Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

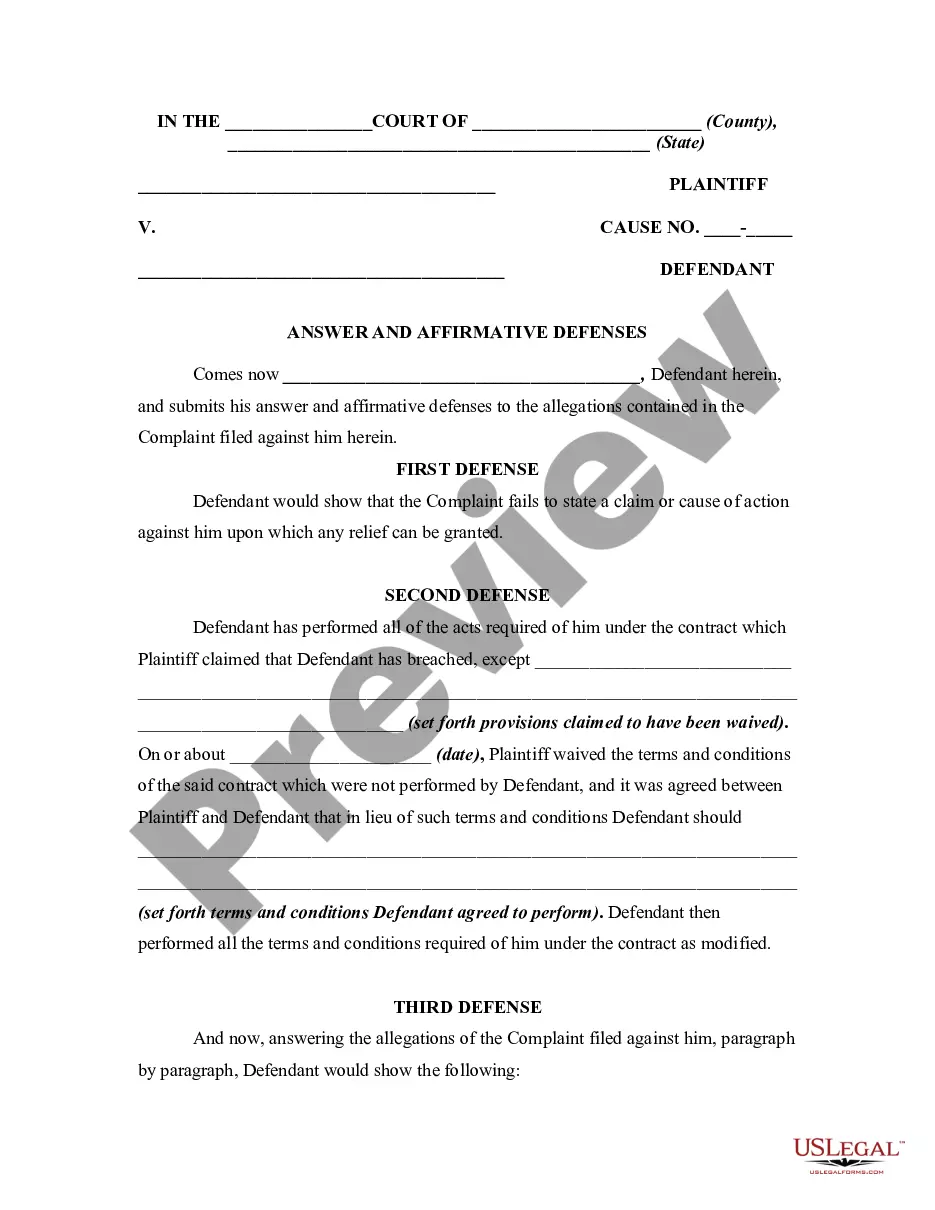

How to fill out Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

Finding the appropriate legal document template might be challenging. Clearly, there are numerous designs accessible online, but how can you acquire the legal form you require? Utilize the US Legal Forms website. This service offers a vast array of templates, such as the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, which you can use for professional and personal needs.

All of the forms have been reviewed by experts and comply with both state and federal regulations. If you are already registered, Log In to your account and click on the Download button to access the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. Use your account to review the legal templates you have previously purchased.

Navigate to the My documents section of your account and obtain another copy of the form you need. If you are a new user of US Legal Forms, here are straightforward steps you can follow: First, ensure you have selected the correct template for your city/state. You may preview the form using the Review option and read the form description to confirm it suits your needs.

US Legal Forms is the largest repository of legal documents where you can find various file formats. Use this service to download professionally crafted forms that meet state requirements.

- If the form does not meet your specifications, use the Search field to locate the correct template.

- Once you are confident that the form is appropriate, click the Purchase now button to obtain the document.

- Select the pricing plan you prefer and input the required information.

- Create your account and complete your purchase using your PayPal account or a credit card.

- Choose the file format and download the legal document template onto your device.

- Complete, modify, print, and sign the received Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

Form popularity

FAQ

A corporate resolution for a bank account is a document that authorizes specific individuals to manage the company’s bank accounts. This document typically includes the names of those authorized and the scope of their authority. For example, in connection with the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, a bank resolution ensures that the necessary funds can be accessed and managed during the redemption process.

The primary purpose of a corporate resolution is to provide documented evidence of a company's decisions. This formal record ensures transparency and serves to protect the interests of shareholders and board members. In situations like the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, having a clear resolution is vital for compliance and establishing authority.

A corporate resolution to sell stock is a formal agreement made by a corporation's board allowing the company to sell its shares. This document outlines the terms and conditions of the sale, ensuring that all regulatory requirements are met. When discussing the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, having a corporate resolution is essential to validate the transaction legally and effectively.

A corporate resolution of authorization grants permission for specific actions by the company. This document often details decisions related to financial transactions, such as the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. By having this resolution, corporations can confidently proceed with transactions, knowing they have the necessary approvals in place.

Filling out a corporate resolution form involves clearly stating the decision being authorized, identifying the directors involved, and documenting the date. It is essential to include specifics about the action, such as the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, to avoid any confusion. Ensuring correct details and signatures on the form will make it valid and enforceable.

A corporate authorization resolution is a formal document that outlines decisions made by a company's board of directors. It serves to officially approve actions such as issuing stock or making significant business decisions. In the context of the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, this resolution ensures that the redemption process is legally sound and recognized by all stakeholders.

Writing a company resolution starts with a clear statement of intent and purpose. For example, when drafting the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, include the date, details of the board meeting, and the specific actions approved. Be concise and ensure all relevant details, such as signatures, are included for validity.

Typically, a corporate resolution is prepared by an officer of the corporation, often the secretary or legal counsel. This ensures that the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is drafted correctly and compliant with state laws. It's vital to involve knowledgeable personnel in this process to maintain proper corporate governance.

The resolution of share redemption outlines the terms under which a corporation can buy back its shares from shareholders. This is often documented in the Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. Such a resolution allows for a clear understanding of the conditions and processes involved, protecting the interests of both the corporation and its shareholders.

An authorizing resolution allows corporate directors to make specific decisions on behalf of the corporation, such as transactions or operational matters. The Connecticut Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is an example of this type of resolution. It gives directors the legal authority to act in the best interest of the corporation, ensuring streamlined operations.