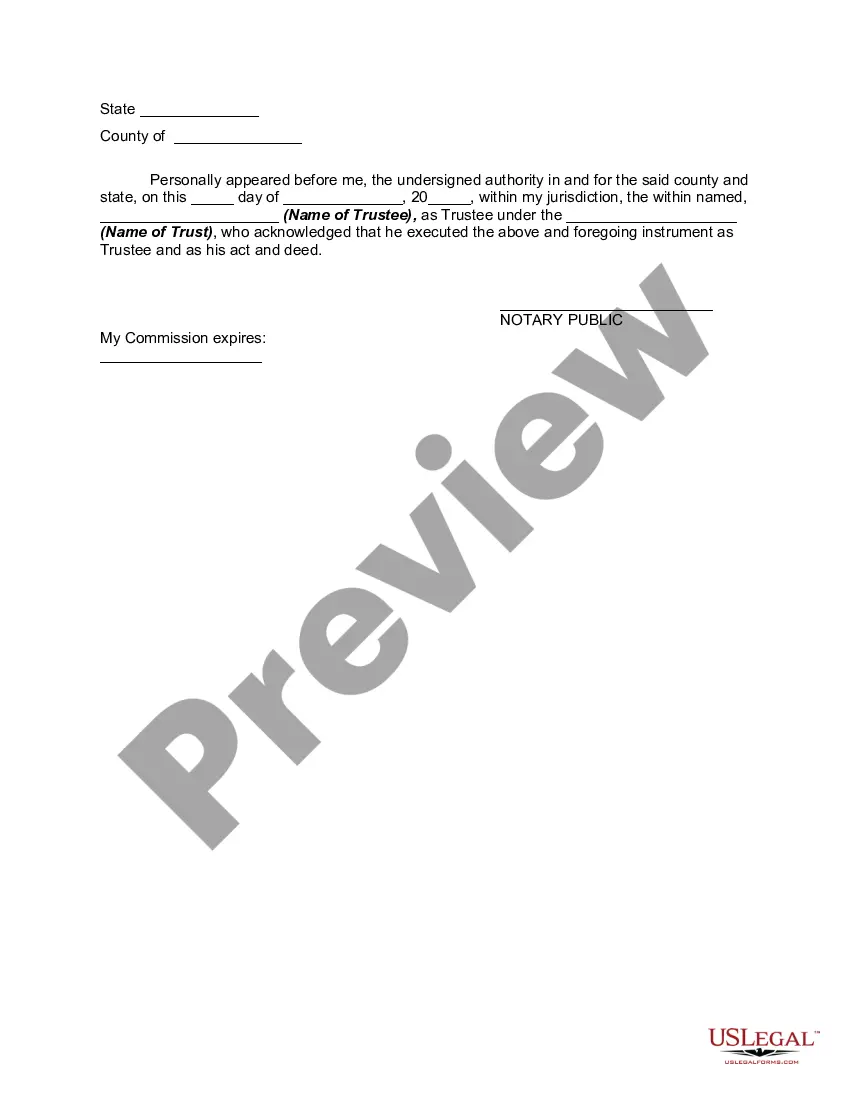

In most states a certificate or memorandum of a trust agreement which conveys or entrusts an interest in real property may be recorded with the land records clerk of the appropriate county in lieu of the entire trust agreement. The certificate must be executed by the trustee and it must contain the following: (a) the name of the trust; (b) the street and mailing address of the office, and the name and street and mailing address of the trustee; (c) the name and street and mailing address of the trustor or grantor; (d) a legally sufficient description of all interests in real property owned by or conveyed to the trust; (e) the anticipated date of termination of the trust; and (f) the general powers granted to the trustee.

