Connecticut Comprehensive Equipment Lease with Provision Regarding Investment Tax The Connecticut Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal agreement that allows businesses in Connecticut to lease equipment while addressing important tax considerations. This lease agreement is specifically designed to help businesses navigate the complexities of investment taxes in the state of Connecticut. The lease encompasses various types of equipment, including but not limited to machinery, vehicles, technology devices, and other tangible assets required for business operations. By entering into this lease, businesses can benefit from the flexibility of leasing, while also taking advantage of provisions that help in managing investment taxes. This comprehensive lease agreement comes with specific provisions that pertain to investment taxes. These provisions are tailored to Connecticut's tax laws and regulations, ensuring compliance and optimal tax management for businesses. By incorporating investment tax provisions within the lease, businesses can potentially mitigate their tax liabilities and maximize their cost-saving benefits. The Connecticut Comprehensive Equipment Lease with Provision Regarding Investment Tax encompasses several types tailored to meet businesses' varying needs: 1. Standard Equipment Lease with Investment Tax Provision: This lease is suitable for businesses with regular equipment leasing requirements. It includes provisions specifically related to investment taxes, ensuring compliance and offering tax benefits. 2. Small Business Equipment Lease with Investment Tax Provision: This lease is specially designed for small businesses that require equipment leasing. It provides advantageous tax provisions tailored to small businesses' unique circumstances, such as tax deductions or credits, helping them save on costs. 3. Technology Equipment Lease with Investment Tax Provision: This lease is intended for businesses that primarily lease technology equipment, such as computers, servers, software, and other tech-related assets. It incorporates investment tax provisions specifically aligned with the technology sector, considering any specific tax regulations or incentives available. 4. Manufacturing Equipment Lease with Investment Tax Provision: This lease is targeted towards businesses operating in the manufacturing industry. It includes investment tax provisions that account for the specialized needs and taxation aspects related to manufacturing equipment, potentially offering tax deductions or incentives. Please note that the specific types of leases mentioned above are just some examples based on general needs and industry-specific requirements. The Connecticut Comprehensive Equipment Lease with Provision Regarding Investment Tax can be further customized to fit the unique needs of each business. Overall, this lease provides businesses in Connecticut the opportunity to secure necessary equipment while considering investment tax implications. It serves as a valuable tool to manage and optimize tax benefits, enhance financial planning, and foster growth and competitiveness within the state's business landscape.

Connecticut Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Connecticut Comprehensive Equipment Lease With Provision Regarding Investment Tax?

Are you currently in the place the place you will need files for both enterprise or personal reasons nearly every time? There are tons of legal record web templates accessible on the Internet, but finding versions you can rely isn`t effortless. US Legal Forms gives 1000s of form web templates, such as the Connecticut Comprehensive Equipment Lease with Provision Regarding Investment Tax, that are published to fulfill state and federal needs.

When you are currently knowledgeable about US Legal Forms internet site and get a free account, just log in. Afterward, you can acquire the Connecticut Comprehensive Equipment Lease with Provision Regarding Investment Tax template.

Should you not have an account and need to begin to use US Legal Forms, follow these steps:

