This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

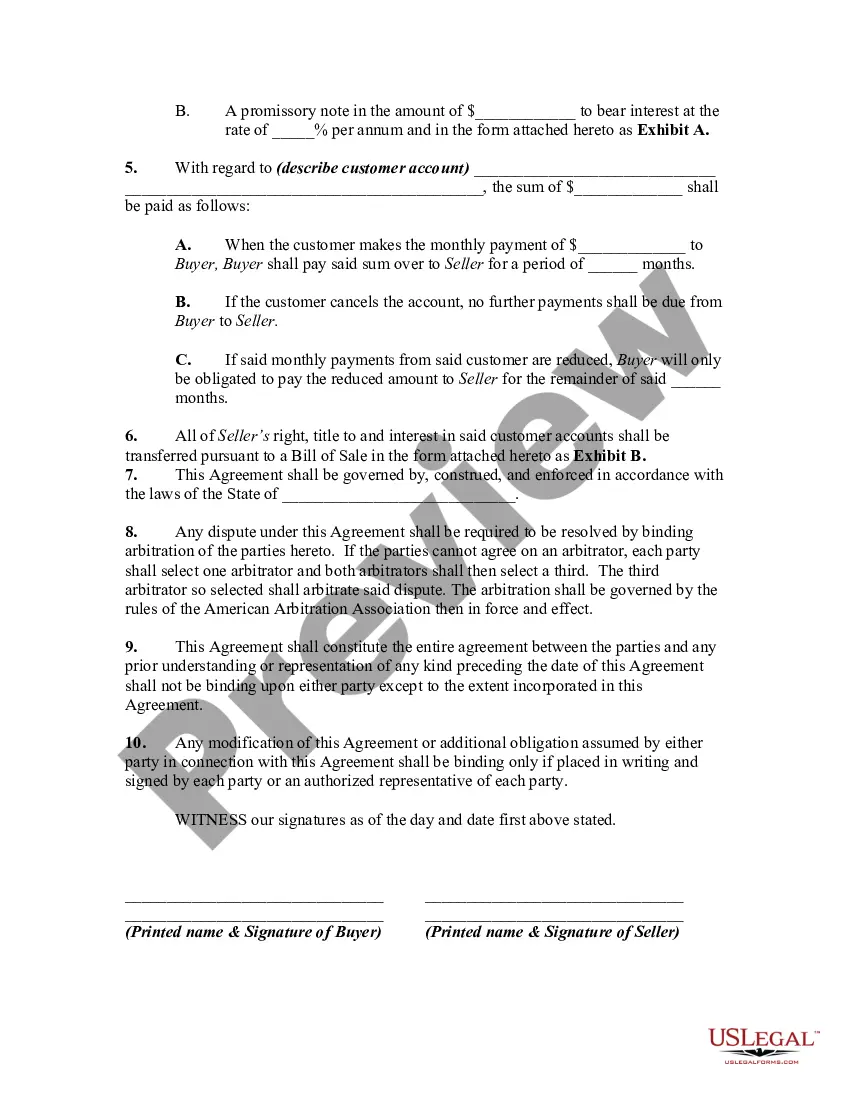

Connecticut Agreement to Sell and Purchase Customer Accounts, also referred to as the Purchase Agreement, is a legal contract that outlines the terms and conditions for the sale and purchase of customer accounts by a buyer from a seller. This agreement is specifically tailored to comply with the laws and regulations in the state of Connecticut. The Connecticut Agreement to Sell and Purchase Customer Accounts serves as a binding agreement between the buyer and the seller, ensuring a smooth and transparent transaction. It sets forth various clauses and provisions, including the purchase price, payment arrangements, representations and warranties, and post-closing obligations. The following are different types or variations of the Connecticut Agreement to Sell and Purchase Customer Accounts: 1. Asset Purchase Agreement: This type of agreement focuses primarily on purchasing the customer accounts as an asset, separately from the seller's entire business entity. It outlines the specific terms regarding the transfer of ownership of the accounts. 2. Stock Purchase Agreement: In contrast to an asset purchase agreement, a stock purchase agreement involves the acquisition of the seller's entire business entity, including its customer accounts. This agreement allows the buyer to acquire ownership of the company in its entirety. 3. Assignment Agreement: An assignment agreement is used when the seller intends to transfer their rights and obligations associated with the customer accounts to the buyer. It transfers the seller's interests to the buyer, who assumes all responsibilities and benefits related to the accounts. 4. Bulk Sale Agreement: A bulk sale agreement is applicable when the seller intends to sell a significant number of customer accounts as part of its business. This agreement requires specific documentation and notification procedures to protect both the buyer and the seller's interests. Regardless of the type, a typical Connecticut Agreement to Sell and Purchase Customer Accounts includes the following essential elements: i. Purchase Price: Specifies the agreed-upon sum for the sale of the customer accounts. ii. Payment Terms: Outlines the payment structure, such as lump sum payment or installments, and any conditions related to payment. iii. Representations and Warranties: Provides assurances from the seller that the customer accounts are accurate, valid, and legally owned, protecting the buyer in case of any liabilities or disputes. iv. Non-Compete and Non-Disclosure Clauses: Defines restrictions imposed on the seller regarding competition and disclosure of confidential information to protect the buyer's interests. v. Indemnification: States the provisions for compensation in case of losses, damages, or liabilities arising from breaches of the agreement or misrepresentations. vi. Governing Law and Jurisdiction: Specifies that the agreement is governed by the laws of Connecticut and sets the jurisdiction for any dispute resolution. It is crucial to consult with legal professionals or attorneys experienced in Connecticut commercial law to draft and review a Connecticut Agreement to Sell and Purchase Customer Accounts, ensuring compliance and protection of both parties involved in the transaction.