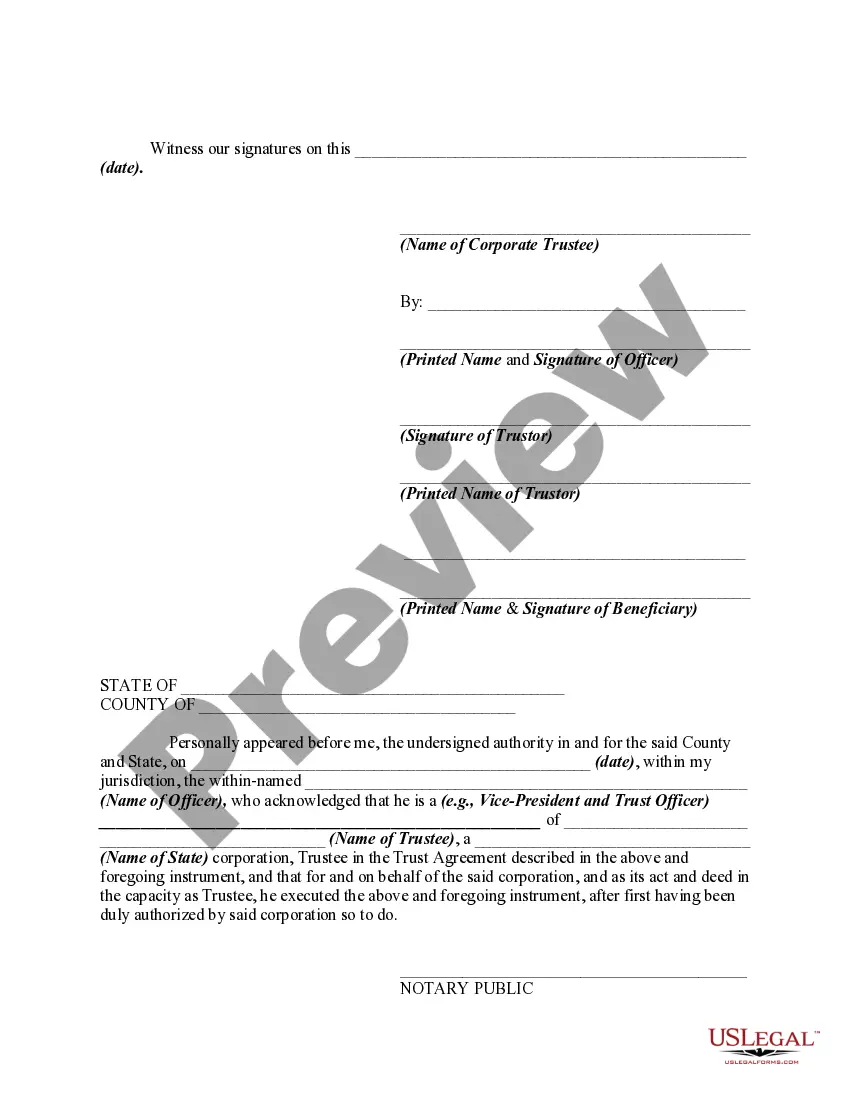

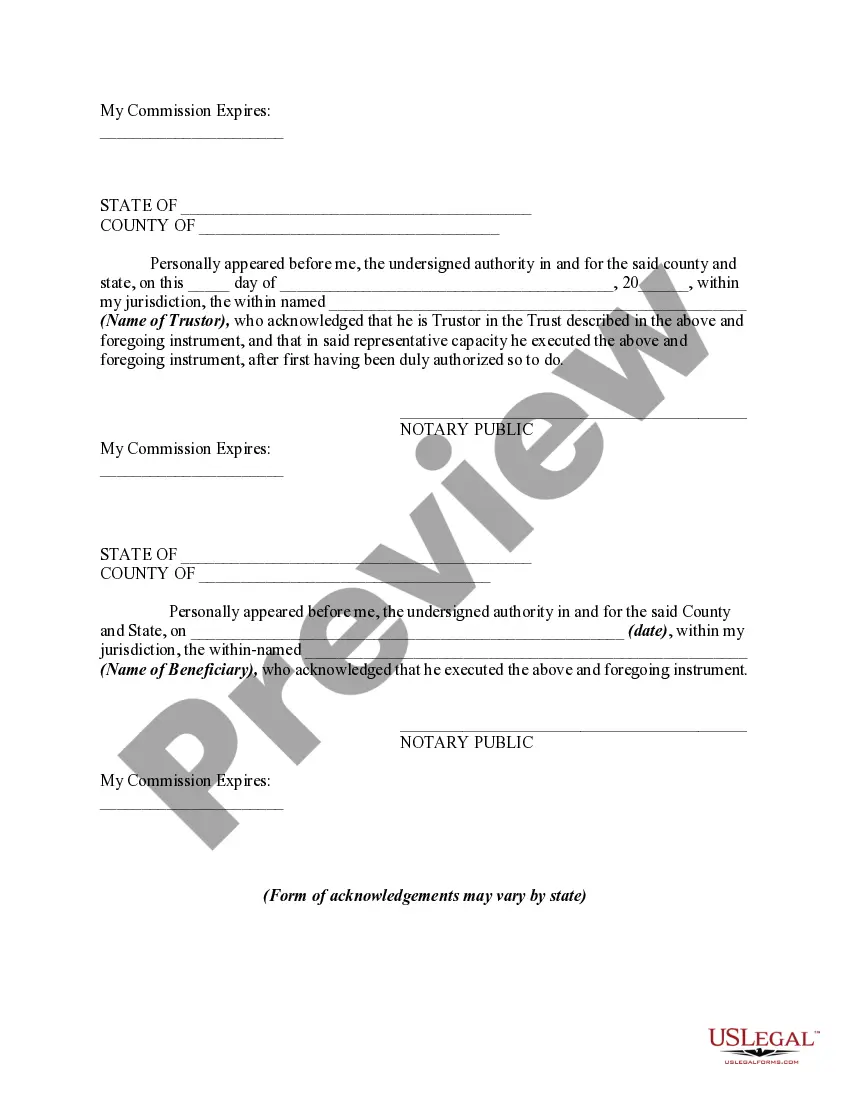

This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Agreement to Renew Trust Agreement

Description

How to fill out Agreement To Renew Trust Agreement?

Selecting the appropriate legal document template can be quite a challenge. Naturally, there are numerous templates accessible online, but how can you find the legal document you need? Utilize the US Legal Forms website. This service provides a vast collection of templates, including the Connecticut Agreement to Renew Trust Agreement, which can be used for both business and personal purposes.

All templates are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to locate the Connecticut Agreement to Renew Trust Agreement. Use your account to access the legal documents you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you need.

Select the document format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Connecticut Agreement to Renew Trust Agreement. US Legal Forms is the largest repository of legal documents where you can find various document templates. Use the service to download properly crafted documents that meet state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the correct document for your specific city/state. You can review the document using the Review option and read the document description to confirm it is the right one for you.

- If the document does not meet your needs, use the Search field to find the correct document.

- Once you are sure that the document is suitable, click the Purchase now button to obtain the document.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

A declaration of trust and a trust agreement serve similar purposes, but they are not the same. A declaration of trust typically is a simpler document that establishes a trust without the extensive details found in a trust agreement. The Connecticut Agreement to Renew Trust Agreement can encompass both elements, ensuring that your intentions regarding asset management and distribution are clearly articulated for all parties involved.

While the terms ‘trust agreement’ and ‘trust’ are often used interchangeably, they have distinct meanings. A trust is the overall arrangement created to manage assets, whereas the trust agreement is the specific legal document detailing how the trust operates. Knowing this distinction is important when discussing legal matters or working with estate planning services. By utilizing the Connecticut Agreement to Renew Trust Agreement, you can effectively set the terms that govern your trust.

The rule against perpetuities in Connecticut limits the duration of certain interests in property to ensure they don't last indefinitely. This rule typically restricts the vesting of future interests to within a certain time frame, usually 21 years after the death of a specified individual. Understanding this rule is essential when creating trust agreements, including the Connecticut Agreement to Renew Trust Agreement, to ensure your estate plan complies with state laws.