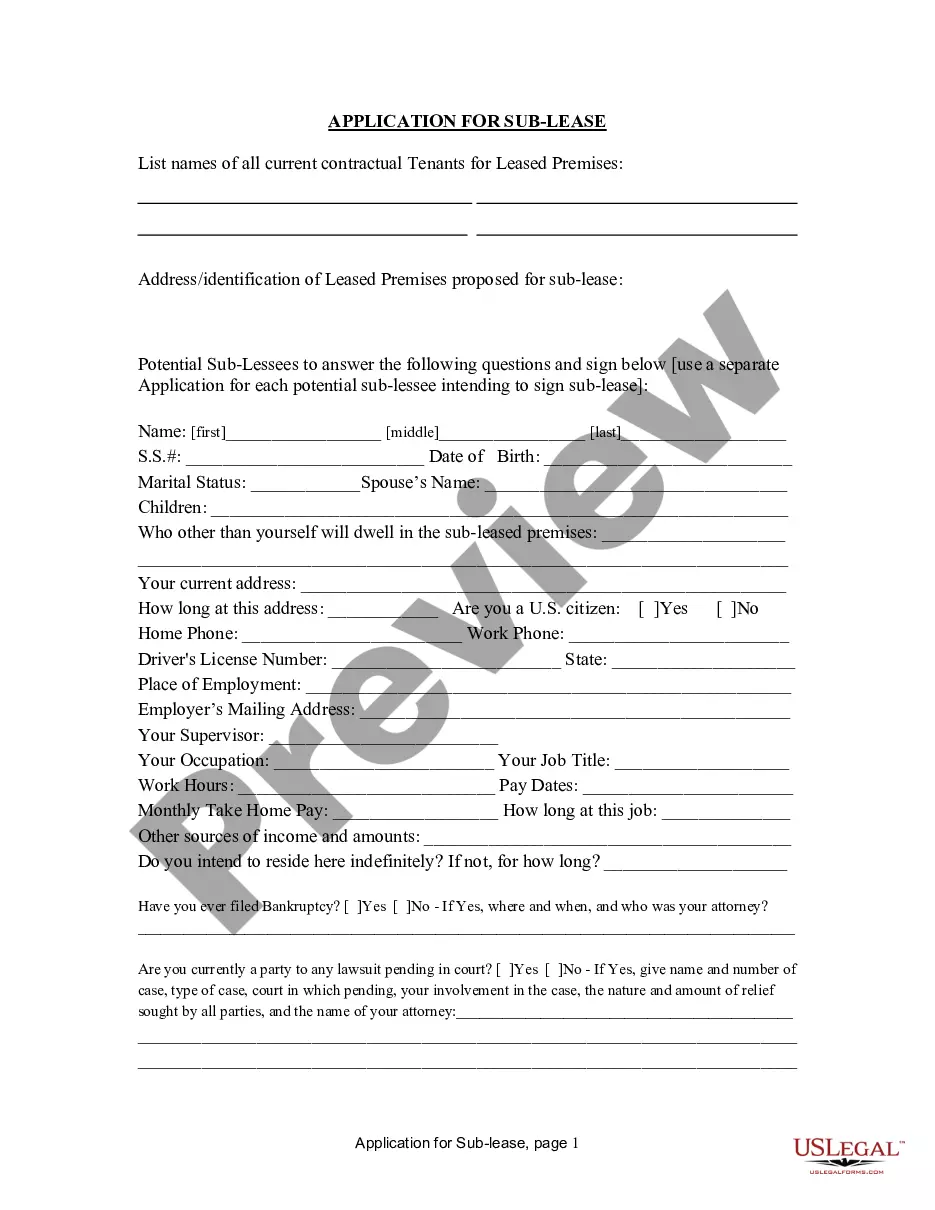

- Get the form you require and ensure it is for that correct city/state.

- Make use of the Preview button to review the shape.

- Browse the description to ensure that you have chosen the correct form.

- In the event the form isn`t what you are seeking, use the Research field to get the form that meets your requirements and needs.

- If you get the correct form, simply click Purchase now.

- Select the prices plan you would like, fill out the specified info to generate your money, and purchase your order utilizing your PayPal or charge card.

- Choose a practical file format and acquire your backup.

Discover all the record web templates you possess purchased in the My Forms menu. You may get a more backup of Connecticut Comprehensive Equipment Lease with Provision Regarding Investment Tax anytime, if needed. Just go through the required form to acquire or produce the record template.

Use US Legal Forms, probably the most comprehensive collection of legal types, to save efforts and stay away from blunders. The service gives expertly manufactured legal record web templates which can be used for a variety of reasons. Produce a free account on US Legal Forms and initiate generating your daily life a little easier.