Connecticut Business Management Consulting or Consultant Services Agreement — Self-Employed A Connecticut Business Management Consulting or Consultant Services Agreement — Self-Employed is a legally binding contract between a self-employed business management consultant and a client based in Connecticut. This agreement outlines the terms and conditions of the consulting services to be provided, including the scope of work, payment terms, confidentiality, and dispute resolution. Keywords: Connecticut, business management consulting, consultant services agreement, self-employed, contract, terms and conditions, scope of work, payment terms, confidentiality, dispute resolution. Types of Connecticut Business Management Consulting or Consultant Services Agreements — Self-Employed: 1. General Business Management Consulting Agreement: This type of agreement covers a wide range of consulting services related to business management, such as strategic planning, marketing, operations, human resources, and financial management. 2. Marketing and Sales Consulting Agreement: This agreement focuses specifically on consulting services related to marketing strategies, sales techniques, market research, brand development, and advertising campaigns. 3. IT Consulting Agreement: This type of agreement is tailored to consultants who specialize in providing information technology (IT) consulting services, including software development, system implementation, network security, and IT project management. 4. Financial Consulting Agreement: This agreement caters to consultants with expertise in financial management, accounting, auditing, investment analysis, and tax strategy consulting. 5. Human Resources Consulting Agreement: Consultants offering human resources (HR) consulting services, including recruitment, employee training, performance management, and organizational development, can use this type of agreement. 6. Legal Consulting Agreement: This agreement is designed for consultants who provide legal advice and assistance, such as contract drafting, intellectual property protection, compliance management, and dispute resolution. 7. Sustainability Consulting Agreement: This type of agreement pertains to consultants specializing in sustainability and environmental practices. They provide expertise in green business initiatives, energy efficiency, waste management, and environmental impact assessments. 8. Operations Consulting Agreement: This agreement caters to consultants addressing operational efficiency, supply chain management, process improvement, quality control, and overall business optimization. It is crucial for both the consultant and the client to carefully review and understand the terms and obligations outlined in the agreement before entering into the contract. Seeking legal advice for drafting or reviewing the agreement is recommended to ensure compliance with applicable laws and to protect the interests of both parties.

Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

How to fill out Connecticut Business Management Consulting Or Consultant Services Agreement - Self-Employed?

