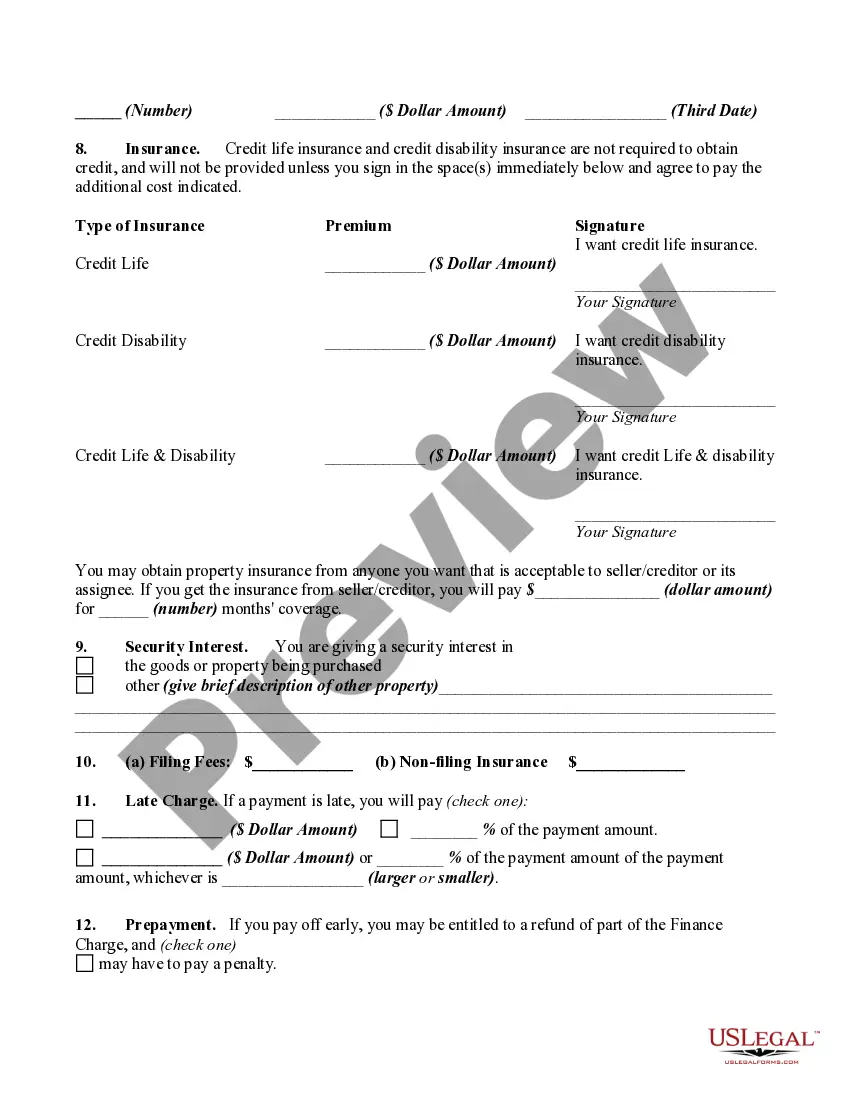

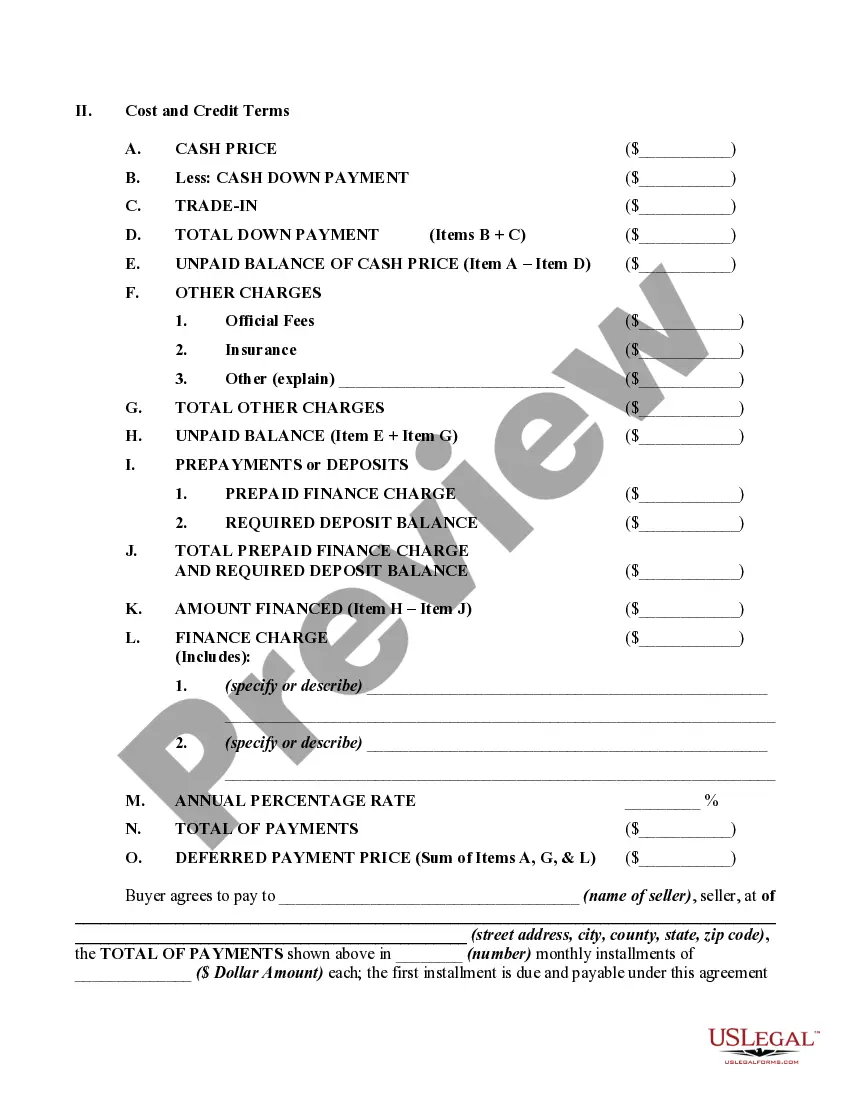

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and must be worded as shown if the form.

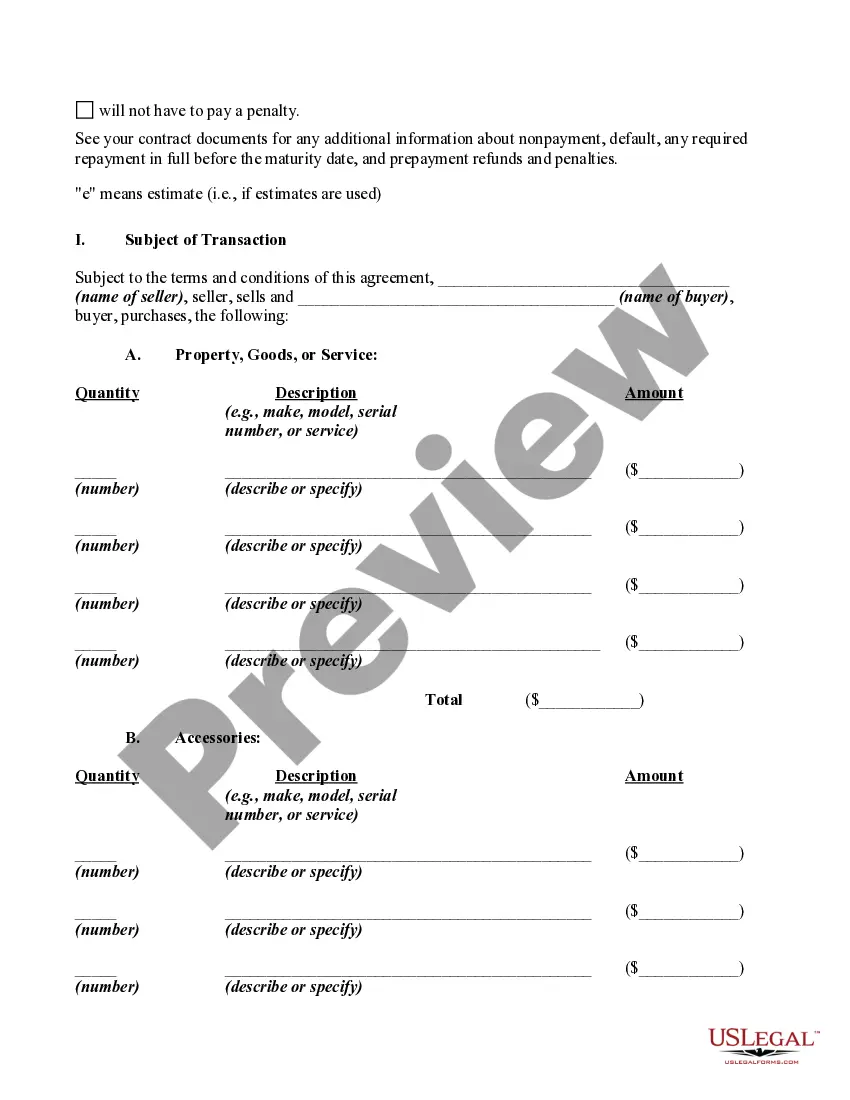

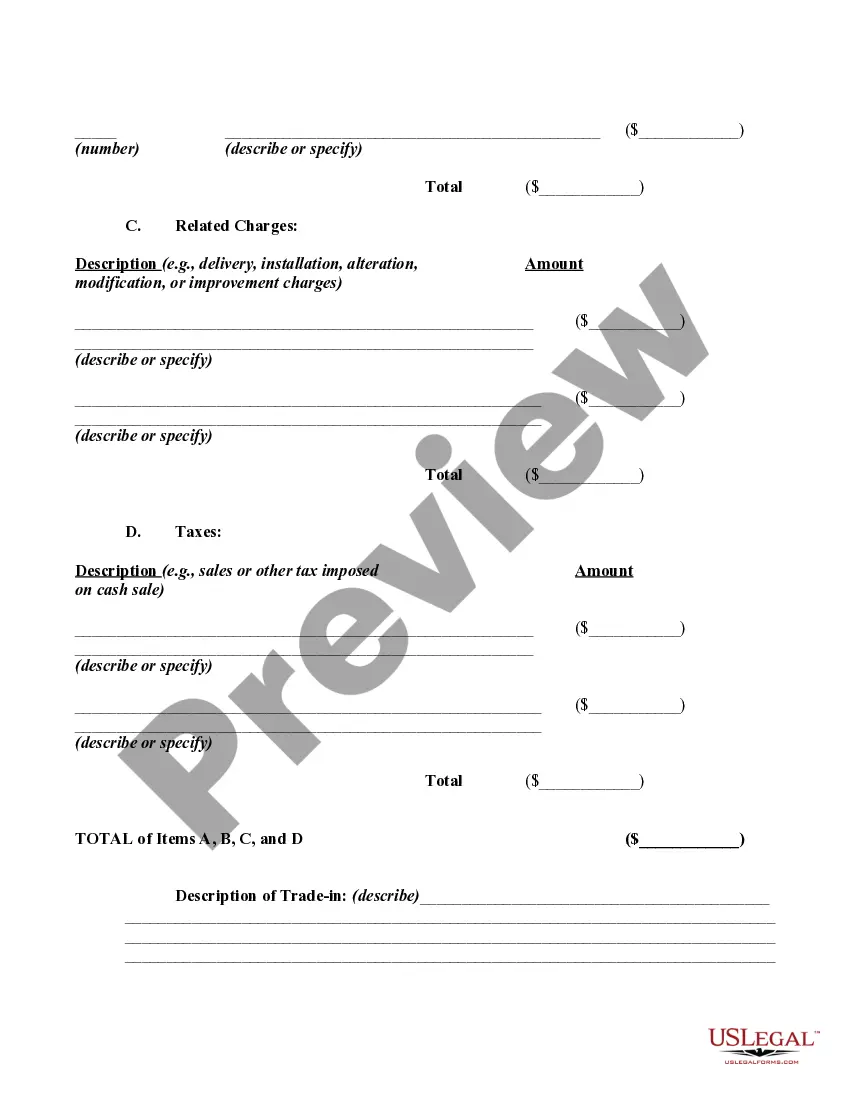

Connecticut Retail Installment Contract and Security Agreement is a legal document that outlines the terms and conditions of purchasing goods or services in Connecticut through a retail installment plan. It establishes an agreement between the buyer (purchaser) and the seller (retailer), specifying the rights, responsibilities, and obligations of both parties involved in the transaction. The key elements included in the Connecticut Retail Installment Contract and Security Agreement may vary based on specific factors such as the nature of the purchase, the parties involved, and the chosen to finance options. However, some common elements generally found in this agreement are: 1. Identification of Parties: The agreement begins by identifying the buyer and the seller, including their legal names, addresses, and contact information. 2. Description of Goods or Services: The agreement should clearly describe the goods or services being purchased, including any model or serial numbers, specifications, or quantity. 3. Purchase Price and Payment Terms: This section outlines the total purchase price, including any additional charges (e.g., taxes, fees). It also specifies the payment terms, such as the down payment amount, installment amounts, the interest rate (if applicable), late payment fees, and the duration of the installment plan. 4. Security Agreement: If the buyer has provided any collateral to secure the purchase, such as a vehicle or real estate, this section clarifies the terms and conditions regarding the collateral, including its valuation, insurance requirements, and rights in the event of default. 