Connecticut Consultant Agreement with Sharing of Software Revenues

Description

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

How to fill out Consultant Agreement With Sharing Of Software Revenues?

You can spend hours online trying to locate the legal document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can download or print the Connecticut Consultant Agreement with Sharing of Software Revenues from our service.

To find another version of the form, use the Search field to locate the format that fulfills your requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can fill out, edit, print, or sign the Connecticut Consultant Agreement with Sharing of Software Revenues.

- Each legal document you acquire is yours indefinitely.

- To obtain an additional copy of the purchased form, visit the My documents section and click on the appropriate option.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document format for the location/city of your choice.

- Review the document description to confirm that you have chosen the right one.

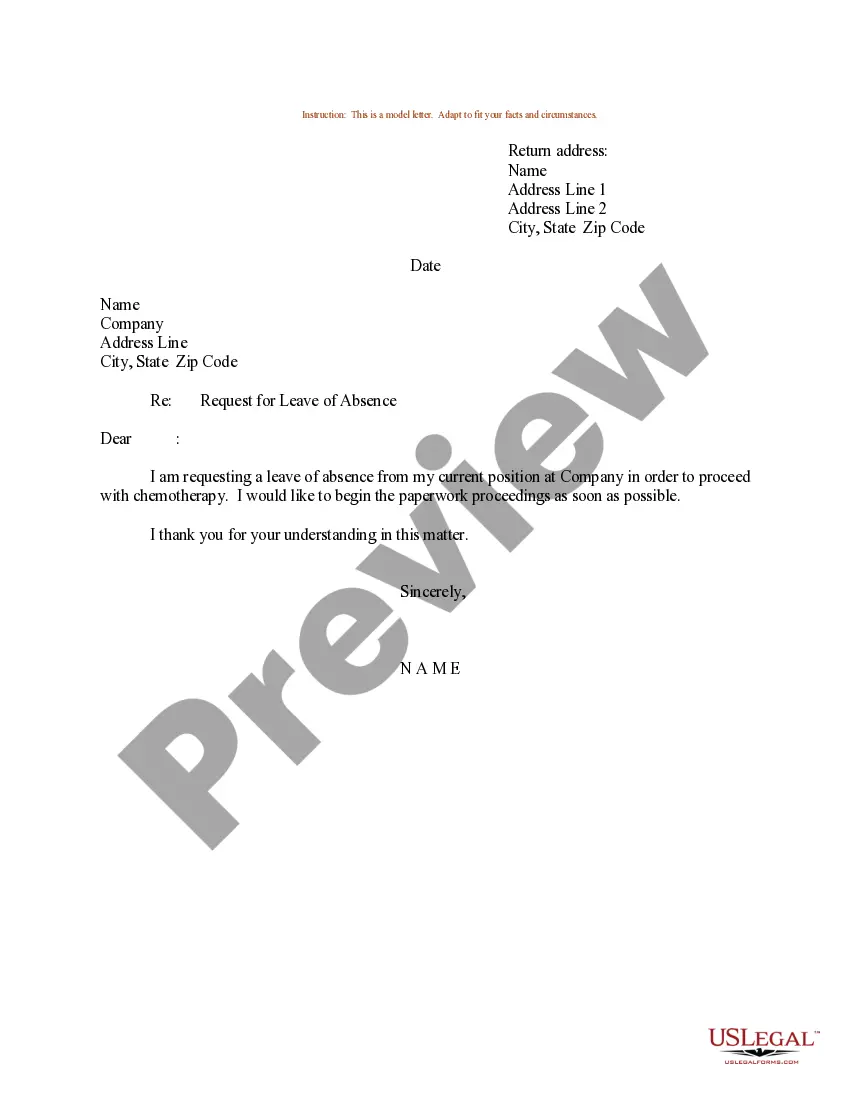

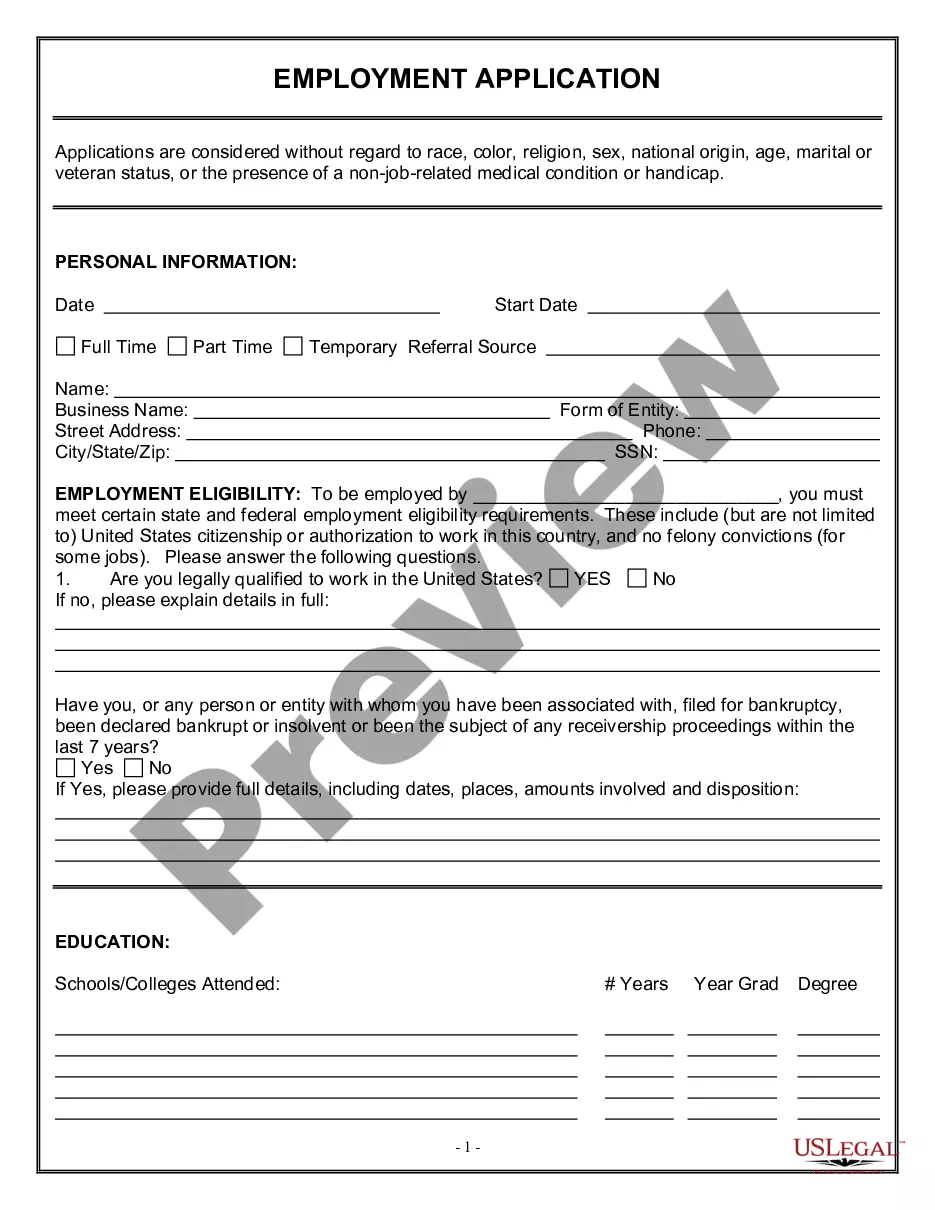

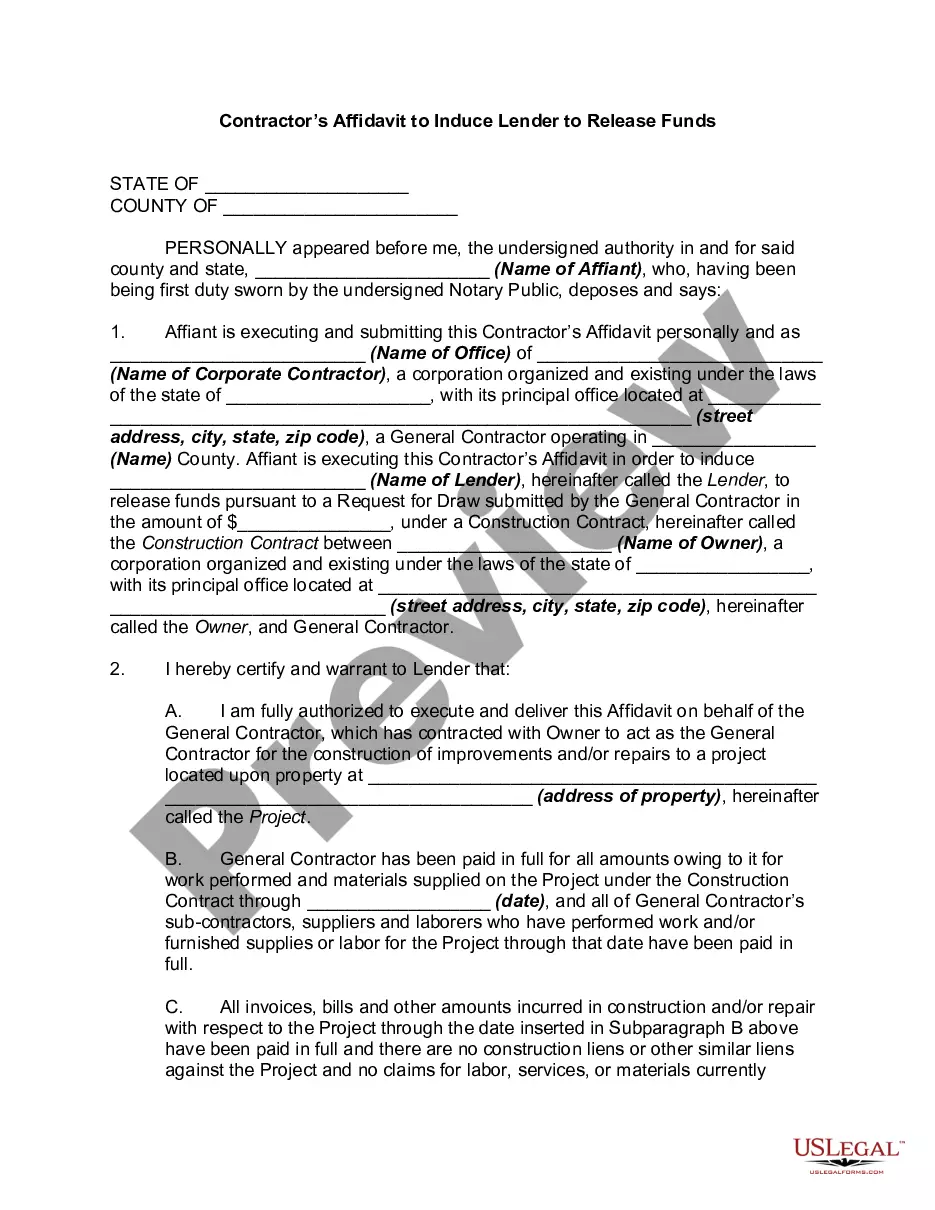

- If available, use the Review option to check the document as well.

Form popularity

FAQ

To structure a revenue sharing agreement effectively, identify the revenue streams and define how profits will be divided among the parties. Include terms such as duration, payment intervals, and conditions for review. You might find it beneficial to use a Connecticut Consultant Agreement with Sharing of Software Revenues template from uslegalforms, which provides a clear framework to help you establish a fair and organized agreement.

