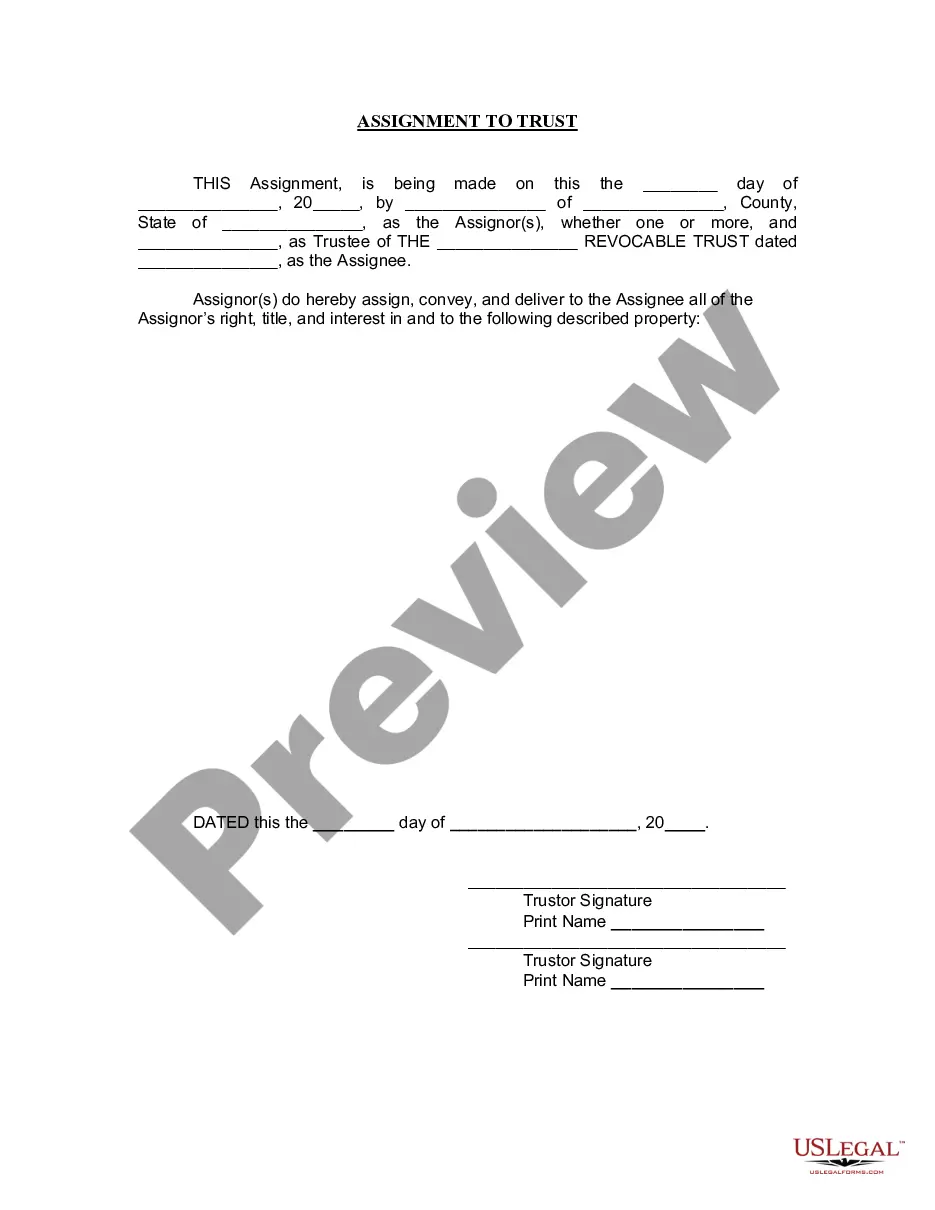

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Assignment by Beneficiary of a Percentage of the Income of a Trust refers to a legal arrangement where a beneficiary of a trust assigns a specific percentage of the trust's income to another party in the state of Connecticut. This assignment allows the beneficiary to transfer a portion of their entitlement to the trust's income to a third party, whether it be a family member, friend, or even a charitable organization. When it comes to Connecticut Assignment by Beneficiary of a Percentage of the Income of a Trust, there are two common types: 1. Irrevocable Assignment: An irrevocable assignment is a type of assignment where the assignor permanently transfers their right to a percentage of the trust's income to the assignee. Once the assignment is made, the assignor cannot reclaim or change the assignment without the consent of the assignee and other relevant parties involved. 2. Revocable Assignment: In contrast, a revocable assignment grants the assignor the ability to alter, modify, or revoke the assignment at any time. This type of assignment provides more flexibility to the assignor, allowing them to adjust the percentage of income assigned, change the assignee, or even suspend the assignment temporarily. Connecticut Assignment by Beneficiary of a Percentage of the Income of a Trust is an essential estate planning tool that allows beneficiaries to redistribute their wealth and income to support their chosen causes, individuals, or organizations. By assigning a portion of their trust's income, beneficiaries can demonstrate their philanthropic interests, family support, or fulfill personal obligations. It is important to note that when considering a Connecticut Assignment by Beneficiary of a Percentage of the Income of a Trust, individuals must consult with an experienced attorney or financial advisor to ensure compliance with Connecticut state laws, trust requirements, and tax implications. Proper documentation, approval from trustees (if required), and effective communication with involved parties are integral parts of establishing a successful assignment.Connecticut Assignment by Beneficiary of a Percentage of the Income of a Trust refers to a legal arrangement where a beneficiary of a trust assigns a specific percentage of the trust's income to another party in the state of Connecticut. This assignment allows the beneficiary to transfer a portion of their entitlement to the trust's income to a third party, whether it be a family member, friend, or even a charitable organization. When it comes to Connecticut Assignment by Beneficiary of a Percentage of the Income of a Trust, there are two common types: 1. Irrevocable Assignment: An irrevocable assignment is a type of assignment where the assignor permanently transfers their right to a percentage of the trust's income to the assignee. Once the assignment is made, the assignor cannot reclaim or change the assignment without the consent of the assignee and other relevant parties involved. 2. Revocable Assignment: In contrast, a revocable assignment grants the assignor the ability to alter, modify, or revoke the assignment at any time. This type of assignment provides more flexibility to the assignor, allowing them to adjust the percentage of income assigned, change the assignee, or even suspend the assignment temporarily. Connecticut Assignment by Beneficiary of a Percentage of the Income of a Trust is an essential estate planning tool that allows beneficiaries to redistribute their wealth and income to support their chosen causes, individuals, or organizations. By assigning a portion of their trust's income, beneficiaries can demonstrate their philanthropic interests, family support, or fulfill personal obligations. It is important to note that when considering a Connecticut Assignment by Beneficiary of a Percentage of the Income of a Trust, individuals must consult with an experienced attorney or financial advisor to ensure compliance with Connecticut state laws, trust requirements, and tax implications. Proper documentation, approval from trustees (if required), and effective communication with involved parties are integral parts of establishing a successful assignment.