Connecticut Sample Letter for Compromise on a Debt

Description

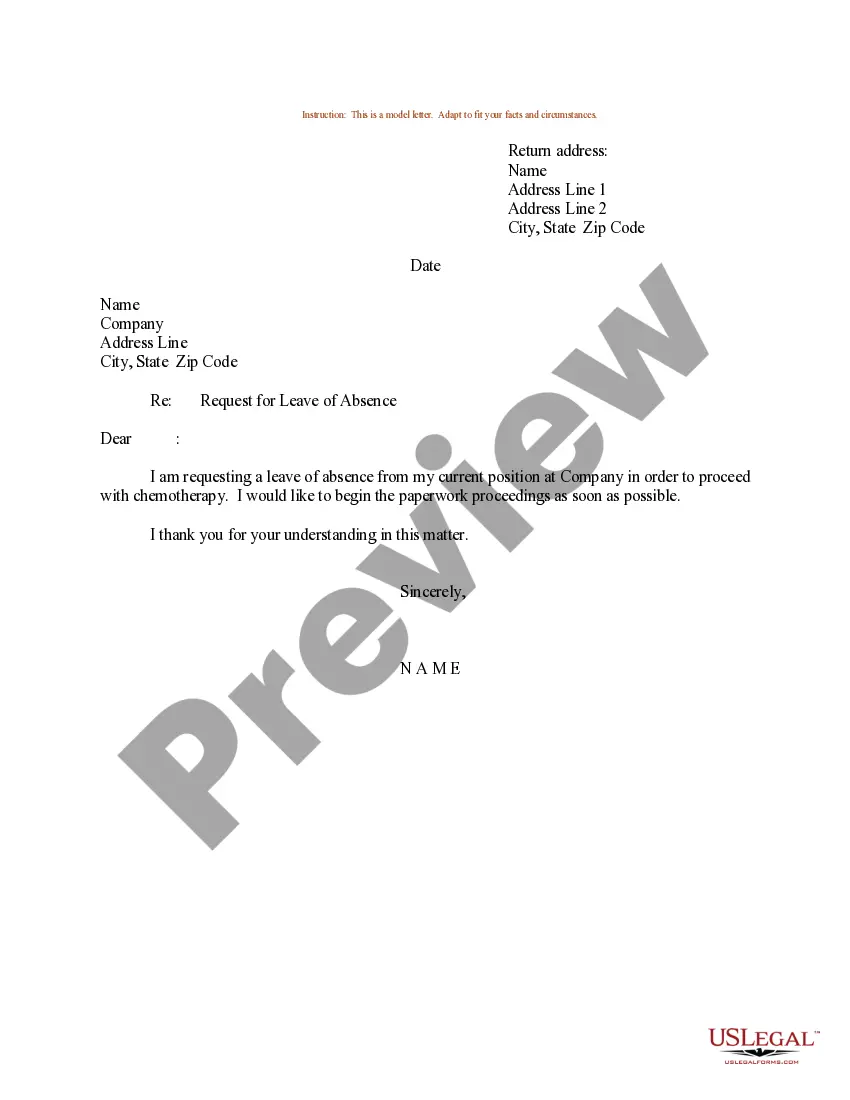

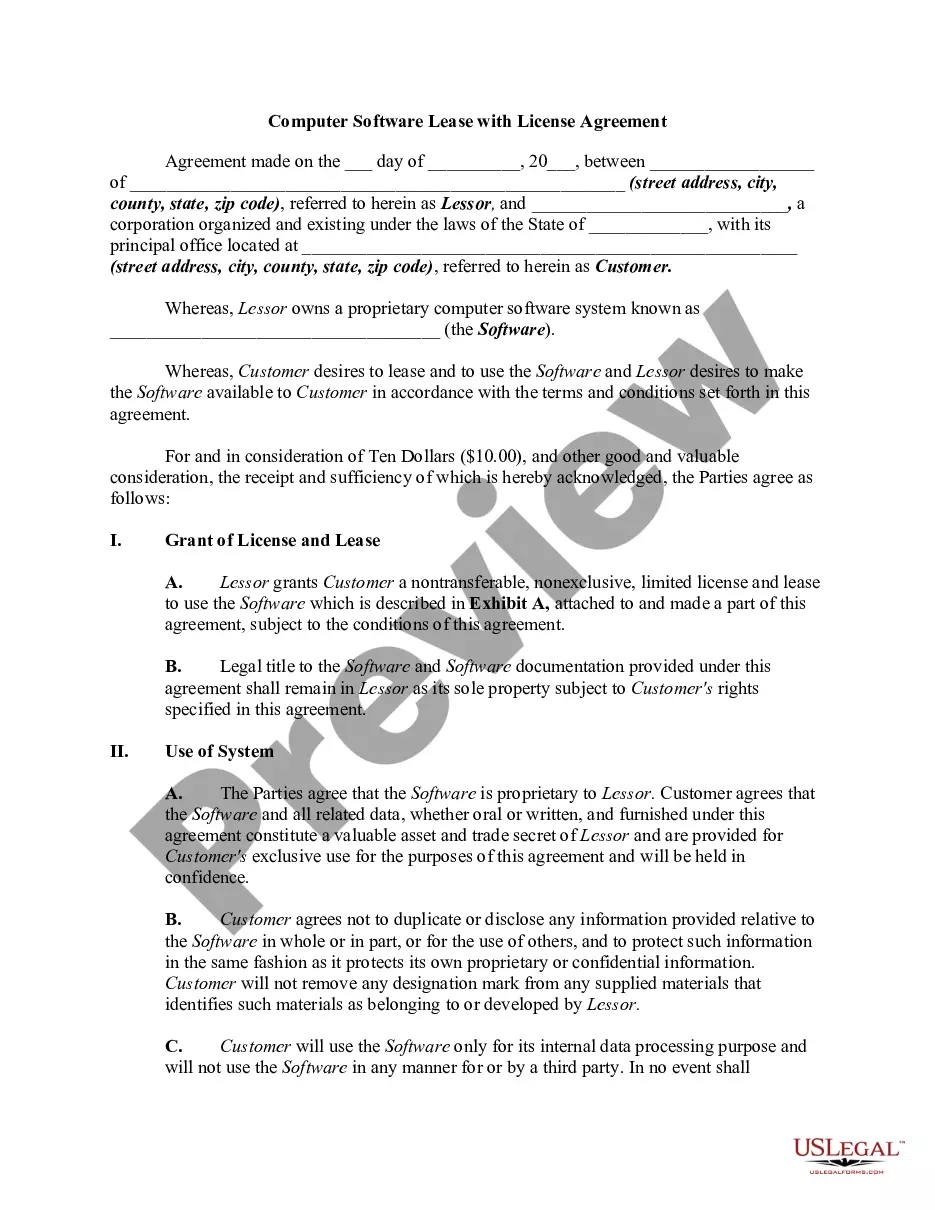

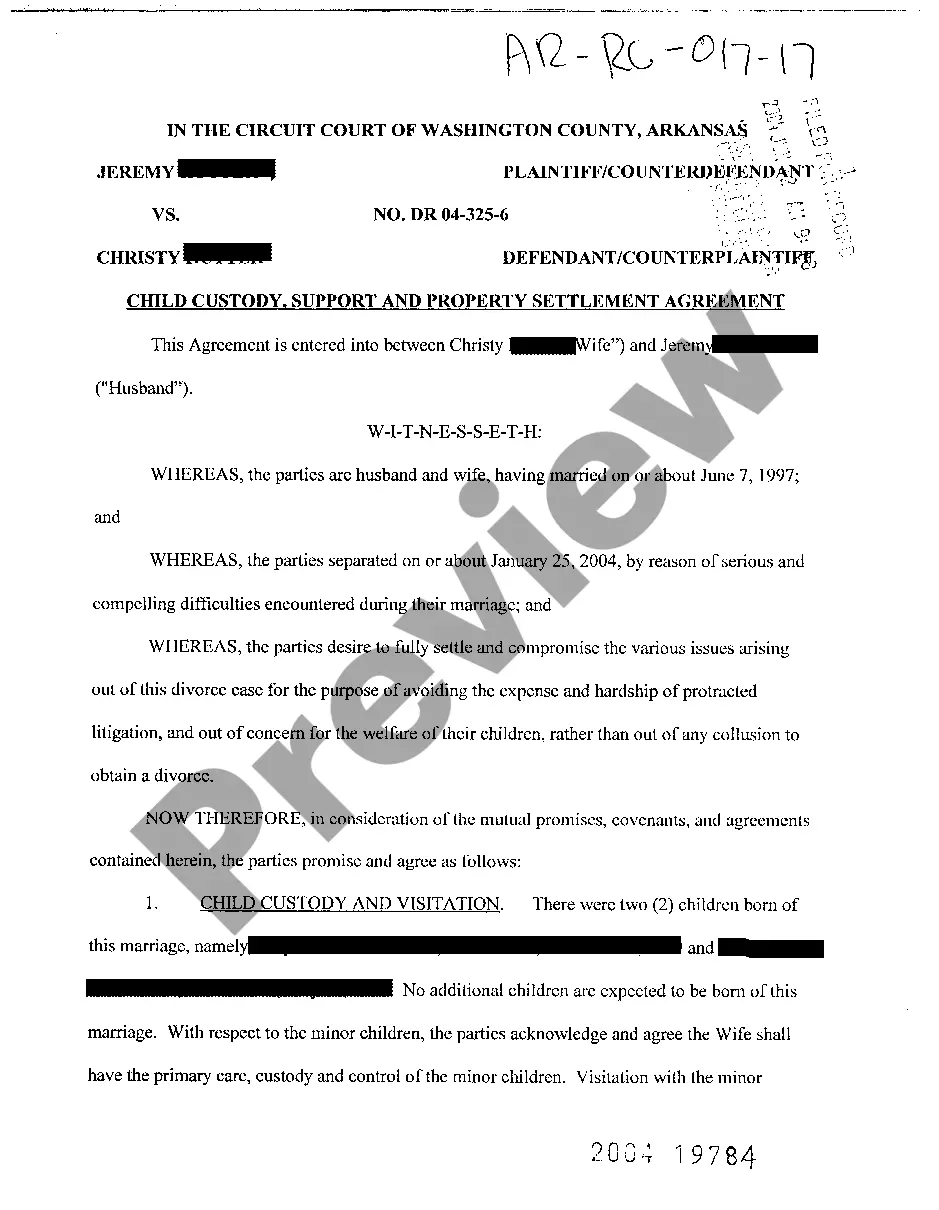

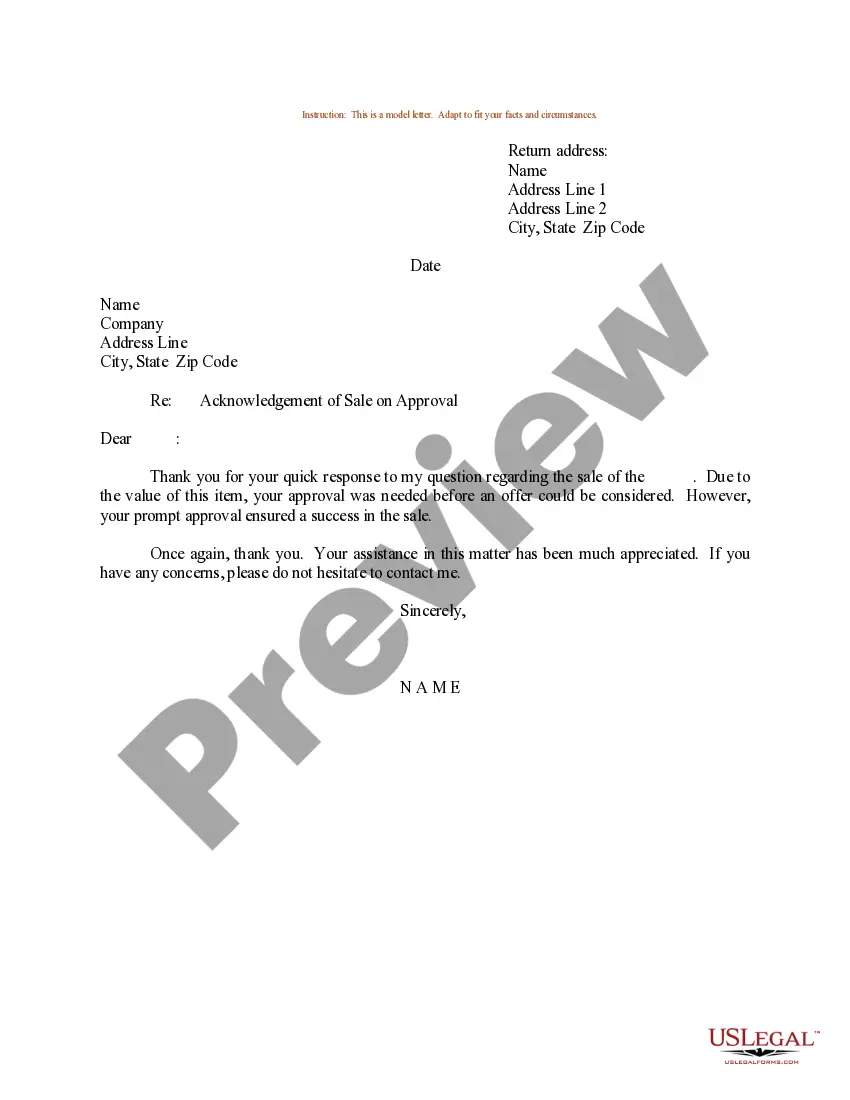

How to fill out Sample Letter For Compromise On A Debt?

If you intend to finalize, retrieve, or create sanctioned document templates, use US Legal Forms, the premier collection of legal documents, that can be accessed online.

Utilize the site's straightforward and user-friendly search to locate the paperwork you require.

Various templates for commercial and personal use are organized by categories and states, or keywords. Use US Legal Forms to find the Connecticut Sample Letter for Debt Compromise with just a few clicks.

Every legal document template you acquire becomes your personal property forever. You have access to every form you saved in your account. Go to the My documents section and choose a form to print or download again.

Compete and download, and print the Connecticut Sample Letter for Debt Compromise with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to get the Connecticut Sample Letter for Debt Compromise.

