A consultant is someone who gives expert or professional advice. Consultants are ordinarily hired on an independent contractor basis, therefore, the hiring party is not liable to others for the acts or omissions of the consultant. As distinguished from an employee, a consultant pays their own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

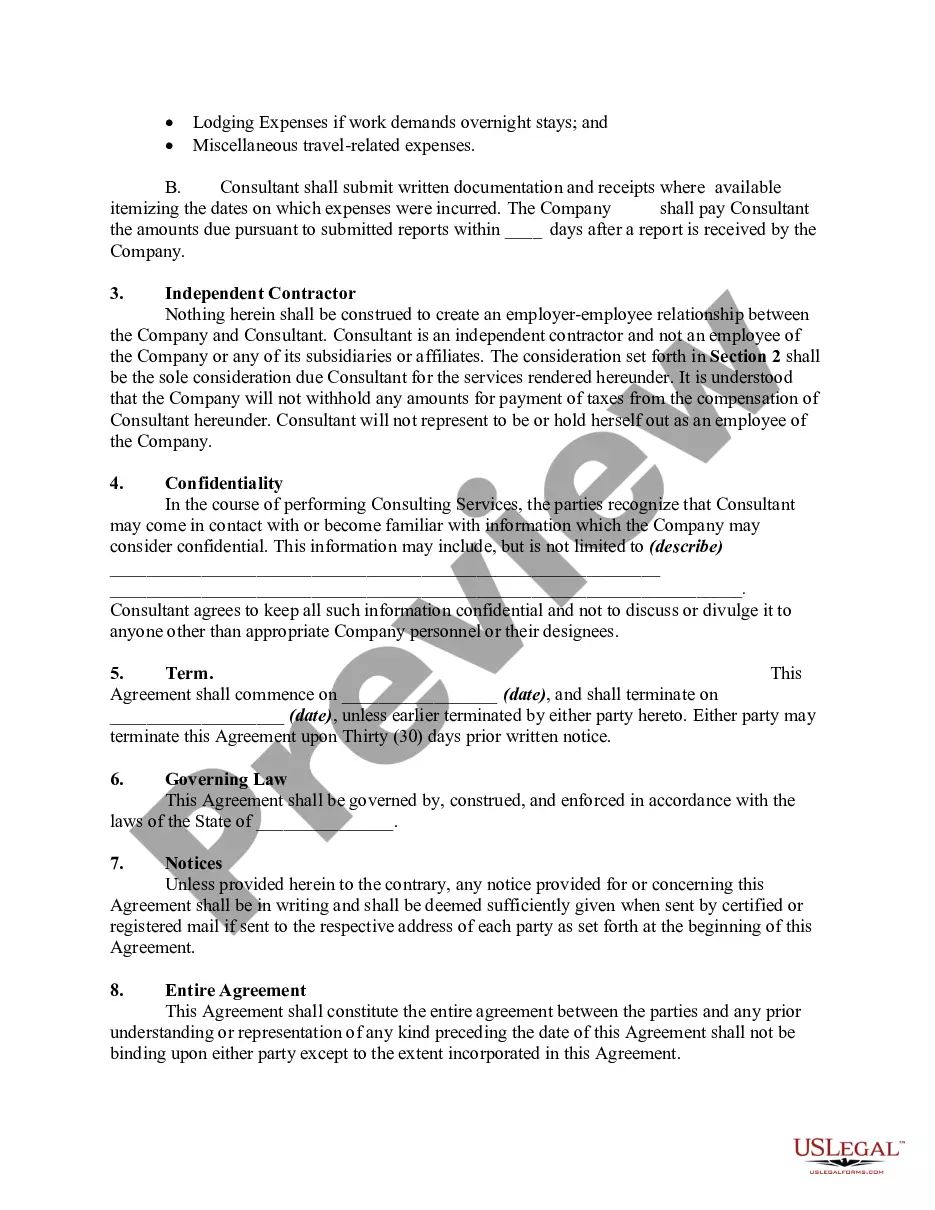

A Connecticut Consulting Agreement — Short is a legally binding document that outlines the terms and conditions of a consulting relationship between a consultant and a client based in Connecticut. This agreement ensures that both parties are on the same page regarding the scope of work, payment, confidentiality, and other crucial aspects of the consulting engagement. Several types of Connecticut Consulting Agreements — Short exist, depending on the specific requirements of the parties involved. Here are some notable variations: 1. Independent Contractor Agreement: This type of agreement establishes the relationship between an independent consultant and a client, clarifying that the consultant is not an employee of the client and highlighting the consultant's responsibility for their own taxes and benefits. 2. Non-Disclosure Agreement (NDA): In certain consulting arrangements, a separate NDA may be included as part of the agreement. This guarantees that all proprietary information, trade secrets, and other sensitive data shared during the consulting engagement remain confidential, preventing unauthorized disclosure or misuse. 3. Fee-Based Services Agreement: This agreement specifies the payment terms and conditions between the client and the consultant. It outlines the consulting fees, payment schedule, reimbursement policies, and any additional costs associated with the project. 4. Scope of Work Agreement: This agreement defines the specific tasks, deliverables, and responsibilities of both the consultant and the client. It outlines the project objectives, timelines, milestones, and any performance metrics necessary to measure success. 5. Termination Agreement: Occasionally, the consulting engagement may be terminated before the agreed-upon term due to unforeseen circumstances. In such cases, a termination agreement provides the necessary clauses and procedures to conclude the relationship amicably and address any remaining obligations. 