Connecticut Bill of Sale by Corporation of all or Substantially all of its Assets is a legal document that facilitates the transfer of ownership of a corporation's assets to another party. This type of bill of sale is crucial when a corporation intends to sell its assets, either in part (some) or entirely (all) to another individual, entity, or another corporation. Keywords: Connecticut, Bill of Sale, Corporation, Assets, Substantially all Types of Connecticut Bill of Sale by Corporation of all or Substantially all of its Assets: 1. Complete Asset Transfer: This type of bill of sale is used when a corporation intends to sell all of its assets to another party. It includes all tangible and intangible assets owned by the corporation, such as machinery, equipment, inventory, patents, trademarks, copyrights, contracts, real estate, and other valuable assets. 2. Partial Asset Transfer: In some cases, a corporation may decide to sell only a substantial portion of its assets instead of transferring everything. This type of bill of sale outlines the specific assets being transferred and provides an agreement regarding the terms and conditions of the sale. 3. Asset Sale Agreement: This document is similar to a bill of sale and may be used interchangeably. It outlines the terms and conditions of the sale, including the purchase price, assets being sold, representations and warranties, indemnification clauses, and other provisions that protect the interests of both the seller and buyer. 4. Intangible Asset Transfer: When a corporation primarily deals with intangible assets such as patents, trademarks, copyrights, or intellectual property, a specific bill of sale may be required to transfer these assets to the buyer. This document includes detailed descriptions of the intangible assets being transferred, their value, restrictions, and any licensing arrangements if applicable. 5. Real Estate Asset Transfer: If the corporation owns real estate and intends to sell it as part of the asset transfer, a separate bill of sale may be necessary. This document includes the legal description of the property, purchase price, any liens or encumbrances, and provisions regarding the transfer of title and possession. In summary, a Connecticut Bill of Sale by Corporation of all or Substantially all of its Assets is a legal document utilized when a corporation wants to sell either all or a substantial portion of its assets to another party. Different types of bill of sale may be required based on the nature of the assets being transferred, such as complete asset transfer, partial asset transfer, asset sale agreement, intangible asset transfer, and real estate asset transfer.

Connecticut Bill of Sale by Corporation of all or Substantially all of its Assets

