Connecticut Notice of Charging Lien on a Judgment — Attorney's Notice of Intent to File Lien In Connecticut, a Notice of Charging Lien on a Judgment serves as an attorney's formal intent to claim a lien on a judgment awarded to a client by the court. This notice provides legal protection and asserts the attorney's right to receive payment for their services from the judgment proceeds. It is crucial for attorneys to follow the necessary steps and comply with the specific requirements outlined in Connecticut law to ensure the validity and enforceability of this charging lien. Keywords: Connecticut, Notice of Charging Lien on a Judgment, Attorney's Notice of Intent to File Lien, attorney, lien, judgment, client, court, payment, services, enforceability Types of Connecticut Notice of Charging Lien on a Judgment — Attorney's Notice of Intent to File Lien: 1. General Notice of Charging Lien: This type of notice is filed by an attorney on behalf of their client after obtaining a judgment in a legal case. It serves as a formal notice to the court, the judgment debtor, and any potential purchasers of the debtor's property that the attorney holds a charging lien on the judgment proceeds. 2. Specific Notice of Charging Lien: A specific notice of charging lien is filed when the attorney intends to claim a lien on a particular asset or property owned by the judgment debtor. This notice specifies the property subject to the lien and establishes the attorney's right to satisfaction using the proceeds from the sale or transfer of the identified property. 3. Notice of Intent to File Lien: Before filing a formal notice of charging lien, an attorney may send a Notice of Intent to File Lien to the judgment debtor and other relevant parties. This preliminary notice informs the debtor of the attorney's intent to claim a charging lien and provides an opportunity to resolve any outstanding debts or negotiate a settlement before the lien is officially filed. 4. Amended Notice of Charging Lien: In case of any changes or updates to the information provided in the original notice, the attorney may file an amended notice of charging lien. This ensures that all parties involved are aware of the updated lien details and allows for accurate tracking and enforcement of the attorney's claim. Attorneys must adhere to strict deadlines and procedural requirements outlined in the Connecticut General Statutes when preparing and filing a Notice of Charging Lien on a Judgment. Failure to comply with these regulations can jeopardize their ability to collect fees owed and protect their lien rights. Therefore, it is advisable for attorneys to seek expert legal counsel or consult the Connecticut Superior Court's guidelines to ensure compliance with all applicable rules and regulations.

Connecticut Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien

Description

How to fill out Notice Of Charging Lien On A Judgment - Attorney's Notice Of Intent To File Lien?

US Legal Forms - among the most significant libraries of legitimate varieties in the States - offers an array of legitimate file web templates you may obtain or printing. Utilizing the site, you may get thousands of varieties for business and personal functions, categorized by types, claims, or key phrases.You will find the newest variations of varieties such as the Connecticut Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien in seconds.

If you already have a membership, log in and obtain Connecticut Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien in the US Legal Forms local library. The Acquire key will show up on every type you view. You gain access to all in the past downloaded varieties within the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, listed here are basic directions to help you get started:

