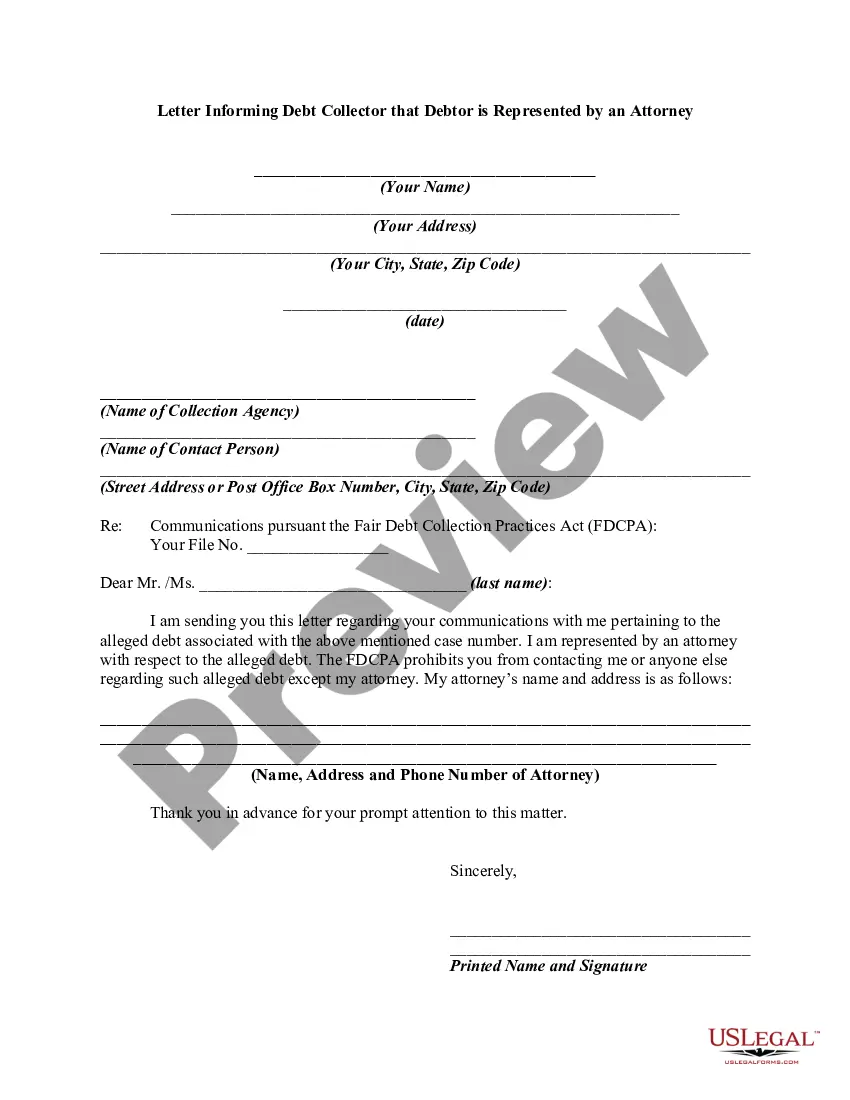

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

Subject: Connecticut Letter Informing Debt Collector of Legal Representation Dear [Debt Collector's Name], I am writing to inform you that I am represented by legal counsel in regard to a debt that you claim I owe. My attorney's name is [Attorney's Name], and they are licensed to practice law in the state of Connecticut. The purpose of this letter is to formally notify you of my representation and to ensure that all communications regarding this debt are directed solely to my attorney. It is my understanding that, under the Fair Debt Collection Practices Act (FD CPA), once you are aware of my legal representation, you must refrain from contacting me directly. Any further communication relating to this debt should be directed to my attorney to ensure compliance with the law. Please update your records accordingly and provide my attorney with his/her individual case number or reference number for future correspondence. Failure to comply with this request may result in legal action taken against your agency. I kindly request that you acknowledge receipt of this letter and confirm that all further communication regarding this matter will be directed to my attorney at the address provided below: [Attorney's Name] [Attorney's Firm Name] [Attorney's Address] [Attorney's City, State, ZIP] In addition to informing you of my legal representation, I also request that you provide the following information related to the alleged debt: 1. The original creditor's name and contact information. 2. The original account number associated with the debt. 3. A complete accounting of the debt, including the principal amount, any interest applied, and any additional fees or charges. 4. Copies of any documents, contracts, or agreements related to the debt. 5. Verification of your authority to collect the debt. Please provide this information within 30 days of receiving this letter, as mandated by the FD CPA. Failure to do so may result in a violation of my rights under federal law, and appropriate legal action will be taken. I trust that you will handle this matter professionally and in accordance with the law. Thank you for your attention to this letter. Sincerely, [Your Full Name] [Your Address] [Your City, State, ZIP] [Your Phone Number] [Date] Alternative Variations of Connecticut Letters Informing Debt Collectors of Legal Representation: 1. Cease and Desist Connecticut Letter Informing Debt Collector of Legal Representation: This version emphasizes the request to cease all further communication and demands that the debt collector stops contacting the debtor entirely, except through their attorney. 2. Dispute Connecticut Letter Informing Debt Collector of Legal Representation: This variation includes elements of disputing the validity or accuracy of the debt and the request for detailed documentation, while informing the debt collector of legal representation. 3. Validation Request Connecticut Letter Informing Debt Collector of Legal Representation: This type of letter specifically requests the debt collector to provide evidence validating the debt and notifies them about the debtor's legal representation simultaneously, ensuring compliance with FD CPA regulations.