- You can also access documents you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not content with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. After locating the form you want, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Connecticut Sample Letter for Debt Compromise.

Form popularity

FAQ

Begin with a polite greeting and state clearly that you are seeking proof of the debt owed. Provide any relevant account details to assist in their response. A Connecticut Sample Letter for Compromise on a Debt can serve as a valuable reference to structure your request properly.

In your request for payment arrangements, begin with a courteous introduction. Carefully outline your current financial difficulties and suggest a feasible plan for payments. Referencing a Connecticut Sample Letter for Compromise on a Debt can offer a reliable template to ensure your request is both professional and clear.

Start with a friendly greeting and express your appreciation for the existing arrangement. Then, explain your current financial situation, and kindly ask for a reduction in your monthly payments. A Connecticut Sample Letter for Compromise on a Debt can provide the framework needed to make your request compelling.

Begin your letter by addressing the recipient respectfully. Clearly state that you are requesting the balance of payments due on your account. Citing relevant documents can strengthen your request, alongside a Connecticut Sample Letter for Compromise on a Debt that outlines the necessary components of your inquiry.

To write a professional letter requesting payment, start with a polite greeting and state the purpose clearly. Refer to the original agreement, including any relevant details about the debt. Be concise, use a respectful tone, and include a Connecticut Sample Letter for Compromise on a Debt to guide you through the process.

To write a letter to clear debt, start by clearly stating your intent to resolve the debt, including specific details about the debt in question. Offer a reasonable payment amount or propose a settlement that outlines your financial situation. Thank the creditor for considering your proposal and ask them to respond in writing. You can use a Connecticut Sample Letter for Compromise on a Debt to guide your writing and ensure professionalism and clarity.

Yes, debt validation letters can be effective in challenging debt collectors. These letters force collectors to provide proof that the debt is valid and belongs to you. If they fail to provide the necessary documentation, they must cease collection efforts. A well-crafted Connecticut Sample Letter for Compromise on a Debt can strengthen your position in this process.

To fill out a debt validation letter, begin by including your personal information at the top, along with the date and the collector’s information. Clearly state that you are requesting validation of the debt, referencing the Fair Debt Collection Practices Act. Include specific details about the debt, such as the amount and the original creditor, to ensure it is processed effectively. Using a Connecticut Sample Letter for Compromise on a Debt can serve as a helpful template.

A typical dispute letter for a debt starts with your name and address, followed by a salutation. It should clearly mention the account number, the exact amount in dispute, and the reason for your challenge. For best practices, consider using a Connecticut Sample Letter for Compromise on a Debt to ensure your letter is well-structured and persuasive.

Writing a good dispute letter involves being clear, concise, and professional. Begin with your contact information and the date, followed by the recipient's details. Clearly state your intent to dispute the debt, provide relevant facts, and mention any documents attached. A Connecticut Sample Letter for Compromise on a Debt can provide you with a strong template to create an effective letter.