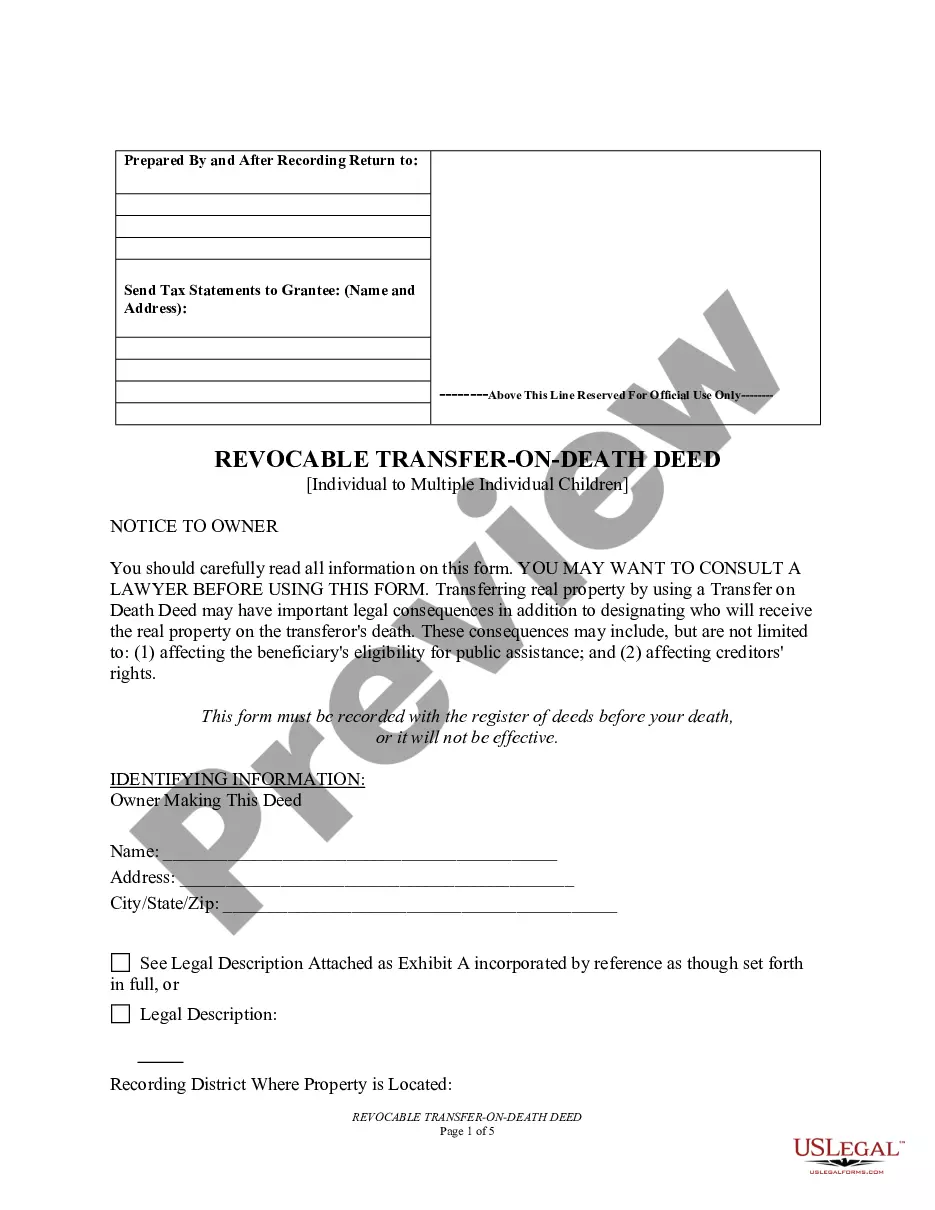

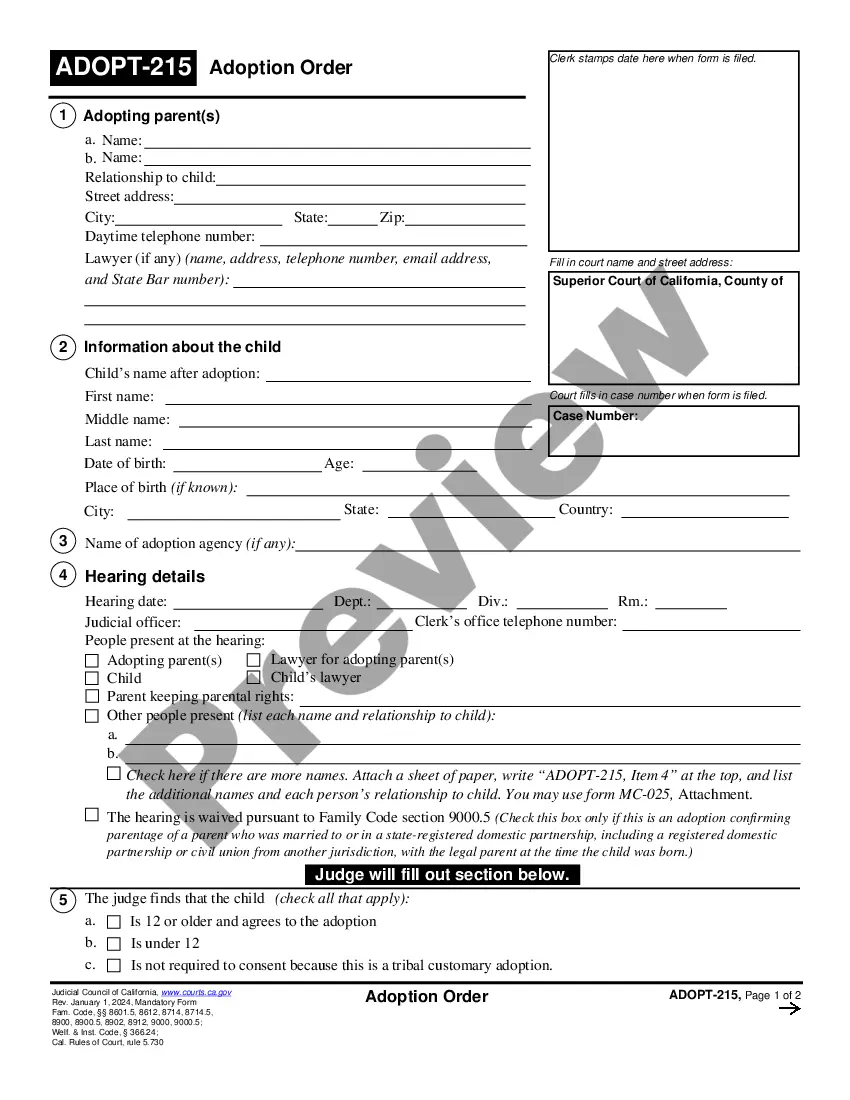

If you want to complete, download, or produce authorized document templates, use US Legal Forms, the biggest variety of authorized varieties, which can be found on the Internet. Utilize the site`s simple and convenient research to get the documents you need. A variety of templates for company and specific functions are sorted by groups and suggests, or search phrases. Use US Legal Forms to get the Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed with a couple of click throughs.