5. Default and Remedies: The agreement states the actions that can be taken by the seller in case the buyer defaults on any payment obligations. This may include repossession of the goods, charging penalties, or pursuing legal remedies. 6. Governing Law and Jurisdiction: This section specifies that the agreement is governed by the laws of Connecticut and outlines the jurisdiction where any legal disputes will be resolved. 7. Disclosures: The Retail Installment Contract and Security Agreement should include all required disclosures as per Connecticut consumer protection laws, such as a statement of the buyer's rights to cancel the agreement within a specified timeframe, a clear explanation of the interest rate calculation, and any insurance disclosures. Types of Connecticut Retail Installment Contract and Security Agreement: 1. Automobile Retail Installment Contract: This type of agreement is specifically designed for the purchase of motor vehicles, including cars, trucks, motorcycles, or recreational vehicles. It includes provisions specific to vehicle financing, such as transfer of title, lien holder information, and required insurance coverage. 2. Retail Installment Contract for Electronics: This type of agreement pertains to the purchase of electronics, including items like televisions, computers, smartphones, or home appliances. 3. Retail Installment Contract for Furniture or Appliances: This agreement is applicable when purchasing furniture or household appliances, ensuring that the terms and conditions are suitable for these specific types of items. In conclusion, the Connecticut Retail Installment Contract and Security Agreement is a legal document that governs the terms of purchasing goods or services through a retail installment plan in