Connecticut Assignment and Transfer of Stock is a legal process that involves the transfer of ownership of stock or shares from one party to another. It is an essential step in the buying and selling of stocks or the issuance of new shares. This process typically requires the completion of specific legal documents and filings. The Connecticut Assignment and Transfer of Stock is governed by various laws and regulations, and it is crucial to understand the specific requirements before initiating any transfers. This transaction can occur for numerous reasons, such as mergers, acquisitions, estate planning, or changes in ownership structure. The process starts with the preparation of an assignment and transfer agreement, which outlines the terms and conditions for the transfer of the stock. This agreement includes important details like the names and addresses of the parties involved, the type and number of shares being transferred, the purchase price or consideration, and any special conditions or obligations. Once the assignment and transfer agreement is finalized, it must be signed by both the transferor (seller) and the transferee (buyer) in the presence of a notary public or witnesses as per Connecticut state laws. This step ensures the authenticity and legality of the transfer. The completion of the assignment and transfer agreement is typically followed by the submission of relevant documentation to the Secretary of State's office or another designated authority in Connecticut. These documents may include an executed copy of the agreement, stock certificates, appropriate IRS forms, and any additional forms or filings required by state or federal authorities. It is essential to note that there are different types of Connecticut Assignment and Transfer of Stock, each with its specific requirements and implications. These may include: 1. Private Stock Transfer: This type of transfer occurs between private individuals or entities without involving public trading platforms or stock exchanges. 2. Public Stock Transfer: This refers to the transfer of stocks or shares that are traded on public exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. Such transfers typically involve additional regulations and reporting requirements. 3. Intra-corporate Stock Transfer: This type of transfer involves the assignment and transfer of stocks within the same corporation, often due to changes in ownership or the need to reallocate stocks among shareholders. 4. Inheritance or Estate Transfer: When a stockholder passes away, their shares may be transferred to designated heirs or beneficiaries according to their estate plan or Connecticut intestacy laws. This type of transfer may involve additional steps to comply with inheritance tax laws and the probate process. In conclusion, the Connecticut Assignment and Transfer of Stock is a legal process governing the transfer of ownership of stocks or shares. This process requires the completion of specific legal documents and filings, adherence to state laws and regulations, and may involve different types of transfers, such as private, public, intra-corporate, or inheritance transfers. It is crucial to consult with legal professionals or financial advisors to ensure compliance and a smooth transfer of ownership.

Connecticut Assignment and Transfer of Stock

Description

How to fill out Connecticut Assignment And Transfer Of Stock?

If you need to full, obtain, or print legitimate document layouts, use US Legal Forms, the most important assortment of legitimate types, which can be found on the Internet. Use the site`s simple and hassle-free search to find the papers you require. Different layouts for enterprise and personal functions are categorized by classes and says, or keywords. Use US Legal Forms to find the Connecticut Assignment and Transfer of Stock with a handful of click throughs.

If you are previously a US Legal Forms customer, log in in your accounts and then click the Acquire option to obtain the Connecticut Assignment and Transfer of Stock. You can even access types you formerly saved inside the My Forms tab of the accounts.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape for the correct city/land.

