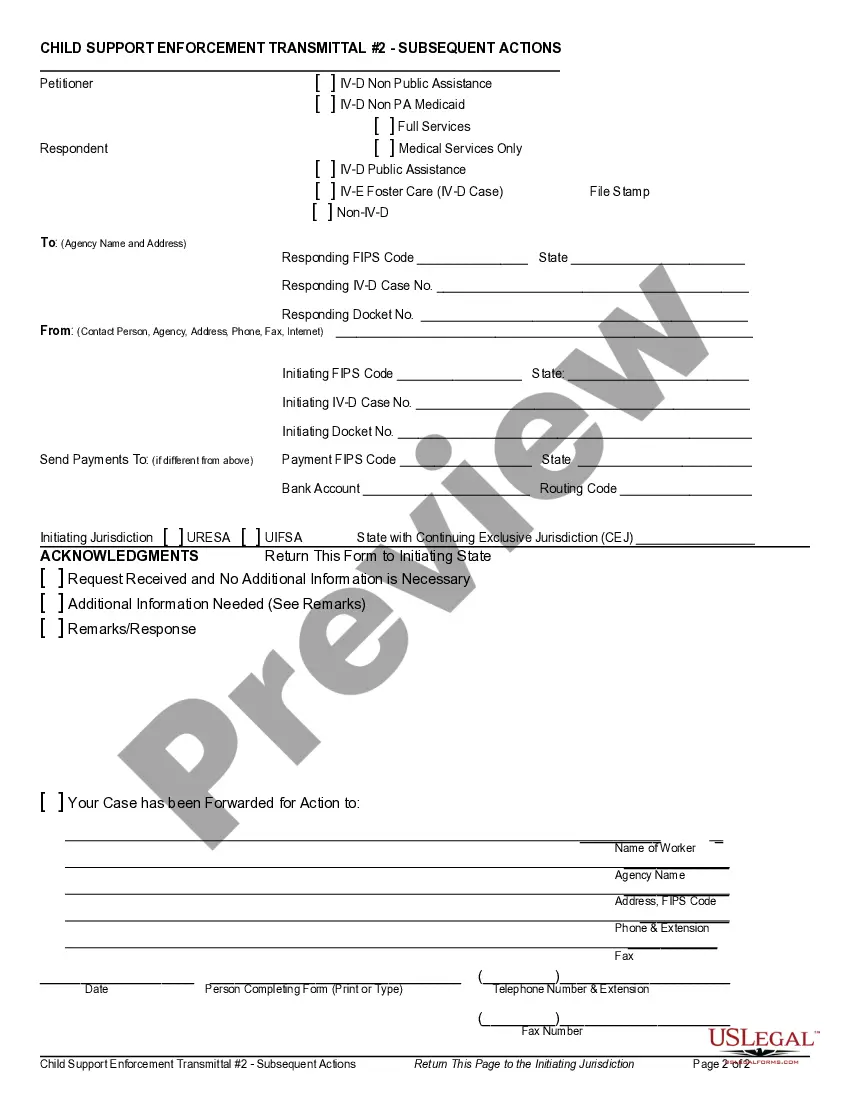

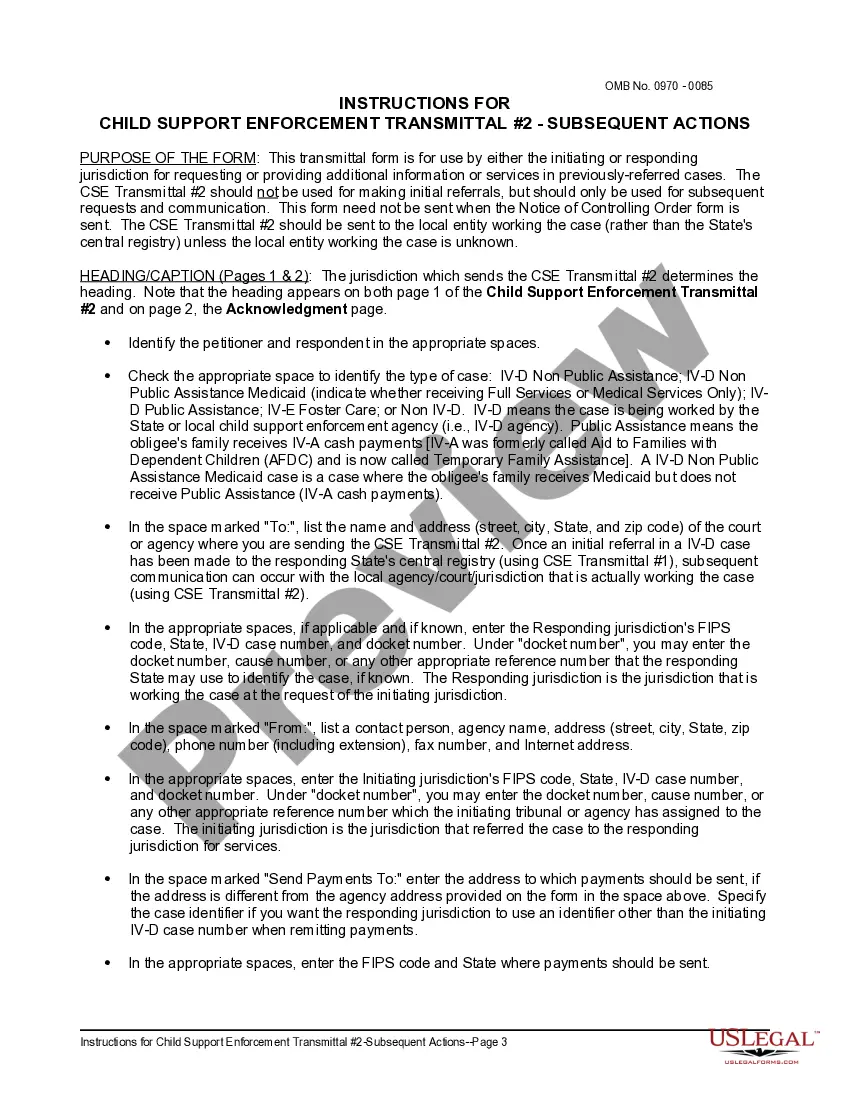

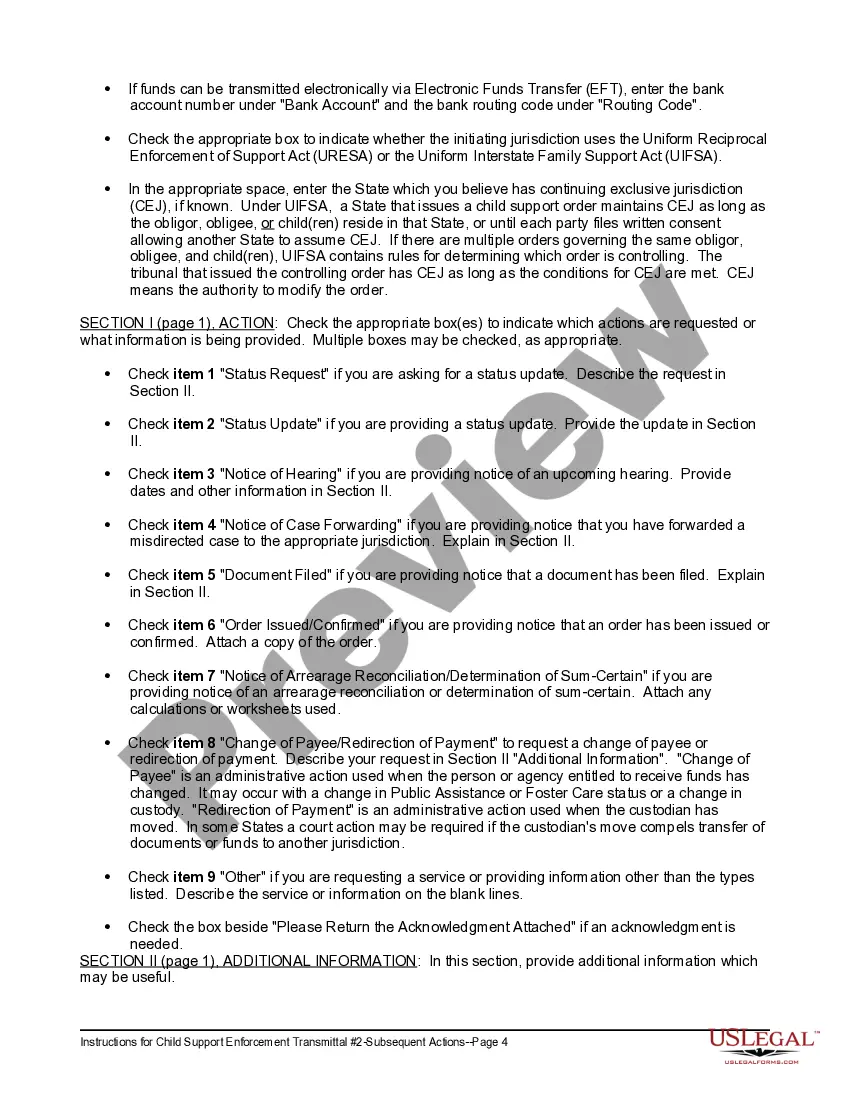

Connecticut Child Support Transmittal #2 - Subsequent Actions and Instructions

Description

How to fill out Child Support Transmittal #2 - Subsequent Actions And Instructions?

If you wish to gather, acquire, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's simple and convenient search function to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to locate the Connecticut Child Support Transmittal #2 - Subsequent Actions and Instructions in just a few clicks.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Connecticut Child Support Transmittal #2 - Subsequent Actions and Instructions. Each legal document template you acquire is yours forever. You will have access to every form you downloaded within your account. Visit the My documents section and choose a form to print or download again. Compete and obtain, and print the Connecticut Child Support Transmittal #2 - Subsequent Actions and Instructions with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Connecticut Child Support Transmittal #2 - Subsequent Actions and Instructions.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

