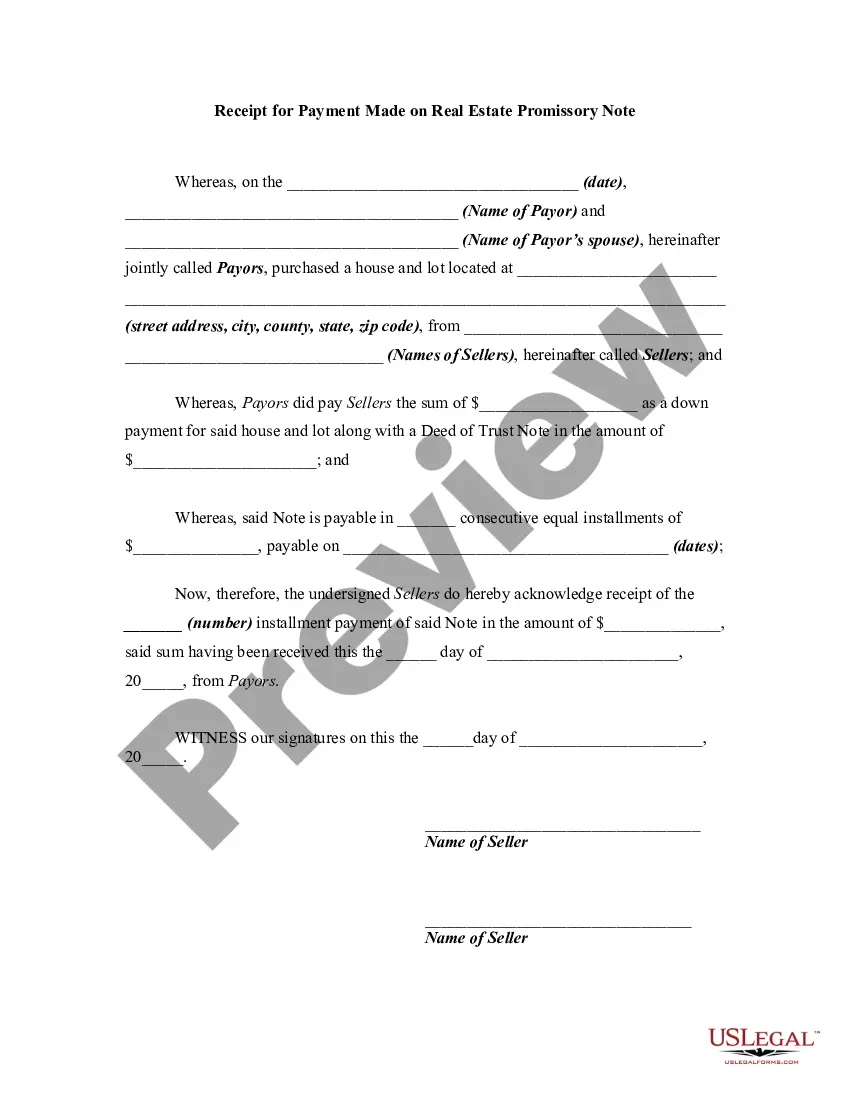

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

Connecticut Receipt for Payment Made on Real Estate Promissory Note

Description

How to fill out Receipt For Payment Made On Real Estate Promissory Note?

Are you in a situation where you require documents for either business or personal purposes nearly every day.

There are numerous legitimate form templates accessible online, but finding ones you can trust isn’t easy.

US Legal Forms offers a vast array of form templates, such as the Connecticut Receipt for Payment Made on Real Estate Promissory Note, which is designed to meet both state and federal requirements.

If you find the right form, click Get now.

Choose the payment plan you prefer, complete the required information to set up your payment method, and purchase the order using your PayPal or credit card. Select a convenient file format and download your copy. You can find all the form templates you have purchased in the My documents list. You can obtain another copy of the Connecticut Receipt for Payment Made on Real Estate Promissory Note at any time, if needed. Just click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. This service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Connecticut Receipt for Payment Made on Real Estate Promissory Note template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and confirm it is for the correct area/county.

- Use the Preview button to check the form.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you are looking for, use the Search section to find the form that satisfies your needs.

Form popularity

FAQ

Bills receivable can include promissory notes, depending on the context. Bills receivable generally refer to amounts owed to a company for goods or services sold, including any formal agreements like a promissory note. For handling such agreements, you might find a Connecticut Receipt for Payment Made on Real Estate Promissory Note useful through uslegalforms.

Yes, a promissory note can be made payable to a specific person or entity. By designating a payee, the borrower specifies who will receive the payment. To formalize your agreement, consider using a Connecticut Receipt for Payment Made on Real Estate Promissory Note available through uslegalforms.

To write a simple promissory note, start by including the date, the names of the parties involved, and the amount owed. Clearly state the repayment terms, including the interest rate and schedule. Make sure to specify what happens in case of default. Utilizing a Connecticut Receipt for Payment Made on Real Estate Promissory Note can help you formalize the payment details and provide clarity.

The limitations of a promissory note primarily include its enforceability, terms, and applicable state laws. For instance, if the promissory note lacks specific terms, it may be deemed legally insufficient. Additionally, the statute of limitations restricts how long a lender can enforce the note, typically six years in Connecticut. For clarity and assistance, consider using uslegalforms to create valid and enforceable promissory notes.

The statute of limitations for debt collection in Connecticut is generally six years for written contracts. This means creditors have six years from the date of default to pursue legal action for recovering debts owed. Understanding these limitations can help you make informed decisions regarding debt management and collection. Resources like uslegalforms provide essential information and tools to help you stay compliant and informed.

In Connecticut, the statute of limitations for indemnification claims is typically six years. This period starts from the date the claim arises, allowing individuals to seek legal remedy when necessary. Being aware of this timeline is critical to ensuring that you protect your rights effectively. Accessing legal information through uslegalforms can help you navigate these timelines with confidence.

To record a promissory note payment, you should maintain detailed records of each transaction. Typically, you would create a Connecticut Receipt for Payment Made on Real Estate Promissory Note documenting the payment amount, date, and method. This receipt serves as proof of the transaction and can protect both the lender and borrower in case of any disputes in the future. Using platforms like uslegalforms can simplify this process by providing templates for clear documentation.

Writing a promissory note involves stating the borrower's name, the lender's name, the principal amount, the interest rate, and the repayment schedule. It's also important to specify the consequences of defaulting on the note, which may include legal action. For added security and clarity, you may want to include a Connecticut Receipt for Payment Made on Real Estate Promissory Note to validate each payment received.

To record a promissory note payment, first, document the payment amount, date, and any applicable interest. You should also retain a copy of your Connecticut Receipt for Payment Made on Real Estate Promissory Note as proof of the transaction. This record is vital for maintaining transparency and helps clarify any future disputes.

In Connecticut, the statute of limitations for enforcing a promissory note generally lasts for six years. This means that a lender must initiate legal action within that timeframe if the borrower defaults. Knowing this can help both lenders and borrowers manage their obligations effectively, including the need for a Connecticut Receipt for Payment Made on Real Estate Promissory Note.