Connecticut Sample Letter regarding Notification of Official Notice of Intent to Administratively Dissolve or Revoke Corporation

Description

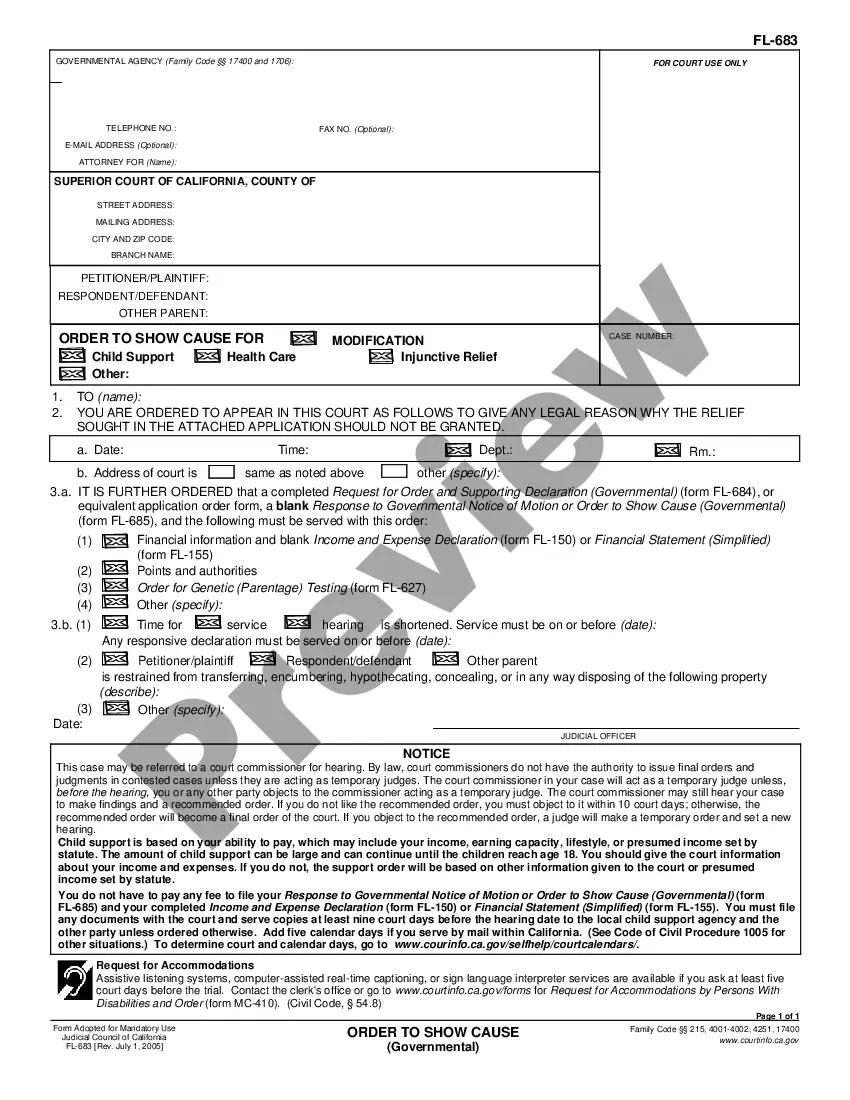

How to fill out Sample Letter Regarding Notification Of Official Notice Of Intent To Administratively Dissolve Or Revoke Corporation?

Selecting the appropriate legal document design can be challenging. Clearly, there are numerous templates accessible online, but how can you locate the specific legal format you need? Utilize the US Legal Forms website. This service provides a vast array of templates, including the Connecticut Sample Letter regarding Notification of Official Notice of Intent to Administratively Dissolve or Revoke Corporation, which you can utilize for both business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Connecticut Sample Letter regarding Notification of Official Notice of Intent to Administratively Dissolve or Revoke Corporation. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account to download another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple steps you can take: First, ensure you have selected the correct form for your region/state. You can review the document using the Review option and read the form description to confirm it is suitable for your needs. If the form does not meet your requirements, use the Search area to find the appropriate document. Once you are confident that the form is acceptable, select the Get now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document design to your device. Complete, modify, print, and sign the obtained Connecticut Sample Letter regarding Notification of Official Notice of Intent to Administratively Dissolve or Revoke Corporation.

Utilize US Legal Forms for all your legal document needs and experience the convenience of obtaining compliant forms effortlessly.

- US Legal Forms is the largest repository of legal documents where you can find a variety of paper templates.

- Use the service to acquire professionally-crafted documents that adhere to state regulations.

- Access a wide selection of templates for business and personal use.

- Ensure compliance with state and federal laws through expert-reviewed forms.

- Easily navigate through previously purchased forms in your account.

- Follow straightforward instructions for new users to find the right legal forms.

Form popularity

FAQ

After the necessary corporate action has been taken to authorize the dissolution, a Certificate of Dissolution must be filed with the Secretary of the State. Following dissolution, the affairs of the corporation must be wound up in the manner provided in The Connecticut Revised Nonstock Corporation Act.

If you voluntarily dissolve your LLC or Limited Partnership you may file a reinstatement, returning to active status while keeping your original date of formation. Reinstatement following a voluntary dissolution is only available for LLCs and Limited Partnerships.

Once terminated, you can no longer reinstate. You'll need to start over and form a new California LLC.

A business entity that has been administratively dissolved is given the status ?forfeited.? If the business wishes to become active again, it must file a reinstatement. Once a business is forfeited, the business name becomes available.

After dissolution, a corporation is generally expected to pay all its existing debts and then liquidate its remaining assets to its shareholders. This sometimes becomes difficult, however, where there are unknown claims that may exist against the corporation.

To officially dissolve your LLC, you must follow certain steps. Step 1: Follow the process in your Operating Agreement. ... Step 2: Check your business tax accounts. ... Step 3: Close your tax and state accounts. ... Step 4: Close your business tax withholdings. ... Step 5: Close your unemployment tax account.

A limited liability company that was administratively dissolved by the Division may apply for reinstatement at any time. In order to reinstate the limited liability company, all annual reports owed must be filed.