Connecticut Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

If you wish to gather, obtain, or print legitimate document templates, utilize US Legal Forms, the most extensive collection of legal forms available on the web.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

A selection of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. After locating the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Use US Legal Forms to find the Connecticut Bill of Transfer to a Trust in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to access the Connecticut Bill of Transfer to a Trust.

- You can also retrieve forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Review feature to evaluate the form’s content. Don't forget to read the information.

- Step 3. If you are dissatisfied with the form, make use of the Search field at the top of the page to find other forms in the legal form catalog.

Form popularity

FAQ

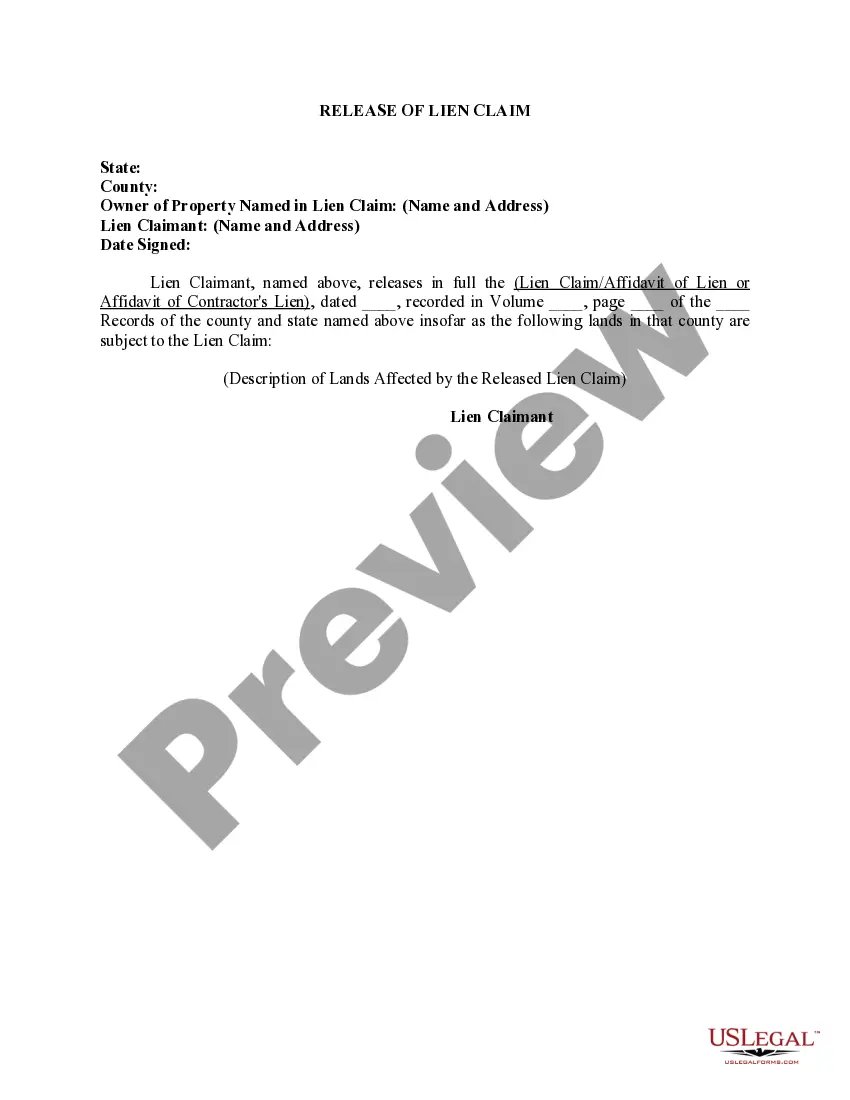

Transferring assets to a trust after death involves a different process than during your lifetime. Typically, the successor trustee accesses the deceased's estate to facilitate the transfer according to the trust agreement. The Connecticut Bill of Transfer to a Trust plays a role here, guiding how specific assets should be handled. Working with an estate attorney can help streamline this process for your loved ones.