A consulting agreement is a specific type of contract that outlines the terms of a consultant's services. While all consulting agreements are contracts, not all contracts qualify as consulting agreements. In the context of a Connecticut Consultant Agreement with Sharing of Software Revenues, the focus is usually on the consultancy services provided and the financial arrangements for shared revenues.

A good revenue sharing arrangement fairly compensates all parties involved based on their contributions and risks. A well-structured agreement ensures clarity on profit distribution, fostering collaboration. In a Connecticut Consultant Agreement with Sharing of Software Revenues, a good revenue share aligns with industry standards while also being equitable for all stakeholders.

Writing a consulting contract agreement involves outlining the services to be provided, the compensation structure, and the duration of the agreement. It’s important to be specific about deliverables and deadlines, ensuring that both parties understand their responsibilities. For convenience, you can use a Connecticut Consultant Agreement with Sharing of Software Revenues template from uslegalforms, which guides you in crafting a clear and comprehensive contract.

A typical revenue sharing percentage often varies based on the industry but generally falls between 20% and 30%. In the context of a Connecticut Consultant Agreement with Sharing of Software Revenues, it’s crucial to discuss and decide on a percentage that reflects the contributions of each party. Open communication about these expectations is essential for a successful partnership.

To write a simple contract agreement, clearly define the roles, responsibilities, and expectations of each party. Include essential elements like the scope of work, compensation details, and duration of the partnership. Utilizing a Connecticut Consultant Agreement with Sharing of Software Revenues template on uslegalforms can streamline this process and ensure you cover all legal bases.

A reasonable profit-sharing percentage often ranges between 10% and 50%, depending on the industry and the contributions of each party. In a Connecticut Consultant Agreement with Sharing of Software Revenues, you may agree on a specific percentage that reflects the roles and responsibilities of each consultant. Always ensure that the terms are clear and mutually beneficial to maintain a healthy working relationship.

A revenue sharing contract is a legal agreement where parties outline how they will share profits generated from a specific venture. For instance, a software developer and a marketing consultant might enter into a Connecticut Consultant Agreement with Sharing of Software Revenues, specifying that the developer provides the software and the marketer earns a percentage of the sales. This arrangement helps both parties benefit financially from the success of the product.

Setting up a consulting agreement involves several steps. Begin by identifying the services offered and clarifying payment details. You should also include terms regarding confidentiality and intellectual property rights. For a structured approach, consider utilizing a Connecticut Consultant Agreement with Sharing of Software Revenues, which can streamline this process and ensure all key elements are addressed.

You do not need an LLC to be a consultant, but forming one can provide legal protection and tax benefits. An LLC can help separate your personal assets from your business liability. However, even without an LLC, you should have a solid consulting agreement in place, like a Connecticut Consultant Agreement with Sharing of Software Revenues, to define your professional relationship and terms.