Description

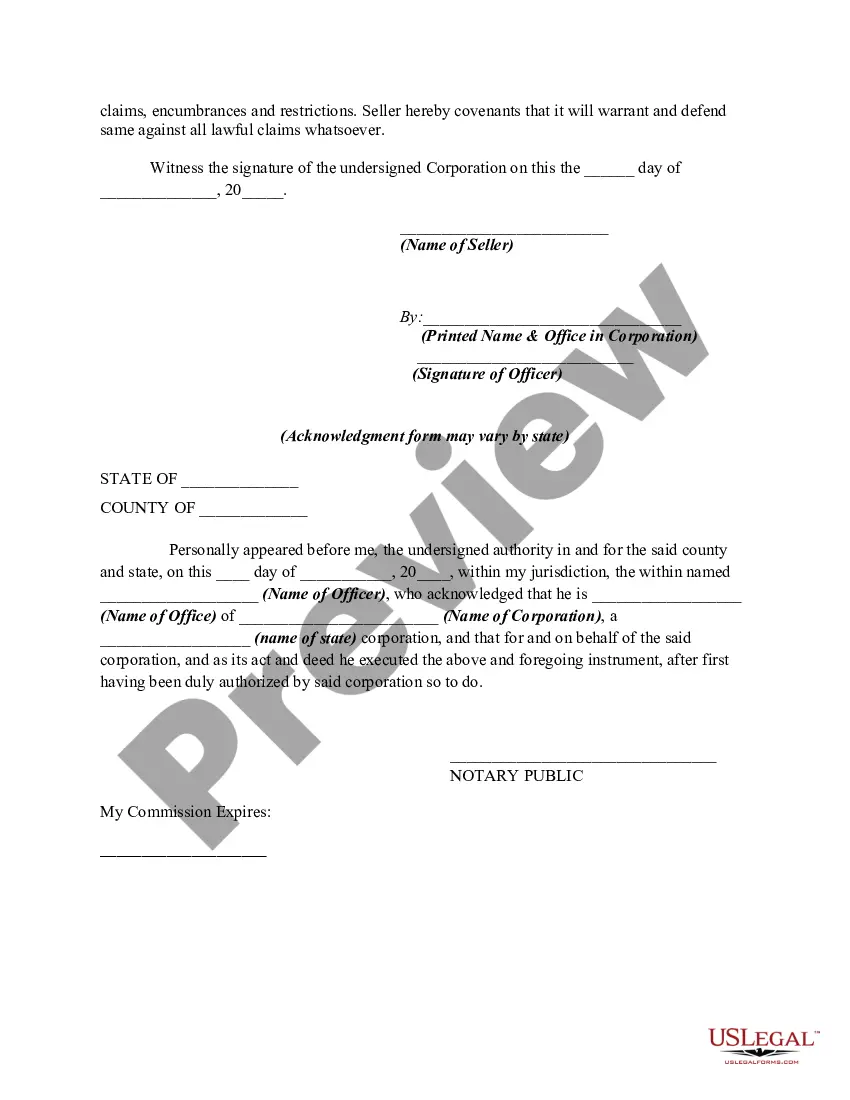

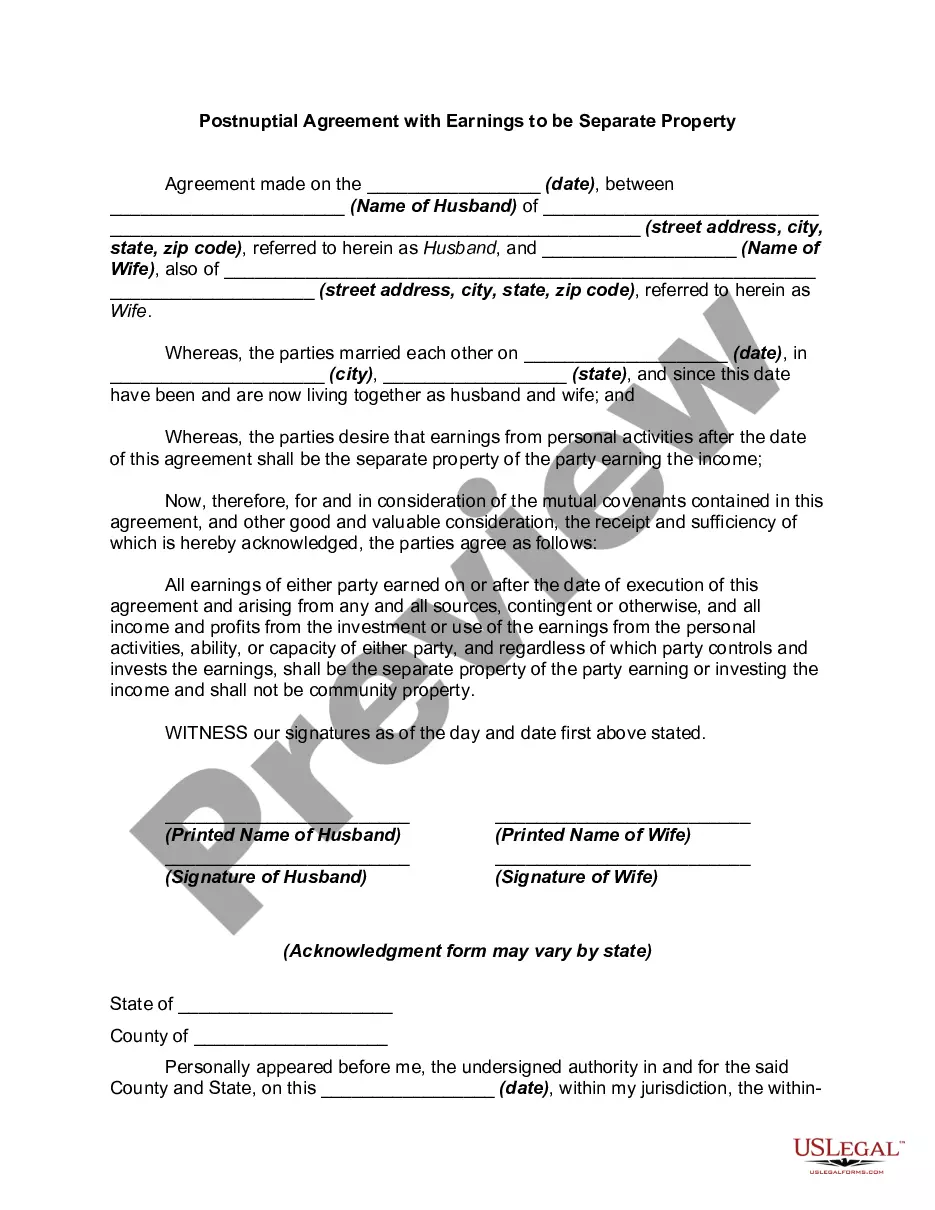

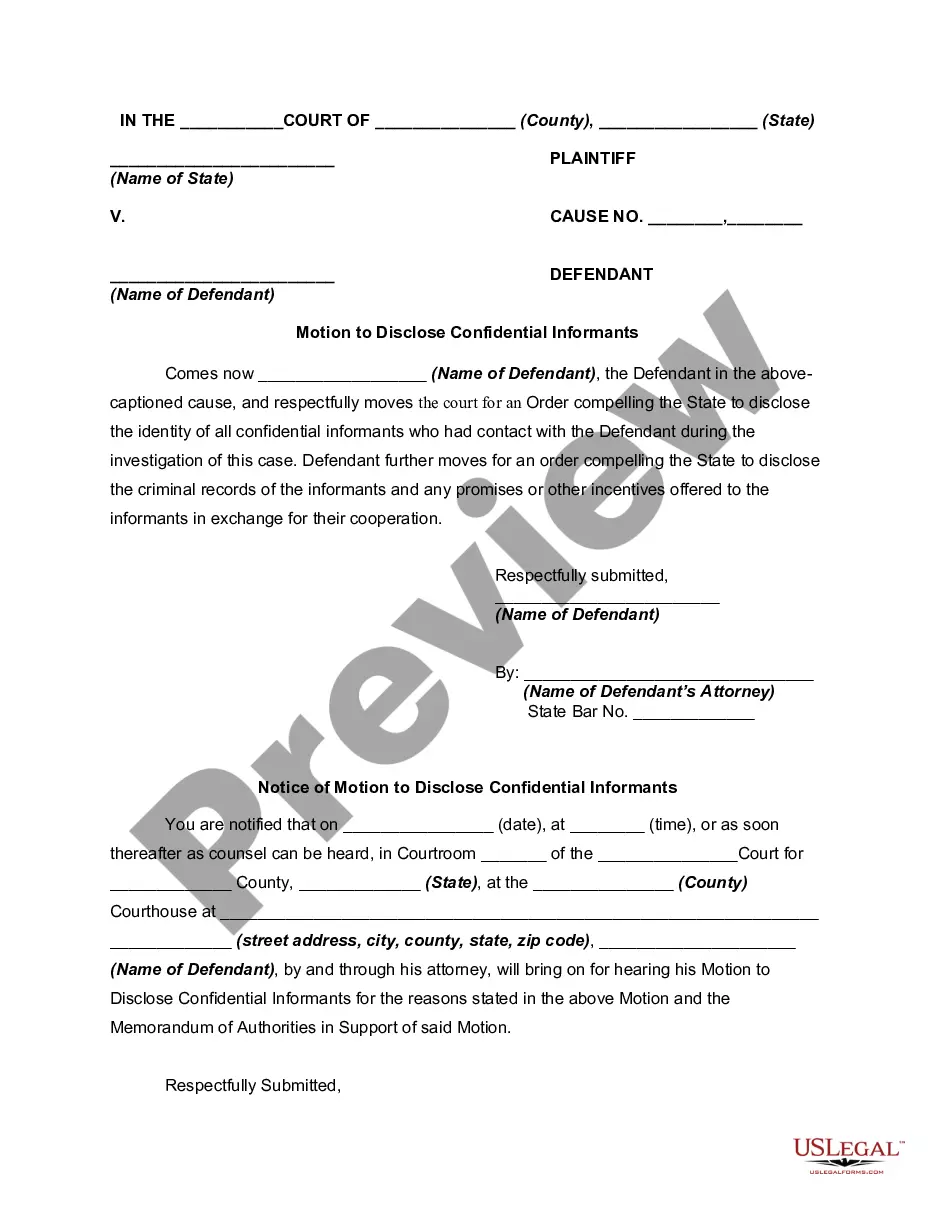

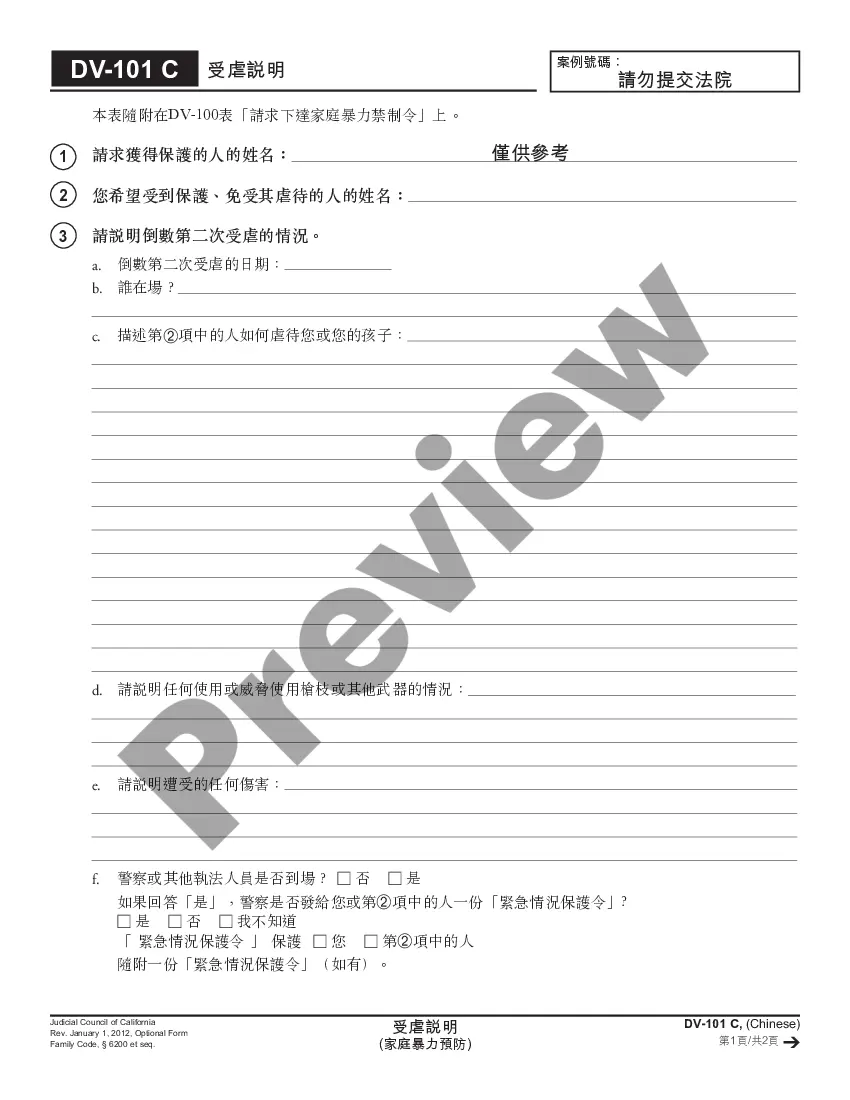

How to fill out Connecticut Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Finding the right legal papers web template can be a battle. Naturally, there are a variety of layouts available on the Internet, but how can you obtain the legal develop you want? Utilize the US Legal Forms website. The services delivers thousands of layouts, including the Connecticut Bill of Sale by Corporation of all or Substantially all of its Assets, that you can use for business and private needs. All of the kinds are checked out by professionals and meet up with state and federal needs.

