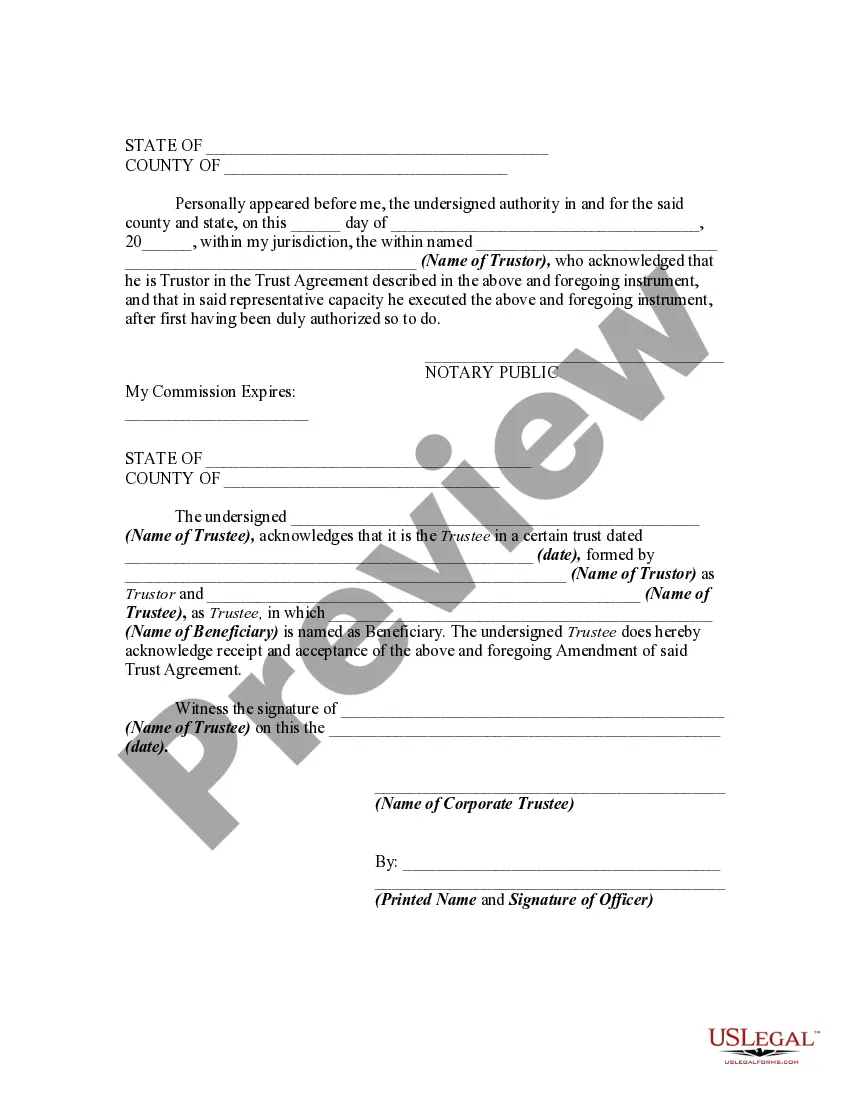

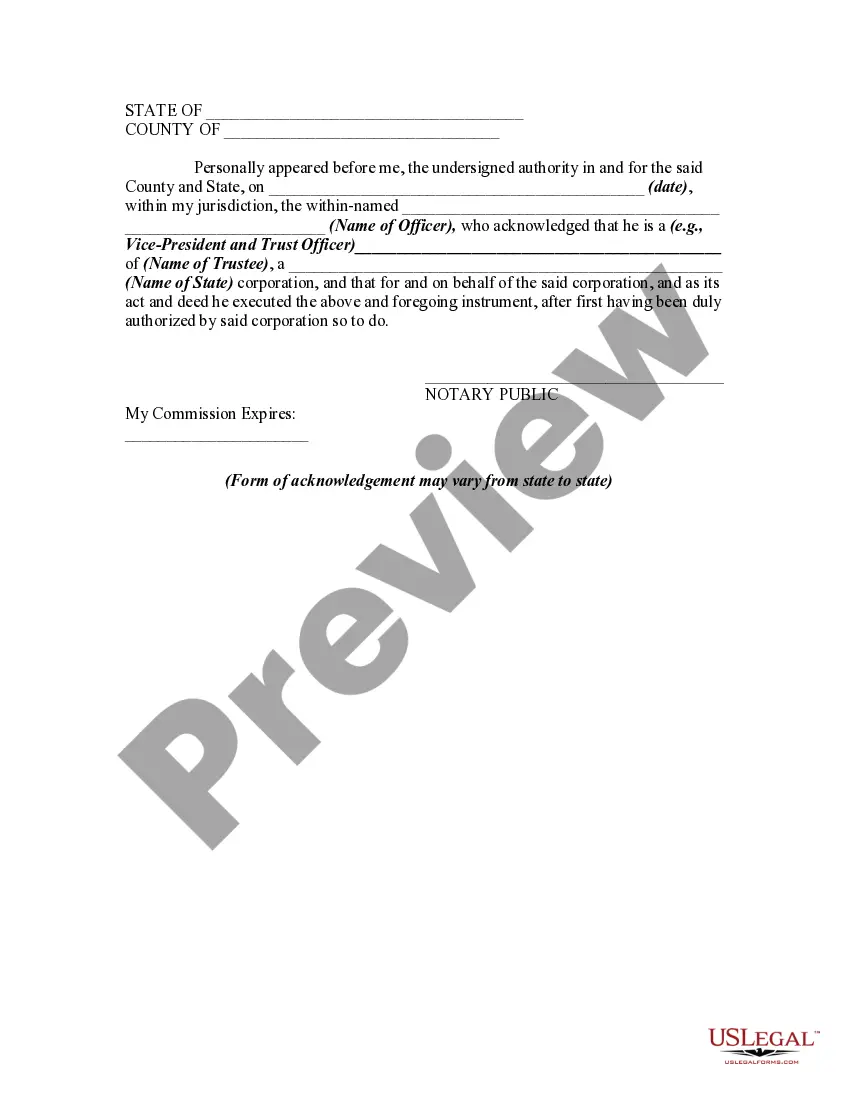

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee

Description

How to fill out Amendment Of Declaration Of Trust With Cancellation And Addition Of Sections And The Consent Of Trustee?

Are you in a situation where you need documents for either business or personal uses almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, designed to comply with federal and state regulations.

Once you find the correct form, click on Get now.

Select a convenient paper format and download your copy. Access all the document templates you have purchased in the My documents menu. You can retrieve another copy of the Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee at any time if needed. Just select the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the description to verify that you have chosen the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Amending and restating an irrevocable trust is generally more complex than with revocable trusts, but it is possible under certain circumstances. Courts may allow modifications if they align with the original intent of the trust and serve the best interests of the beneficiaries. When considering a Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, consulting legal guidance is essential to navigate this process effectively.

The designated representative statute in Connecticut allows individuals to appoint someone else to act on their behalf regarding trust matters. This statute facilitates smoother trust administration and communication with trustees. It is relevant to the Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, as it helps ensure that all decisions are made in the best interest of beneficiaries.

To obtain a trust amendment form, you can start by consulting legal resources or platforms like uslegalforms that provide templates tailored to Connecticut laws. These forms are vital for ensuring the amendments align with state regulations. By using a Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee form, you can efficiently manage changes within your trust.

Yes, a trust can be altered, amended, or revoked, depending on its type and the terms outlined within it. For revocable trusts, the grantor maintains the right to make changes or dissolve the trust during their lifetime. In the context of a Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, it is essential to follow proper legal protocols to implement these changes effectively.

