Connecticut Assignment of Accounts Receivable

Description

How to fill out Assignment Of Accounts Receivable?

Have you ever found yourself in a situation where you require documents for potential organization or specific tasks nearly every time.

There is a multitude of legal document templates accessible online, but obtaining reliable ones isn't straightforward.

US Legal Forms offers thousands of form templates, including the Connecticut Assignment of Accounts Receivable, which can be completed to satisfy federal and state requirements.

Once you find the appropriate form, simply click Acquire now.

Choose the payment plan you prefer, complete the necessary information to create your account, and purchase your order using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Connecticut Assignment of Accounts Receivable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to your relevant city/region.

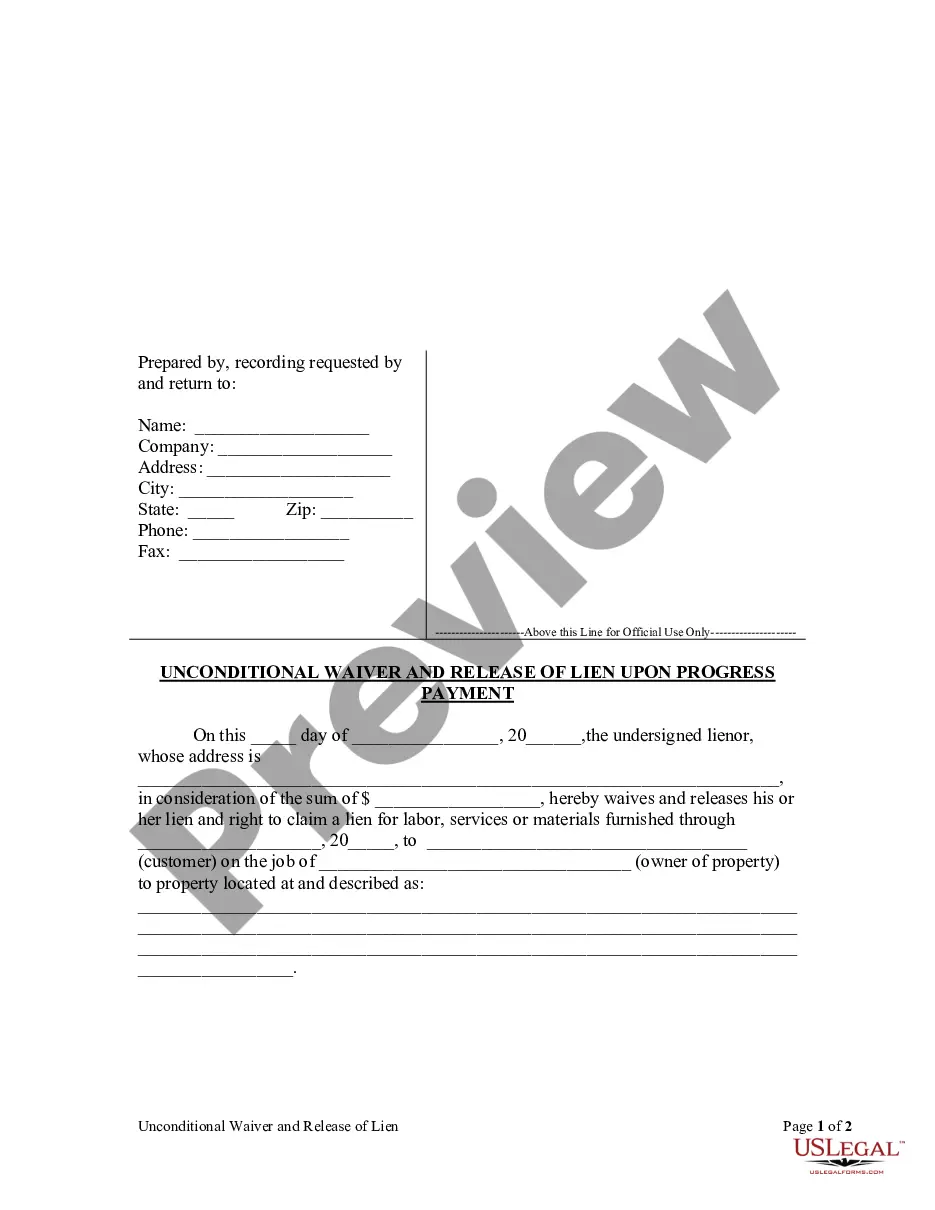

- Use the Preview button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form isn't what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Filing accounts receivable involves recording the amounts due from customers and tracking payments. Start by organizing all related documentation, such as invoices and payment records, to ensure accuracy. The Connecticut Assignment of Accounts Receivable process allows you to assign these receivables to a third party when necessary. Consider using uslegalforms to simplify this process and ensure compliance with state regulations while you file.

To record accounts receivable effectively in Connecticut, create a clear documentation process that includes invoices and payment terms. This ensures you capture the amount owed accurately. When handling the Connecticut Assignment of Accounts Receivable, maintain organized records that detail each transaction and its status. Using trusted platforms, like uslegalforms, can streamline this process by providing templates and guidance for proper documentation.

To establish an account receivable, you would debit the accounts receivable account and credit the service or product sales revenue account. This entry indicates that you've made a sale on credit, creating an asset for your business. This practice is essential for proper recognition of your income.

The journal entry for accounts receivable typically involves debiting the accounts receivable account and crediting the sales revenue account. This entry reflects a sale made on credit, increasing your assets and acknowledging income earned. Keep in mind that accurately recording these entries is crucial for financial reporting.

An adjusting journal entry for accounts receivable accounts for any unpaid invoices or discrepancies in revenue recognition. Typically, this involves debiting the accounts receivable account and crediting revenue when recognizing revenue earned but not yet received. Proper adjustments ensure your financial statements reflect the true financial position.

To find accounts receivable, start by reviewing your company's accounting system or software, where these records are maintained. You can also refer to the accounts receivable aging report, which lists outstanding invoices and their due dates. This information is crucial for managing the Connecticut Assignment of Accounts Receivable process effectively.

To assign accounts receivable, first review your outstanding invoices to select which ones to assign. Then, draft an assignment agreement to legally transfer the rights to collect these receivables to another entity. Utilizing services through uslegalforms eases the process of Connecticut Assignment of Accounts Receivable and ensures all legal requirements are met.

You can find accounts receivable listed on your company’s balance sheet, showcasing the amounts owed by customers. Additionally, you can track it through your accounting software, which provides detailed reports. Leveraging resourceful platforms like uslegalforms can also simplify the management of your Connecticut Assignment of Accounts Receivable.

A notice of assignment of receivables is a document that informs debtors that their payment obligations have been transferred to another party. This notice typically includes details about the original creditor, the new creditor, and instructions for future payments. Issuing this notice is a key step in the process of Connecticut Assignment of Accounts Receivable, helping ensure smooth transitions.

To calculate accounts receivables, start with the total sales made on credit during a specific period. Then, subtract any payments received from these sales to find your outstanding receivables. It’s essential to maintain accurate records, as this helps in operations related to Connecticut Assignment of Accounts Receivable, ensuring timely collections.