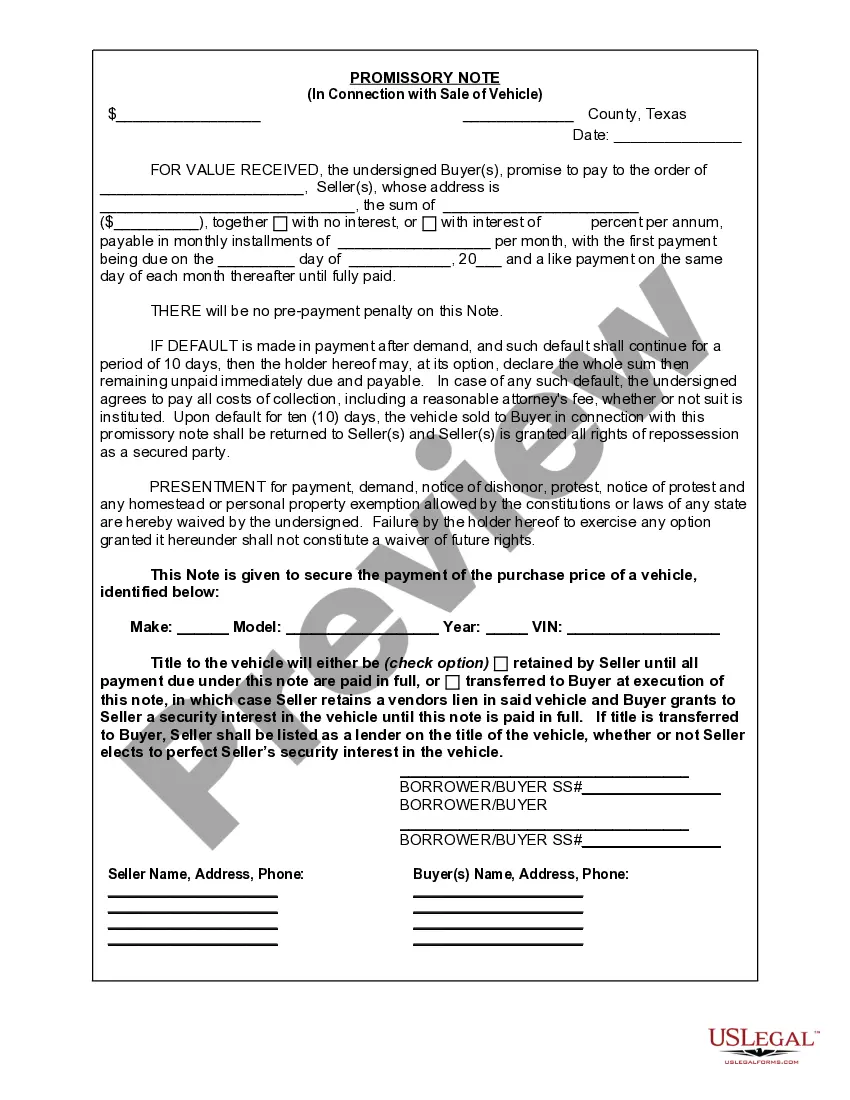

A bill of transfer in a trust serves as a legal document that facilitates the movement of assets into the trust. This document clearly outlines the assets being transferred and ensures they are placed under the jurisdiction of the trust. Utilizing a Connecticut Bill of Transfer to a Trust is fundamental to maintaining clarity and legal compliance. Engage with a professional to ensure all transfers are handled correctly.

Choosing between transfer on death and a trust involves weighing your specific needs and circumstances. While a transfer on death allows for straightforward asset transfer, a trust, particularly through a Connecticut Bill of Transfer to a Trust, offers additional benefits like asset protection and management during incapacity. Ultimately, it's crucial to evaluate your estate planning goals to determine the best approach for you.

One common mistake parents make is failing to fund the trust properly. Establishing a trust is only the first step; without properly transferring assets, the trust remains ineffective. This oversight can lead to unintended consequences for beneficiaries. To avoid this, ensure you understand the Connecticut Bill of Transfer to a Trust and consider seeking professional help to navigate the complexities.

Transferring accounts to a trust involves changing the ownership from your name to the trust's name. First, you need to complete a Connecticut Bill of Transfer to a Trust, which outlines the details of the transfer. Next, you may need to provide specific documents like your trust agreement to financial institutions. Using resources like US Legal Forms can help ease this process, providing the necessary forms and guidance.

The recent updates to trust law in Connecticut simplify the process of creating and managing trusts. Revised regulations aim to enhance asset protection and streamline the Connecticut Bill of Transfer to a Trust. These changes reflect the state's commitment to modernizing estate planning tools for residents. Be sure to stay informed, as these laws can significantly impact your estate strategy.

When considering the Connecticut Bill of Transfer to a Trust, it's essential to remember that not every asset belongs in a trust. Typically, assets like retirement accounts, life insurance policies, and certain types of personal property may not be ideal candidates. Generally, maintaining control and ensuring tax efficiency are key factors in your decision. Always consult with a legal expert or use a trusted platform to guide you.

While there are many benefits to placing your house in a trust, there are some potential disadvantages to consider. You may incur upfront costs for setting up the trust and related legal documents, such as the Connecticut Bill of Transfer to a Trust. Additionally, managing the trust might require extra paperwork and compliance with laws. It's crucial to weigh these factors with the help of a professional advisor.

To put your house in a trust in Connecticut, you need to complete a Connecticut Bill of Transfer to a Trust. This document will formally transfer ownership of the property to the trust. You may also need to record the transfer with your local land records office. Utilizing legal services, like uslegalforms, can simplify this process and ensure everything is done correctly and efficiently.

The best type of trust for your house often depends on your goals. For many people in Connecticut, a revocable living trust works well because it allows for flexibility and control during your lifetime. With the Connecticut Bill of Transfer to a Trust, you can easily specify how your property will be managed and distributed. Always consider discussing your options with a legal expert to ensure it meets your needs.