A trust is a fiduciary arrangement where one party manages assets for the benefit of another. In contrast, a trust agreement is the written document that establishes the trust, detailing its terms and conditions. Understanding this difference is crucial for effective estate planning. When using the Connecticut Agreement to Renew Trust Agreement, you maintain the trust's framework while clarifying the responsibilities outlined in the trust agreement.

A trust agreement is a vital document in estate planning that outlines how assets will be managed and distributed. It provides clarity and direction for trustees, beneficiaries, and the courts. By establishing a trust agreement, you ensure that your wishes are honored, minimizing potential disputes among beneficiaries. In Connecticut, utilizing the Connecticut Agreement to Renew Trust Agreement can help maintain the trust's validity and effectiveness.

Form CT-1040 Ext should be sent to the Connecticut Department of Revenue Services at the address listed on the form. It is necessary to mail the extension before your tax return's due date to ensure it is accepted. This extension provides you with extra time to prepare your full tax return. If applicable, keep in mind how the Connecticut Agreement to Renew Trust Agreement might influence your filing decisions.

You should mail Form CT 1065 and CT 1120SI Ext to the Connecticut Department of Revenue Services. The address is outlined on the form and typically varies if you are using a legal service or filing separately. Make sure to check for any specific filing instructions related to your trust or business entity, particularly if you are managing a Connecticut Agreement to Renew Trust Agreement.

Filing an extension involves completing the appropriate form, such as Form CT-1040EXT, and submitting it to the Connecticut Department of Revenue Services. Ensure you file it before the original due date of your tax return to avoid penalties. After submitting the extension, you will have additional time to prepare your tax return. If the Connecticut Agreement to Renew Trust Agreement impacts your situation, be sure to address any tax implications in your planning.

To file a Connecticut extension, complete Form CT-1040EXT. You can submit this form online or send it by mail before the due date of your tax return. This form allows you to automatically extend your filing deadline for six months. If you're involved with a Connecticut Agreement to Renew Trust Agreement, this extension could be helpful for managing the trust's tax responsibilities.

A CT 1041 must be filed by estates and trusts that generate income during the tax year. If the gross income exceeds $1,000, the fiduciary responsible for the estate or trust must file this form. Furthermore, if your trust is involved in a Connecticut Agreement to Renew Trust Agreement, it's vital to make sure all tax obligations are properly addressed to keep your trust compliant.