Connecticut Certificate or Memorandum of Trust Agreement

Description

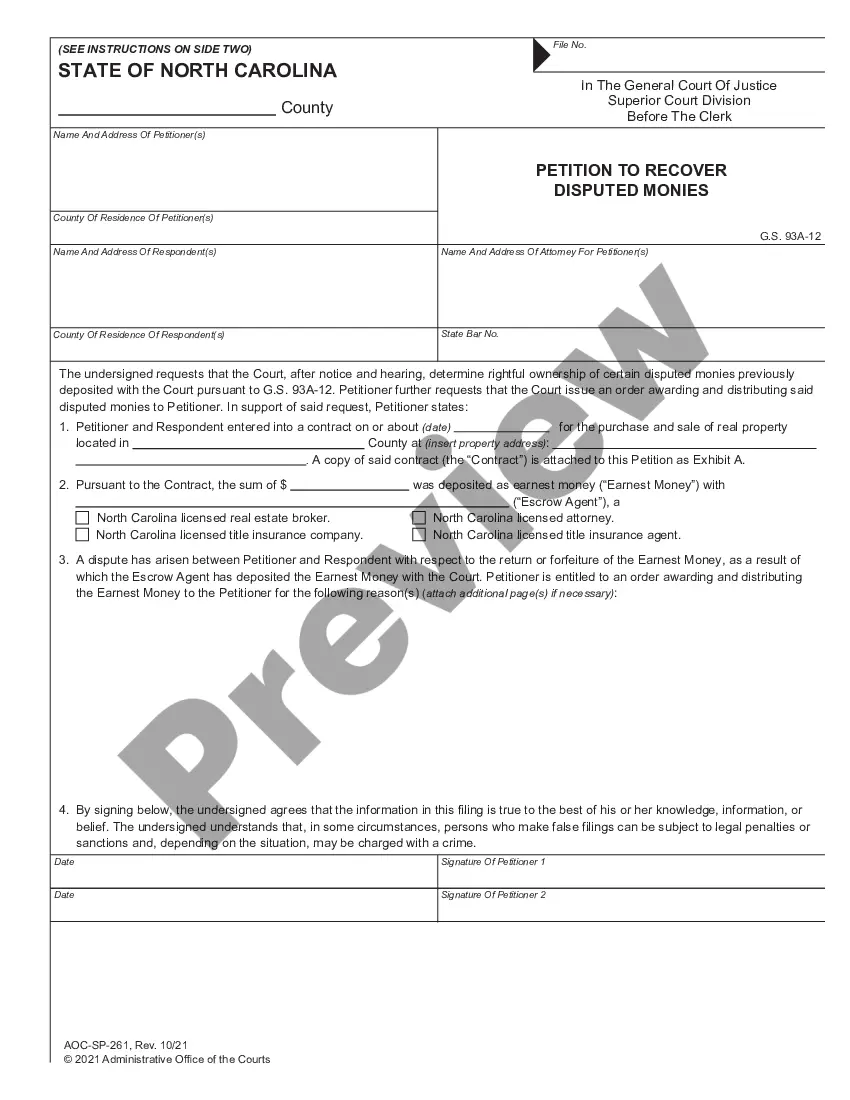

How to fill out Certificate Or Memorandum Of Trust Agreement?

If you wish to complete, download, or print legitimate document web templates, use US Legal Forms, the largest variety of legitimate varieties, that can be found on the Internet. Utilize the site`s simple and handy look for to obtain the paperwork you want. Numerous web templates for business and specific purposes are categorized by groups and says, or search phrases. Use US Legal Forms to obtain the Connecticut Certificate or Memorandum of Trust Agreement in just a handful of click throughs.

When you are currently a US Legal Forms customer, log in to your profile and click the Down load button to get the Connecticut Certificate or Memorandum of Trust Agreement. You can also accessibility varieties you formerly downloaded in the My Forms tab of your own profile.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for that right town/land.

- Step 2. Utilize the Preview option to look through the form`s content. Never overlook to read through the information.

- Step 3. When you are not satisfied together with the develop, take advantage of the Search area on top of the display to find other models from the legitimate develop design.

- Step 4. Upon having found the form you want, select the Buy now button. Pick the pricing strategy you choose and add your references to register to have an profile.

- Step 5. Approach the purchase. You should use your credit card or PayPal profile to perform the purchase.

- Step 6. Choose the structure from the legitimate develop and download it on your own device.

- Step 7. Comprehensive, change and print or sign the Connecticut Certificate or Memorandum of Trust Agreement.

Every legitimate document design you buy is your own property forever. You may have acces to each develop you downloaded within your acccount. Select the My Forms segment and decide on a develop to print or download once more.

Be competitive and download, and print the Connecticut Certificate or Memorandum of Trust Agreement with US Legal Forms. There are millions of expert and express-distinct varieties you can use for your business or specific needs.

Form popularity

FAQ

Resident estates, full?year resident trusts, and part?year resident trusts use Form CT?1041, Part 1, Schedule B, to calculate a credit against the Connecticut income tax liability for income taxes paid for the taxable year to another state, a political subdivision of that state, or to the District of Columbia.

Funds received from a trust are subject to different taxation than funds from ordinary investment accounts. Trust beneficiaries must pay taxes on income and other distributions from a trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets.