The new decanting statute in Connecticut allows trustees to transfer assets from one trust to another, effectively altering the terms of the original trust. This legal provision provides flexibility, enabling adjustments in response to changing circumstances or beneficiaries' needs. When discussing the Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, decanting offers an important strategy to improve the trust's effectiveness.

In Connecticut, the rule against perpetuities limits how long a trust can last before it must distribute its assets. Generally, this rule states that interests in property must vest within a certain period, usually 21 years after the death of a relevant individual. Understanding this rule is crucial when considering the Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, as it ensures compliance with state law.

A codicil is a legal document that adds to or modifies an existing trust without replacing it entirely. To write a codicil, clearly state the changes you intend to make, specifying which sections of the trust are affected. This document must meet the legal requirements of Connecticut, similar to a Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Using platforms like USLegalForms can help ensure your codicil is correctly drafted and legally binding.

The best way to amend a trust typically involves drafting a formal amendment document that outlines the specific changes desired. This document should be clear, concise, and comply with Connecticut laws involving amendments, specifically the Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Using a professional service like USLegalForms can simplify this process by providing templates and guidance tailored to your needs.

While co-trustees in Connecticut often have to make decisions together, this requirement can vary based on the trust document's wording. If the document allows for independent action, one trustee can make decisions without the other's consent. Understanding these stipulations is important, especially when implementing a Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Clarity in the trust document will facilitate smoother operations between trustees.

Writing an addendum to a trust involves drafting a document that specifies the changes you want to make. This can include alterations or additions to specific sections of the trust. It is crucial to ensure that the addendum aligns with Connecticut laws regarding trust amendments, particularly the Connecticut Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Consulting a legal expert when preparing this document can help ensure clarity and compliance.