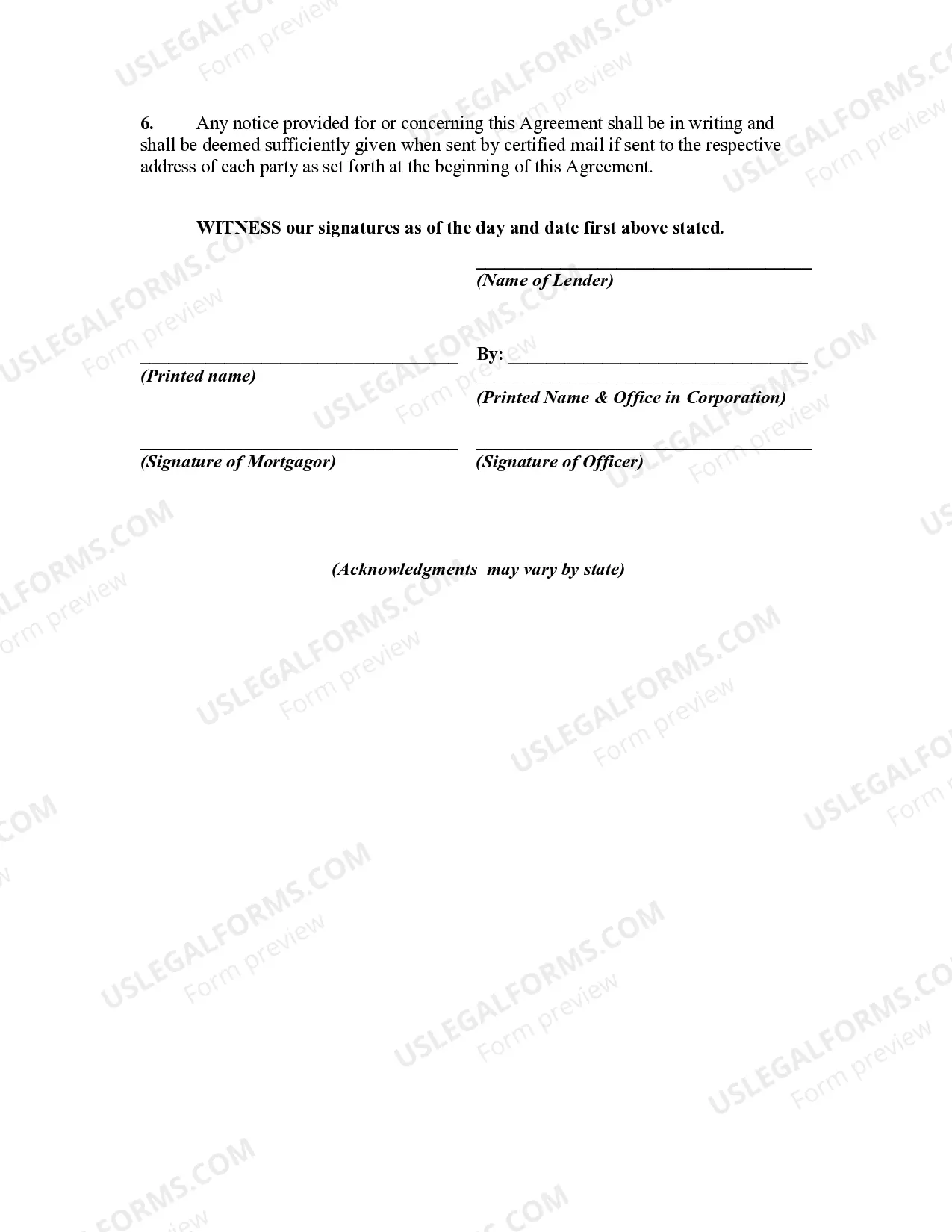

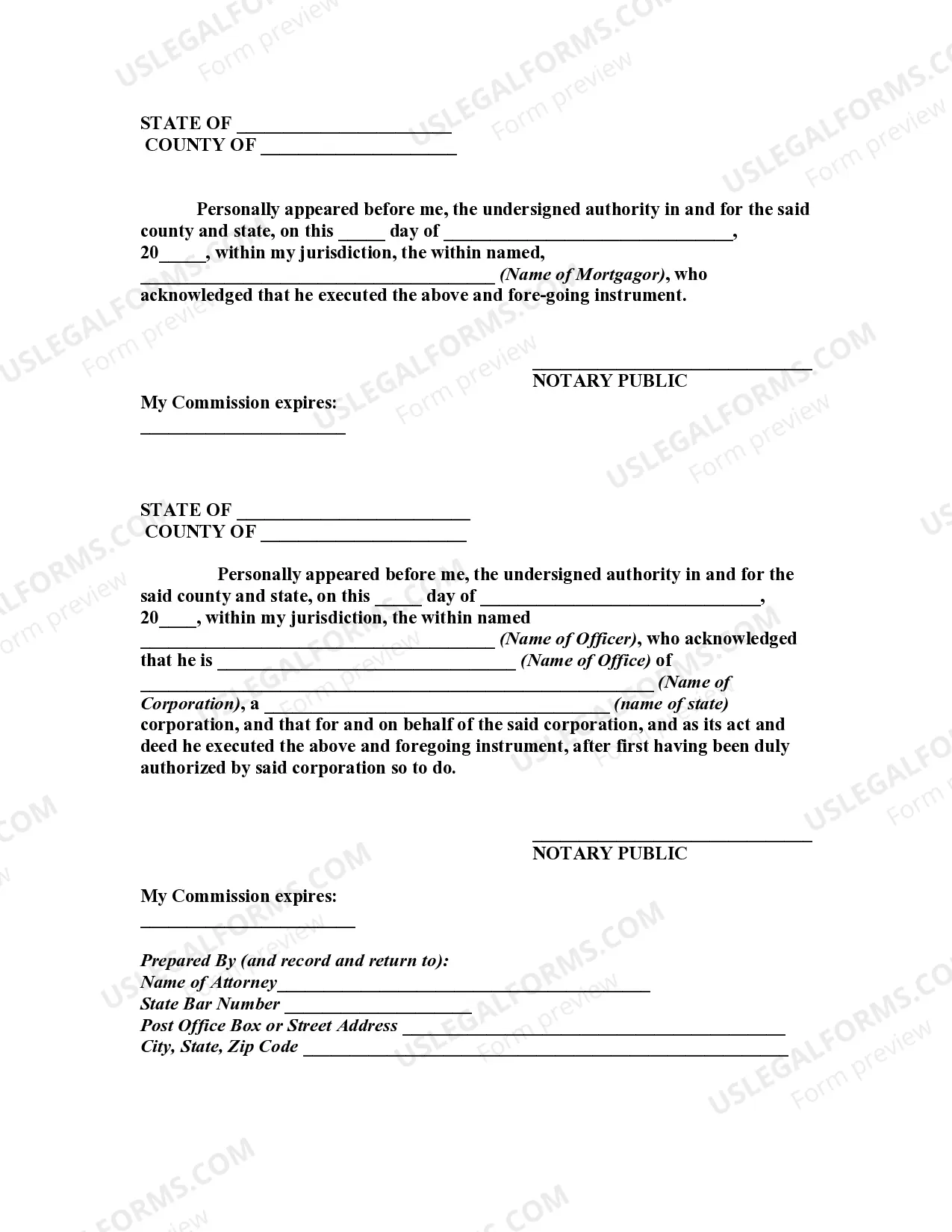

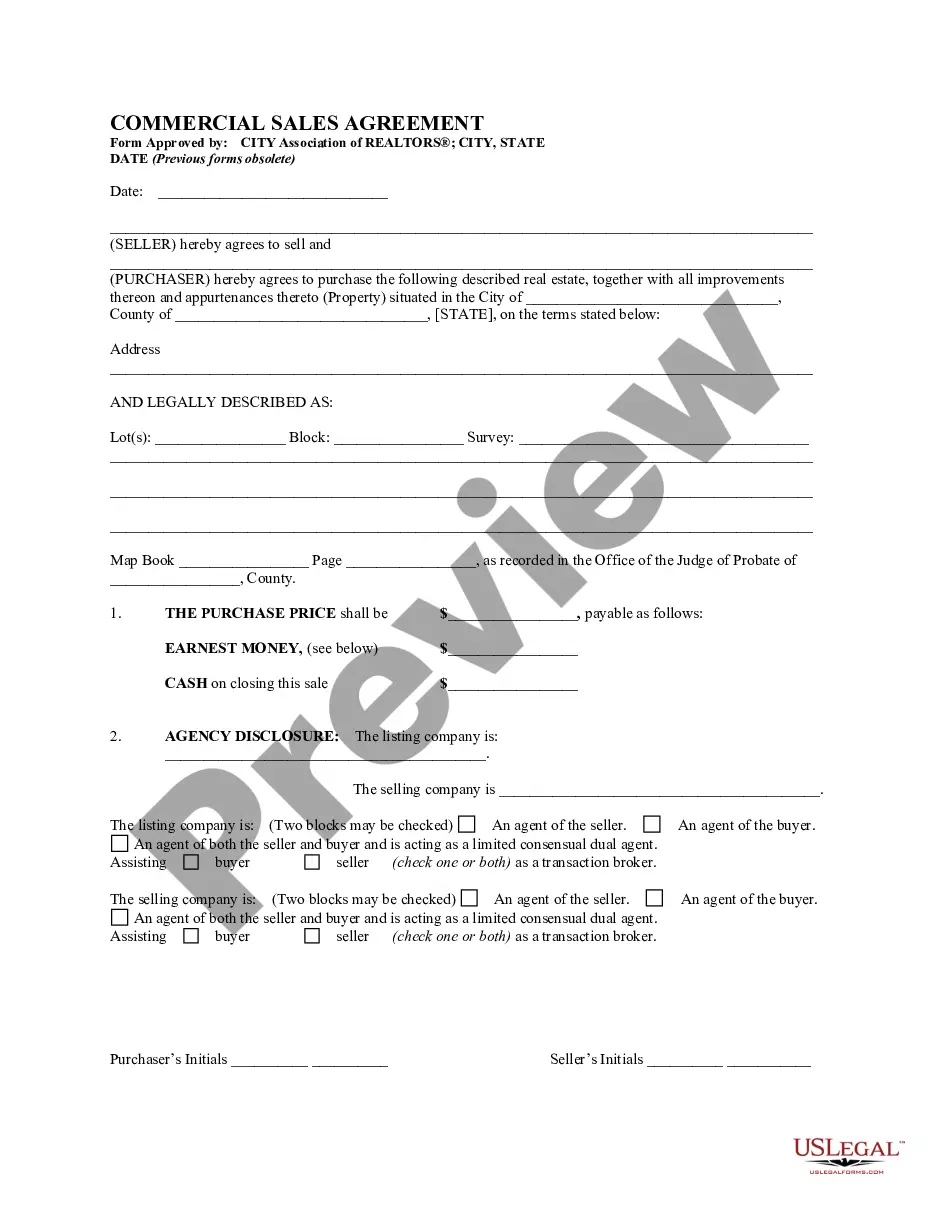

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate A Connecticut Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate is a legal document that allows borrowers in Connecticut to extend the maturity date of their existing mortgage loan while also increasing the interest rate. This agreement is typically entered into when borrowers are facing financial difficulties and are unable to meet their current mortgage obligations. By signing this agreement, borrowers agree to extend the term of their mortgage loan beyond the initial maturity date set forth in the original loan agreement. This extension provides borrowers with additional time to repay the outstanding balance of the loan. However, it also comes with a higher interest rate to compensate the lender for the increased risk associated with the extended repayment period. The Connecticut Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate outlines the terms and conditions of the agreement, including the new maturity date, the revised interest rate, and any additional fees or charges that may apply. It is crucial for borrowers to carefully review and understand these terms before signing the agreement. Types of Connecticut Mortgage Loan Extension Agreements as to Maturity Date and Increase in Interest Rate: 1. Short-term Extension Agreement: This type of agreement allows borrowers to extend the maturity date and increase the interest rate on their mortgage loan for a relatively short period, usually a few months to a year. It provides temporary relief to borrowers who are facing temporary financial hardships but expect their situation to improve within a short timeframe. 2. Long-term Extension Agreement: This agreement allows borrowers to extend the maturity date and increase the interest rate on their mortgage loan for a more extended period, often several years. It is typically utilized by borrowers who are experiencing significant financial difficulties and need a more extended period to recover their financial stability. 