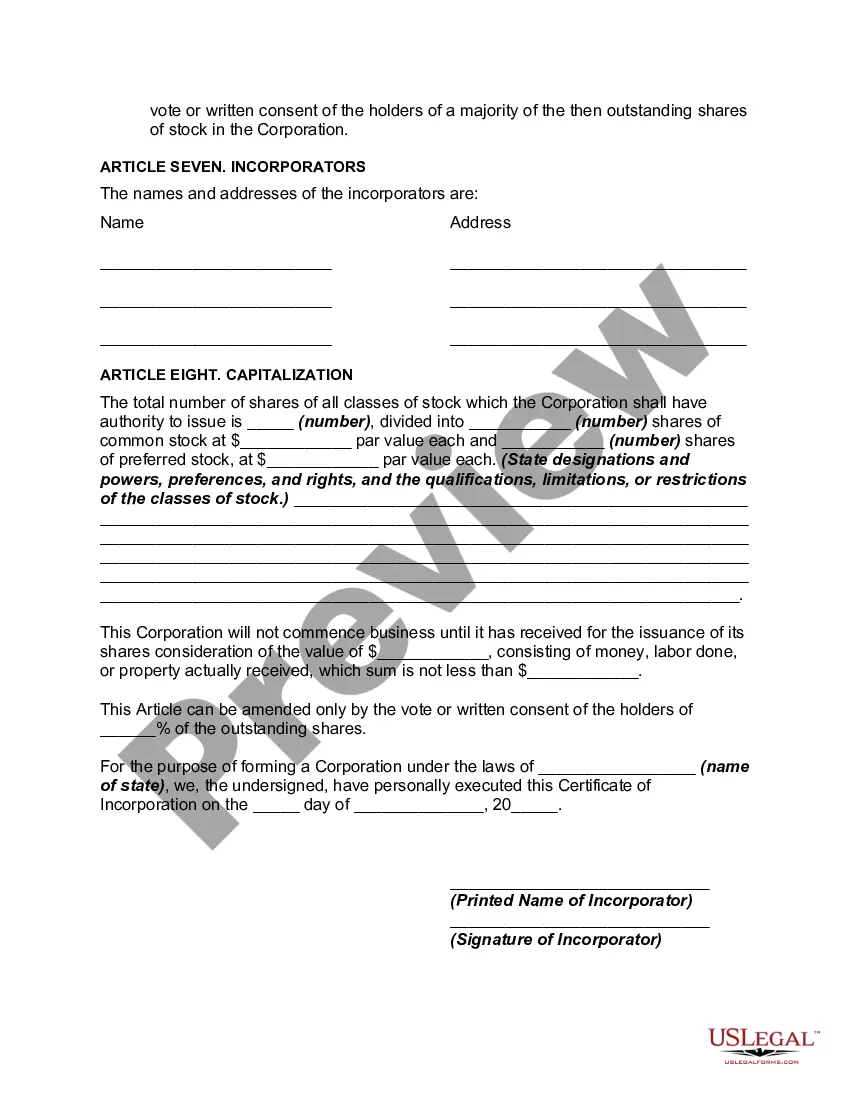

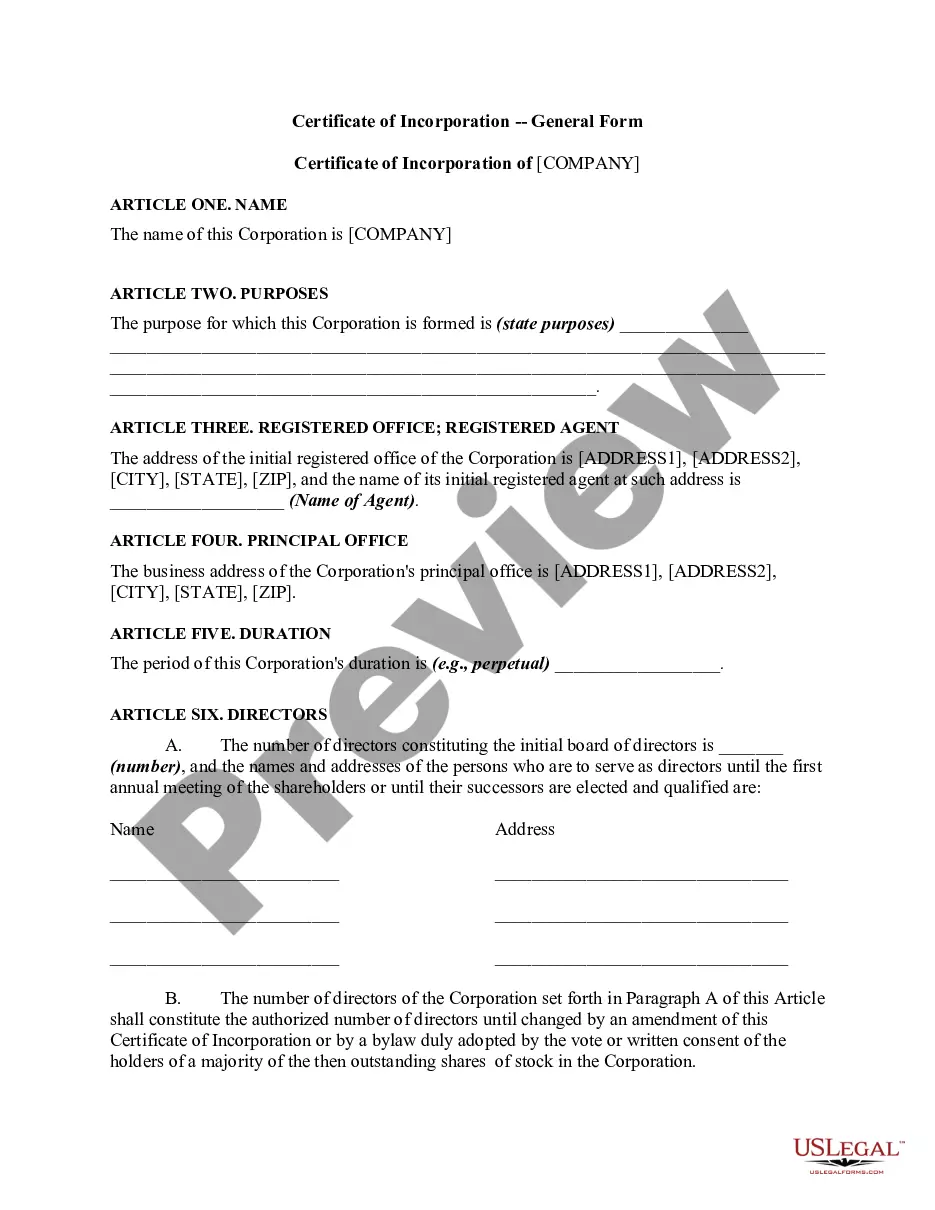

The proper form and necessary content of a certificate of incorporation depend largely on the requirements of individual state statutes, which in many instances designate the appropriate form and content. While the certificate must stay within the limitations imposed by the various statutes and by the policies and interpretations of the responsible state officials and agencies, the certificate may usually be drafted so as to meet the business needs of the proposed corporation. In many states, official forms are provided; in some of these jurisdictions, use of such forms is mandatory. Although in some jurisdictions, the secretary of state's printed forms are not required to be used, it is wise to use the language found in the forms since much of the language found in them is required.

