An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow in this form is to protect the purchaser of real property from having to pay for a possible defect in the real property after the sale has been made.

Connecticut Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action

Description

How to fill out Escrow Agreement For Sale Of Real Property And Deposit To Protect Purchaser Against Cost Of Required Remedial Action?

US Legal Forms - one of the major collections of legal templates in the United States - offers a variety of legal document styles that you can download or print.

Utilizing the website, you can discover numerous forms for professional and personal use, organized by categories, states, or keywords.

You will find the latest versions of forms such as the Connecticut Escrow Agreement for Sale of Real Property and Deposit to Safeguard Purchaser Against Expense of Necessary Remedial Action within moments.

Review the form outline to ensure that you have selected the appropriate form.

If the form doesn't fit your requirements, utilize the Search field at the top of the screen to locate one that does.

- If you possess a subscription, Log In and download the Connecticut Escrow Agreement for Sale of Real Property and Deposit to Safeguard Purchaser Against Expense of Necessary Remedial Action from the US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are some basic instructions to assist you in getting started.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to verify the form’s content.

Form popularity

FAQ

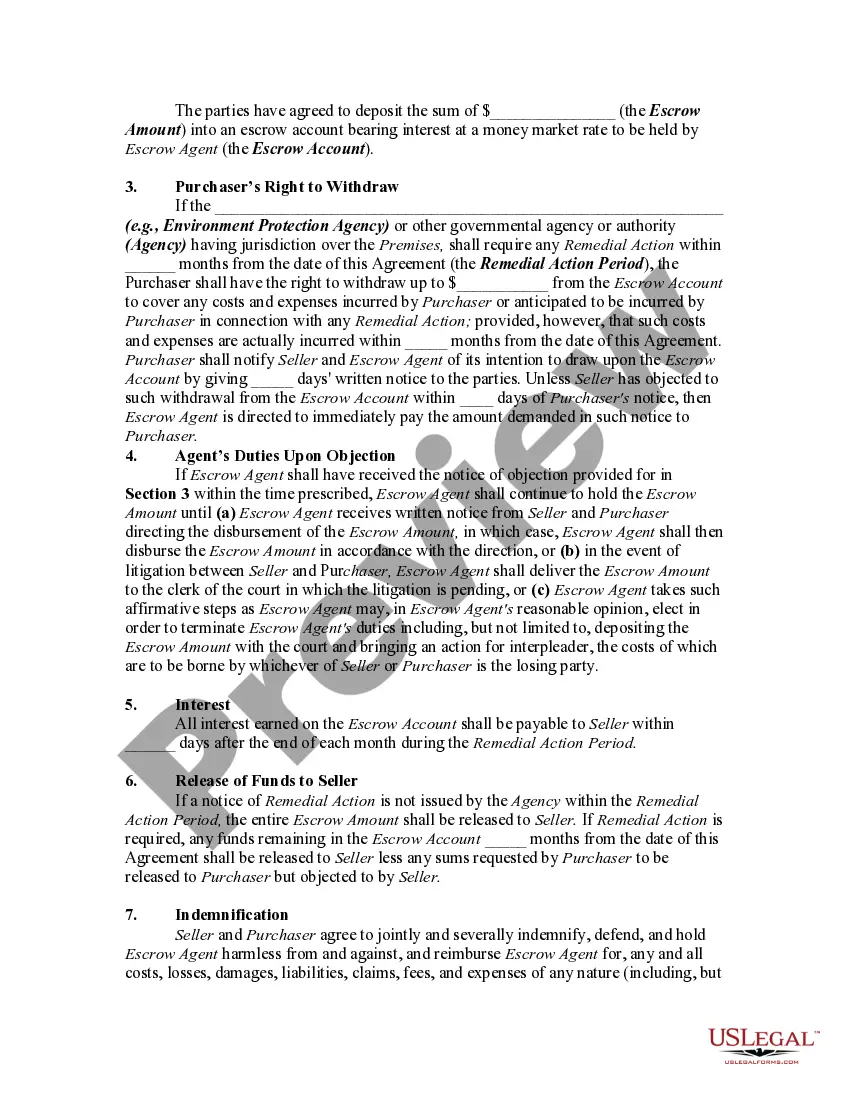

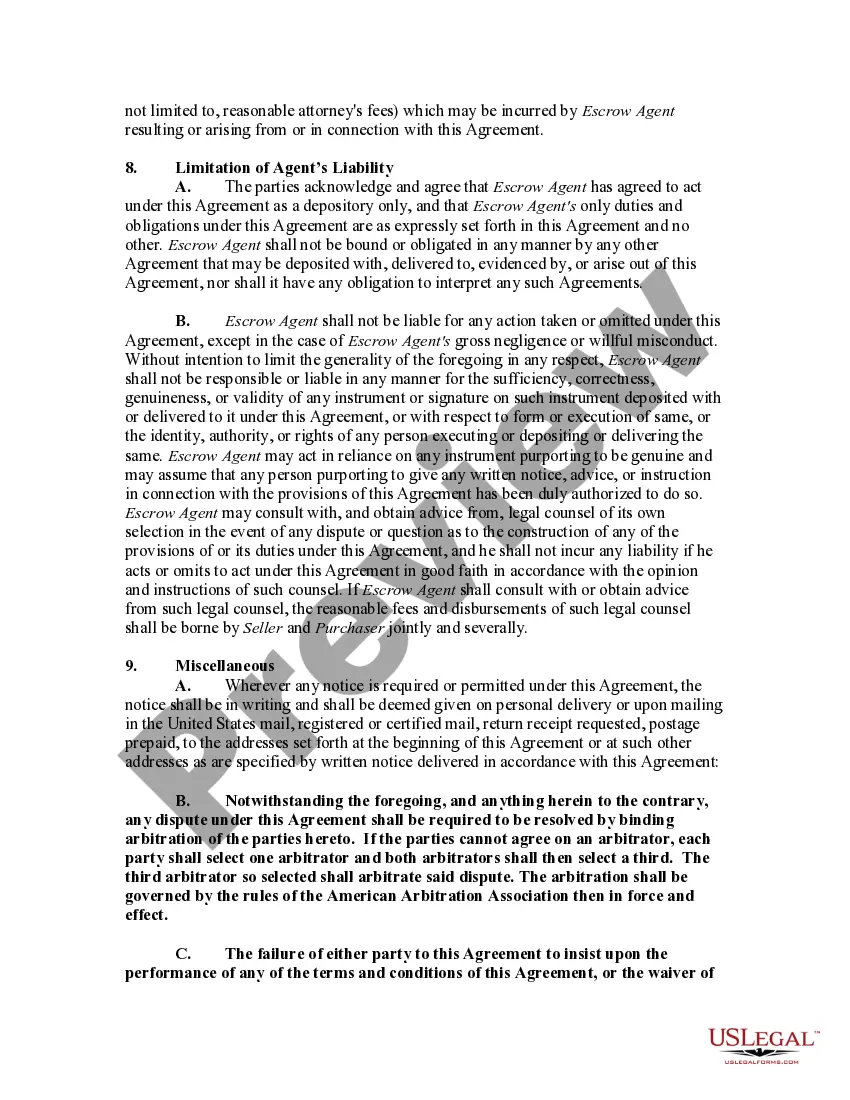

In a real estate escrow agreement, the buyer and seller agree to have a neutral third party an escrow agent hold the buyer's funds while the contractual conditions and obligations of each party are fulfilled. Escrow accounts provide protection to all parties involved in the transaction.

