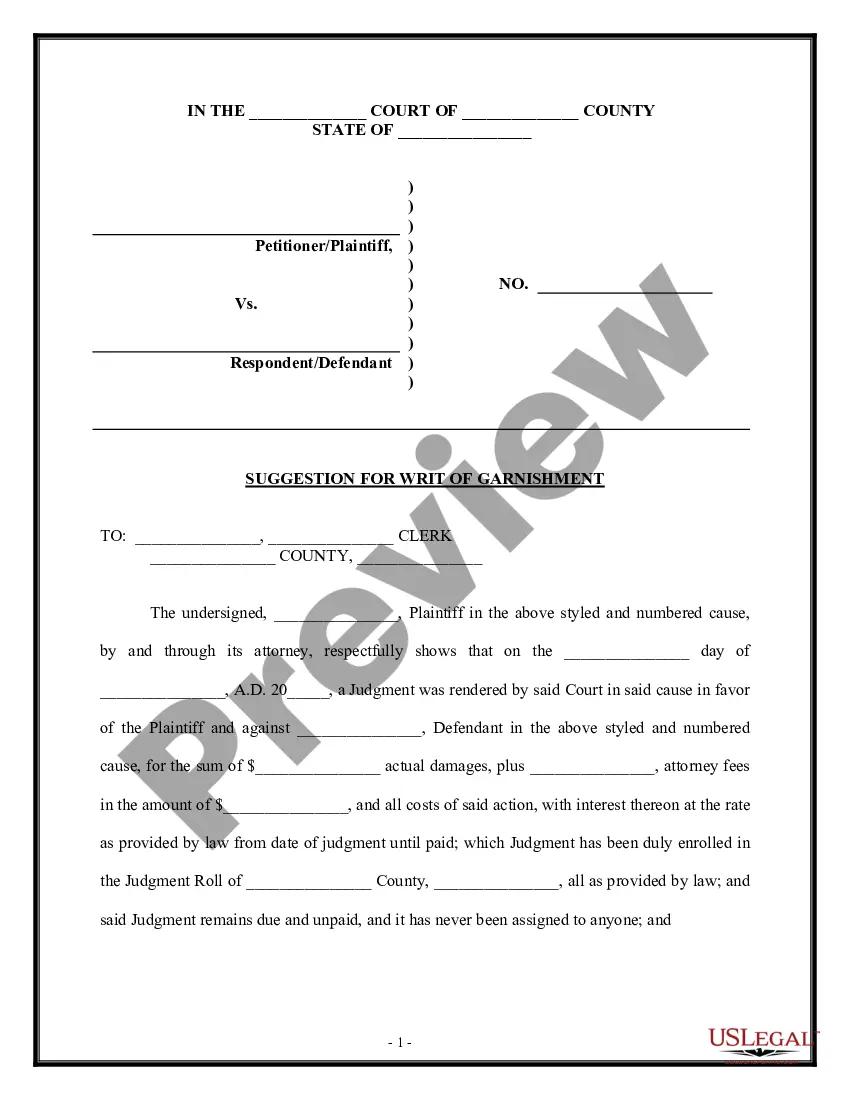

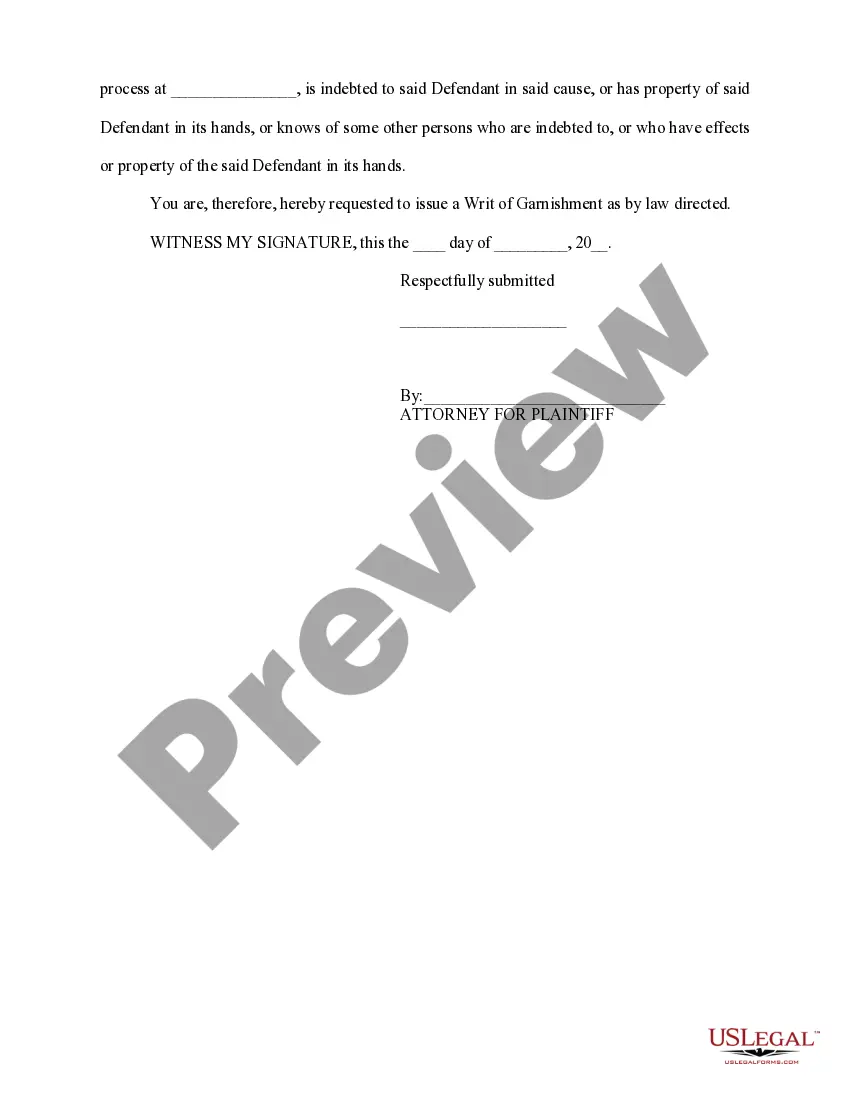

Connecticut Suggestion for Writ of Garnishment

Description

How to fill out Suggestion For Writ Of Garnishment?

Have you been within a position where you need documents for either organization or personal reasons almost every day? There are a lot of legal document templates accessible on the Internet, but finding kinds you can rely is not straightforward. US Legal Forms gives a huge number of develop templates, much like the Connecticut Suggestion for Writ of Garnishment, which can be written to meet state and federal needs.

If you are previously familiar with US Legal Forms web site and have a free account, simply log in. Next, you can download the Connecticut Suggestion for Writ of Garnishment web template.

Should you not have an accounts and need to start using US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is for that appropriate metropolis/region.

- Take advantage of the Preview key to examine the shape.

- Read the description to ensure that you have selected the correct develop.

- In case the develop is not what you are looking for, utilize the Research field to find the develop that fits your needs and needs.

- If you find the appropriate develop, simply click Get now.

- Pick the prices strategy you would like, fill in the desired information to make your account, and pay for the order making use of your PayPal or bank card.

- Pick a convenient file formatting and download your version.

Discover all the document templates you might have purchased in the My Forms menus. You can obtain a further version of Connecticut Suggestion for Writ of Garnishment anytime, if required. Just go through the necessary develop to download or produce the document web template.

Use US Legal Forms, probably the most extensive collection of legal forms, in order to save efforts and prevent errors. The support gives skillfully created legal document templates that can be used for a range of reasons. Make a free account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

