A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

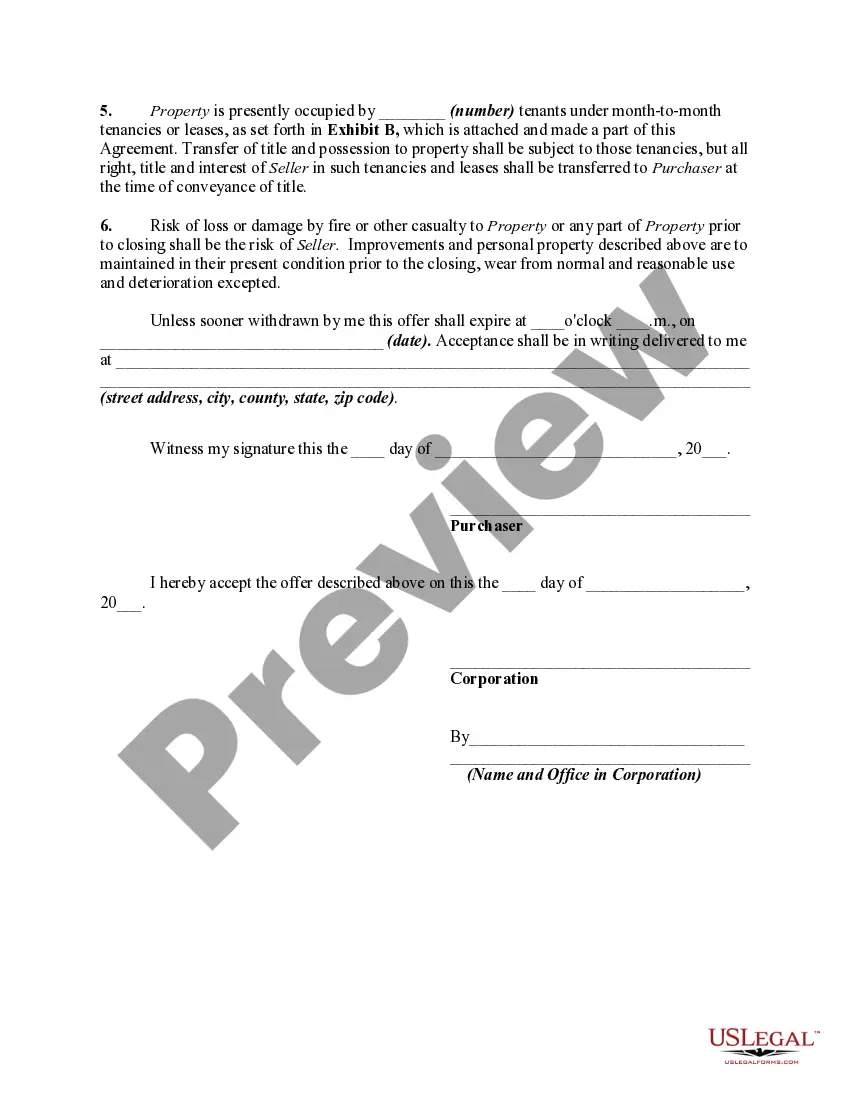

A Connecticut Offer to Purchase Commercial Property is a legal document used to outline the terms and conditions for buying a commercial property in the state of Connecticut. This agreement is typically prepared by the buyer or their attorney, and it serves as a proposal to the seller to acquire the specified property. The Connecticut Offer to Purchase Commercial Property encompasses all essential details of the transaction, helping ensure a clear understanding between the parties involved. It includes relevant information such as the buyer's identification, the seller's identification, property details (such as address, legal description, and listing price), proposed purchase price, and special terms and conditions. There are several types of Connecticut Offer to Purchase Commercial Property that may be utilized depending on the specific details and requirements of the transaction. Some common types include: 1. Standard Offer to Purchase Commercial Property: This is the most basic type of offer, outlining essential details such as purchase price, financing options, proposed closing date, and any contingencies that need to be satisfied before the transaction can proceed. 2. Offer with Contingencies: In some cases, buyers may include contingencies in their offer to protect themselves. These contingencies can address various concerns such as property inspections, financing approval, or the sale of the buyer's existing property. 3. Cash Offer: A cash offer is made when the buyer intends to purchase the property without relying on financing. This type of offer may appeal to certain sellers who prefer a quick and guaranteed transaction. 4. Lease Option Offer: This type of offer allows the buyer to lease the property for a specified period with an option to purchase at a later date. This arrangement gives the buyer time to assess the property before committing to the purchase. 5. Conditional Offer: A conditional offer is made when the buyer has specific conditions that must be met for the transaction to proceed, such as obtaining zoning approval or securing necessary permits. It is important to note that each Connecticut Offer to Purchase Commercial Property can be customized to meet the buyer's specific needs and the seller's requirements. Seeking legal advice or assistance from real estate professionals is highly recommended ensuring the offer is comprehensive, compliant with relevant laws, and suitable for the intended purchase.A Connecticut Offer to Purchase Commercial Property is a legal document used to outline the terms and conditions for buying a commercial property in the state of Connecticut. This agreement is typically prepared by the buyer or their attorney, and it serves as a proposal to the seller to acquire the specified property. The Connecticut Offer to Purchase Commercial Property encompasses all essential details of the transaction, helping ensure a clear understanding between the parties involved. It includes relevant information such as the buyer's identification, the seller's identification, property details (such as address, legal description, and listing price), proposed purchase price, and special terms and conditions. There are several types of Connecticut Offer to Purchase Commercial Property that may be utilized depending on the specific details and requirements of the transaction. Some common types include: 1. Standard Offer to Purchase Commercial Property: This is the most basic type of offer, outlining essential details such as purchase price, financing options, proposed closing date, and any contingencies that need to be satisfied before the transaction can proceed. 2. Offer with Contingencies: In some cases, buyers may include contingencies in their offer to protect themselves. These contingencies can address various concerns such as property inspections, financing approval, or the sale of the buyer's existing property. 3. Cash Offer: A cash offer is made when the buyer intends to purchase the property without relying on financing. This type of offer may appeal to certain sellers who prefer a quick and guaranteed transaction. 4. Lease Option Offer: This type of offer allows the buyer to lease the property for a specified period with an option to purchase at a later date. This arrangement gives the buyer time to assess the property before committing to the purchase. 5. Conditional Offer: A conditional offer is made when the buyer has specific conditions that must be met for the transaction to proceed, such as obtaining zoning approval or securing necessary permits. It is important to note that each Connecticut Offer to Purchase Commercial Property can be customized to meet the buyer's specific needs and the seller's requirements. Seeking legal advice or assistance from real estate professionals is highly recommended ensuring the offer is comprehensive, compliant with relevant laws, and suitable for the intended purchase.