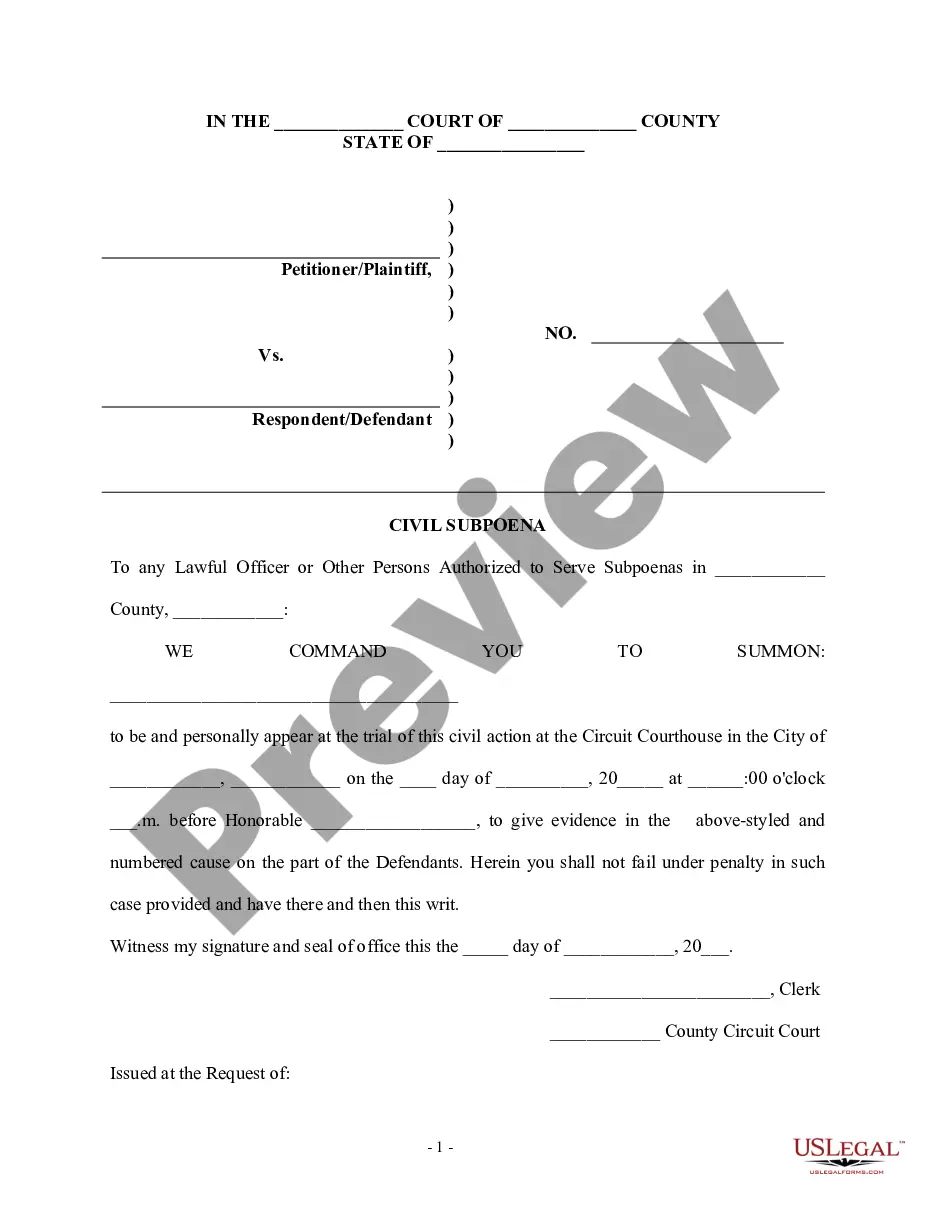

Connecticut Certificate of Incorporation - General Form

Description

How to fill out Certificate Of Incorporation - General Form?

Have you been within a situation where you require documents for either business or personal reasons virtually every working day? There are a variety of legal papers web templates accessible on the Internet, but finding versions you can rely is not straightforward. US Legal Forms delivers thousands of develop web templates, just like the Connecticut Certificate of Incorporation - General Form, which are written to satisfy federal and state specifications.

Should you be previously acquainted with US Legal Forms website and have an account, simply log in. After that, you can obtain the Connecticut Certificate of Incorporation - General Form design.

If you do not provide an profile and want to begin to use US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is for your correct area/state.

- Take advantage of the Review key to examine the shape.

- Browse the description to ensure that you have chosen the right develop.

- In case the develop is not what you are looking for, use the Research industry to get the develop that fits your needs and specifications.

- When you find the correct develop, simply click Purchase now.

- Pick the pricing prepare you need, fill in the necessary details to generate your money, and pay money for an order with your PayPal or bank card.

- Choose a handy document file format and obtain your version.

Find all of the papers web templates you have purchased in the My Forms menus. You can obtain a additional version of Connecticut Certificate of Incorporation - General Form at any time, if possible. Just go through the required develop to obtain or printing the papers design.

Use US Legal Forms, one of the most substantial collection of legal types, in order to save efforts and steer clear of blunders. The assistance delivers professionally made legal papers web templates which can be used for a range of reasons. Create an account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

To start a corporation in Connecticut, you'll need to do three things: appoint a registered agent, choose a name for your business, and file a Certificate of Incorporation with the Secretary of State. You can file this document online, by mail, or in person. (In-person service is restricted during COVID-19 pandemic.)

A certificate of good standing is a document proving a business is legally registered with and able to operate in a state. The certificate is also referred to as a certificate of existence, certificate of status, or a state-specific name.

To obtain your Connecticut Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

On the mailing, CT Certificate Service lists a West Hartford address, which makes it seem like it is based in Connecticut. In reality, the West Hartford address is a private mailbox service. CT Certificate Service actually appears to be a fictitious name used by a company based in Saint Petersburg, Florida.

Fees & Payment Options Filing MethodFiling Fee & Minimum Franchise Tax (MFT)Expedited ServiceMail$250Filing Fee & MFT+ $50In-Person$250Filing Fee & MFT+ $50Fax$250Filing Fee & MFT+ $50Online$250Filing Fee & MFT+ $50

Legal entity interests may be owned individually, owned by another legal entity, or held in trust. Some of the most common legal entities holding title to real property in California are: Corporations. Limited liability companies (LLC) Partnerships.

A certificate of Legal Existence (also called a Certificate of Good Standing in some states) verifies that your business is registered with the State of Connecticut and is up-to-date with all your filing obligations.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email or in person, but we recommend faxing. Normal processing takes up to 5 business days, plus additional time for mailing, and costs $55 for certification.