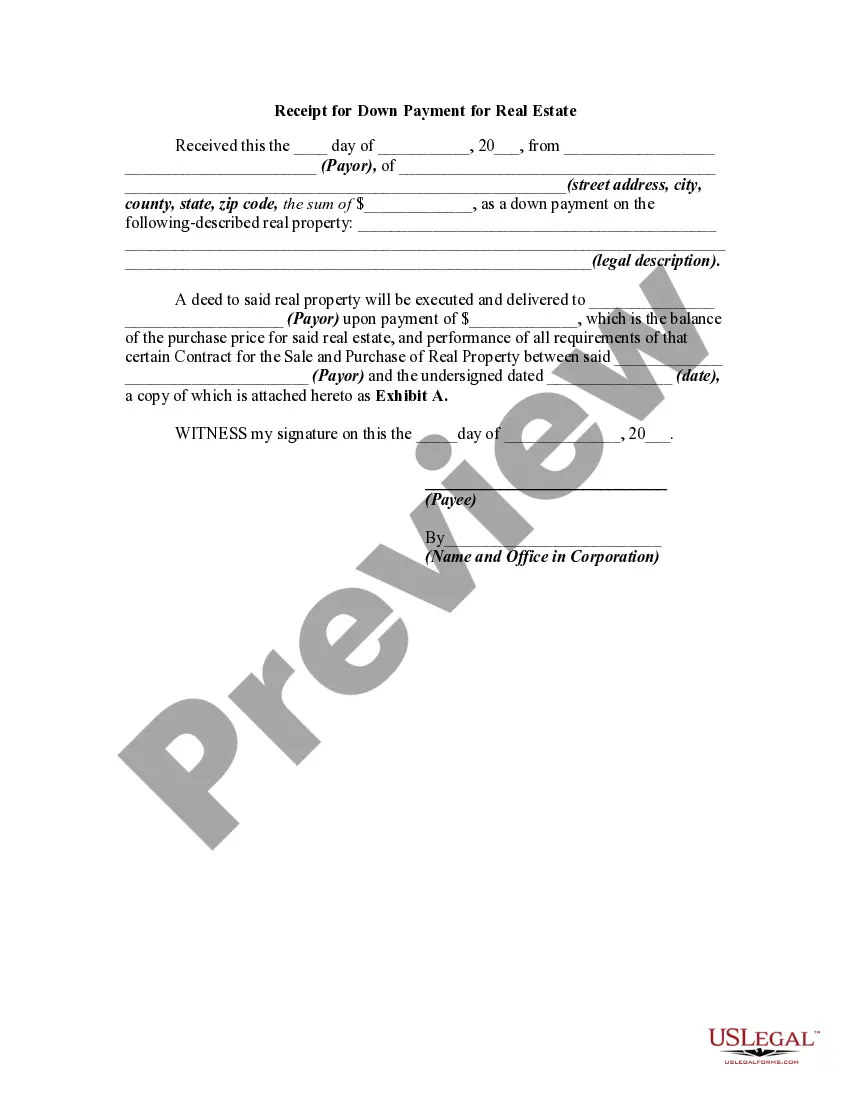

Connecticut Receipt for Down Payment for Real Estate is a legal document used to provide proof of payment made by a buyer to the seller in a real estate transaction. This receipt outlines the specifics of the down payment made, ensuring transparency and protecting the rights of both parties involved. Keywords: Connecticut, receipt, down payment, real estate, legal document, buyer, seller, transaction, proof of payment, transparency, rights. Different types of Connecticut Receipt for Down Payment for Real Estate may include: 1. Standard Connecticut Receipt for Down Payment for Real Estate: This type of receipt is used in most real estate transactions in Connecticut. It includes essential information such as the names and contact details of the buyer and seller, the property address, the date of payment, the amount paid as a down payment, and any terms and conditions related to the down payment. 2. Residential Property Connecticut Receipt for Down Payment for Real Estate: Specifically designed for residential real estate transactions, this type of receipt caters to the unique needs and requirements of buying or selling residential properties. It might include additional information such as the size and layout of the property, the presence of any amenities, and any specific disclosures related to the property. 3. Commercial Property Connecticut Receipt for Down Payment for Real Estate: This type of receipt is used when buying or selling commercial properties like office buildings, retail stores, or industrial spaces. It may contain specific terms and conditions related to the commercial property, such as zoning regulations, lease agreements, or special provisions required for the operation of certain businesses. 4. Vacant Land Connecticut Receipt for Down Payment for Real Estate: When purchasing or selling vacant land, this type of receipt is used to record the down payment made. It might include details such as the land's location, size, zoning regulations, and any environmental considerations that need disclosure. 5. Condominium or Cooperative Apartment Connecticut Receipt for Down Payment for Real Estate: In the case of buying or selling a condominium or cooperative apartment, this type of receipt is used to document the down payment made. It may contain specific details related to the condominium or cooperative, such as the monthly fees, bylaws, rules and regulations, or any pending assessments. By utilizing a Connecticut Receipt for Down Payment for Real Estate, buyers and sellers ensure that all financial transactions related to the down payment are properly recorded, protecting their interests throughout the real estate transaction process.

