A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships.

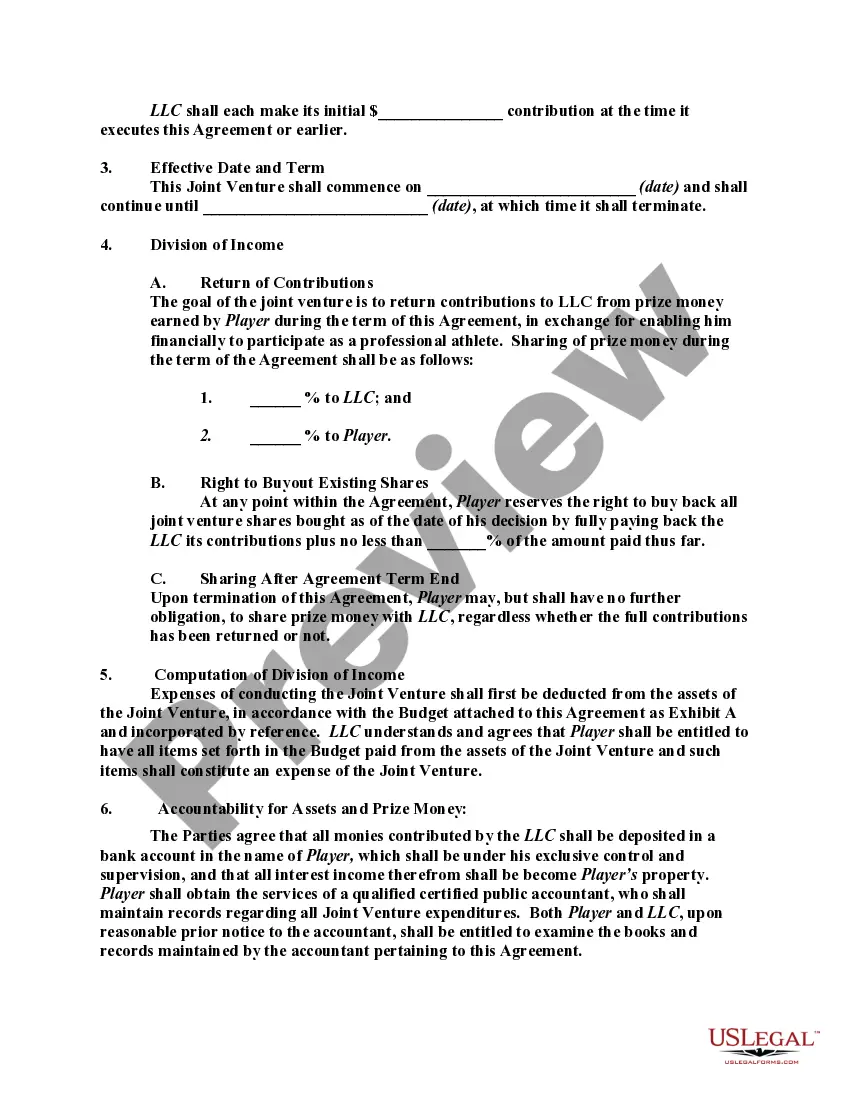

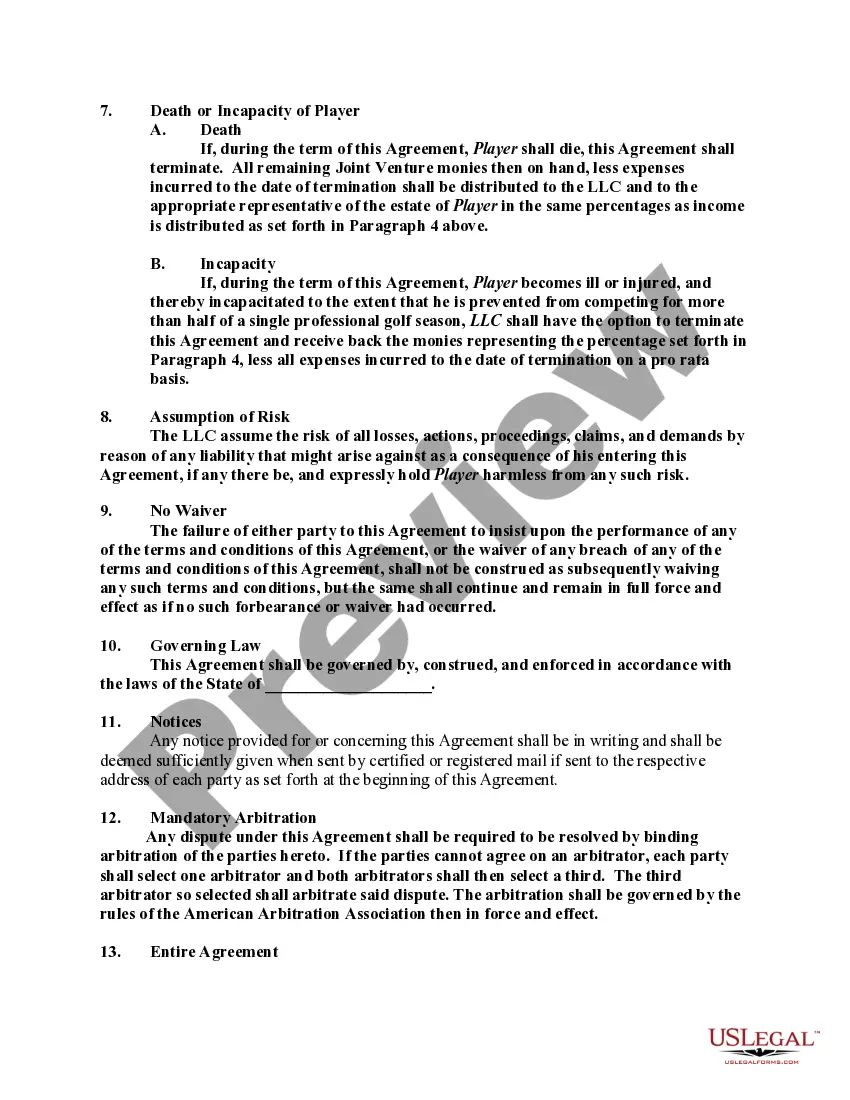

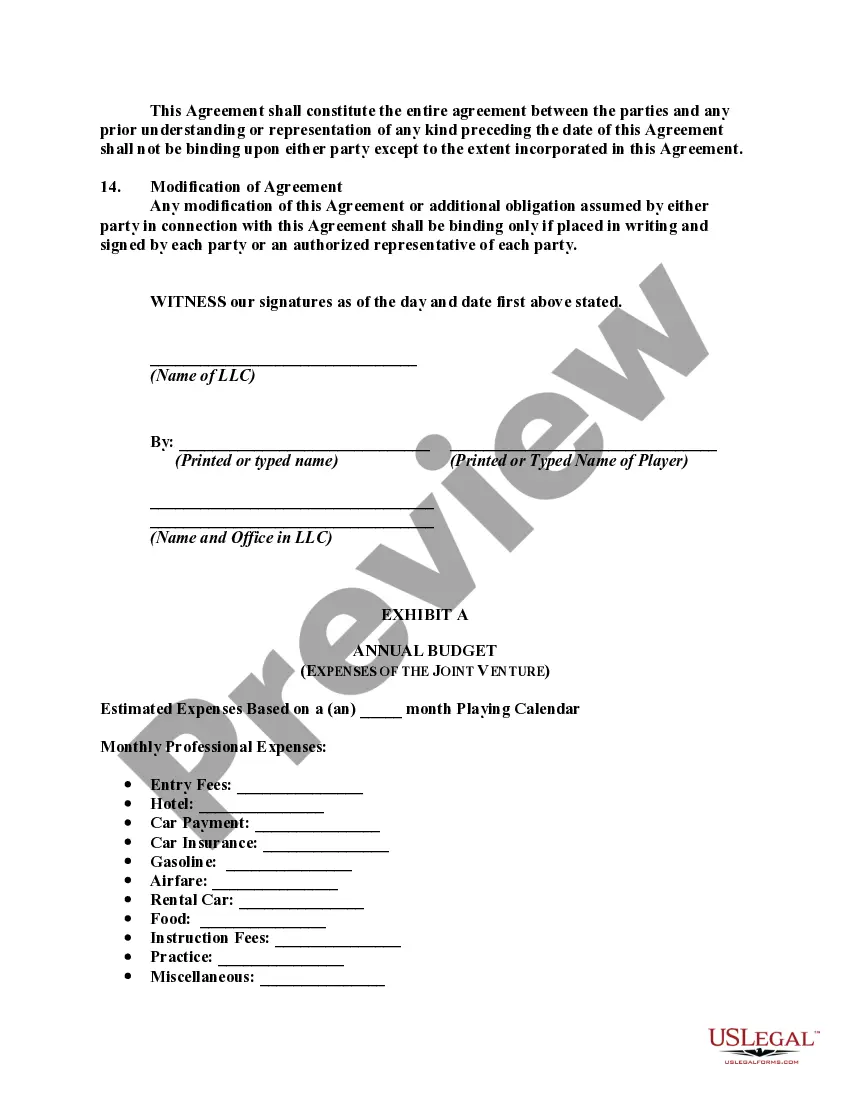

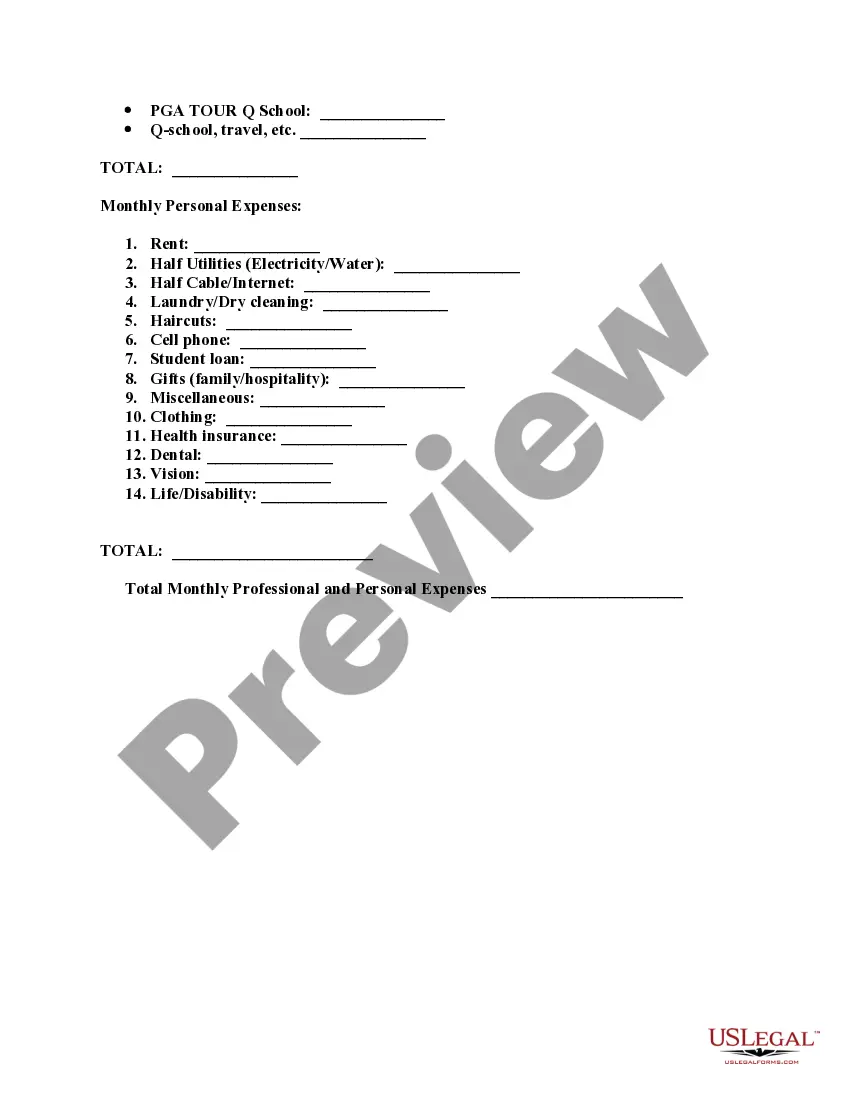

Connecticut Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds A Connecticut Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer is a legal contract that outlines the terms and conditions for a joint business venture in the state of Connecticut. This agreement's purpose is for the LLC to sponsor and provide funds to support the professional golfer's career in exchange for certain rights and potential profits. Keywords: Connecticut Joint Venture Agreement, Limited Liability Company, Professional Golfer, Sponsor, Funds. This type of agreement lays down the foundation for a mutually beneficial collaboration where the LLC's financial resources can be put to use in promoting and supporting the professional golfer's career aspirations. The agreement defines the roles, responsibilities, and expectations of both parties involved and ensures a fair distribution of risks, benefits, and potential rewards. The Connecticut Joint Venture Agreement between a Limited Liability Company and a Professional Golfer may have various types depending on the specific arrangement and objectives. Here are a few possible variations: 1. Funding and Branding Partnership: This type of agreement establishes a partnership where the LLC provides financial support to the professional golfer in exchange for branding opportunities, such as displaying the LLC's logo on the golfer's apparel, equipment, or promotional materials during tournaments or public appearances. 