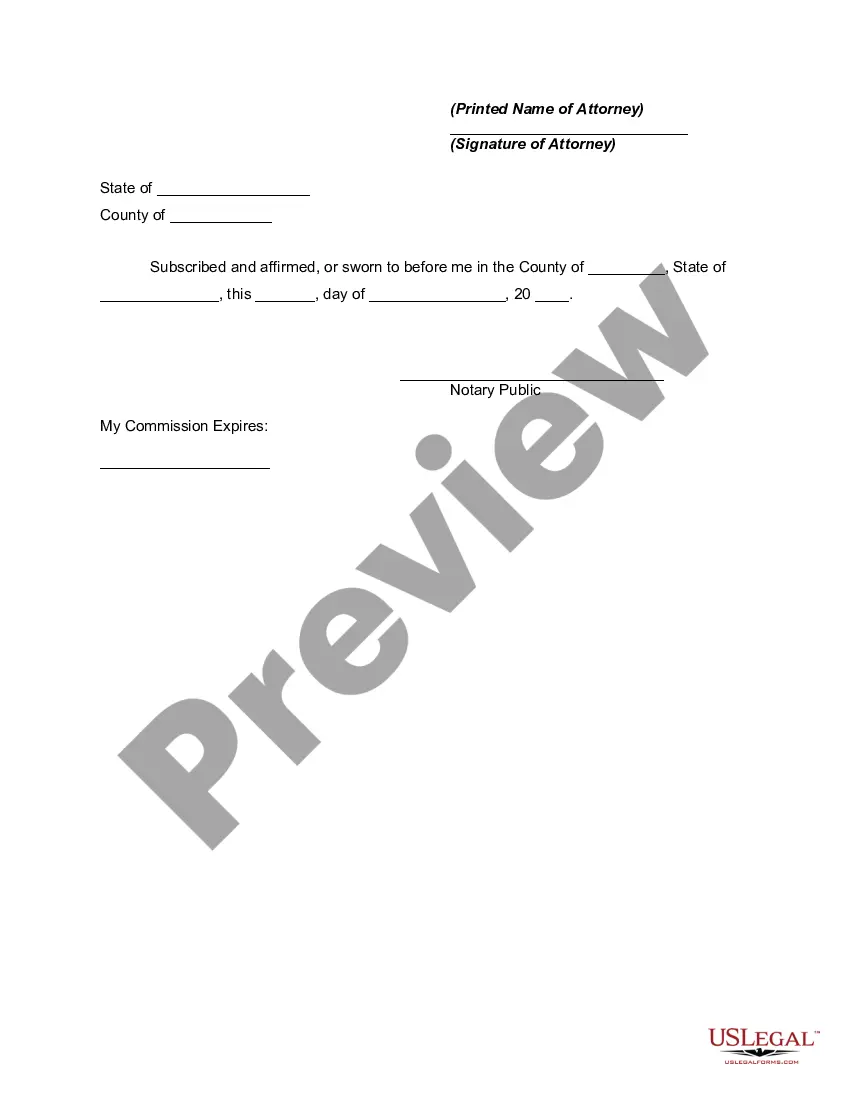

- Ensure you have picked the correct type for the area/state. Click on the Review key to analyze the form`s articles. Browse the type outline to actually have chosen the appropriate type.

- If the type does not suit your demands, use the Research industry on top of the monitor to discover the one who does.

- In case you are content with the shape, validate your selection by simply clicking the Acquire now key. Then, select the prices program you want and supply your accreditations to sign up for an bank account.

- Process the purchase. Make use of your Visa or Mastercard or PayPal bank account to accomplish the purchase.

- Select the file format and obtain the shape on your own product.

- Make alterations. Fill up, edit and printing and signal the downloaded Connecticut Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien.

Every design you included in your bank account lacks an expiration date and it is your own property forever. So, in order to obtain or printing another copy, just check out the My Forms area and click on around the type you require.

Get access to the Connecticut Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien with US Legal Forms, one of the most substantial local library of legitimate file web templates. Use thousands of expert and state-distinct web templates that fulfill your small business or personal demands and demands.

Form popularity

FAQ

A Notice of Intent to Lien is required by Connecticut statutes and warns the owner that a Connecticut Mechanic's Lien will be filed. The Notice of Intent needs to be sent to the owner prior to recording a mechanics lien in order to meet the statutory notice of lien requirements.

How long does a judgment lien last in Connecticut? A judgment lien in Connecticut will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or five years (liens on personal property).

In CT, a lien must be filed within 90 days of the last date that you performed work. You can file a lien as a private person, but that is irrelevant because you've missed the deadline.

4 steps to file a mechanics lien in Connecticut Prepare the lien form. First, make sure you are using a lien form that meets the statutory requirements in Connecticut. ... Sign & notarize the form. ... Deliver the lien to the town clerk. ... Serve a copy on the property owner.

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.

How does a creditor go about getting a judgment lien in Connecticut? The creditor must attach a lien to real estate during the lawsuit itself and, within four months of getting a judgment, the creditor must file a lien certificate with the town clerk in the Connecticut town where the debtor's property is located.

Mechanic's liens in Connecticut must be served on the property owner and recorded on land records within 90 days of the last date substantial work was done.

4 steps to file a mechanics lien in Connecticut Prepare the lien form. First, make sure you are using a lien form that meets the statutory requirements in Connecticut. ... Sign & notarize the form. ... Deliver the lien to the town clerk. ... Serve a copy on the property owner.