Subject: Connecticut Sample Letter for Correcting Erroneous Information on Credit Report Dear [Credit Reporting Agency], I am writing to bring to your attention a concerning discrepancy on my credit report that requires immediate correction. Connecticut's law provides consumers with the right to accurate credit information, and I request your assistance in rectifying this error promptly. I have recently reviewed my credit report, and I noticed an entry that is inaccurate and damaging to my creditworthiness. The error can be found in [describe the specific erroneous information, such as an account balance, payment history, or personal information]. This misinformation is negatively impacting my credit score, financial opportunities, and overall reputation, which is why I am requesting its correction. As per the Fair Credit Reporting Act (FCRA) and the Connecticut Fair Credit Reporting Act (CF CRA), it is your duty to investigate and correct any inaccuracies on credit reports. I have enclosed copies of the relevant documentation that supports the discrepancy, including [provide copies of supporting documents such as bank statements, receipts, or any other proof validating your claim]. In light of the aforementioned legislation, I kindly request the following actions to be taken: 1. Conduct a thorough investigation into the inaccurate information mentioned above, including confirmation of the original source of this data. 2. Confirm receipt of this dispute letter and communicate with the furnished of this data about the dispute as required by law. 3. Promptly remove or correct the inaccurate information within 30 days, as mandated by the FCRA and the CF CRA, to ensure the accuracy and completeness of my credit report. 4. Provide me with a written notice of the investigation results and any changes made to my credit report within 5 business days. Failure to adhere to the laws and rectify this matter within the specified timeframes may result in legal action against your agency. Please forward a copy of this dispute to the furnished of the incorrect information as per Connecticut law. I appreciate your attention to this matter and, once again, request that you prioritize the necessary investigation and correction promptly. If you require any additional information or documentation, please feel free to contact me at the address or phone number provided below. Thank you for your cooperation and swift resolution of this matter. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] Additional Types of Sample Letters for Erroneous Information on Credit Report in Connecticut: — Connecticut Sample Letter for Credit Report Identity Theft Dispute — Connecticut Sample Letter for Removal of Outdated or Expired Information on Credit Report — Connecticut Sample Letter for Challenging Incomplete or Unverifiable Credit Report Entries

Connecticut Sample Letter for Erroneous Information on Credit Report

Description

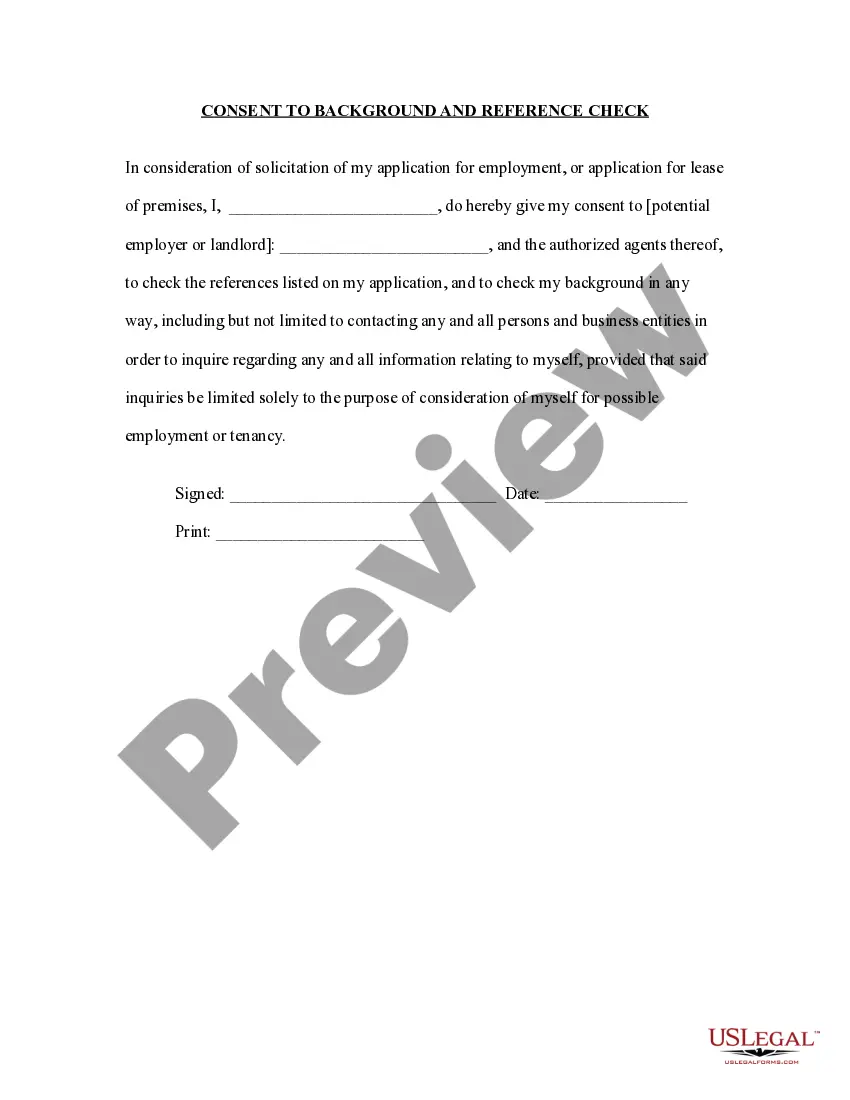

How to fill out Connecticut Sample Letter For Erroneous Information On Credit Report?

