If you want to comprehensive, acquire, or produce authorized document web templates, use US Legal Forms, the greatest assortment of authorized forms, that can be found on-line. Utilize the site`s basic and handy lookup to get the documents you need. Numerous web templates for business and personal reasons are categorized by groups and says, or keywords. Use US Legal Forms to get the Connecticut Mortgage Loan Commitment for Home Equity Line of Credit within a couple of click throughs.

Should you be previously a US Legal Forms customer, log in to the profile and then click the Obtain switch to find the Connecticut Mortgage Loan Commitment for Home Equity Line of Credit . Also you can entry forms you earlier acquired in the My Forms tab of your own profile.

If you work with US Legal Forms initially, follow the instructions under:

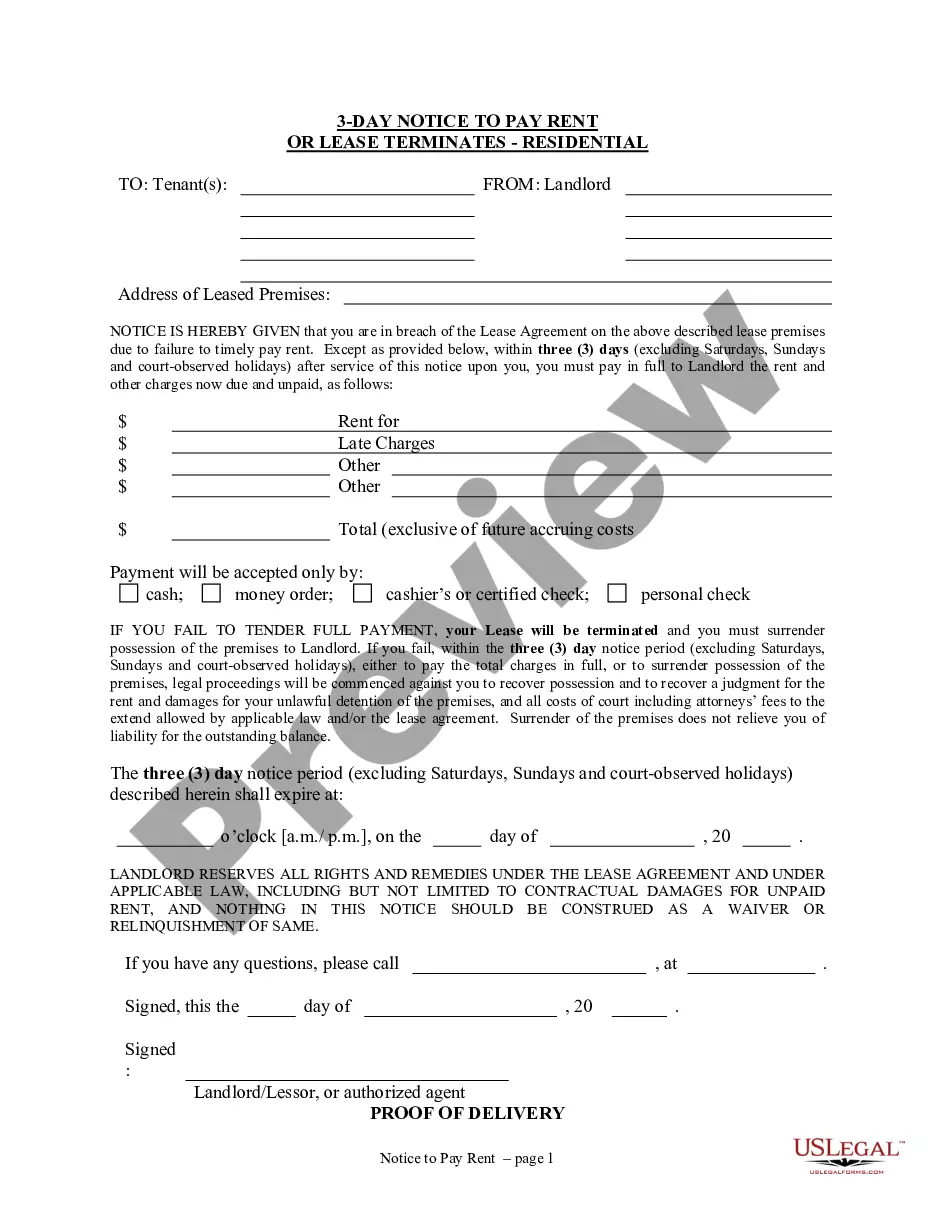

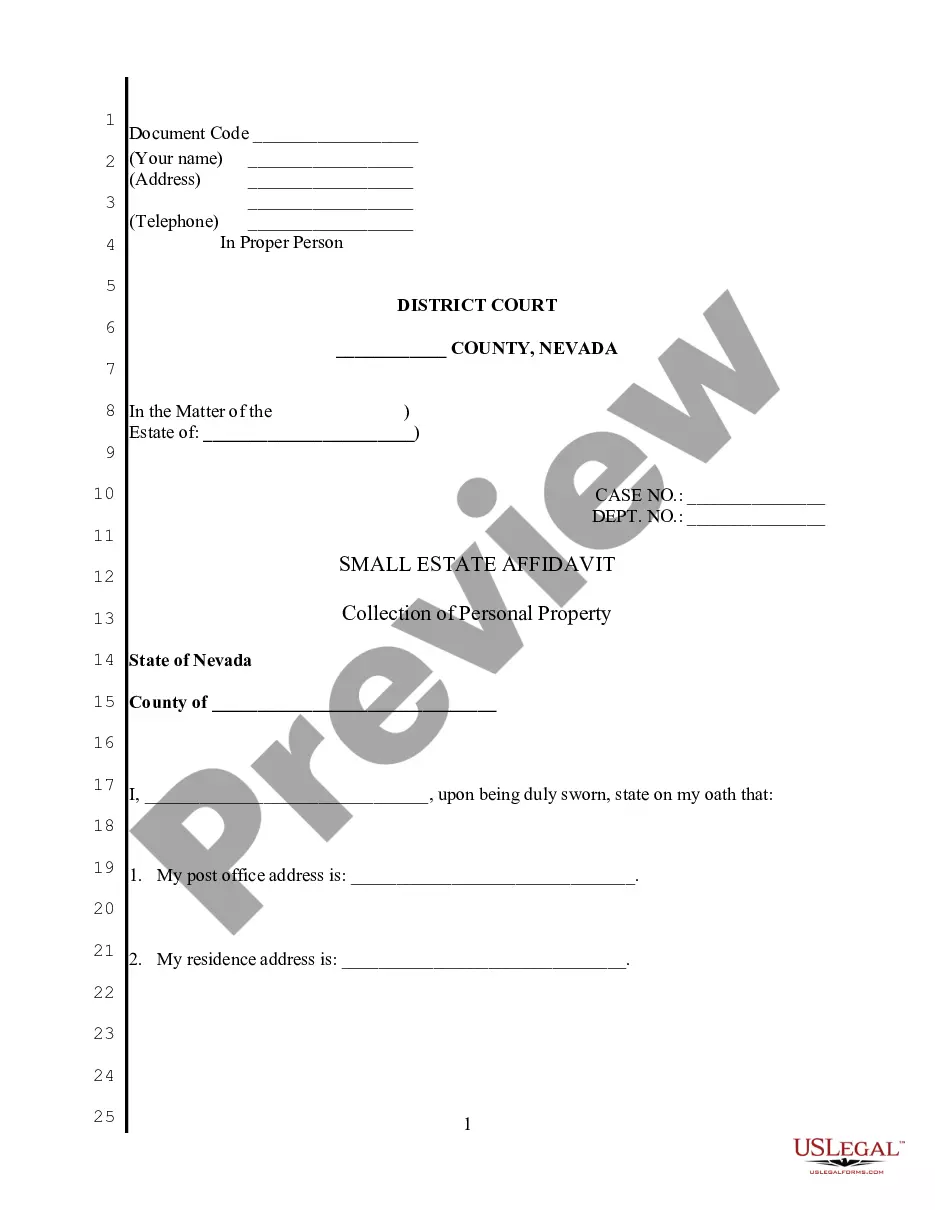

- Step 1. Ensure you have selected the form for the proper town/region.

- Step 2. Utilize the Review option to examine the form`s articles. Do not forget about to read through the information.

- Step 3. Should you be not satisfied with all the type, utilize the Research industry near the top of the monitor to find other models in the authorized type format.

- Step 4. After you have discovered the form you need, select the Acquire now switch. Pick the costs plan you choose and put your references to register for an profile.

- Step 5. Approach the deal. You can use your credit card or PayPal profile to accomplish the deal.

- Step 6. Pick the file format in the authorized type and acquire it on your own product.

- Step 7. Comprehensive, edit and produce or signal the Connecticut Mortgage Loan Commitment for Home Equity Line of Credit .

Each authorized document format you purchase is the one you have forever. You possess acces to every single type you acquired with your acccount. Click on the My Forms portion and pick a type to produce or acquire once more.

Be competitive and acquire, and produce the Connecticut Mortgage Loan Commitment for Home Equity Line of Credit with US Legal Forms. There are millions of professional and state-certain forms you can use for the business or personal demands.