When you are already signed up, log in in your accounts and click on the Down load switch to find the Connecticut Bill of Sale by Corporation of all or Substantially all of its Assets. Make use of accounts to search with the legal kinds you may have bought earlier. Visit the My Forms tab of your respective accounts and have one more backup of the papers you want.

When you are a new user of US Legal Forms, allow me to share basic guidelines that you should comply with:

- Initial, be sure you have selected the correct develop for the metropolis/state. It is possible to look through the shape making use of the Review switch and browse the shape description to guarantee it is the best for you.

- If the develop is not going to meet up with your requirements, take advantage of the Seach area to discover the appropriate develop.

- Once you are sure that the shape would work, click on the Acquire now switch to find the develop.

- Select the rates program you want and enter the needed info. Make your accounts and buy your order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the data file formatting and acquire the legal papers web template in your device.

- Comprehensive, modify and printing and sign the obtained Connecticut Bill of Sale by Corporation of all or Substantially all of its Assets.

US Legal Forms will be the largest local library of legal kinds that you can find a variety of papers layouts. Utilize the company to acquire skillfully-made documents that comply with status needs.

Form popularity

FAQ

1. NAME OF CORPORATION (required) (Must include business designation, e.g., Inc., Co., Corp.): The corporation is nonprofit and shall not have or issue shares of stock or make distributions.