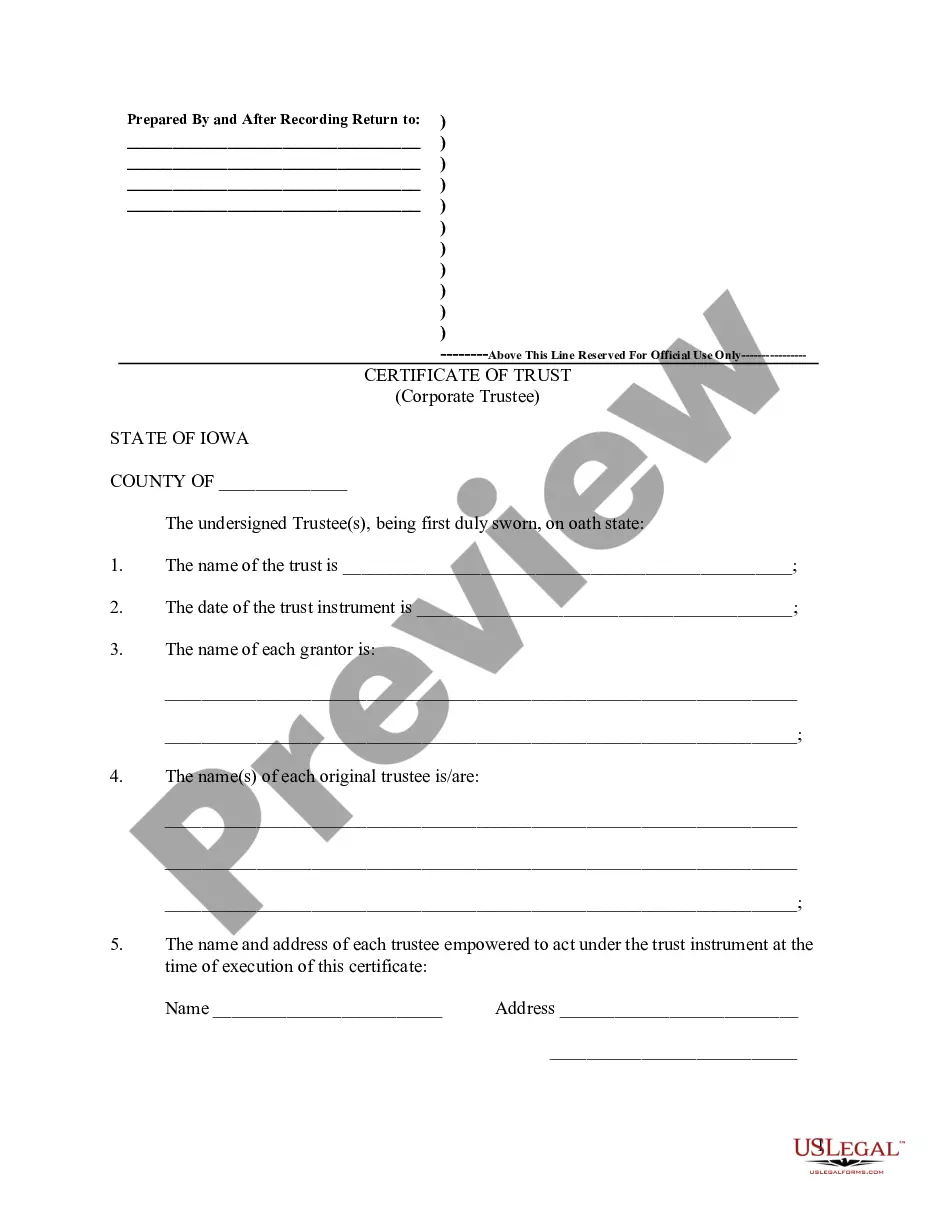

- Step 2. Take advantage of the Preview choice to look through the form`s articles. Do not forget about to learn the description.

- Step 3. If you are not happy with all the type, use the Lookup industry on top of the monitor to locate other variations in the legitimate type web template.

- Step 4. Upon having found the shape you require, go through the Buy now option. Opt for the prices prepare you favor and include your accreditations to sign up for the accounts.

- Step 5. Procedure the deal. You can utilize your charge card or PayPal accounts to finish the deal.

- Step 6. Choose the formatting in the legitimate type and obtain it on the system.

- Step 7. Comprehensive, change and print or sign the Connecticut Assignment and Transfer of Stock.

Each legitimate document web template you purchase is yours forever. You have acces to each and every type you saved with your acccount. Select the My Forms portion and choose a type to print or obtain once more.

Be competitive and obtain, and print the Connecticut Assignment and Transfer of Stock with US Legal Forms. There are millions of professional and condition-specific types you may use to your enterprise or personal demands.