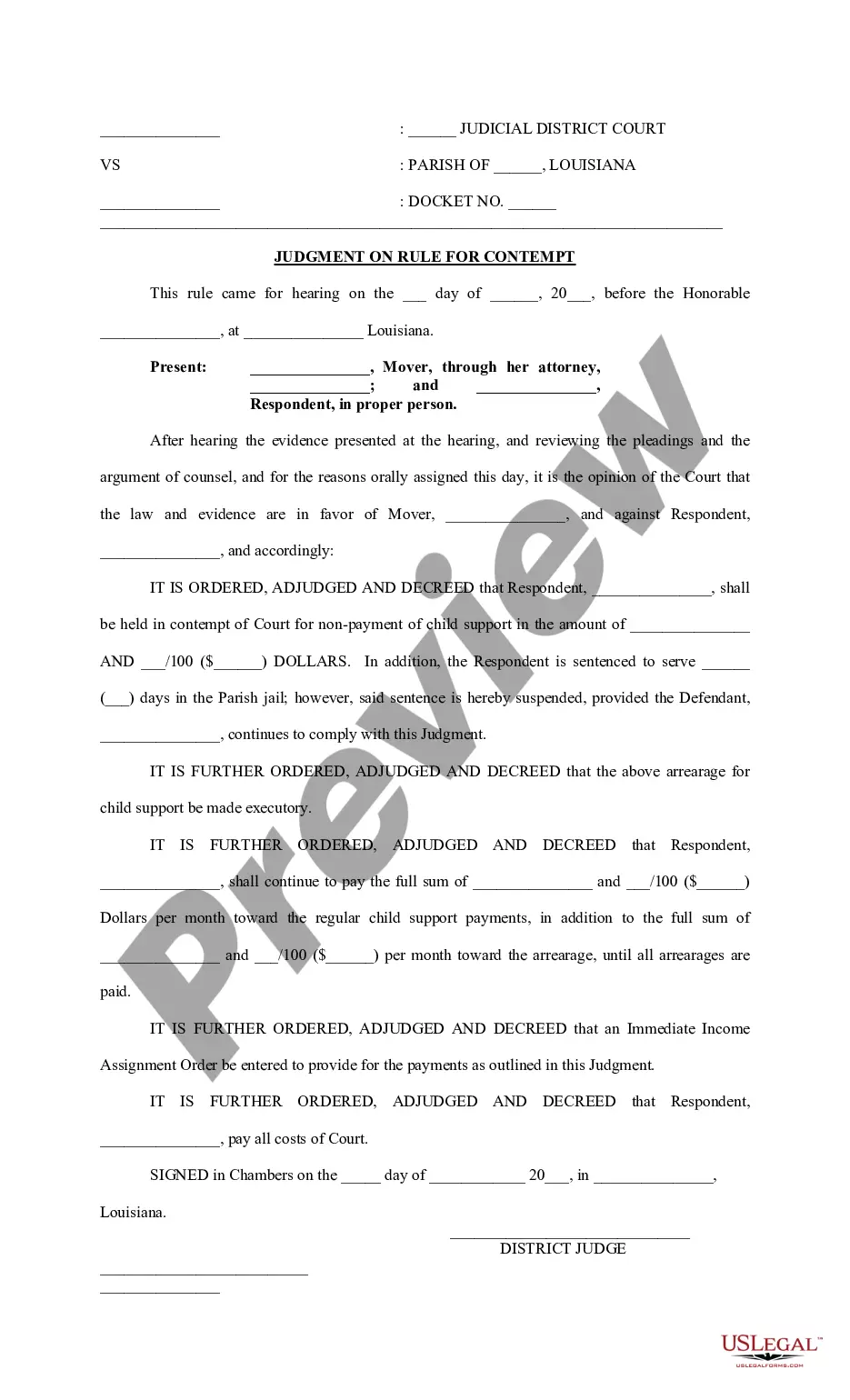

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

How to fill out Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

If you require to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the largest assortment of legal forms accessible online.

Make use of the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal uses are sorted by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred payment plan and provide your information to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the Connecticut Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Connecticut Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The spousal elective share in Connecticut allows a surviving spouse to claim a portion of the deceased spouse's estate, regardless of the will's terms. This share equals 50% of the estate if there are no children, and one-third if there are children. Understanding this can help you navigate estate planning and protect your rights. Additionally, utilizing a Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can further clarify financial obligations.

When a husband dies, a wife has specific rights under Connecticut law, which include the right to inherit a portion of the estate. If there is a will, the terms of that document will guide the inheritance process. If no will exists, state laws determine the distribution of assets, ensuring the spouse receives their rightful share. To navigate this complicated terrain, understanding the Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can help address any concerns regarding debts and liabilities.

Typically, you are not responsible for your spouse's individual debts in Connecticut when your name is not on the account. However, debt collectors may pursue the spouse for debts incurred during the marriage. If you’re looking to protect your assets from potential claims, the Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse is a valuable resource. Additionally, consulting with a legal expert can provide clarity on your obligations.

No, a spouse does not automatically inherit everything in Connecticut. In cases where a will is present, estate distribution follows the wishes outlined in that document. However, if no will exists, state laws will determine inheritance shares, which may not favor the spouse exclusively. To protect your interests, you might explore the Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse as part of your financial planning.

In Connecticut, whether a wife receives everything after her husband’s death depends on the circumstances, including whether there is a will. If no will exists, the wife generally inherits a significant portion of the estate, but not necessarily everything. Understanding how assets are distributed under state law is crucial. For further guidance, the Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse may provide insight into your rights and positions.

In Connecticut, a wife is entitled to a fair division of marital assets during a divorce settlement. This includes any property acquired during the marriage, such as real estate, savings, and retirement accounts. It's crucial to understand that debts also play a role in this division. If you are concerned about how your spouse's debts may affect your share, considering the Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can help clarify your rights.

In most cases, you are not responsible for your spouse's debts unless you have co-signed or jointly incurred the debt. The Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse effectively protects you from bearing the burden of your spouse's financial obligations. Consulting with a knowledgeable attorney can provide deeper insights into your responsibilities and rights concerning debts.

Connecticut is an equitable distribution state, meaning that marital property is divided fairly, but not necessarily equally, during a divorce. Marital property encompasses assets and debts accrued during the marriage, with some exceptions. Understanding the nuances of marital property laws and the implications of the Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can significantly impact your financial landscape.

In Connecticut, debt is divided in a divorce based on equitable distribution principles, which means it may not always be split 50/50 but will depend on various factors. Marital debts incurred during the marriage generally remain joint obligations. Utilizing the Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can help clarify liabilities and protections during this process.

Creditors usually cannot pursue an individual for the debts of their spouse unless the debt is jointly held or you co-signed for it. The Connecticut Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse serves as a safeguard against being held liable for your spouse's debts. However, it's advisable to consult with a legal expert to clarify your specific situation regarding any debts.