Connecticut Receipt Template for Rent is a legally binding document that serves as proof of payment made by a tenant to a landlord or property owner in exchange for the rental of a property in Connecticut. This comprehensive receipt template includes all the necessary information required by law and helps in managing financial transactions smoothly. The Connecticut Receipt Template for Rent typically consists of the following key elements: 1. Landlord and Tenant Information: It includes the full name, address, and contact details of both the landlord and tenant. 2. Property Details: This section provides a description of the rented property, including the address, type of dwelling (apartment, house, etc.), and specific details about the unit (such as the number of bedrooms, bathrooms, etc.). 3. Rental Payment Details: The receipt specifies the rental period (start and end dates), the total amount of rent due, and the payment method used (cash, check, online transfer, etc.). 4. Security Deposit: If applicable, the receipt acknowledges the receipt of the security deposit and provides details about the amount paid, the purpose of the deposit, and the terms and conditions for its refund. 5. Late Fees or Penalties: If there are any late payment fees or penalties specified in the lease agreement, they should be clearly mentioned in the receipt. 6. Additional Charges: This section covers any additional charges or fees, such as utilities, parking fees, maintenance charges, etc., which are not included in the monthly rent. 7. Signatures and Date: The receipt must be signed and dated by both the landlord and tenant to indicate their agreement and authentication. 8. Legal Compliance: The template ensures compliance with Connecticut state laws and regulations governing rental transactions, which may include specific requirements regarding the format and information included in the receipt. Different types of Connecticut Receipt Templates for Rent may include specific variations depending on individual needs or unique rental situations. Some examples include: 1. Monthly Rent Receipt: This type of receipt is used for recording the monthly rental payment. 2. Partial Rent Payment Receipt: If a tenant makes a partial payment, a specific receipt can be generated to acknowledge the partial amount received. 3. Security Deposit Receipt: This receipt is specifically designed to document the payment of the security deposit, including any specific terms and conditions related to its refund. 4. Pet Deposit Receipt: In case a tenant pays a separate pet deposit, a specific receipt can be generated to document the receipt of this additional payment. Using a standardized Connecticut Receipt Template for Rent ensures transparency, accountability, and a clear record of financial transactions between landlords and tenants. It helps both parties maintain accurate financial records, avoid disputes, and provide evidence in case of legal proceedings.

Connecticut Receipt Template for Rent

Description

How to fill out Connecticut Receipt Template For Rent?

You are able to spend hours online trying to find the authorized record format which fits the federal and state specifications you require. US Legal Forms supplies 1000s of authorized kinds that are analyzed by professionals. It is simple to download or print the Connecticut Receipt Template for Rent from my assistance.

If you have a US Legal Forms account, you are able to log in and then click the Obtain option. Following that, you are able to complete, change, print, or sign the Connecticut Receipt Template for Rent. Every authorized record format you get is your own property permanently. To obtain another copy for any bought form, visit the My Forms tab and then click the related option.

Should you use the US Legal Forms site the very first time, follow the straightforward instructions beneath:

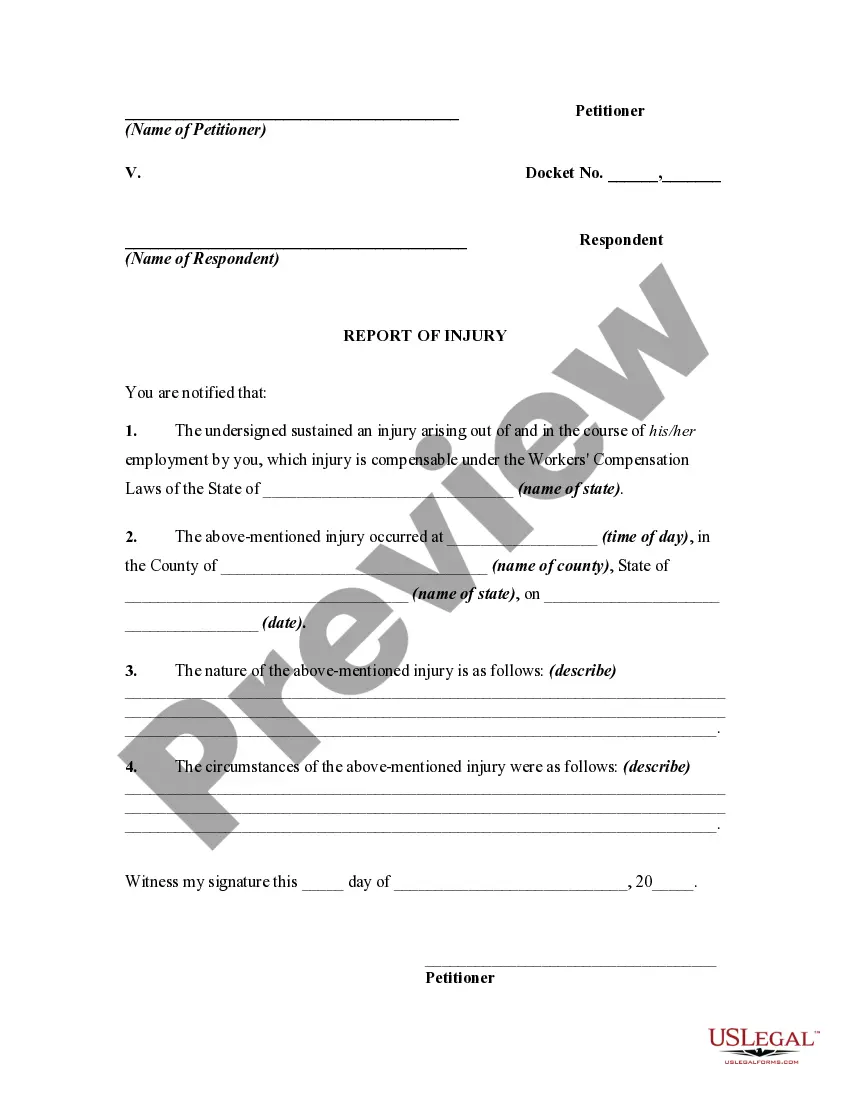

- Initial, make certain you have selected the best record format for the area/city of your liking. See the form description to make sure you have picked the correct form. If offered, utilize the Preview option to appear from the record format also.

- If you would like discover another version from the form, utilize the Research field to find the format that suits you and specifications.

- When you have identified the format you want, simply click Acquire now to carry on.

- Find the costs prepare you want, type in your credentials, and sign up for your account on US Legal Forms.

- Total the transaction. You should use your bank card or PayPal account to cover the authorized form.

- Find the format from the record and download it for your gadget.

- Make alterations for your record if required. You are able to complete, change and sign and print Connecticut Receipt Template for Rent.

Obtain and print 1000s of record themes using the US Legal Forms site, that provides the greatest collection of authorized kinds. Use professional and express-specific themes to deal with your company or individual demands.