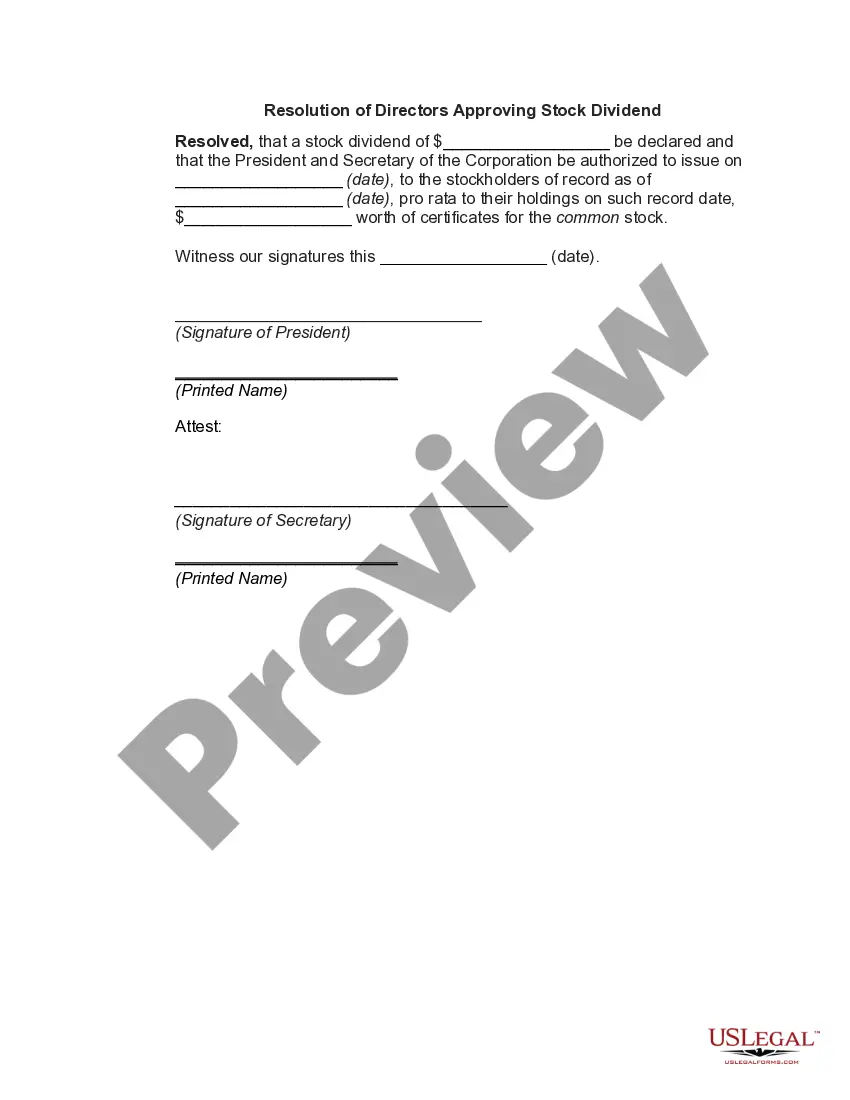

Sample 1. Sale of all or substantially all of the assets means the sale, lease, transfer, conveyance or other disposition in one or more related transactions (other than by way of merger or consolidation by the Company) of assets of the Company and its Restricted Subsidiaries equal to at least 80% of Total Assets.

Substantial Assets means assets sold or otherwise disposed of in a single transaction or a series of related transactions representing 25% or more of the consolidated assets of the Borrower and its Consolidated Subsidiaries, taken as a whole.

Implied Powers Of Corporation Definition The corporation has powers that are limited to those actions required to be taken for exercising the purpose of the corporation establishment and not exercise those actions that are over and above their earlier declared purposes are called implied powers of the corporation.

The. "substantially-all" requirement has come to mean that all of the. operating assets of the target corporation must be moved into the. acquiring corporation.

The corporation must be a domestic corporation. The corporation must have at least one nonresident alien as a shareholder. The corporation must operate in more than one state. The corporation cannot have more than 100 shareholders.

Corporate charter. A legal document that the state issued to a company based on information the company provides in the articles of incorporation. Corporation. A legal entity, created by the state, whose assets and liabilities are separate from its owners.

Charters are documents that bind a company's objectives and goals, be it non-profit or for-profit status, full registered name, and location of the company's representative. The authorised representative is the individual who can legally sign and accept documents on the company's behalf.

What information must a corporate charter include regarding the company's stock? Par value; Classes and series; Number of shares.

What information must a corporate charter include regarding the company's stock? Par value; Classes and series; Number of shares.