Connecticut Receipt for Down Payment for Real Estate

Description

How to fill out Connecticut Receipt For Down Payment For Real Estate?

Selecting the finest authorized document template can be quite a challenge.

Certainly, there is an array of templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The service provides an extensive collection of templates, including the Connecticut Receipt for Down Payment for Real Estate, which can be utilized for both business and personal purposes.

If the form does not meet your criteria, utilize the Search field to find the correct form. When you are certain that the form is accurate, click on the Get now button to acquire the form. Select your desired pricing plan and provide the necessary information. Create your account and pay for your order using your PayPal account or credit card. Choose the format and download the legal document template to your device. Complete, modify, print, and sign the obtained Connecticut Receipt for Down Payment for Real Estate. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to obtain properly crafted papers that adhere to state regulations.

- All forms are reviewed by specialists and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Connecticut Receipt for Down Payment for Real Estate.

- Use your account to access the legal forms you have previously obtained.

- Navigate to the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, confirm you have selected the correct form for the area/county. You can review the form using the Preview button and examine the form outline to ensure it is the correct one for you.

Form popularity

FAQ

To write proof of payment, start by documenting the payment details including the date, amount, and the purpose of the payment, such as a Connecticut receipt for down payment for real estate. You should also include the names of the involved parties to validate the transaction. Keeping this record helps in future references, especially in real estate dealings. Utilize platforms like US Legal Forms for convenient templates that simplify this process.

When writing a receipt for a down payment, include the payment date and amount. Clearly label the receipt as a Connecticut receipt for down payment for real estate, which helps clarify its purpose. Include the names of both the buyer and seller, along with any property details, to enhance its reliability. Ensure both parties retain a copy for their records.

Creating an invoice for a down payment requires you to list the date, invoice number, and total amount due. Clearly specify that it is a Connecticut receipt for down payment for real estate. Include details about the property, payment terms, and both parties' contact information. Ensure you keep a record and send a copy to the client.

If you need to write a receipt for payment, start with the issuing date and the total amount received. Indicate the nature of the payment clearly as a Connecticut receipt for down payment for real estate. Including identities of both parties strengthens the document's validity. Finally, ensure your signature is present to authenticate the receipt.

Writing a deposit receipt involves noting the date, the deposit amount, and specifying that it is a Connecticut receipt for down payment for real estate. You should also list the payer's name and the payee’s details. Include information about what the deposit secures, such as the property involved, to avoid any future confusion. Don’t forget to keep a copy for your records.

To write a Connecticut receipt for down payment for real estate, start by including the date and payment amount. Clearly state the purpose of the payment, identifying it as a down payment. Include the names of both the payer and the payee, and provide a brief description of the transaction. Finally, sign the receipt to validate it.

Local transfer tax in Connecticut is generally the responsibility of the seller, similar to the state transfer tax. This tax varies by municipality, so it's important to review local laws and regulations. An understanding of these taxes ensures you are well-prepared for the costs associated with selling a property, including securing the Connecticut Receipt for Down Payment for Real Estate. Staying informed about your financial obligations is key to a successful transaction.

Connecticut does not impose an exit tax on residents moving out of the state. However, if you sell your property, there may be capital gains taxes associated with the sale. It's essential to keep track of all transactions and documents, such as your Connecticut Receipt for Down Payment for Real Estate, for your records. Consulting with a tax professional can clarify any concerns you might have regarding this issue.

Yes, you may need to file a Connecticut tax return based on your income levels. Individuals earning above a certain threshold should file to remain compliant with state tax laws. Filing a return also provides documentation, which may be beneficial for obtaining a Connecticut Receipt for Down Payment for Real Estate. It's always wise to consult a tax professional for detailed advice tailored to your situation.

You can mail form CT 1040ES to the Connecticut Department of Revenue Services. Ensure you check the specific mailing address on the form, as it may vary based on your payment type. It is important to keep a record of your payment to facilitate your Connecticut Receipt for Down Payment for Real Estate. Following proper submission guidelines helps in making your tax process smoother.