A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

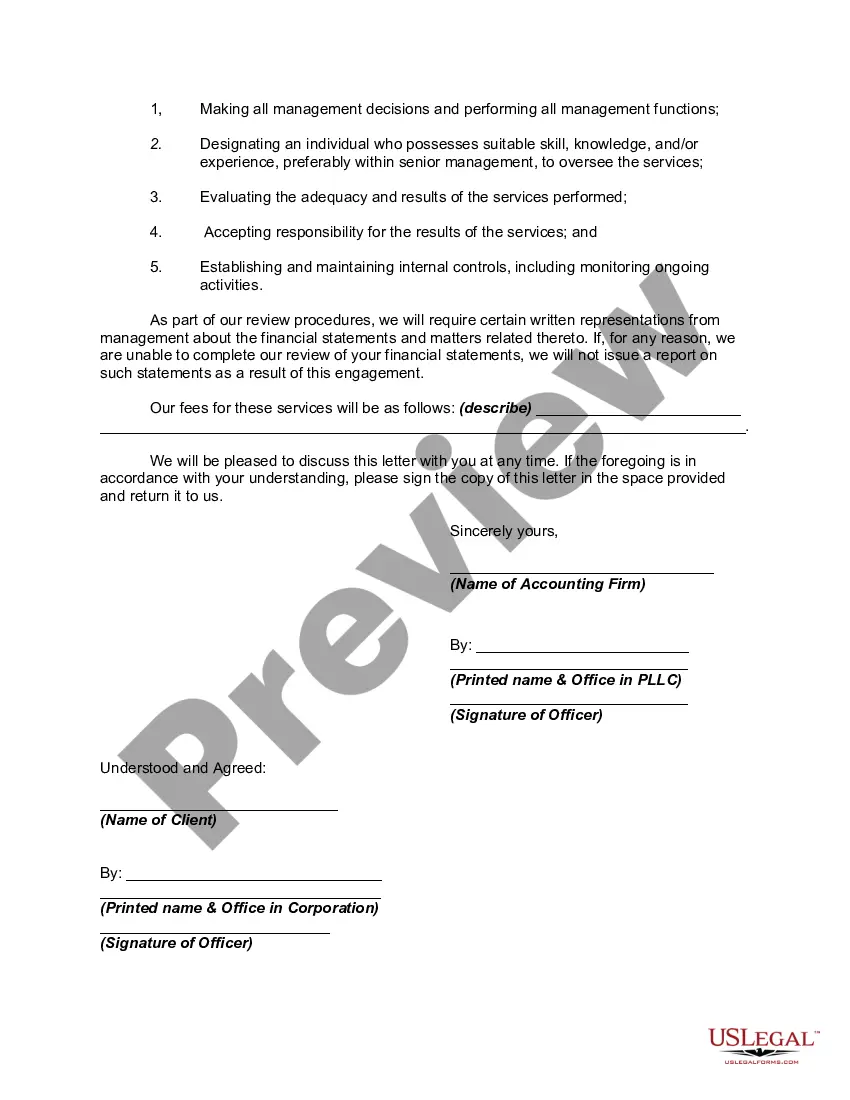

Connecticut Engagement Letter for Review of Financial Statements by Accounting Firm is a crucial document that establishes the terms and conditions governing the engagement between a certified accounting firm and its client in Connecticut. An engagement letter is a written agreement outlining the responsibilities, objectives, and limitations of the reviewed financial statements' engagement. It is crucial for both parties to clearly understand the scope and nature of the services provided to avoid misunderstandings and ensure a smooth working relationship. The Connecticut Engagement Letter for Review of Financial Statements typically includes the following key components: 1. Engagement details: This section identifies the accounting firm, the client, and provides a brief background about the purpose of the engagement. It also outlines the time period covered by the reviewed financial statements. 2. Objective and scope: This section describes the objective of the engagement, which is to conduct a review of the client's financial statements to provide limited assurance on their accuracy and reliability. It specifies that the review will be performed in accordance with the applicable professional standards, including Generally Accepted Accounting Principles (GAAP) or other relevant guidelines. 3. Responsibilities of the accounting firm: This section outlines the specific tasks and responsibilities of the accounting firm, such as obtaining an understanding of the client's business and industry, performing analytical procedures, and obtaining management representations. It also details the extent of the review procedures and the level of assurance expected to be provided. 4. Responsibilities of the client: This section highlights the client's responsibilities, including providing accurate and complete financial records, disclosing all relevant information, and making management representations as required during the engagement. 5. Limitations of the review: This section clarifies that a review does not provide absolute assurance, unlike an audit. It advises the client that the accounting firm's review procedures may not detect all errors, fraud, or irregularities that may exist in the financial statements. 6. Confidentiality and data security: This section specifies that the accounting firm will treat all client information with utmost confidentiality and outlines the measures taken to ensure data security. 7. Fee and payment terms: This section discloses the fees charged by the accounting firm for the review engagement and provides payment terms, including billing frequency and method of payment. Types of Connecticut Engagement Letters for Review of Financial Statements by Accounting Firm: 1. Standard Engagement Letter: This is the general engagement letter used for most routine review engagements in Connecticut. It covers the essential points mentioned above and is suitable for clients with straightforward financial statements. 2. Specialized or Industry-specific Engagement Letter: This type of engagement letter is tailored to specific industries or unique circumstances that require additional review procedures or considerations. It caters to clients with complex financial structures or regulatory requirements. In conclusion, the Connecticut Engagement Letter for Review of Financial Statements by Accounting Firm is a crucial legal document that outlines the responsibilities, objectives, and limitations of the reviewed financial statements' engagement. It is important for both the accounting firm and the client to understand and agree upon the terms laid out in the engagement letter to ensure a