6. Intellectual Property Agreement: When a consultant develops any intellectual property during the engagement, this agreement defines the ownership rights and any licensing or usage terms associated with the created assets. Regardless of the specific type, a Connecticut Consulting Agreement — Short provides a comprehensive framework for both parties to establish a professional consulting relationship. It protects the rights and interests of both the consultant and the client, ensuring a clear understanding of the engagement's terms, expectations, and obligations.A Connecticut Consulting Agreement — Short is a legally binding document that outlines the terms and conditions of a consulting relationship between a consultant and a client based in Connecticut. This agreement ensures that both parties are on the same page regarding the scope of work, payment, confidentiality, and other crucial aspects of the consulting engagement. Several types of Connecticut Consulting Agreements — Short exist, depending on the specific requirements of the parties involved. Here are some notable variations: 1. Independent Contractor Agreement: This type of agreement establishes the relationship between an independent consultant and a client, clarifying that the consultant is not an employee of the client and highlighting the consultant's responsibility for their own taxes and benefits. 2. Non-Disclosure Agreement (NDA): In certain consulting arrangements, a separate NDA may be included as part of the agreement. This guarantees that all proprietary information, trade secrets, and other sensitive data shared during the consulting engagement remain confidential, preventing unauthorized disclosure or misuse. 3. Fee-Based Services Agreement: This agreement specifies the payment terms and conditions between the client and the consultant. It outlines the consulting fees, payment schedule, reimbursement policies, and any additional costs associated with the project. 4. Scope of Work Agreement: This agreement defines the specific tasks, deliverables, and responsibilities of both the consultant and the client. It outlines the project objectives, timelines, milestones, and any performance metrics necessary to measure success. 5. Termination Agreement: Occasionally, the consulting engagement may be terminated before the agreed-upon term due to unforeseen circumstances. In such cases, a termination agreement provides the necessary clauses and procedures to conclude the relationship amicably and address any remaining obligations. 6. Intellectual Property Agreement: When a consultant develops any intellectual property during the engagement, this agreement defines the ownership rights and any licensing or usage terms associated with the created assets. Regardless of the specific type, a Connecticut Consulting Agreement — Short provides a comprehensive framework for both parties to establish a professional consulting relationship. It protects the rights and interests of both the consultant and the client, ensuring a clear understanding of the engagement's terms, expectations, and obligations.