3. Combination Extension Agreement: Some borrowers may require both a modification to their maturity date and an increase in interest rate. This type of agreement combines the extensions of the maturity date and interest rate increase into a single document, providing a comprehensive solution to borrowers facing financial challenges. In conclusion, a Connecticut Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate allows borrowers to extend the maturity date of their mortgage loan while also increasing the interest rate. It serves as a means of providing temporary or long-term relief to borrowers experiencing financial difficulties, allowing them additional time to repay their loan obligations. It is important for borrowers to carefully review and understand the terms of the agreement before signing to ensure they fully comprehend the implications of the extension and interest rate increase.Connecticut Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate A Connecticut Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate is a legal document that allows borrowers in Connecticut to extend the maturity date of their existing mortgage loan while also increasing the interest rate. This agreement is typically entered into when borrowers are facing financial difficulties and are unable to meet their current mortgage obligations. By signing this agreement, borrowers agree to extend the term of their mortgage loan beyond the initial maturity date set forth in the original loan agreement. This extension provides borrowers with additional time to repay the outstanding balance of the loan. However, it also comes with a higher interest rate to compensate the lender for the increased risk associated with the extended repayment period. The Connecticut Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate outlines the terms and conditions of the agreement, including the new maturity date, the revised interest rate, and any additional fees or charges that may apply. It is crucial for borrowers to carefully review and understand these terms before signing the agreement. Types of Connecticut Mortgage Loan Extension Agreements as to Maturity Date and Increase in Interest Rate: 1. Short-term Extension Agreement: This type of agreement allows borrowers to extend the maturity date and increase the interest rate on their mortgage loan for a relatively short period, usually a few months to a year. It provides temporary relief to borrowers who are facing temporary financial hardships but expect their situation to improve within a short timeframe. 2. Long-term Extension Agreement: This agreement allows borrowers to extend the maturity date and increase the interest rate on their mortgage loan for a more extended period, often several years. It is typically utilized by borrowers who are experiencing significant financial difficulties and need a more extended period to recover their financial stability. 3. Combination Extension Agreement: Some borrowers may require both a modification to their maturity date and an increase in interest rate. This type of agreement combines the extensions of the maturity date and interest rate increase into a single document, providing a comprehensive solution to borrowers facing financial challenges. In conclusion, a Connecticut Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate allows borrowers to extend the maturity date of their mortgage loan while also increasing the interest rate. It serves as a means of providing temporary or long-term relief to borrowers experiencing financial difficulties, allowing them additional time to repay their loan obligations. It is important for borrowers to carefully review and understand the terms of the agreement before signing to ensure they fully comprehend the implications of the extension and interest rate increase.