successful and professional working relationship.Connecticut Engagement Letter for Review of Financial Statements by Accounting Firm is a crucial document that establishes the terms and conditions governing the engagement between a certified accounting firm and its client in Connecticut. An engagement letter is a written agreement outlining the responsibilities, objectives, and limitations of the reviewed financial statements' engagement. It is crucial for both parties to clearly understand the scope and nature of the services provided to avoid misunderstandings and ensure a smooth working relationship. The Connecticut Engagement Letter for Review of Financial Statements typically includes the following key components: 1. Engagement details: This section identifies the accounting firm, the client, and provides a brief background about the purpose of the engagement. It also outlines the time period covered by the reviewed financial statements. 2. Objective and scope: This section describes the objective of the engagement, which is to conduct a review of the client's financial statements to provide limited assurance on their accuracy and reliability. It specifies that the review will be performed in accordance with the applicable professional standards, including Generally Accepted Accounting Principles (GAAP) or other relevant guidelines. 3. Responsibilities of the accounting firm: This section outlines the specific tasks and responsibilities of the accounting firm, such as obtaining an understanding of the client's business and industry, performing analytical procedures, and obtaining management representations. It also details the extent of the review procedures and the level of assurance expected to be provided. 4. Responsibilities of the client: This section highlights the client's responsibilities, including providing accurate and complete financial records, disclosing all relevant information, and making management representations as required during the engagement. 5. Limitations of the review: This section clarifies that a review does not provide absolute assurance, unlike an audit. It advises the client that the accounting firm's review procedures may not detect all errors, fraud, or irregularities that may exist in the financial statements. 6. Confidentiality and data security: This section specifies that the accounting firm will treat all client information with utmost confidentiality and outlines the measures taken to ensure data security. 7. Fee and payment terms: This section discloses the fees charged by the accounting firm for the review engagement and provides payment terms, including billing frequency and method of payment. Types of Connecticut Engagement Letters for Review of Financial Statements by Accounting Firm: 1. Standard Engagement Letter: This is the general engagement letter used for most routine review engagements in Connecticut. It covers the essential points mentioned above and is suitable for clients with straightforward financial statements. 2. Specialized or Industry-specific Engagement Letter: This type of engagement letter is tailored to specific industries or unique circumstances that require additional review procedures or considerations. It caters to clients with complex financial structures or regulatory requirements. In conclusion, the Connecticut Engagement Letter for Review of Financial Statements by Accounting Firm is a crucial legal document that outlines the responsibilities, objectives, and limitations of the reviewed financial statements' engagement. It is important for both the accounting firm and the client to understand and agree upon the terms laid out in the engagement letter to ensure a successful and professional working relationship.