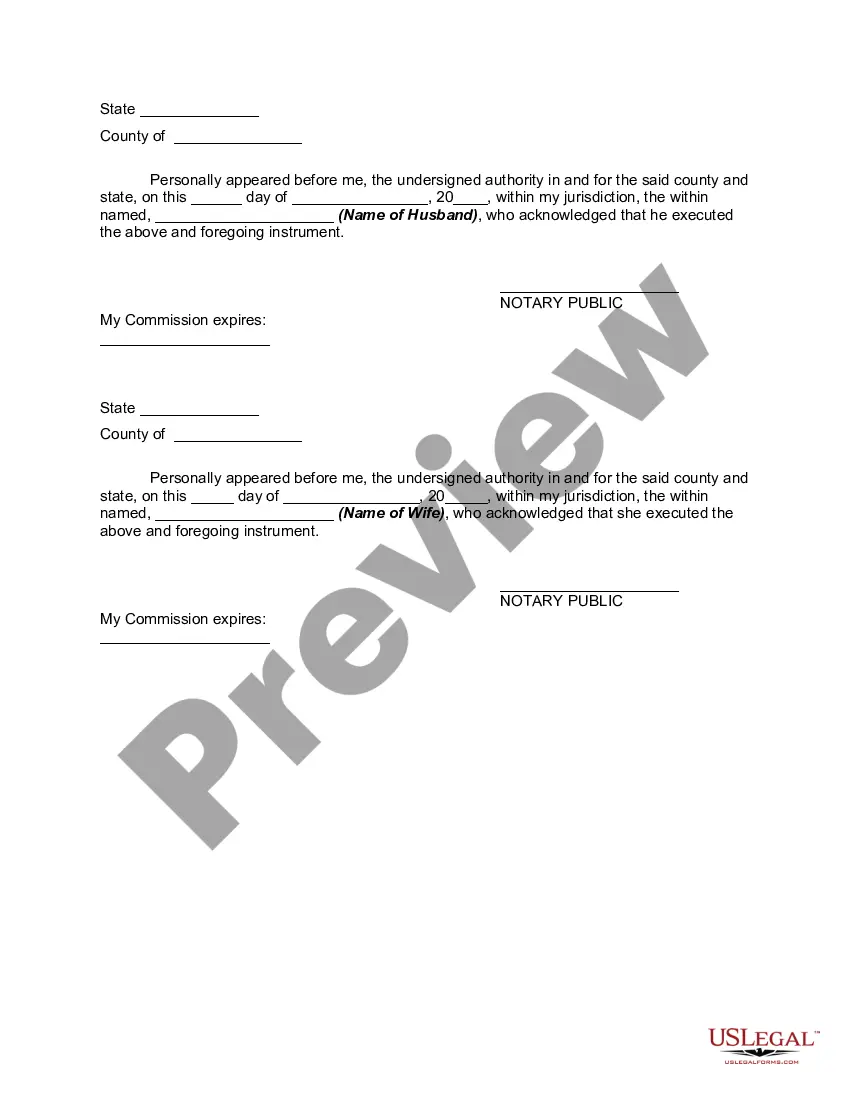

A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

Connecticut Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Description

How to fill out Transmutation Or Postnuptial Agreement To Convert Community Property Into Separate Property?

If you wish to fulfill, download, or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal documents available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you require.

A range of templates for business and personal purposes are classified by categories and regions, or search terms.

Step 4. After finding the document you require, click on the Get now button. Choose the subscription plan you prefer and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Connecticut Transmutation or Postnuptial Agreement for Converting Community Property to Separate Property in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and then click the Download button to obtain the Connecticut Transmutation or Postnuptial Agreement for Converting Community Property to Separate Property.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions outlined below.

- Step 1. Make sure you have selected the document for the appropriate city/state.

- Step 2. Use the Preview option to review the document's contents. Be sure to check the summary.

- Step 3. If you are unhappy with the document, use the Search box at the top of the screen to find other versions in the legal document format.

Form popularity

FAQ

While a postnuptial agreement can cover many aspects of financial and property arrangements, it cannot address child custody or child support matters. These issues must be resolved separately in court, as they prioritize the child's well-being. Nevertheless, a Connecticut Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can effectively manage assets, providing a structured approach to financial agreements between spouses.

Connecticut does not recognize community property in the traditional sense, following an equitable distribution model instead. However, couples in Connecticut can still address property issues through a Connecticut Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. This ensures that spouses can clearly define their rights and interests in their assets, promoting fairness and understanding, especially during divorce or separation.

A transmutation agreement allows spouses to change the character of their property, meaning they can convert community property into separate property. This is particularly valuable in Connecticut, where such agreements can provide legal clarity and financial security. By utilizing a Connecticut Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, couples can better align their assets with their personal goals and intentions.

In separate property states, assets owned by one spouse before marriage remain their own, while in community property states, most assets acquired during marriage are jointly owned. Understanding this distinction is crucial, especially when considering a Connecticut Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. Such agreements allow couples in community property states to define ownership changes, ensuring clarity and protection for both parties.

A postnuptial agreement can be drafted by the spouses themselves or by an attorney specializing in family law. Engaging a knowledgeable lawyer can ensure that your Connecticut Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property accurately reflects your intentions and meets all legal requirements. Alternatively, you can use US Legal Forms for straightforward access to customizable templates, allowing you to create a well-structured agreement on your own.

Yes, you can create your own postnuptial agreement. However, it is wise to ensure that it meets all legal standards in Connecticut for it to effectively serve as a Connecticut Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. Using a reputable platform like US Legal Forms can simplify this process, providing templates and guidance specific to your needs. This approach helps to prevent future legal disputes and ensures your agreement is enforceable.

Yes, postnuptial agreements are generally binding in Connecticut, provided they meet all legal requirements. The agreement should be fair, signed voluntarily, and include full disclosure of financial obligations. A well-prepared Connecticut transmutation or postnuptial agreement to convert community property into separate property can provide clarity and security for both spouses.

A postnuptial agreement can be very binding if it adheres to Connecticut laws and both parties enter into it willingly. These agreements typically outline property rights and responsibilities, and if properly executed, they are enforceable in court. Utilizing a Connecticut transmutation or postnuptial agreement to convert community property into separate property provides a clear structure for both parties.

To invalidate a postnuptial agreement in Connecticut, one must typically demonstrate that it was signed under duress or without adequate legal counsel. Additionally, if there was significant misinformation or concealed assets at the time of signing, that could cause invalidation. Proper documentation and clarity, especially in a Connecticut transmutation or postnuptial agreement to convert community property into separate property, can prevent such issues.

For a prenuptial agreement to be enforceable in Connecticut, it must be in writing, signed voluntarily by both parties, and both should have had full financial disclosure. Additionally, the terms of the agreement should be fair and reasonable. Understanding these principles is crucial when drafting a Connecticut transmutation or postnuptial agreement to convert community property into separate property.