The state of Connecticut requires you to pay taxes if you are a resident or nonresident who receives income from a Connecticut source. State income tax rates range from 3.0% to 6.99%, and the sales tax rate is 6.35%.

Ing to the Connecticut CT-1040 Instructions, you must file a CT resident tax return if: You had Connecticut income tax withheld. You made estimated tax payments to Connecticut or a payment by extension. You had a PE Tax Credit; You meet the Gross Income Test. You had a federal alternative minimum tax liability.

If you have neither a will nor a living trust, your assets are distributed ing to Connecticut's intestacy statutes, parceling out your assets among relatives ing to a formula with no input from you.

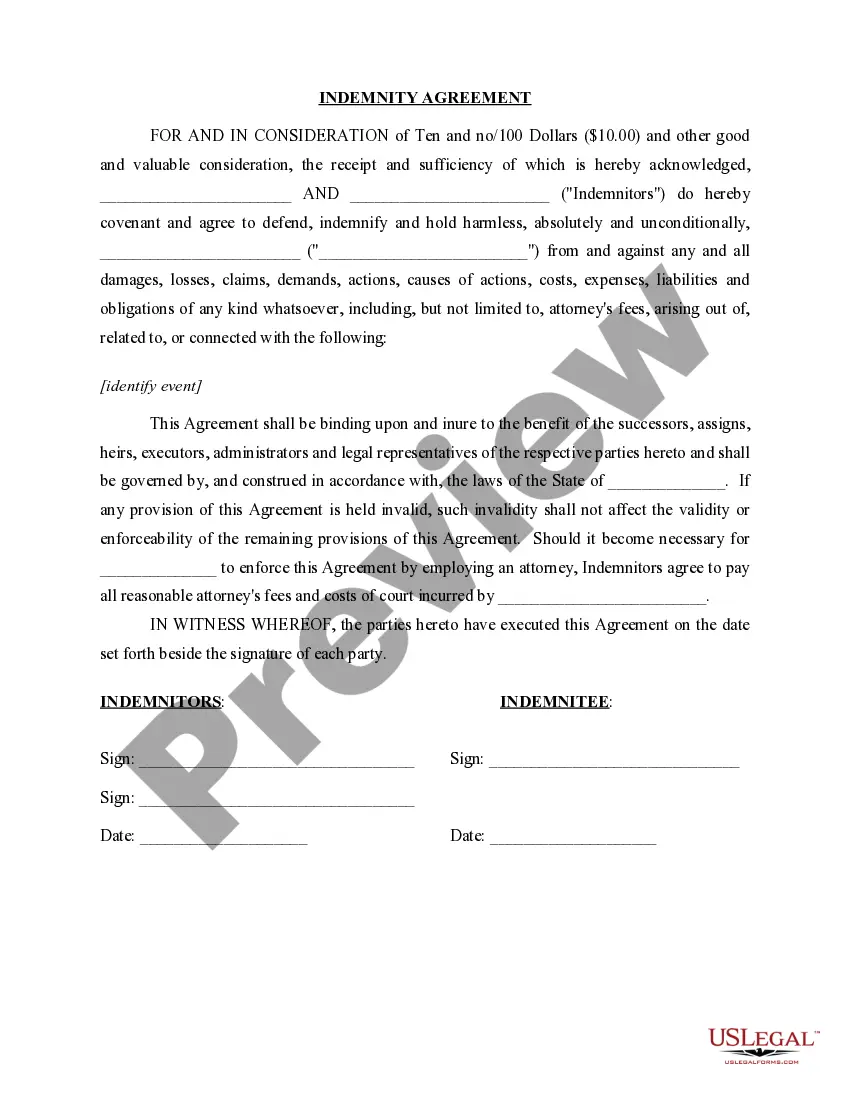

A trust agreement is a legal document containing, terms, conditions and provisions that allows the trustor to transfer the ownership of assets to the trustee to be held for the trustor's beneficiaries. The trustees will manage the property and assets on behalf of the beneficiary.

Public Acts 19-20 and 19-23, also known as the "Trust Act," created new guidelines for how Connecticut Law Enforcement works and cooperates with U.S. Immigration and Customs Enforcement (ICE).

Resident estates, full?year resident trusts, and part?year resident trusts use Form CT?1041, Part 1, Schedule B, to calculate a credit against the Connecticut income tax liability for income taxes paid for the taxable year to another state, a political subdivision of that state, or to the District of Columbia.