In case you are presently a US Legal Forms customer, log in to the account and then click the Acquire switch to get the Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed. You can also access varieties you formerly delivered electronically from the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for the appropriate metropolis/nation.

- Step 2. Use the Preview option to examine the form`s content material. Do not forget about to learn the information.

- Step 3. In case you are not happy with the kind, utilize the Research field on top of the screen to discover other variations from the authorized kind format.

- Step 4. Upon having found the shape you need, click on the Get now switch. Opt for the rates prepare you choose and include your accreditations to sign up for an account.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal account to accomplish the transaction.

- Step 6. Select the file format from the authorized kind and download it on the gadget.

- Step 7. Complete, edit and produce or sign the Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed.

Each authorized document format you get is yours eternally. You may have acces to every kind you delivered electronically within your acccount. Select the My Forms portion and choose a kind to produce or download once more.

Compete and download, and produce the Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed with US Legal Forms. There are many specialist and condition-particular varieties you can use to your company or specific needs.

Form popularity

FAQ

A consultant provides expert advice and strategy to help clients overcome challenges, whereas a service provider primarily delivers tangible services or products. In Connecticut Business Management Consulting, recognizing these roles can enhance your service approach, whether you are operating as a self-employed consultant or collaborating with others. Clear differentiation can lead to better client expectations and successful project outcomes.

A master service agreement establishes a long-term relationship between a service provider and a client, covering multiple projects or services under one document. On the other hand, a consulting agreement is typically project-specific and focuses on providing expert insights. As you explore Connecticut Business Management Consulting opportunities, understanding these contracts can help you navigate your professional landscape effectively.

Yes, having a contract is essential for consultants. A well-drafted agreement protects your rights and outlines the expectations between you and your client. In the realm of Connecticut Business Management Consulting, this contract can include terms regarding payment, scope of work, and confidentiality, ensuring a smooth professional relationship.

Consulting involves offering expert advice and insights to help a business make informed decisions, while service refers to executing tasks or delivering products. In Connecticut Business Management Consulting, understanding this distinction can enhance your approach to client relationships and project management. As a self-employed consultant, defining your role clearly can lead to better outcomes.

A consulting agreement typically centers on strategic advice and the provision of specialized knowledge in areas like business management. In contrast, a service agreement revolves around performing specific tasks or services. When engaging in Connecticut Business Management Consulting, it's important to recognize these differences to protect your interests as a self-employed consultant.

A service agreement outlines the responsibilities and expectations for a specific task or project, while a consultancy agreement focuses on providing expert advice and insights. Both are crucial in Connecticut Business Management Consulting, as they define the scope of work. Understanding these differences can help you choose the right document for your needs as a self-employed consultant.

Yes, consulting services can be taxable in Connecticut, especially if they relate to selling taxable goods or certain professional fields. The key is to assess the specific type of service in question, as tax liability can vary greatly. By reviewing your Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed carefully, you can identify which services may be taxable. For further guidance on local laws and requirements, exploring USLegalForms can provide you with the answers you need.

Whether consulting services are taxable depends on the specific nature of the services rendered in Connecticut. Generally, if the service involves professional advice or services that do not result in a tangible product, it might not be taxable. Thus, understanding the tax implications for your Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed is crucial. Utilize resources like USLegalForms to obtain more detailed information on your obligations.

Certain items and services are exempt from sales tax in Connecticut, including most services that do not involve the sale of tangible personal property. For example, educational services and certain personal services may be exempt. When preparing your Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed, it's vital to identify any exemptions that may apply to your specific services. USLegalForms can provide valuable templates and resources to help clarify these exemptions.

Consulting fees in Connecticut may be taxable based on the type of consulting services offered. For instance, fees related to services that qualify as taxable services under state law will incur tax. This impacts many professionals, so it's advisable to clearly outline your Connecticut Business Management Consulting or Consultant Services Agreement - Self-Employed. To ensure compliance, consider consulting with a tax advisor or check tools available on the USLegalForms platform for assistance.

More info

CONTRACTOR'S AGREEMENT this agreement to have undertaken to carry out all, if any, tasks on behalf of Contractor for this year. Page the execution of a number and amount of tasks. Contractor agrees as to the following: Page 1. The amount and details of all work should be stated to Contractor or any Partner and agreed to by the Partner in advance in writing. Page 2. A detailed written agreement regarding the service to be performed by Contractor for this year. Contractor shall pay to the Partner on demand to carry out and perform said tasks. Contractor shall be entitled to reimbursement on demand in relation to any loss, damage, expense expenses incurred by Contractor by reason of such tasks. Contractor shall also agree to reimburse the Partner for any expenses incurred by Contractor directly or indirectly by reason of the undertakings or tasks carried out by Contractor.