Connecticut Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

Are you in a situation where you require documents for business or personal purposes almost every day.

There is an array of legal document templates accessible online, yet finding ones you can rely on is challenging.

US Legal Forms provides a vast selection of form templates, including the Connecticut Contract for Sale of Goods on Consignment, which can be generated to comply with state and federal regulations.

Select the pricing plan you prefer, complete the necessary details to create your account, and pay for your order using PayPal or a credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Connecticut Contract for Sale of Goods on Consignment anytime, if needed. Just select the required form to download or print the document template. Utilize US Legal Forms, the largest collection of legal documents, to save time and avoid errors. The service offers expertly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Connecticut Contract for Sale of Goods on Consignment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area.

- Use the Review option to inspect the document.

- Verify the summary to confirm you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search field to find a form that fits your needs.

- Once you find the right form, click Buy now.

Form popularity

FAQ

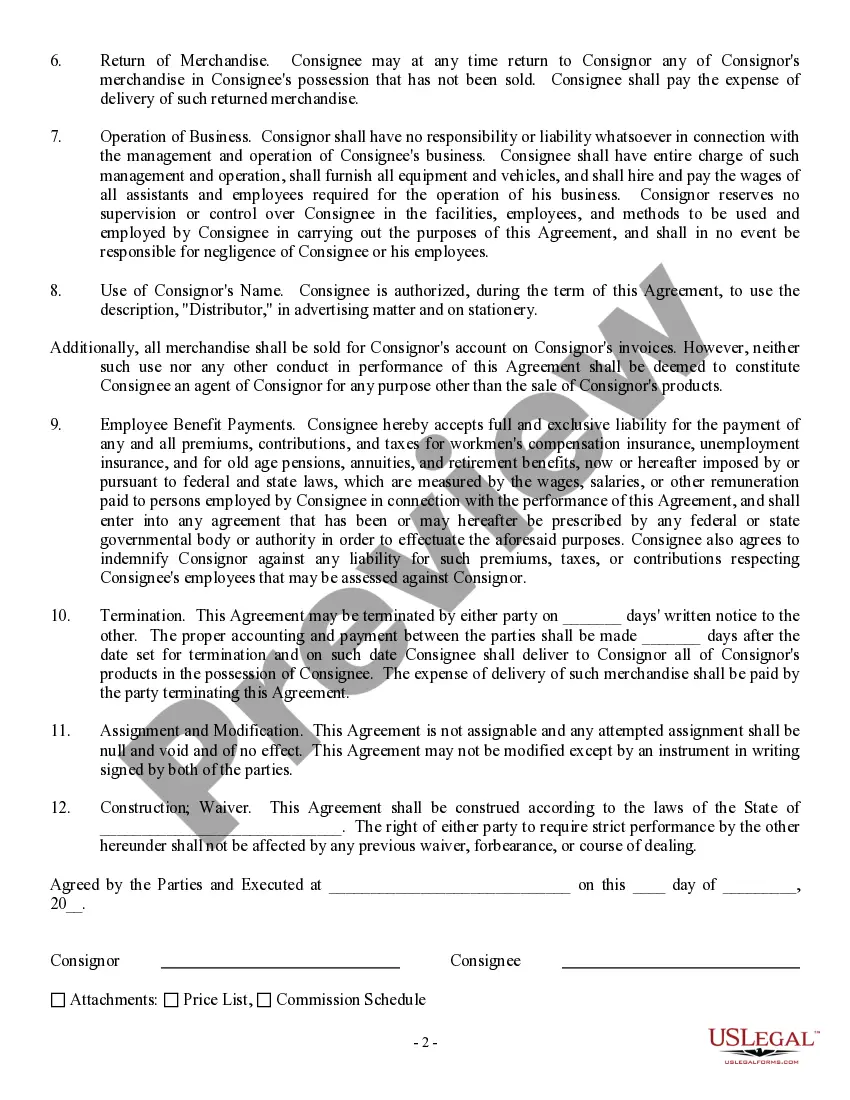

To write a consignment agreement, start by including the names of the parties, a description of the goods, and the agreed-upon commission structure. Clearly state the duration of the consignment, payment terms, and responsibility for unsold items. You can simplify this process by using a template, such as those available through US Legal Forms, which offers a comprehensive Connecticut Contract for Sale of Goods on Consignment to meet your needs.

A fair split for consignment sales often ranges from 50/50 to 70/30, where the seller retains a majority of the proceeds. This split can depend on various factors, such as the type of goods, market trends, and the agreement made between the parties. Establishing a clear understanding in the Connecticut Contract for Sale of Goods on Consignment helps ensure both parties feel satisfied with the arrangement.

Terminating a consignment agreement typically involves following the instructions outlined in the contract. Usually, either party can provide written notice to end the agreement, specifying the termination date. When you have a Connecticut Contract for Sale of Goods on Consignment, it often includes termination provisions to guide you through this process. If you need assistance, uslegalforms offers resources to help you navigate contract termination smoothly.

Yes, consignment sales are generally reported to the IRS, as they involve income. The consignee needs to report the income received from the sale of goods, while the consignor tracks their earnings from consignment sales. Using a Connecticut Contract for Sale of Goods on Consignment can help keep both parties organized and compliant with tax obligations. Ensure you maintain proper documentation to support your reported income.

Writing a consignment contract requires attention to detail and clear terms. Start by identifying the parties involved and describe the goods being consigned. Include important elements such as commission rates, payment schedules, and duration of the agreement. With a Connecticut Contract for Sale of Goods on Consignment template from uslegalforms, you can easily draft a contract that meets legal standards.

A consignment contract allows one party to sell goods on behalf of another party. The consignor retains ownership of the goods until they sell, while the consignee earns a commission based on sales. This arrangement is formalized through a Connecticut Contract for Sale of Goods on Consignment, ensuring clarity and protection for both parties. You can utilize uslegalforms to create an effective consignment contract tailored to your needs.

You do not send 1099s to individuals or businesses that are exempt from reporting, such as corporations or LLCs treated as corporations. Additionally, payments to tax-exempt organizations are not eligible for a 1099. Understanding the specifics outlined in your Connecticut Contract for Sale of Goods on Consignment can help avoid unnecessary paperwork and ensure compliance.

You do issue a 1099 for merchandise sales if your total sales to a buyer reach $600 or more within a calendar year. This includes sales made through consignment agreements outlined in your Connecticut Contract for Sale of Goods on Consignment. It's important to maintain detailed records for accurate tax filings and audits.

Generally, you receive a 1099 if you sell goods and exceed the threshold of $600 in a year to a single buyer. This also hinges on whether you operate as a business or sole proprietor. Including this detail in your Connecticut Contract for Sale of Goods on Consignment can help clarify tax responsibilities and streamline your reporting process.

The percentage of a consignment agreement typically ranges from 20% to 60%, depending on the agreement between the consignor and consignee. When drafting a Connecticut Contract for Sale of Goods on Consignment, it’s essential to clearly outline the commission percentage and any additional fees. This ensures both parties understand their obligations and benefits within the transaction.