Connecticut. It protects the rights of both the buyer and the seller, ensuring that the terms of the transaction are transparent and fair.Connecticut Retail Installment Contract and Security Agreement is a legal document that outlines the terms and conditions of purchasing goods or services in Connecticut through a retail installment plan. It establishes an agreement between the buyer (purchaser) and the seller (retailer), specifying the rights, responsibilities, and obligations of both parties involved in the transaction. The key elements included in the Connecticut Retail Installment Contract and Security Agreement may vary based on specific factors such as the nature of the purchase, the parties involved, and the chosen to finance options. However, some common elements generally found in this agreement are: 1. Identification of Parties: The agreement begins by identifying the buyer and the seller, including their legal names, addresses, and contact information. 2. Description of Goods or Services: The agreement should clearly describe the goods or services being purchased, including any model or serial numbers, specifications, or quantity. 3. Purchase Price and Payment Terms: This section outlines the total purchase price, including any additional charges (e.g., taxes, fees). It also specifies the payment terms, such as the down payment amount, installment amounts, the interest rate (if applicable), late payment fees, and the duration of the installment plan. 4. Security Agreement: If the buyer has provided any collateral to secure the purchase, such as a vehicle or real estate, this section clarifies the terms and conditions regarding the collateral, including its valuation, insurance requirements, and rights in the event of default. 