In an escrow agreement, one partyusually a depositordeposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

Tip: It is possible for sellers to negotiate for earnest money to become non-refundable after inspection. If buyers are looking for ways to strengthen their offer, they might consider this option. Non-refundable deposits, common with new construction, differ from earnest money.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

"In escrow" is a type of legal holding account for items, which can't be released until predetermined conditions are satisfied. Typically, items are held in escrow until the process involving a financial transaction has been completed. Valuables held in escrow can include real estate, money, stocks, and securities.

How to Protect Your Earnest Money DepositNever give an earnest money deposit directly to the seller.Make the deposit payable to a reputable third party, such as a well-known and established real estate brokerage, legal firm, escrow company, or title company.More items...

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

Here's how to hold money in escrow:The buyer and seller agree to the terms of the transaction.Payment is sent to the escrow company.Seller ships the goods or provides the service to the buyer.Buyer accepts the goods or services.More items...

Reasons you can lose earnest money Two scenarios that may lead to the forfeiture of your good faith deposit are: Waiving your contingencies. Financing and inspection contingencies protect your earnest money if your mortgage doesn't go through or the house is beyond repair.

A Standard Clause providing for an escrow of a portion of the purchase price in an M&A transaction to satisfy the seller's obligations to pay any adjustments to the purchase price and any potential indemnification claims. It can be used in connection with a private stock purchase, asset purchase, or merger.