crucial to consult with an attorney experienced in small business transactions to draft or review the Connecticut Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage to ensure all legal requirements are met and to address any specific needs or concerns of the parties involved.

Connecticut Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Connecticut Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

If you require extensive, download, or create authentic legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly and efficient search to locate the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and enter your credentials to sign up for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Use US Legal Forms to locate the Connecticut Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to access the Connecticut Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

- You can also retrieve forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for your specific city/region.

- Step 2. Use the Review option to check the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The IRS taxes 1099 contractors as self-employed. And, if you made more than $400, you need to pay self-employment tax. Self-employment taxes include Medicare and Social Security taxes, and they total 15.3% of the net profit on your earnings as a contractor (not your total taxable income).

Key Takeaways. Form 1099-MISC is used to report miscellaneous compensation such as rents, prizes and awards, medical and healthcare payments, and payments to an attorney.

Although, as an out-of-state business, you may not be required to collect sales tax from your customers in New York State, your customers are still responsible for the payment of sales or use tax on their purchases. The use tax complements the sales tax.

7 min read. A tax invoice broadly contains the description of goods sold, their quantity, taxes charged, total taxable value, and other particulars. It is a piece of primary evidence that the recipient of goods can claim an input tax credit.

Tax invoice broadly contains details like description, quantity, value of goods/service, tax charged thereon and other particulars as may be prescribed. Tax invoice is a primary evidence for recipient to claim input tax credit of goods & service.

Generally sales tax and freight is not included on 1099 forms.

Name, address, and VAT registration number of the supplier. Name, address and where the recipient is a VAT Vendor the recipient's VAT registration number. Invoice number and date of issue of the invoice. An accurate description of goods and/or services (indicating where applicable that the goods are second hand).

Sales Tax Exemptions in Connecticut Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

A tax invoice should ideally contain the below details:Supplier name and contact.Customer name and contact.Tax invoice number.PAN and GSTIN of the supplier and customer.Date of issue of invoice.Place of supply of goods.Tax rate, HSN code and tax amount.Description of goods sold.More items...?08-Apr-2022

Invoices usually include:your business name.a unique invoice number.your business contact details.your Australian business number (ABN)the date you issued the invoice.a brief list of the items sold, including quantity and price.the GST amount (if any)payment terms and details.More items...?24-Sept-2021

Interesting Questions

More info

The following instructions can also be found at the bottom of this page:.