Connecticut Invoice Template for Hairdresser: A Comprehensive Guide If you are a hairdresser based in Connecticut, it is crucial to have a professional invoice template that accurately represents your services and ensures prompt payment from your clients. An invoice template plays a significant role in maintaining business records, tracking payments, and providing a detailed breakdown of the services provided. In Connecticut, there are different types of invoice templates available specifically designed for hairdressers to cater to their unique needs. 1. Connecticut Hairdresser Invoice Template: This general invoice template is suitable for all hairdressers in Connecticut, regardless of their specialization. It includes standard sections such as the hairdresser's contact information, client details, invoice number, dates, and itemized list of services performed. The layout is structured, making it easy to read and understand for both hairdressers and clients. It also allows for customization, where you can add your logo, brand colors, and terms of payment. 2. Haircut and Styling Invoice Template: This specific invoice template is primarily designed for hairdressers focused on hair cutting and styling services. Apart from the standard sections found in the general invoice template, it includes additional fields to detail the specific haircut and styling services provided to the client. These additional fields may include options like haircut type, styling techniques used, hair treatments, and any additional products used during the appointment. 3. Color and Highlights Invoice Template: Connecticut hairdressers specializing in color and highlights require a dedicated invoice template that effectively addresses these services. This template includes sections to capture detailed information on the specific colors used, techniques applied, and the time spent on client consultations and color applications. It allows hairdressers to clearly outline the costs associated with color and highlight services and provides transparency to clients regarding the breakdown of expenses. 4. Bridal Hair Invoice Template: Bridal hair services are prevalent in Connecticut, especially during weddings and special events. This invoice template caters specifically to hairdressers providing bridal hair services. Along with the standard invoice sections, it encompasses details such as hair trials, styling for the wedding day, and any additional services like hair extensions or accessories. It enables hairdressers to keep track of wedding-related appointments and simplifies the billing process associated with bridal services. 5. Mobile Hairdresser Invoice Template: For hairdressers who provide mobile services and travel to their clients' locations, this invoice template serves as an excellent organizational tool. It includes fields to specify the traveling expenses such as mileage, parking fees, and travel time charges. This template ensures transparent communication between hairdressers and clients regarding any additional costs incurred due to their mobility. In conclusion, Connecticut offers a variety of invoice templates tailored specifically for hairdressers. These templates range from general options suitable for all hairdressers to specialized templates catering to hair cutting and styling, color and highlights, bridal hair services, and mobile hairdressing. Implementing the appropriate invoice template ensures efficiency, professionalism, and streamlined payment processes for hairdressers working in the state.

