Connecticut Venture Capital Finder's Fee Agreement is a legal contract entered into by a company or individual (the "finder") and a venture capital firm. This agreement outlines the terms and conditions for the finder to receive a fee or commission for successfully introducing the venture capital firm to potential investment opportunities. The purpose of this agreement is to define the relationship between the finder and the venture capital firm and clearly state the finder's compensation for facilitating the investment. While there may not be different types of Connecticut Venture Capital Finder's Fee Agreement per se, the terms and specifics can vary based on the nature of the investment, the finder's role, and the parties involved. Keywords relevant to this topic include: 1. Connecticut Venture Capital: Refers to venture capital firms operating in the state of Connecticut, specialized in providing funding to startups and high-growth companies. 2. Finder's Fee: The commission or compensation paid to a finder for connecting the venture capital firm with a potential investment opportunity. 3. Agreement: A legal contract that outlines the terms, conditions, and obligations of both the finder and the venture capital firm. 4. Investment Opportunity: A potential company or business venture that the finder identifies and presents to the venture capital firm for potential investment. 5. Compensation: The fee or commission that the finder receives upon successful completion of the investment deal. 6. Introduction: The act of connecting or introducing the venture capital firm to a potential investment opportunity, typically involving the exchange of relevant information between parties. 7. Role: The specific responsibilities and duties of the finder in facilitating the investment process, such as conducting due diligence or providing ongoing support to the venture capital firm. Although the Connecticut Venture Capital Finder's Fee Agreement may not have distinct types, the terms within the agreement can be customized based on the requirements and preferences of the parties involved. It is crucial for both parties to negotiate and clearly define the scope of the finder's services, the fee structure, payment terms, termination clauses, and any other relevant factors to ensure a fair and transparent agreement. Professional legal advice is advisable when drafting or reviewing such agreements to protect the interests of all parties involved.

Connecticut Venture Capital Finder's Fee Agreement

Description

How to fill out Connecticut Venture Capital Finder's Fee Agreement?

Choosing the right legitimate document format could be a have a problem. Naturally, there are a lot of web templates available on the Internet, but how will you get the legitimate type you need? Utilize the US Legal Forms site. The service provides a huge number of web templates, including the Connecticut Venture Capital Finder's Fee Agreement, that can be used for organization and private demands. All the kinds are checked out by specialists and meet federal and state needs.

If you are already listed, log in for your profile and click the Acquire switch to obtain the Connecticut Venture Capital Finder's Fee Agreement. Use your profile to look through the legitimate kinds you might have purchased previously. Check out the My Forms tab of the profile and have one more version in the document you need.

If you are a fresh end user of US Legal Forms, listed here are simple guidelines so that you can comply with:

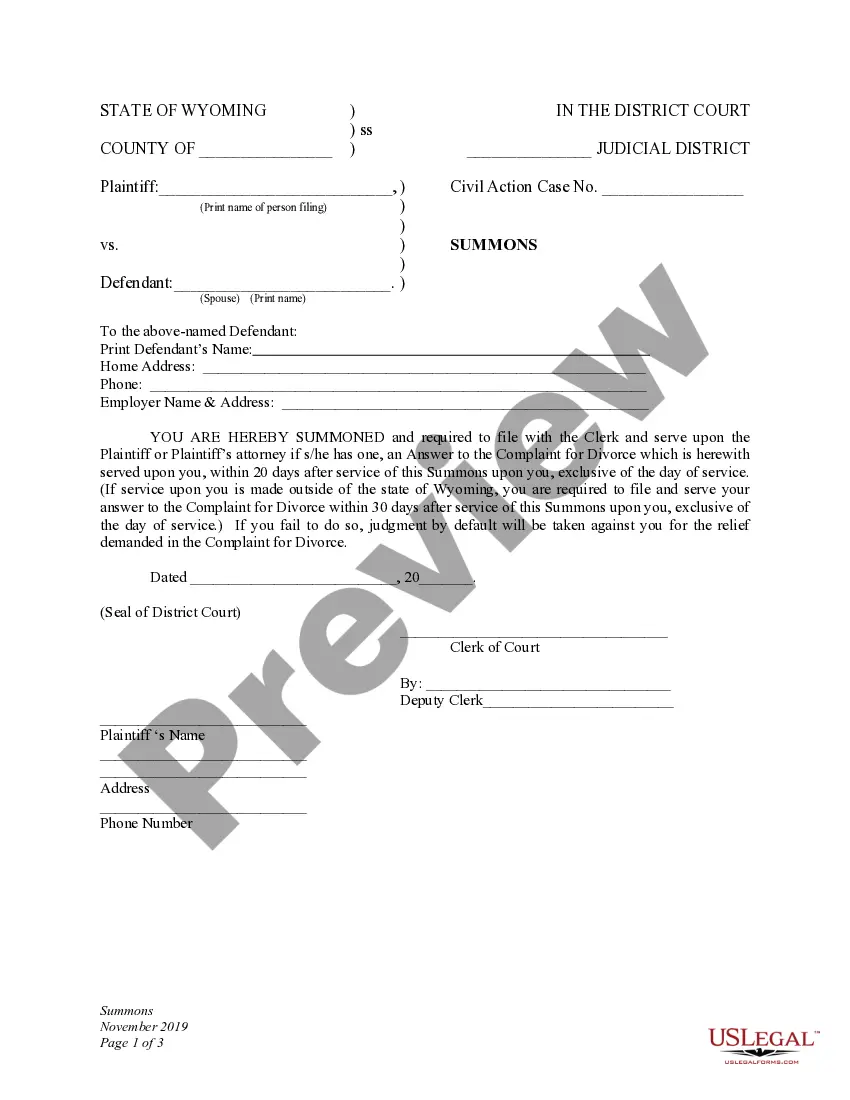

- Initial, ensure you have chosen the correct type for your metropolis/county. You can look through the form using the Preview switch and look at the form outline to guarantee it will be the right one for you.

- In the event the type will not meet your expectations, utilize the Seach discipline to obtain the correct type.

- When you are certain that the form is proper, click the Purchase now switch to obtain the type.

- Pick the pricing prepare you need and enter the needed information. Build your profile and buy the transaction making use of your PayPal profile or credit card.

- Opt for the submit format and acquire the legitimate document format for your gadget.

- Total, edit and produce and indicator the attained Connecticut Venture Capital Finder's Fee Agreement.

US Legal Forms is definitely the largest library of legitimate kinds that you can see a variety of document web templates. Utilize the company to acquire skillfully-manufactured papers that comply with express needs.