Connecticut Receipt for Payment of Rent

Description

How to fill out Receipt For Payment Of Rent?

Are you in the scenario where you need documents for various businesses or particular tasks nearly every day.

There are numerous legal document templates available online, but finding versions you can trust isn't simple.

US Legal Forms provides thousands of form templates, such as the Connecticut Receipt for Payment of Rent, which are designed to fulfill state and federal regulations.

Once you find the right form, click Get now.

Select the pricing plan you want, complete the necessary information to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Receipt for Payment of Rent template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

- Utilize the Review button to inspect the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you’re searching for, use the Search field to find one that meets your requirements.

Form popularity

FAQ

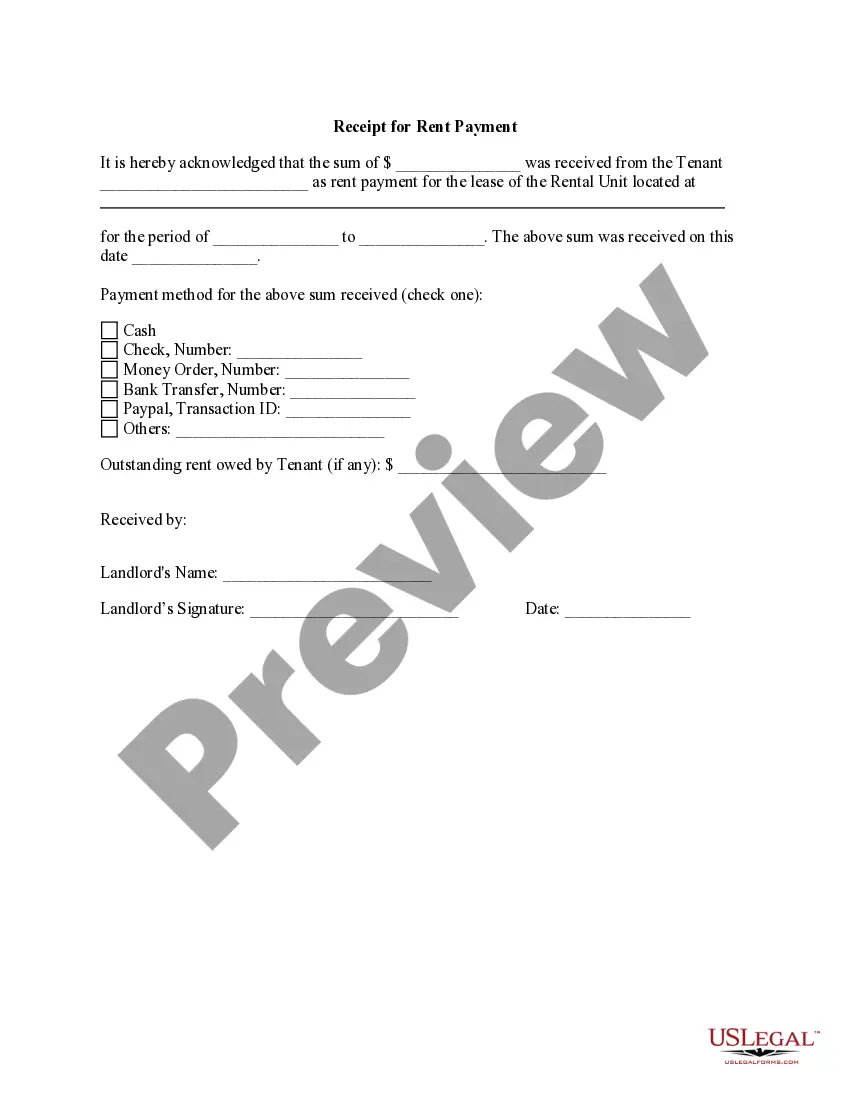

To fill out a rent receipt, begin with the title 'Receipt for Rent.' Include the date, the name of the tenant, the property address, and the total amount received. It's also important to feature the rental period that this payment covers. Providing clear and accurate information helps maintain transparency in the rental process.

Renters in Connecticut have several rights that protect them, including the right to a safe and livable environment, the right to privacy, and the right to dispute illegal evictions. Tenants also have the right to receive a Connecticut Receipt for Payment of Rent, ensuring there is documented proof of their timely payments. Familiarizing yourself with these rights empowers you as a renter and promotes a healthier landlord-tenant relationship. For more detailed information, visit US Legal Forms for helpful resources.

In Connecticut, landlords cannot engage in retaliatory actions against tenants, such as raising rent or evicting tenants for exercising their legal rights. Additionally, landlords must respect tenants' privacy by giving appropriate notice before entering rented premises. Understanding these rights is vital, and utilizing a Connecticut Receipt for Payment of Rent can help safeguard your interests. For clear guidance on landlord-tenant laws, consider leveraging resources from US Legal Forms.