Selecting the most suitable authentic document template can be challenging. Of course, there are numerous designs available on the internet, but how can you find the genuine form you require? Utilize the US Legal Forms site.

The service provides thousands of templates, including the Connecticut Sample Letter for Incorrect Information on Credit Report, that you can utilize for business and personal purposes. All the documents are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Connecticut Sample Letter for Incorrect Information on Credit Report. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you need.

Complete, edit, print, and sign the received Connecticut Sample Letter for Incorrect Information on Credit Report. US Legal Forms is the largest collection of legal documents where you can find various file templates. Use the service to download professionally crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your city/region. You can review the form with the Preview option and examine the form description to confirm it is the right one for you.

- If the form does not fulfill your requirements, utilize the Search feature to find the correct form.

- Once you are certain that the form is appropriate, click on the Purchase now button to acquire the form.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and finalize your order using your PayPal account or Visa or Mastercard.

- Select the document format and download the legitimate document template to your device.

Form popularity

FAQ

To eliminate an incorrect collection, you need to first contact the creditor listed and request validation of the debt. If they cannot provide proof, you can dispute the collection with the credit bureau. You can use the Connecticut Sample Letter for Erroneous Information on Credit Report as a guide to craft an effective dispute letter. This approach not only clarifies your position but also reinforces your request for the removal of the inaccurate information.

To remove incorrect information, start by disputing the inaccuracies with the credit reporting agency. File your dispute online or through a written letter, ensuring you provide documentation that supports your claim. Utilizing the Connecticut Sample Letter for Erroneous Information on Credit Report can streamline this process, as it outlines exactly what to include in your dispute. If the agency verifies the information is indeed incorrect, they are required to remove it from your report.

To obtain a 609 letter, first, prepare a written request to the credit reporting agency. This letter should include your personal information and a clear statement that you are requesting verification of the information on your credit report. You may find a convenient template online, such as the Connecticut Sample Letter for Erroneous Information on Credit Report, which you can customize to fit your situation. Using this letter helps ensure that you address all necessary points for your request to be processed efficiently.

The 609 letter requests your credit bureau to verify the accuracy of the information reported. While it may prompt the bureau to investigate, it is essential to understand that it does not guarantee removal of the information. Combining the 609 letter with a Connecticut Sample Letter for Erroneous Information on Credit Report may provide a more comprehensive strategy for addressing disputes on your credit report.

A 623 letter example typically includes your identification information, a detailed explanation of the disputed items, and supporting evidence. The letter should clearly state that you are invoking your rights under the Fair Credit Reporting Act. Utilizing a Connecticut Sample Letter for Erroneous Information on Credit Report can serve as a strong foundation for creating your own 623 letter and ensuring it meets legal standards.

To remove erroneous information from your credit report, you must first identify the inaccuracies specifically. Once identified, write a well-structured Connecticut Sample Letter for Erroneous Information on Credit Report, addressing the credit bureau and stating the facts clearly. Submit your letter along with any supporting documents, and the bureau is mandated to investigate your claims and respond within a reasonable time frame.

An effective dispute letter for a debt outlines the inaccuracies associated with the debt and provides contextual information about your situation. You may include personal details, such as payment history or disputes about the validity of the debt. Using a Connecticut Sample Letter for Erroneous Information on Credit Report, you can create a comprehensive letter to communicate your concerns to the creditor or credit bureau.

A 623 letter is a formal request you send to a creditor to resolve inaccuracies on your credit report. Under Section 623 of the Fair Credit Reporting Act, creditors must respond when you identify erroneous information. By utilizing a Connecticut Sample Letter for Erroneous Information on Credit Report, you can formally dispute entries and ensure creditors fulfill their responsibilities to investigate and correct any inaccuracies.

To correct erroneous information in your credit file, first, request a copy of your credit report. Review the report carefully to identify inaccuracies. Then, draft a Connecticut Sample Letter for Erroneous Information on Credit Report, detailing the errors and providing evidence to support your claims. Send this letter to the credit reporting agency, and they are required to investigate your dispute.

To correct a mistake on your credit report, first, identify the error and gather any supporting documentation. Next, you can file a dispute with the credit bureau using a Connecticut Sample Letter for Erroneous Information on Credit Report, which will help streamline your appeal process. Following this, keep track of communications and make sure to follow up as necessary to achieve a timely resolution.

Interesting Questions

More info

To apologize in advance for any mistake take your time since regretting what you've done takes time. Your apology must be specific, not general or generalizing. In a generic form that you are comfortable with. Make sure to express that you are going to correct and make up for your mistake and apologize for any harm caused because you did it. If you're making a mistake you should go through this process, not trying to get away with it. In general, it is a way to put off apologizing. However, the problem can never be fixed with a simple apology. There are many things that can go wrong as a result of your actions. You should consider your actions in light of your actions. Sometimes it is the wrongness of an action that causes harm and therefore requires your apology to be specific and direct. To apologize for your mistake can be extremely frustrating. Your intentions should be to remedy the problem or at least fix the damage it caused.