5. Default and Remedies: The agreement states the actions that can be taken by the seller in case the buyer defaults on any payment obligations. This may include repossession of the goods, charging penalties, or pursuing legal remedies. 6. Governing Law and Jurisdiction: This section specifies that the agreement is governed by the laws of Connecticut and outlines the jurisdiction where any legal disputes will be resolved. 7. Disclosures: The Retail Installment Contract and Security Agreement should include all required disclosures as per Connecticut consumer protection laws, such as a statement of the buyer's rights to cancel the agreement within a specified timeframe, a clear explanation of the interest rate calculation, and any insurance disclosures. Types of Connecticut Retail Installment Contract and Security Agreement: 1. Automobile Retail Installment Contract: This type of agreement is specifically designed for the purchase of motor vehicles, including cars, trucks, motorcycles, or recreational vehicles. It includes provisions specific to vehicle financing, such as transfer of title, lien holder information, and required insurance coverage. 2. Retail Installment Contract for Electronics: This type of agreement pertains to the purchase of electronics, including items like televisions, computers, smartphones, or home appliances. 3. Retail Installment Contract for Furniture or Appliances: This agreement is applicable when purchasing furniture or household appliances, ensuring that the terms and conditions are suitable for these specific types of items. In conclusion, the Connecticut Retail Installment Contract and Security Agreement is a legal document that governs the terms of purchasing goods or services through a retail installment plan in Connecticut. It protects the rights of both the buyer and the seller, ensuring that the terms of the transaction are transparent and fair.