The receipt date of a payment refers to the day when a landlord officially acknowledges the tenant's rent payment. This date is crucial for both parties as it serves as proof of payment and can be essential for record-keeping. When using a Connecticut Receipt for Payment of Rent, you help clarify any potential disputes regarding late payments or miscommunications. It's always a good practice to obtain this receipt for your records.

To obtain a receipt for your rent payment in Connecticut, you should request one directly from your landlord or property manager at the time of payment. If they do not provide one, consider using a template for a Connecticut Receipt for Payment of Rent, which you can create through platforms like US Legal Forms. This way, you ensure that both you and your landlord have a clear record of each transaction, which can significantly help in avoiding misunderstandings or disputes in the future.

When writing a letter for a rental, begin with your intent clearly stated at the top. Include details such as the rental property's address, your proposal or request, and any terms related to the rental. This letter can help outline terms clearly, paving the way for a smooth rental process, which could also require a Connecticut Receipt for Payment of Rent.

The new renters law in Connecticut focuses on providing stronger protections for tenants. It addresses issues such as security deposit limits and payment timelines. Staying informed about these changes is vital for both tenants and landlords, especially when documenting transactions like a Connecticut Receipt for Payment of Rent.

The name on the rent receipt typically includes the landlord or property management company who receives the payment. Additionally, the tenant's name should also be present to indicate who made the payment. This ensures clarity in records for the Connecticut Receipt for Payment of Rent.

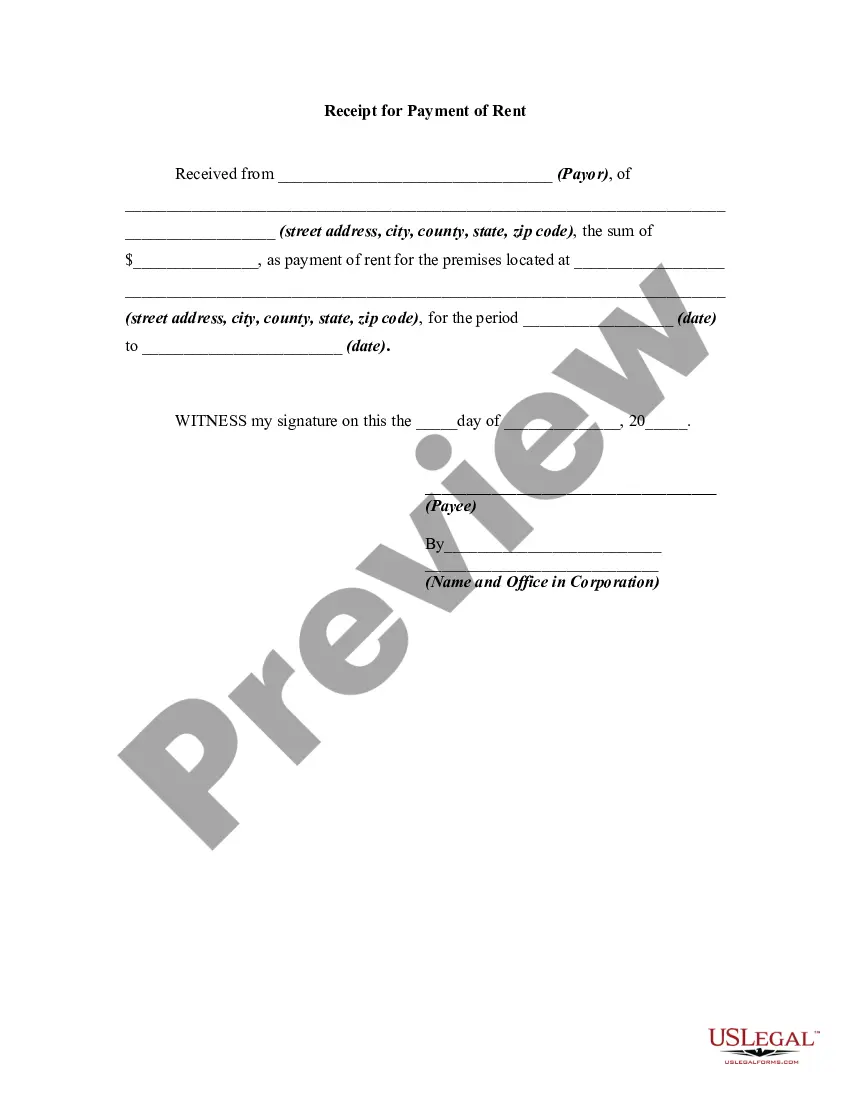

A proof of rent payment letter should outline the payment amount, date, and rental period. Start with your name and contact information, then provide the details in a concise manner. This letter serves as a useful document, acting as your Connecticut Receipt for Payment of Rent, which can be beneficial for future reference.

To create a receipt for rent payment, include essential details like the date, amount received, and the property address. Clearly state that it is a receipt for rent and include both the landlord’s and tenant’s names. This document acts as a Connecticut Receipt for Payment of Rent, ensuring both parties have a record of the transaction.