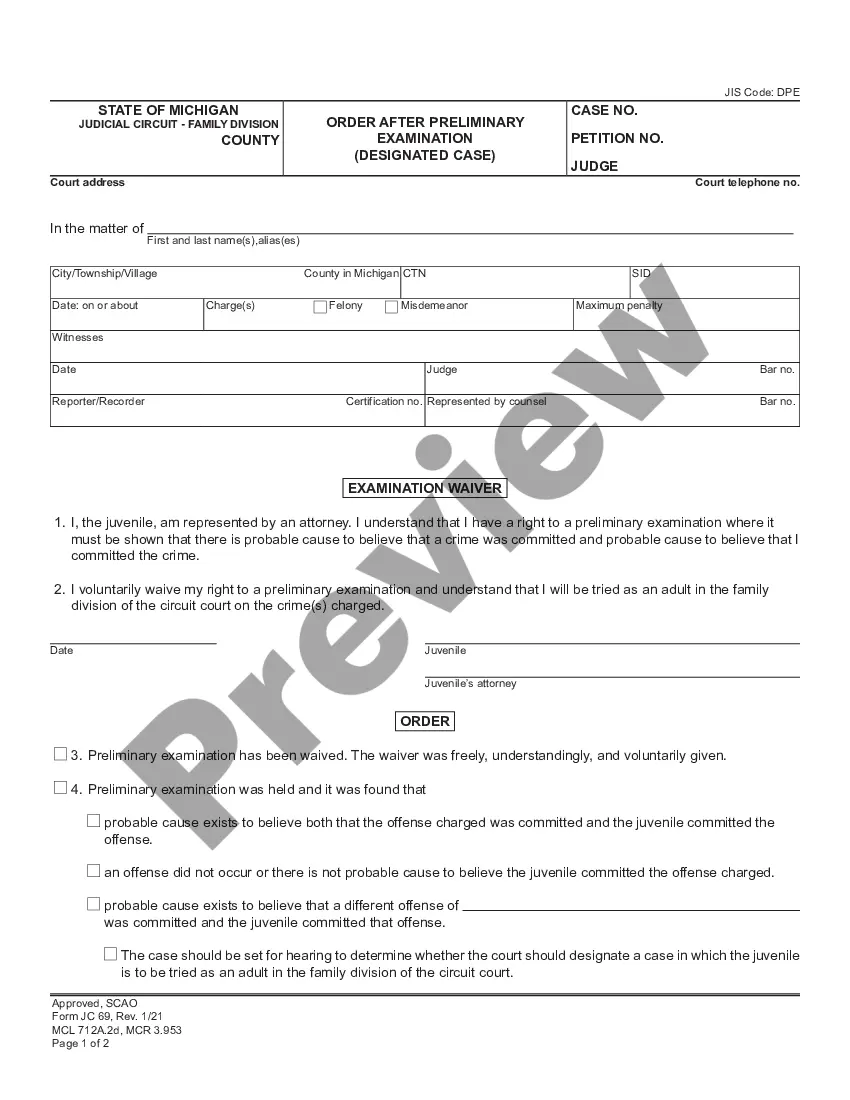

This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities

Description

How to fill out Affidavit Or Proof Of Income And Property - Assets And Liabilities?

Have you ever been in a situation where you require documents for either business or personal reasons nearly every workday.

There are numerous legal document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms provides a vast array of form templates, such as the Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities, which can be filled out to comply with federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities at any time, if necessary. Simply click on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally created legal document templates for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Preview feature to review the document.

- Examine the details to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find a template that fits your needs and requirements.

- Once you find the correct form, click Acquire now.

- Select the payment plan you prefer, enter the required information to create your account, and complete your order using PayPal or a credit card.

Form popularity

FAQ

An affidavit in finance is a formal statement made under oath that outlines an individual's financial information. This can include income sources, total assets, and liabilities, providing clarity during financial transactions or legal disputes. Accurate affidavits are vital for maintaining trust and transparency in financial dealings.

A sworn financial affidavit is a legally binding document that you sign under oath, affirming that the financial information you provide is true and accurate. This affidavit is often required in court proceedings to ensure honesty in financial disclosures. Ensuring the accuracy of your sworn statements can prevent future legal complications.

The purpose of a financial affidavit is to provide the court with a comprehensive account of an individual's financial condition. This document helps in determining spousal support, child support, and division of assets during legal proceedings. Accurate disclosures are crucial, making it essential to utilize resources like Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities.

To fill out an affidavit for divorce, gather all relevant financial information, such as income, debts, and property details. Then, follow the specific format required by your state, ensuring you accurately disclose all required information. Using uslegalforms can simplify this process by providing templates that are tailored to meet legal standards, helping you avoid common pitfalls.

An affidavit of financial status is a legal document that outlines your financial situation. It includes details about your income, expenses, assets, and liabilities. This document is often required in various legal proceedings, including divorce or custody cases, to provide a clear picture of your financial status.

The affidavit of financial ability is a document used to prove your income and financial status. This Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities outlines your financial situation, helping various institutions assess your ability to meet obligations. By providing clear evidence of your income and assets, you enhance your credibility when applying for loans, mortgages, or leases. With US Legal Forms, you can easily create and customize the affidavit to suit your specific needs, making the process straightforward and efficient.

Filling out a personal information affidavit requires you to input your personal details such as name, address, and contact information accurately. You should also detail your financial situation, emphasizing how your assets and liabilities intersect. The Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities template helps you maintain clarity and accuracy throughout this process.

When filling out an affidavit of financial information, start by clearly stating all necessary financial details. Include your total income, ongoing expenses, and all relevant assets and liabilities. By referring to the Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities format, you can ensure your information is well-organized and reliable.

Filling an affidavit of financial support involves listing your income, assets, and any liabilities accurately. Ensure you include supporting evidence to substantiate your claims. The Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities provides a structured approach that helps you complete this process efficiently.

To fill out a financial affidavit short form, focus on the essential information like income, expenses, and basic asset details. Use concise language and avoid unnecessary elaboration. The short form should still reflect your financial position accurately in line with the Connecticut Affidavit or Proof of Income and Property - Assets and Liabilities.