A reservation of rights defense is a means by which a liability insurance carrier agrees to protect and defend its insured against a claim or suit while reserving the right to further evaluate and perhaps even deny coverage for some or all of the claim. It is most commonly used when the claim or suit contains both covered and non-covered allegations, when the allegations are in excess of policy limits, or when the insurer is still investigating its defense and coverage obligations. For the insurer, a reservation of rights provides the flexibility to satisfy its duty to defend without committing to coverage. For the business owner who ultimately may have to pay for an adverse judgment, it requires careful monitoring and attention.

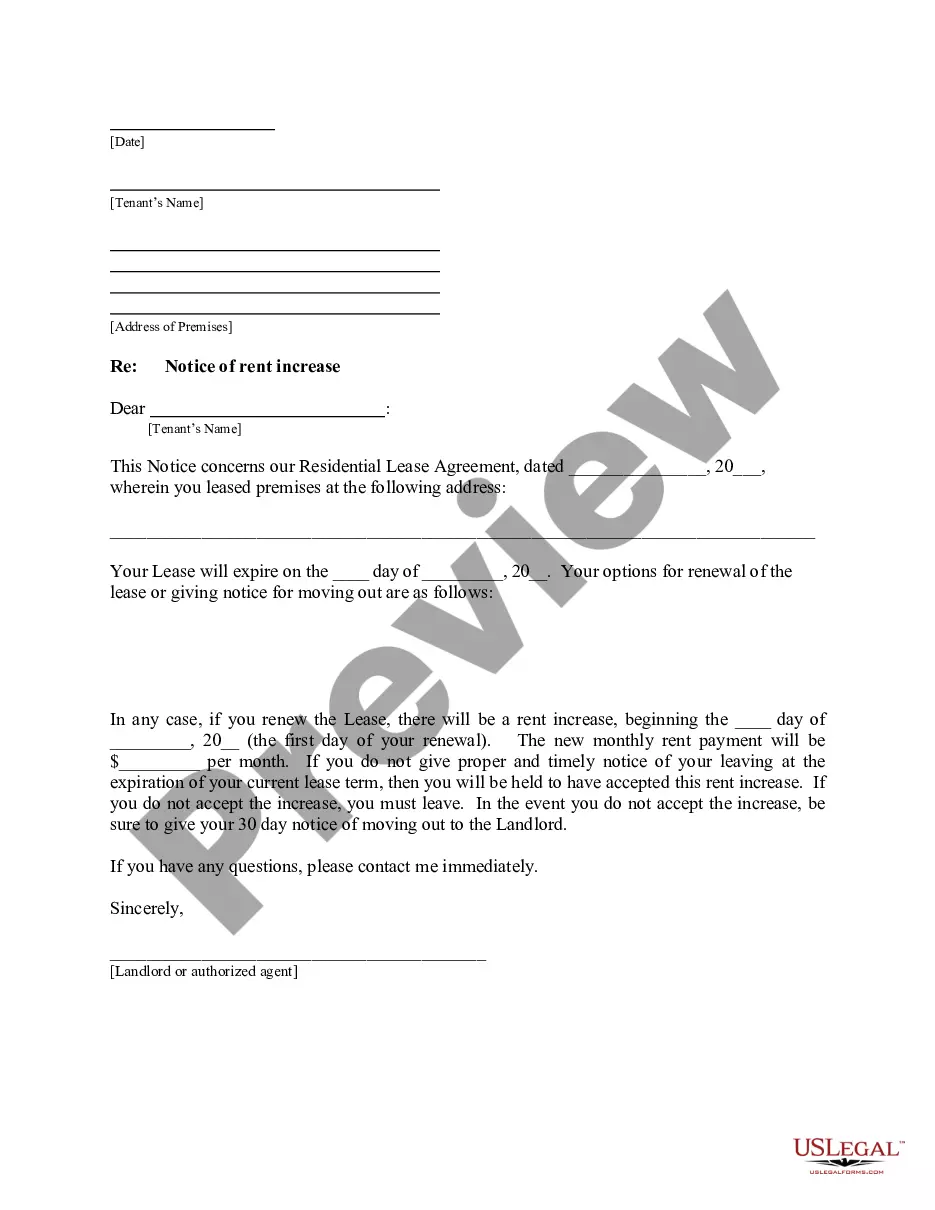

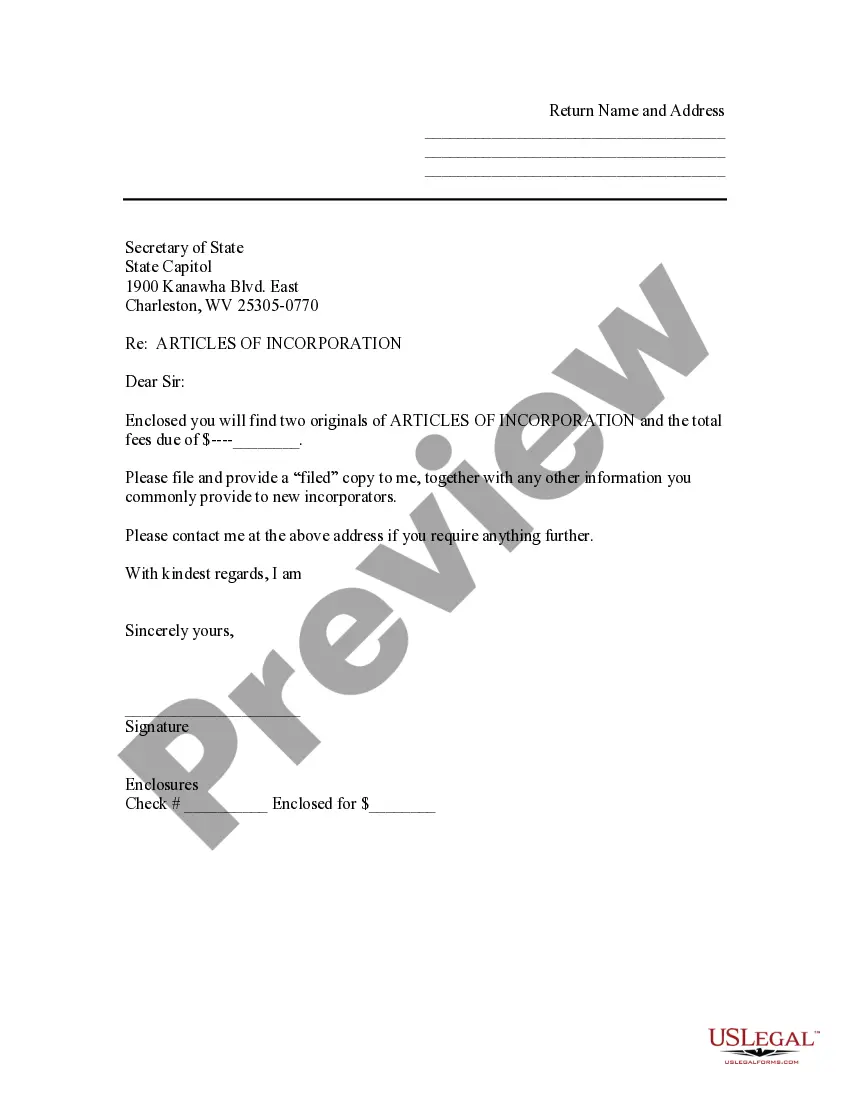

Connecticut Reservation of Rights Letter

Description

How to fill out Reservation Of Rights Letter?

Choosing the best legitimate document design could be a battle. Obviously, there are a lot of themes available on the net, but how do you obtain the legitimate kind you will need? Use the US Legal Forms site. The assistance provides 1000s of themes, like the Connecticut Reservation of Rights Letter, which you can use for company and private needs. All the types are inspected by professionals and meet state and federal needs.

When you are already authorized, log in for your bank account and click the Down load button to have the Connecticut Reservation of Rights Letter. Utilize your bank account to check from the legitimate types you might have acquired formerly. Proceed to the My Forms tab of your bank account and get another copy of the document you will need.

When you are a fresh user of US Legal Forms, allow me to share simple guidelines so that you can stick to:

- Very first, ensure you have chosen the appropriate kind for the city/state. You may look over the form using the Preview button and browse the form explanation to guarantee it will be the best for you.

- If the kind fails to meet your requirements, utilize the Seach discipline to find the right kind.

- When you are positive that the form would work, click on the Get now button to have the kind.

- Pick the rates prepare you need and enter the required information and facts. Make your bank account and pay for the order with your PayPal bank account or bank card.

- Choose the file formatting and down load the legitimate document design for your device.