2. Tournament Sponsorship Agreement: In this variant, the LLC sponsors specific golf tournaments or events in which the professional golfer participates. The agreement outlines the financial contribution from the LLC, the marketing benefits gained in return, and the golfer's commitment to endorse and promote the LLC as an event sponsor. 3. Long-term Talent Investment Partnership: This type of joint venture agreement signifies a more extensive collaboration between the LLC and the professional golfer. It involves a substantial financial commitment from the LLC to support the golfer's career development, training, and competition participation. The agreement defines profit-sharing mechanisms, potential endorsement deals, and the golfer's commitment to represent the LLC's brand exclusively. 4. Product Endorsement Joint Venture: In this arrangement, the LLC manufactures or sells golf-related products. The agreement outlines the professional golfer's endorsement of the product(s), which includes using and promoting them during tournaments, media appearances, and in personal brand marketing efforts. The golfer may receive monetary compensation or a share of profits based on product sales. Overall, a Connecticut Joint Venture Agreement between a Limited Liability Company and a Professional Golfer to Sponsor and Provide Funds establishes a legally binding contract that governs the collaboration, financial arrangements, and promotional activities between the LLC and the professional golfer. It enables both parties to leverage each other's strengths and resources to achieve their respective goals in the golfing industry.Connecticut Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds A Connecticut Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer is a legal contract that outlines the terms and conditions for a joint business venture in the state of Connecticut. This agreement's purpose is for the LLC to sponsor and provide funds to support the professional golfer's career in exchange for certain rights and potential profits. Keywords: Connecticut Joint Venture Agreement, Limited Liability Company, Professional Golfer, Sponsor, Funds. This type of agreement lays down the foundation for a mutually beneficial collaboration where the LLC's financial resources can be put to use in promoting and supporting the professional golfer's career aspirations. The agreement defines the roles, responsibilities, and expectations of both parties involved and ensures a fair distribution of risks, benefits, and potential rewards. The Connecticut Joint Venture Agreement between a Limited Liability Company and a Professional Golfer may have various types depending on the specific arrangement and objectives. Here are a few possible variations: 1. Funding and Branding Partnership: This type of agreement establishes a partnership where the LLC provides financial support to the professional golfer in exchange for branding opportunities, such as displaying the LLC's logo on the golfer's apparel, equipment, or promotional materials during tournaments or public appearances. 2. Tournament Sponsorship Agreement: In this variant, the LLC sponsors specific golf tournaments or events in which the professional golfer participates. The agreement outlines the financial contribution from the LLC, the marketing benefits gained in return, and the golfer's commitment to endorse and promote the LLC as an event sponsor. 3. Long-term Talent Investment Partnership: This type of joint venture agreement signifies a more extensive collaboration between the LLC and the professional golfer. It involves a substantial financial commitment from the LLC to support the golfer's career development, training, and competition participation. The agreement defines profit-sharing mechanisms, potential endorsement deals, and the golfer's commitment to represent the LLC's brand exclusively. 4. Product Endorsement Joint Venture: In this arrangement, the LLC manufactures or sells golf-related products. The agreement outlines the professional golfer's endorsement of the product(s), which includes using and promoting them during tournaments, media appearances, and in personal brand marketing efforts. The golfer may receive monetary compensation or a share of profits based on product sales. Overall, a Connecticut Joint Venture Agreement between a Limited Liability Company and a Professional Golfer to Sponsor and Provide Funds establishes a legally binding contract that governs the collaboration, financial arrangements, and promotional activities between the LLC and the professional golfer. It enables both parties to leverage each other's strengths and resources to achieve their respective goals in the golfing industry.