With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

Connecticut Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable

Description

How to fill out Agreement For Sale And Purchase Of Accounts Receivable Of Business With Seller Agreeing To Collect The Accounts Receivable?

If you wish to finalize, acquire, or produce authentic document templates, utilize US Legal Forms, the finest assortment of official forms available on the web.

Employ the site's straightforward and efficient search to find the documents you need. Various templates for business and personal use are classified by categories and claims, or keywords.

Utilize US Legal Forms to locate the Connecticut Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Committing to Collect the Accounts Receivable in just a few clicks.

Every legal document template you receive is your property indefinitely. You have access to each form you downloaded within your account. Click the My documents section and select a form to print or download again.

Complete and acquire, and print the Connecticut Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Committing to Collect the Accounts Receivable with US Legal Forms. Numerous professional and state-specific forms are available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to find the Connecticut Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Committing to Collect the Accounts Receivable.

- You can also access forms you previously submitted online in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to browse the form’s content. Don’t forget to read the explanation.

- Step 3. If you are not satisfied with the template, use the Lookup section at the top of the screen to find other versions of the legal form template.

- Step 4. After locating the form you need, click the Acquire now button. Select your preferred pricing option and enter your credentials to register for an account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

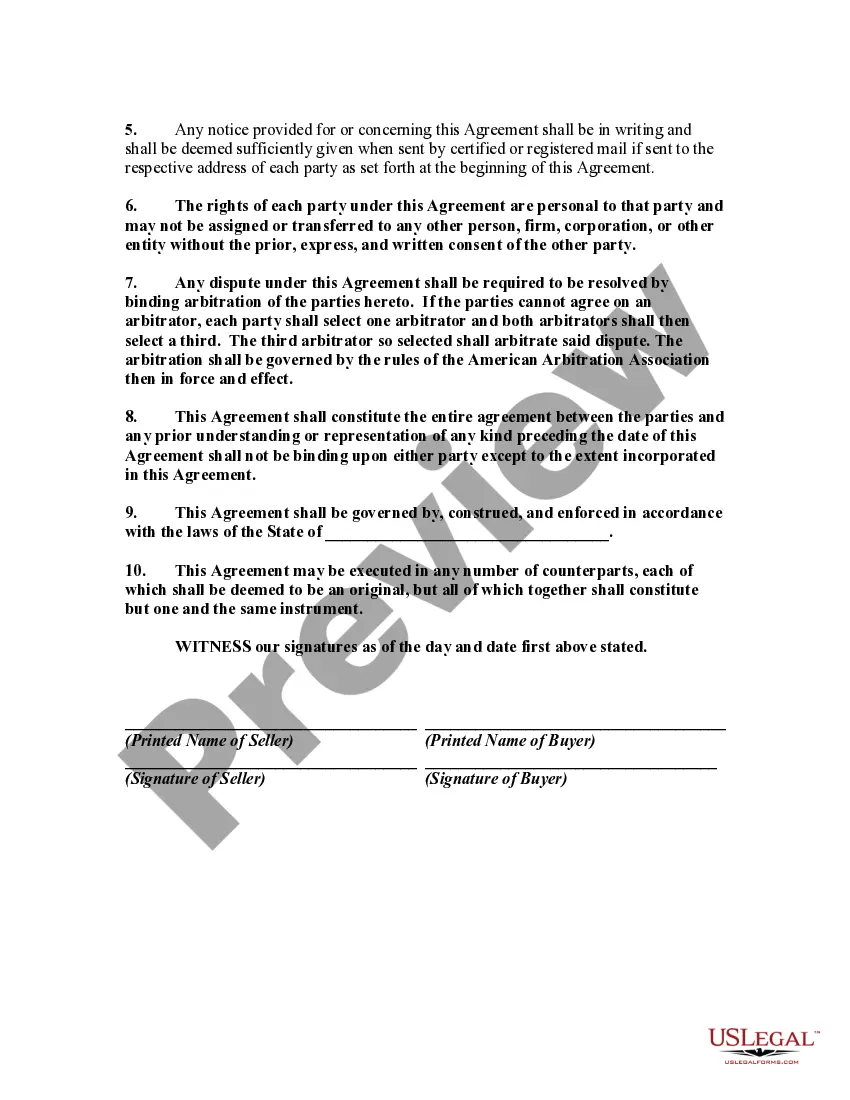

- Step 7. Complete, modify, and print or sign the Connecticut Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Committing to Collect the Accounts Receivable.

Form popularity

FAQ

A receivables purchase agreement is a contract between two or more parties, usually a buyer or a customer and a seller. This contract is often a kind of purchase arrangement that outlines the terms and conditions of the sale.

Also, including accounts receivable as part of the asset purchase agreement can lead to unwanted tension, and possibly litigation, between the buyer and the seller. There is the risk that some of the payors will continue to pay the seller, instead of the buyer, leading to disputes over the after-closing payments.

Selling receivables improves cash flow Companies can improve their cash flow by selling their invoices to a factoring company. This sale provides your company with quick access to funds while the factor waits to get paid. The process of financing receivables is called factoring.

You might choose to sell your accounts receivable in order to accelerate cash flow. Doing so is accomplished by selling them to a third party in exchange for cash and a hefty interest charge. This results in an immediate cash receipt, rather than waiting for customers to pay under normal credit terms.

Overview of Accounts Receivable When goods or services are sold to a customer, and the customer is allowed to pay at a later date, this is known as selling on credit, and creates a liability for the customer to pay the seller. Conversely, this creates an asset for the seller, which is called accounts receivable.

Accounts receivable are held by a seller and refer to promises of payment from customers to sellers. These transactions are often called credit sales or sales on account (or on credit). Accounts receivable are increased by credit sales and billings to customers, but are decreased by customer payments.

Receivables purchase agreements (RPAs) are financing arrangements that can unlock the value of a company's accounts receivable. Here's how they work: A "Seller" will sell its goods to a customer (1). The customer becomes an "Account Debtor" since it owes the Seller a Debt for those goods (2).

For many business sales, the buyer receives the receivable accounts. Service businesses such as doctor's practices or heating and air conditioning companies that rely on repeat business often must assume the debt to maintain the client base. The buyer assumes the risk as well as the customers.

In nearly all small business sales, the seller will retain the cash and accounts receivables, they will pay off the payables, and deliver the business "free and clear" to you. In larger purchases, the buyers will likely acquire these balance sheet items to provide them with immediate working capital.