- Total, edit and produce and indicator the received Connecticut Reservation of Rights Letter.

US Legal Forms is definitely the largest collection of legitimate types that you will find various document themes. Use the company to down load expertly-manufactured papers that stick to condition needs.

Form popularity

FAQ

When the insurer sends you a reservation of rights letter, it is telling you that it has doubts whether your policy covers some or all of the claims. In a liability lawsuit, the plaintiff often makes several claims. The policy might cover some and exclude others.

Demand letter reservation of rights clause The demand letter advises the recipient that the sender has legal rights, and those rights may be pursued in a legal setting, such as a courtroom, if the sender does not receive satisfactory relief from the recipient.

A reservation of rights permits an insurer to fulfill its broad duty to defend while avoiding waiver, estoppel, or forfeiture of rights or being bound by a judgment entered against its policyholder and serves to warn the policyholder to take steps to protect oneself from the reserving insurer.

After receiving a reservation of rights letter, the first step should always be to call your attorney. If you want to assert your right to have independent attorneys handle your case, your attorney will let the insurer know, and (if there's an argument to be made), will dispute the insurer's reservation of rights.

Demand letter reservation of rights clause The demand letter advises the recipient that the sender has legal rights, and those rights may be pursued in a legal setting, such as a courtroom, if the sender does not receive satisfactory relief from the recipient.

When an insurer issues a reservation of rights letter to its insured, it agrees to accept defense of the claim while reserving the right to later contest coverage under the policy depending on the facts developed through its investigation.

The reservation of rights letter also allows the insurer to decline to indemnify the insured for any portion of a judgment that it not covered under the policy, as long as the grounds for non-coverage are raised in the reservation of rights letter.

A reservation of rights, in American legal practice, is a statement that an individual, company, or other organization is intentionally retaining full legal rights to warn others of those rights.