In Connecticut, like with most states, a non-custodial parent's child support obligation is calculated as a percentage of their total income compared to the needs of the child. Generally, this is 23% of your net weekly income for 1 child, 32% of your pay for 2 children, and 39% of your pay for 3 children.

The Connecticut theory is that a child should receive the same proportion of parental income as he or she would have received if the parents lived together. In other words, even when parents have joint custody, there may be child support moving from the higher-earning parent to the lower-earning parent.

The Family Support Magistrate may order a variety of things including lump sum payments to make up the missed payments and, in the most serious cases, jail for the non-paying parent until the child support is paid.

Ing to the guidelines, the basic child support obligation for parents earning a total of $1,000 per week is: $229 (or about 23%) of the combined net weekly income for 1 child. $322 (or about 32%) for 2 children. $385 (or about 39%) for 3 children.

If you're a paying parent, you cannot simply stop paying or reduce child support. You can, however, apply for a Post Judgment modification. Generally speaking, if your child lives in Connecticut, you can request that a Connecticut court change the order.

The Guidelines use the combined income of the mother and the father and the number of children to set a child support amount. The court will also enter a medical insurance order for the minor children if it is available through an employer for a reasonable cost.

Usually, the duty to support created by a child support order ends when the child is 18 years old. However, this may vary from state to state. For example, in Connecticut, the duty to support may go to age 19 if the child is still in high school.

Is there a limit to the amount of money that can be taken from my paycheck for child support? 50 percent of disposable income if an obligated parent has a second family. 60 percent if there is no second family.