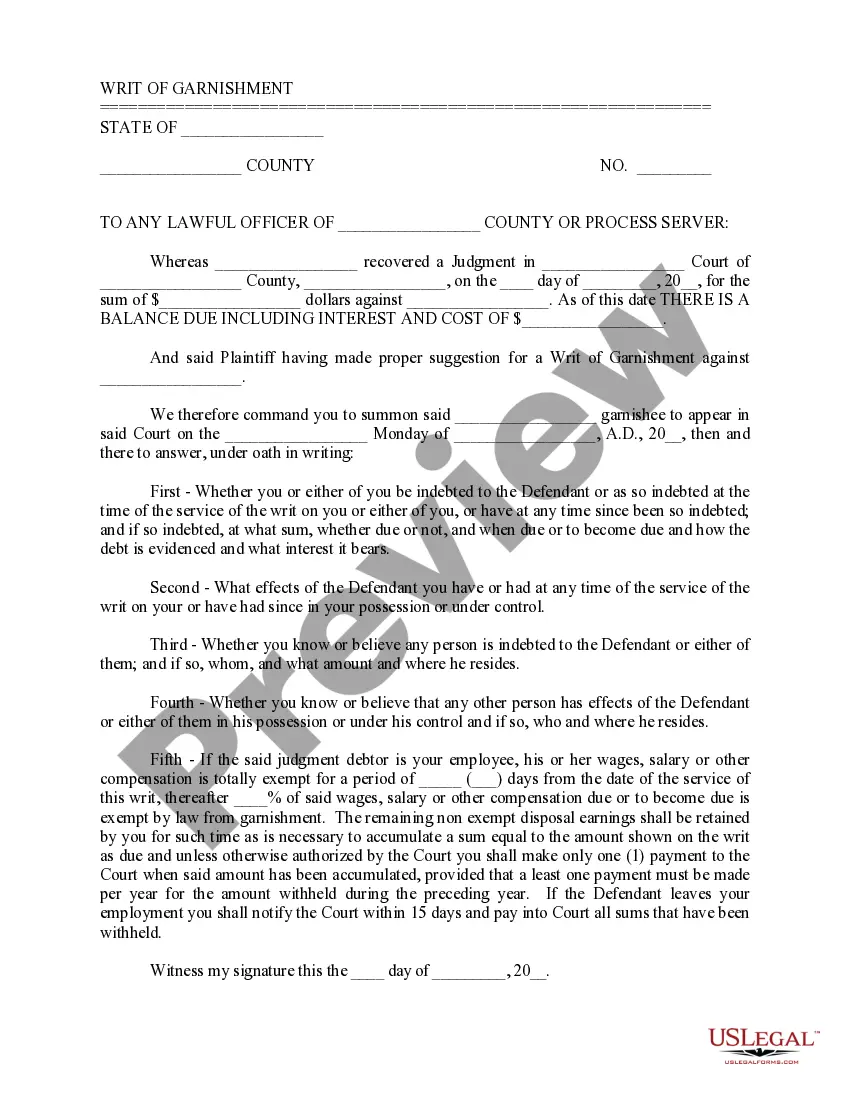

Keep in mind, judgments issued by Connecticut Superior Courts are enforceable for up to 20 years and can possibly be revived for an additional period of time if proper procedure is followed before the expiration date.

Money judgments entered in Connecticut can be secured by filing a Judgment Lien on Connecticut real estate owned by the judgment debtor.

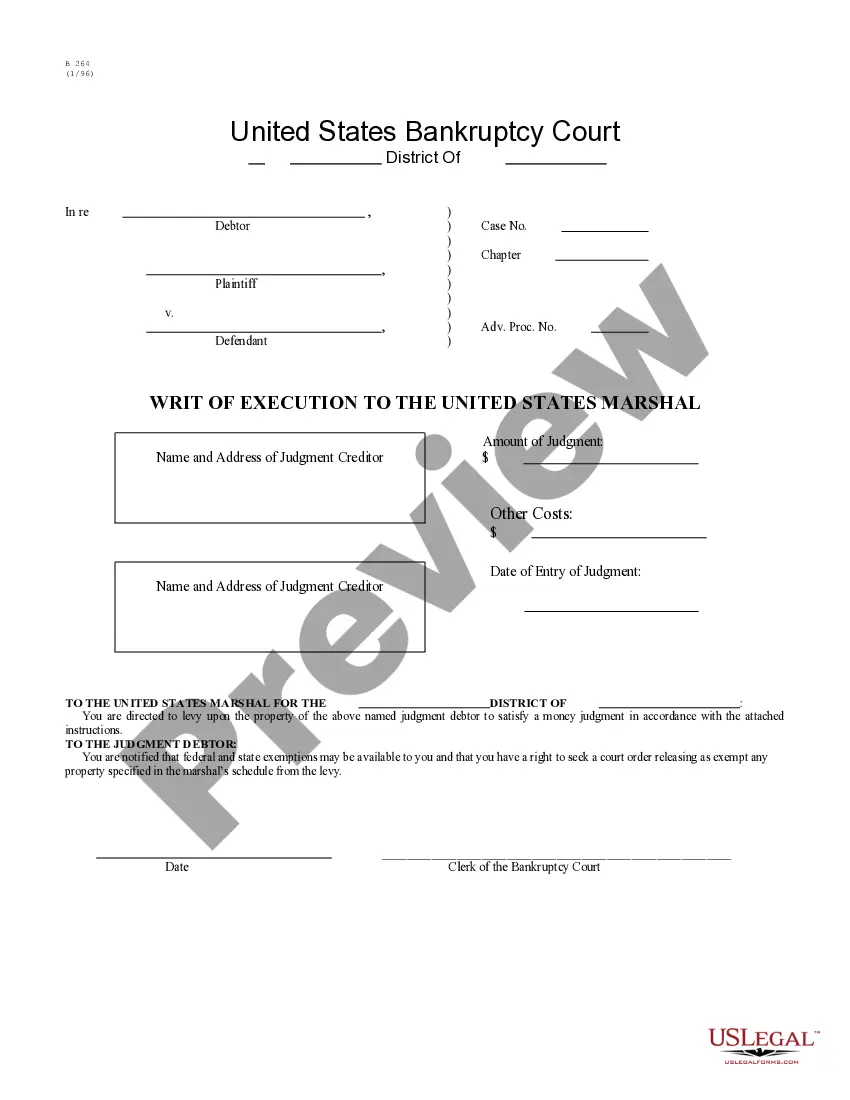

Filing for bankruptcy can stop all wage garnishments by judgment collectors. A wage garnishment lawyer can discuss your options, which may include a petition for hardship or bankruptcy.

If you're looking to put a stop to wage garnishment, you have four options: Repay your debt. Negotiate with your creditor. File a consumer proposal. File for bankruptcy.

In Connecticut, the most that can be garnished from your wages is the lesser of the following two options: 25% of your weekly disposable earnings, or. the amount by which your weekly disposable earnings exceed 40 times the federal hourly minimum wage or the Connecticut minimum fair wage, whichever is greater.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

Connecticut Law allows a judgment creditor to apply for a wage execution (garnishment) if a judgment debtor defaults on court ordered periodic payments.

The ways you can put a stop to a garnishee are: Negotiate repayment terms with your creditor on the condition that they agree to remove the garnishee. Obtain a loan to pay off the garnisheeing creditor in full. File with orderly payment of debts (where available).