Connecticut Invoice Template for Hairdresser

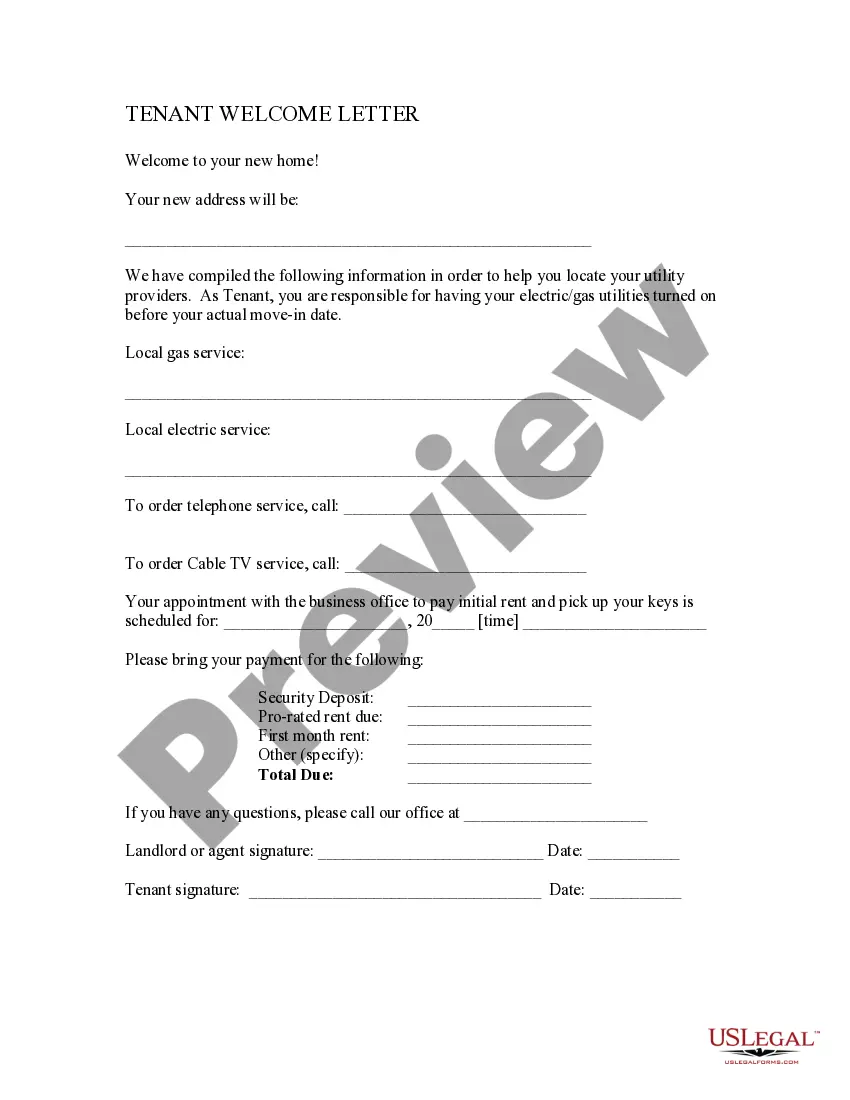

Description

How to fill out Connecticut Invoice Template For Hairdresser?

If you need to complete, obtain, or print legal document templates, use US Legal Forms, the most important selection of legal kinds, that can be found on the web. Make use of the site`s easy and hassle-free research to discover the papers you will need. Different templates for business and personal functions are sorted by types and claims, or key phrases. Use US Legal Forms to discover the Connecticut Invoice Template for Hairdresser with a number of click throughs.

If you are presently a US Legal Forms buyer, log in to the accounts and then click the Down load switch to have the Connecticut Invoice Template for Hairdresser. You can also entry kinds you formerly acquired from the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for the appropriate area/land.

- Step 2. Make use of the Review method to look through the form`s articles. Do not neglect to learn the explanation.

- Step 3. If you are not happy using the kind, use the Research industry near the top of the display screen to get other models in the legal kind format.

- Step 4. When you have discovered the shape you will need, click on the Purchase now switch. Choose the pricing prepare you choose and include your accreditations to register for the accounts.

- Step 5. Procedure the purchase. You can utilize your bank card or PayPal accounts to perform the purchase.

- Step 6. Find the format in the legal kind and obtain it on the gadget.

- Step 7. Total, modify and print or signal the Connecticut Invoice Template for Hairdresser.

Each and every legal document format you acquire is your own eternally. You have acces to every single kind you acquired with your acccount. Select the My Forms section and decide on a kind to print or obtain once more.

Be competitive and obtain, and print the Connecticut Invoice Template for Hairdresser with US Legal Forms. There are thousands of expert and express-specific kinds you may use for your personal business or personal demands.

Form popularity

FAQ

Keep these expense receipts for taxes:Canceled checks.Cash register tapes.Account statements.Credit card receipts and statements.Petty cash slips.Invoices.

How to Properly Fill Out an InvoiceCompany name, address, phone number, and email address.Customer name, address, phone number, and email address.Unique invoice number.Invoice date.The due date for payment by the customer.Line item type (service/hours/days/product/discount)Line item description.Unit price.More items...

Hair care and haircuts Similar to makeup costs, hair care expenses only qualify as a tax deduction when they are specifically for work-related photoshoots or shows. If you order your products from a professional supplier and only use them for performances or shoots, then you can claim the deduction.

How to Properly Fill Out an InvoiceCompany name, address, phone number, and email address.Customer name, address, phone number, and email address.Unique invoice number.Invoice date.The due date for payment by the customer.Line item type (service/hours/days/product/discount)Line item description.Unit price.More items...

What to include in your invoice for contract work.Your name (or company name) and contact details.Your client's name and contact details.Date of invoice.Invoice number.Itemized list and description of services.Date or duration of service.Pricing breakdowns, such as hourly or flat rates.Applicable taxes.More items...

Here's a guide on how to invoice as a contractor:Identify the Document as an Invoice.Include Your Business Information.Add the Client's Contact Details.Assign a Unique Invoice Number.Add the Invoice Date.Provide Details of Your Services.Include Your Payment Terms.List the Total Amount Due.More items...

When it comes to hair stylist tax deductions, tools and supplies may be the easiest and most common option. Items can include scissors, smocks, shampoo and conditioner, blow dryers, sinks, mirrors and styling chairs. All your tools of the trade, from combs to clippers, are likely deductible.

Hair stylists are required to keep thorough records of earnings, since some companies do not provide 1099s. These records include cash payments, checks, and credit card charges for services. Simplistic accounting software, such as Microsoft Excel, is ideal for maintaining this information.

Your invoice should generally include the following: Service details: Be as clear as possible when describing the product or service you're providing. Service Date: Including a service date is optional, but if you decide to note it, this would be the date you performed the contractor service. Description: Be specific.

The IRS does not let you deduct personal expenses from your taxes. The Court states, expenses such as haircuts, makeup, clothes, manicures, grooming, teeth whitening, hair care, manicures, and other cosmetic surgery are not deductible.